|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

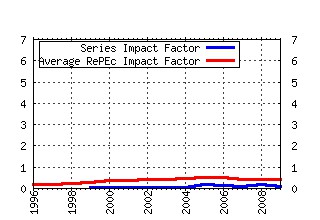

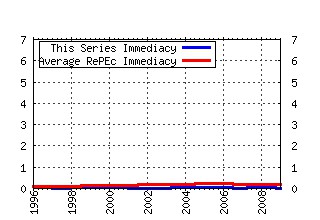

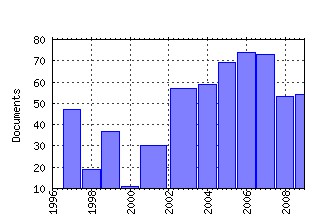

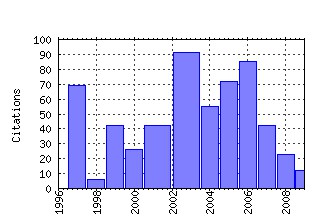

Journal of Business Finance & Accounting Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jbfnac:v:25:y:1998-06:i:5&6:p:521-570 (). (2) RePEc:bla:jbfnac:v:24:y:1997-09:i:7&8:p:1009-1030 (). (3) RePEc:bla:jbfnac:v:30:y:2003-12:i:9-10:p:1363-1421 Efficiency, Ownership and Market Structure, Corporate Control and Governance in the Turkish Banking Industry (2003). (4) RePEc:bla:jbfnac:v:33:y:2006-01:i:1-2:p:245-262 Efficiency and Stock Performance in European Banking (2006). (5) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:309-342 Detecting Information from Directors Trades: Signal Definition and Variable Size Effects (1997). (6) RePEc:bla:jbfnac:v:28:y:2001-04:i:3-4:p:327-356 Social and Environmental Disclosure and Corporate Characteristics: A Research Note and Extension (2001). (7) RePEc:bla:jbfnac:v:24:y:1997-06:i:5:p:705-725 Ethical Unit Trust Financial Performance: Small Company Effects and Fund Size Effects (1997). (8) RePEc:bla:jbfnac:v:28:y:2001-01:i:1-2:p:175-198 Determinants of Capital Structure and Adjustment to Long Run Target: Evidence From UK Company Panel Data (2001). (9) RePEc:bla:jbfnac:v:27:y:2000-06:i:5&6:p:523-554 (). (10) RePEc:bla:jbfnac:v:32:y:2005-09:i:7-8:p:1465-1493 Evaluating the Performance of Ethical and Non-ethical Funds: A Matched Pair Analysis (2005). (11) RePEc:bla:jbfnac:v:32:y:2005-09:i:7-8:p:1311-1346 Board Monitoring and Earnings Management: Do Outside Directors Influence Abnormal Accruals? (2005). (12) RePEc:bla:jbfnac:v:34:y:2007-11:i:9-10:p:1615-1634 Benchmark Status in Fixed-Income Asset Markets (2007). (13) RePEc:bla:jbfnac:v:30:y:2003-12:i:9-10:p:1253-1276 European Stock Market Integration: Does EMU Matter? (2003). (14) RePEc:bla:jbfnac:v:27:y:2000-04:i:3-4:p:447-467 Volatility Spillovers Between Stock Returns and Exchange Rate Changes: International Evidence (2000). (15) RePEc:bla:jbfnac:v:24:y:1997-07:i:6:p:803-813 International Stock Market Efficiency and Integration: A Study of Eighteen Nations (1997). (16) RePEc:bla:jbfnac:v:26:y:1999-11:i:9-10:p:1043-1091 The Profitability of Momentum Investing (1999). (17) RePEc:bla:jbfnac:v:29:y:2002-04:i:3&4:p:317-351 (). (18) RePEc:bla:jbfnac:v:30:y:2003-04:i:3-4:p:573-588 Does Working Capital Management Affect Profitability of Belgian Firms? (2003). (19) RePEc:bla:jbfnac:v:31:y:2004-06:i:5-6:p:711-728 Determinants of the Capital Structures of European SMEs (2004). (20) RePEc:bla:jbfnac:v:25:y:1998-01:i:1&2:p:1-27 (). (21) RePEc:bla:jbfnac:v:26:y:1999-04:i:3-4:p:419-449 Penetrating the Book-to-Market Black Box: The R&D Effect (1999). (22) RePEc:bla:jbfnac:v:28:y:2001-09:i:7&8:p:799-819 (). (23) RePEc:bla:jbfnac:v:31:y:2004-01:i:1-2:p:115-148 The Timeliness of Income Recognition by European Companies: An Analysis of Institutional and Market Complexity (2004). (24) RePEc:bla:jbfnac:v:30:y:2003-01:i:1-2:p:25-56 Scale and the Scale Effect in Market-based Accounting Research (2003). (25) RePEc:bla:jbfnac:v:33:y:2006-06:i:5-6:p:909-931 Corporate Failure Prediction Modeling: Distorted by Business Groups Internal Capital Markets? (2006). (26) RePEc:bla:jbfnac:v:33:y:2006-11:i:9-10:p:1321-1343 The Small World of Corporate Boards (2006). (27) RePEc:bla:jbfnac:v:27:y:2000-11:i:9&10:p:1139-1183 (). (28) RePEc:bla:jbfnac:v:28:y:2001-06:i:5-6:p:531-562 A Comparative Analysis of Earnings Forecasts in Europe (2001). (29) RePEc:bla:jbfnac:v:28:y:2001-06:i:5-6:p:671-692 R&D Intensity and Corporate Financial Policy: Some International Evidence (2001). (30) RePEc:bla:jbfnac:v:30:y:2003-01:i:1-2:p:125-168 Voluntary Disclosure of Management Earnings Forecasts in IPO Prospectuses (2003). (31) RePEc:bla:jbfnac:v:26:y:1999-01:i:1-2:p:199-225 The Nature of Board Nominating Committees and Their Role in Corporate Governance (1999). (32) RePEc:bla:jbfnac:v:26:y:1999-06:i:5&6:p:681-708 (). (33) RePEc:bla:jbfnac:v:31:y:2004-01:i:1-2:p:87-112 CAPM, Higher Co-moment and Factor Models of UK Stock Returns (2004). (34) RePEc:bla:jbfnac:v:32:y:2005-06:i:5-6:p:909-943 Incentive Effects, Monitoring Mechanisms and the Market for Corporate Control: An Analysis of the Factors Affecting Public to Private Transactions in the UK (2005). (35) RePEc:bla:jbfnac:v:27:y:2000-04:i:3-4:p:423-446 An Empirical Analysis of the Bias and Rationality of Profit Forecasts Published in New Issue Prospectuses (2000). (36) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:511-525 The Provision of Non-audit Services and the Pricing of Audit Fees (1997). (37) RePEc:bla:jbfnac:v:26:y:1999-06:i:5&6:p:559-593 (). (38) RePEc:bla:jbfnac:v:30:y:2003-06:i:5-6:p:715-747 Measuring the Impact of Corporate Investment Announcements on Share Prices: The Spanish Experience (2003). (39) RePEc:bla:jbfnac:v:34:y:2007-06:i:5-6:p:872-888 UK Stock Returns and the Impact of Domestic Monetary Policy Shocks (2007). (40) RePEc:bla:jbfnac:v:24:y:1997-04:i:3:p:497-509 The Effect of Bond Rating Changes and New Ratings on UK Stock Returns (1997). (41) RePEc:bla:jbfnac:v:33:y:2006-11:i:9-10:p:1535-1555 House Prices, Fundamentals and Bubbles (2006). (42) RePEc:bla:jbfnac:v:25:y:1998-06:i:5&6:p:721-745 (). (43) RePEc:bla:jbfnac:v:30:y:2003-06:i:5-6:p:699-714 The Time Series Properties of Financial Ratios: Lev Revisited (2003). (44) RePEc:bla:jbfnac:v:27:y:2000-04:i:3-4:p:487-510 The Distributional Characteristics of a Selection of Contracts Traded on the London International Financial Futures Exchange (2000). (45) RePEc:bla:jbfnac:v:32:y:2005-01:i:1-2:p:161-181 US, UK and European Stock Market Integration (2005). (46) RePEc:bla:jbfnac:v:31:y:2004-01:i:1-2:p:257-292 What Role Taxes and Regulation? A Second Look at Open Market Share Buyback Activity in the UK (2004). (47) RePEc:bla:jbfnac:v:31:y:2004-04:i:3-4:p:539-578 Stability, Asymmetry and Seasonality of Fund Performance: An Analysis of Australian Multi-sector Managed Funds (2004). (48) RePEc:bla:jbfnac:v:24:y:1997-09:i:7&8:p:943-961 (). (49) RePEc:bla:jbfnac:v:24:y:1997-03:i:2:p:155-178 Consistency of UK Pension Fund Investment Performance (1997). (50) RePEc:bla:jbfnac:v:24:y:1997-07:i:6:p:869-879 A Note on Selecting a Response Measure for Financial Distress (1997). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:may:mayecw:n2021009.pdf The sequencing of stock market liberalization events and corporate financing decisions (2009). Economics, Finance and Accounting Department Working Paper Series Recent citations received in: 2008 (1) RePEc:kap:apfinm:v:15:y:2008:i:3:p:209-228 Empirical Investigation of the Ability of Sensitivity of Stock Prices to Earnings News in Predicting Earnings Management and Management Forecast Errors (2008). Asia-Pacific Financial Markets (2) RePEc:pra:mprapa:13890 Competitive conditions in the Central and Eastern European banking systems (2008). MPRA Paper (3) RePEc:pra:mprapa:15250 Stock Futures Introduction & Its Impact on Indian Spot Market (2008). MPRA Paper (4) RePEc:san:crieff:0810 Value Ambiguity and Gains from Acquisitions of Unlisted Targets (2008). CRIEFF Discussion Papers Recent citations received in: 2007 (1) RePEc:cdf:accfin:2007/6 Further Evidence on Auditor Selection Bias and The Big 4 Premium (2007). Cardiff Accounting and Finance Working Papers Recent citations received in: 2006 (1) RePEc:eab:financ:22248 Impact of Financial Reforms on Efficiency of State-owned, Private and Foreign Banks in Pakistan (2006). Finance Working Papers (2) RePEc:ner:leuven:urn:hdl:123456789/120984 Earnings management and debt. (2006). Open Access publications from Katholieke Universiteit Leuven (3) RePEc:pra:mprapa:8304 Corporate culture and shareholder value in banking industry (2006). MPRA Paper (4) RePEc:wly:mgtdec:v:27:y:2006:i:2-3:p:173-187 Explaining clustering in social networks: towards an evolutionary theory of cascading benefits (2006). Managerial and Decision Economics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||