|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

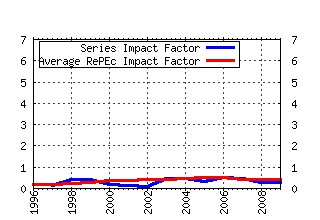

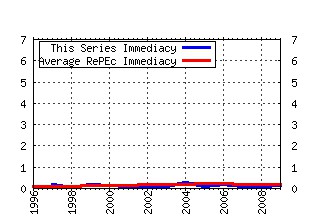

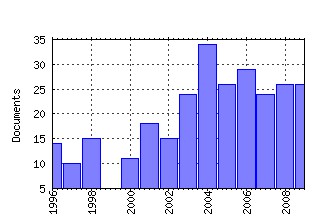

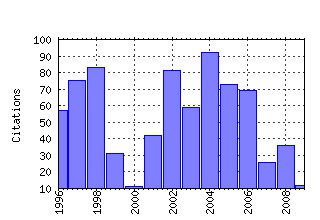

Studies in Nonlinear Dynamics & Econometrics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bpj:sndecm:v:6:y:2002:i:2:n:3 Asymmetries in Monetary Policy Reaction Function: Evidence for U.S. French and German Central Banks (2002). (2) RePEc:bpj:sndecm:v:3:y:1998:i:1:n:2 The Decomposition of Economic Relationships by Time Scale Using Wavelets: Expenditure and Income (1998). (3) RePEc:bpj:sndecm:v:2:y:1997:i:1:n:1 Inference in TAR Models (1997). (4) RePEc:bpj:sndecm:v:2:y:1997:i:1:n:2 Investigating Cyclical Asymmetries (1997). (5) RePEc:bpj:sndecm:v:7:y:2003:i:4:n:3 Nonlinearities and Cyclical Behavior: The Role of Chartists and Fundamentalists (2003). (6) RePEc:bpj:sndecm:v:2:y:1998:i:4:n:4 GARCH for Irregularly Spaced Financial Data: The ACD-GARCH Model (1998). (7) RePEc:bpj:sndecm:v:9:y:2005:i:1:n:2 A Practitioners Guide to Lag Order Selection For VAR Impulse Response Analysis (2005). (8) RePEc:bpj:sndecm:v:8:y:2004:i:3:n:4 Household Income Dynamics in Two Transition Economies (2004). (9) RePEc:bpj:sndecm:v:8:y:2004:i:3:n:1 The Long Memory of the Efficient Market (2004). (10) RePEc:bpj:sndecm:v:5:y:2002:i:4:n:3 Microeconomic Models for Long Memory in the Volatility of Financial Time Series (2002). (11) RePEc:bpj:sndecm:v:1:y:1996:i:1:n:re1 A Check on the Robustness of Hamiltons Markov Switching Model Approach to the Economic Analysis of the Business Cycle (1996). (12) RePEc:bpj:sndecm:v:5:y:2001:i:3:n:1 Real Exchange Rate Dynamics in Transition Economies: A Nonlinear Analysis (2001). (13) RePEc:bpj:sndecm:v:10:y:2006:i:3:n:2 Point and Interval Forecasting of Spot Electricity Prices: Linear vs. Non-Linear Time Series Models (2006). (14) RePEc:bpj:sndecm:v:8:y:2004:i:3:n:2 Nonlinear Monetary Policy Rules: Some New Evidence for the U.S. (2004). (15) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:1 Stability Analysis of Continuous-Time Macroeconometric Systems (1999). (16) RePEc:bpj:sndecm:v:9:y:2005:i:4:n:6 Forecasting Stock Market Volatility with Regime-Switching GARCH Models (2005). (17) RePEc:bpj:sndecm:v:11:y:2007:i:4:n:3 Jump-and-Rest Effect of U.S. Business Cycles (2007). (18) RePEc:bpj:sndecm:v:8:y:2004:i:2:n:14 Inference and Forecasting for ARFIMA Models With an Application to US and UK Inflation (2004). (19) RePEc:bpj:sndecm:v:1:y:1997:i:4:n:1 Endogenous Cycles in Competitive Models: An Overview (1997). (20) RePEc:bpj:sndecm:v:6:y:2002:i:1:n:3 Characterizing the Degree of Stability of Non-linear Dynamic Models (2002). (21) RePEc:bpj:sndecm:v:10:y:2006:i:4:n:1 Interest Rate Setting and Inflation Targeting: Evidence of a Nonlinear Taylor Rule for the United Kingdom (2006). (22) RePEc:bpj:sndecm:v:1:y:1996:i:1:n:3 Optimal Cycles and Chaos: A Survey (1996). (23) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:4 Monetary Policy with a Nonlinear Phillips Curve and Asymmetric Loss (1999). (24) RePEc:bpj:sndecm:v:3:y:1998:i:1:n:1 Avoiding the Pitfalls: Can Regime-Switching Tests Reliably Detect Bubbles? (1998). (25) RePEc:bpj:sndecm:v:2:y:1997:i:2:n:2 Finite Sample Properties of the Efficient Method of Moments (1997). (26) RePEc:bpj:sndecm:v:8:y:2004:i:2:n:8 Mixture Processes for Financial Intradaily Durations (2004). (27) RePEc:bpj:sndecm:v:10:y:2006:i:3:n:3 The Nature of Power Spikes: A Regime-Switch Approach (2006). (28) RePEc:bpj:sndecm:v:10:y:2006:i:2:n:3 Output and Inflation Responses to Credit Shocks: Are There Threshold Effects in the Euro Area? (2006). (29) RePEc:bpj:sndecm:v:10:y:2006:i:4:n:2 Measuring the Interaction of Wage and Price Phillips Curves for the U.S. Economy (2006). (30) RePEc:bpj:sndecm:v:7:y:2003:i:4:n:5 Credit Market Imperfections and Business Cycle Dynamics: A Nonlinear Approach (2003). (31) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:2 Sectoral Investigation of Asymmetries in the Conditional Mean Dynamics of the Real U.S. GDP (1999). (32) RePEc:bpj:sndecm:v:6:y:2002:i:3:n:3 Common Persistent Factors in Inflation and Excess Nominal Money Growth and a New Measure of Core Inflation (2002). (33) RePEc:bpj:sndecm:v:9:y:2005:i:4:n:5 Dual Long Memory in Inflation Dynamics across Countries of the Euro Area and the Link between Inflation Uncertainty and Macroeconomic Performance (2005). (34) RePEc:bpj:sndecm:v:3:y:1998:i:3:n:1 Information-Theoretic Analysis of Serial Dependence and Cointegration (1998). (35) RePEc:bpj:sndecm:v:9:y:2005:i:4:n:4 The International CAPM and a Wavelet-Based Decomposition of Value at Risk (2005). (36) RePEc:bpj:sndecm:v:1:y:1996:i:3:n:al1 SIMANN: A Global Optimization Algorithm using Simulated Annealing (1996). (37) RePEc:bpj:sndecm:v:7:y:2003:i:4:n:4 The Relationship Between Financial Variables and Real Economic Activity: Evidence From Spectral and Wavelet Analyses (2003). (38) RePEc:bpj:sndecm:v:12:y:2008:i:3:n:8 Threshold Adjustment of Deviations from the Law of One Price (2008). (39) repec:bpj:sndecm:v:2:y:1997:i:2:n:1 (). (40) RePEc:bpj:sndecm:v:8:y:2004:i:1:n:4 An Investigation of Current Account Solvency in Latin America Using Non Linear Nonstationarity Tests (2004). (41) RePEc:bpj:sndecm:v:9:y:2005:i:4:n:1 Can GARCH Models Capture Long-Range Dependence? (2005). (42) RePEc:bpj:sndecm:v:7:y:2003:i:1:n:1 Investment Under Uncertainty with Stochastically Switching Profit Streams: Entry and Exit over the Business Cycle. (2003). (43) RePEc:bpj:sndecm:v:5:y:2001:i:1:n:7 Wavelet Analysis of the Cost-of-Carry Model (2001). (44) RePEc:bpj:sndecm:v:5:y:2001:i:3:n:3 Energy Shocks and Financial Markets: Nonlinear Linkages (2001). (45) RePEc:bpj:sndecm:v:3:y:1998:i:2:n:1 Smooth-Transition GARCH Models (1998). (46) RePEc:bpj:sndecm:v:1:y:1996:i:2:n:1 If Nonlinear Models Cannot Forecast, What Use Are They? (1996). (47) RePEc:bpj:sndecm:v:5:y:2001:i:3:n:2 Evaluating the Persistence and Structuralist Theories of Unemployment from a Nonlinear Perspective (2001). (48) RePEc:bpj:sndecm:v:10:y:2006:i:3:n:7 Risk Premia in Electricity Forward Prices (2006). (49) RePEc:bpj:sndecm:v:3:y:1998:i:3:n:2 Characterizing Asymmetries in Business Cycles Using Smooth-Transition Structural Time-Series Models (1998). (50) RePEc:bpj:sndecm:v:5:y:2001:i:1:n:2 Estimating the Fractional Order of Integration of Interest Rates Using a Wavelet OLS Estimator (2001). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:cfr:cefirw:w0136 Directional Prediction of Returns under Asymmetric Loss: Direct and Indirect Approaches (2009). Working Papers (2) RePEc:imk:wpaper:3-2009 Heterogenous Behavioral Expectations, FX Fluctuations and Dynamic Stability in a Stylized Two-Country Macroeconomic Model (2009). IMK Working Paper (3) RePEc:kap:compec:v:34:y:2009:i:2:p:145-172 Which Econometric Specification to Characterize the U.S. Inflation Rate Process? (2009). Computational Economics Recent citations received in: 2008 (1) RePEc:fip:fedlwp:2008-046 Mexicos integration into NAFTA markets: a view from sectoral real exchange rates (2008). Working Papers (2) RePEc:imf:imfwpa:08/123 Mexicos Integration into NAFTA Markets: A View from Sectoral Real Exchange Rates and Transaction Costs (2008). IMF Working Papers Recent citations received in: 2007 (1) RePEc:ebl:ecbull:v:3:y:2007:i:67:p:1-10 Estimating the Fractionally Integrated Model with a Break in the Differencing Parameter (2007). Economics Bulletin (2) RePEc:pra:mprapa:19365 Los Ciclos del Mercado Inmobiliario y su Relación con los Ciclos de la EconomÃa (2007). MPRA Paper Recent citations received in: 2006 (1) RePEc:deg:conpap:c011_019 Growth, Sectoral Composition, and the Wealth of Nations (2006). DEGIT Conference Papers (2) RePEc:fip:fedgfe:2007-03 Linear cointegration of nonlinear time series with an application to interest rate dynamics (2006). Finance and Economics Discussion Series (3) RePEc:imk:wpaper:04-2006 Disequilibrium Macroeconomic Dynamics, Income Distribution and Wage-Price Phillips Curves (2006). IMK Working Paper (4) RePEc:mcl:mclwop:2006-14 EXTREME DEPENDENCE IN THE NASDAQ AND S&P COMPOSITE INDEXES (2006). Departmental Working Papers (5) RePEc:pra:mprapa:1363 Point and interval forecasting of wholesale electricity prices: Evidence from the Nord Pool market (2006). MPRA Paper (6) RePEc:udc:esteco:v:33:y:2006:i:1:p:65-81 Regime-Dependent output convergence in Latin America (2006). Estudios de Economia Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||