|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

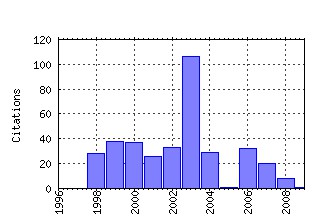

Berkeley Olin Program in Law & Economics, Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cdl:oplwec:7972 Executive Compensation as an Agency Problem (2003). (2) RePEc:cdl:oplwec:43 Expressive Law and Economics (1998). (3) RePEc:cdl:oplwec:20 Valuing Research Leads: Bioprospecting and the Conservation of Genetic Resources (2000). (4) RePEc:cdl:oplwec:30875 Exclusion or Efficient Pricing? The Big Deal Bundling of Academic Journals (2004). (5) RePEc:cdl:oplwec:19 On the Performance and Use of Government Revenue Forecasts (1999). (6) RePEc:cdl:oplwec:38129 Stopping Above-Cost Predatory Pricing (2001). (7) RePEc:cdl:oplwec:244302 Shadow Economy, Tax Morale, Governance and Institutional Quality: A Panel Analysis (2007). (8) RePEc:cdl:oplwec:3126 Rotten Apples: An Investigation of the Prevalence and Predictors of Teacher Cheating (2002). (9) RePEc:cdl:oplwec:171125 The Demand for Currency Approach and the Size of the Shadow Economy: A Critical Assessment (2006). (10) RePEc:cdl:oplwec:256655 The Future of Capital Income Taxation (2006). (11) RePEc:cdl:oplwec:6907 Valuable Patents (2003). (12) RePEc:cdl:oplwec:36 Expressive Law: Framing or Equilibrium Selection? (2001). (13) RePEc:cdl:oplwec:256652 Why Have Corporate Tax Revenues Declined? Another Look (2007). (14) RePEc:cdl:oplwec:38128 Mixed equilibria are unstable in games of strategic complements (2004). (15) RePEc:cdl:oplwec:27 The Questionable Ascent of Hadley v. Baxendale (1999). (16) RePEc:cdl:oplwec:12366 Environmental Regulation, Cost-Benefit Analysis, and the Discounting of Human Lives (1999). (17) RePEc:cdl:oplwec:483860 Voting as a Rational Choice (2008). (18) RePEc:cdl:oplwec:10 Lesson from Fiascos in Russian Corporate Governance (2000). (19) RePEc:cdl:oplwec:6906 Policy Levers in Patent Law (2003). (20) RePEc:cdl:oplwec:5583 The Political Economy of Intellectual Property Treaties (2003). (21) RePEc:cdl:oplwec:75 The Myth of State Competition in Corporate Law (2002). (22) RePEc:cdl:oplwec:272642 Dividend Taxes and Firm Valuation: New Evidence (2006). (23) RePEc:cdl:oplwec:72 Beyond Outcomes: Measuring Procedural Utility (2002). (24) RePEc:cdl:oplwec:13271 Privacy and Information Acquisition in Competitive Markets (2004). (25) RePEc:cdl:oplwec:55 Anti-Insurance (2002). (26) RePEc:cdl:oplwec:45865 The Welfare Losses from Price-Matching Policies (1999). (27) RePEc:cdl:oplwec:37 The Virtuous Circle of Distrust: A Mechanism to Deter Bribes and Other Cooperative Crimes (2000). (28) RePEc:cdl:oplwec:9 The Impact of Legalized Abortion on Crime (2000). (29) RePEc:cdl:oplwec:6904 The Uninvited Guest: Patents on Wall Street (2003). (30) RePEc:cdl:oplwec:3490 The Political Economy of Litigation and Settlement at the WTO (2003). (31) RePEc:cdl:oplwec:1741 Do the Merits Matter More? Class Actions under the Private Securities Litigation Reform Act (2002). (32) RePEc:cdl:oplwec:58 Executive Compensation in America: Optimal Contracting or Extraction of Rents? (2001). (33) RePEc:cdl:oplwec:502483 Independent Directors and Board Control in Venture Finance (2008). (34) RePEc:cdl:oplwec:228814 Government Accountability and Fiscal Discipline: A panel analysis using Swiss data (2006). (35) RePEc:cdl:oplwec:12367 Models of Morality in Law and Economics: Self-Control and Self-Improvement for the Bad Man of Holmes (1998). (36) RePEc:cdl:oplwec:18 Rational Ignorance at the Patent Office (2000). (37) RePEc:cdl:oplwec:229233 Tax Morale and Conditional Cooperation (2006). (38) RePEc:cdl:oplwec:61 The Effect of Electoral Institutions on Tort Awards (2002). (39) RePEc:cdl:oplwec:12335 Lesson from Fiascos in Russian Corporate Governance (1999). (40) RePEc:cdl:oplwec:5556 Hand Rule Damages for Incompensable Losses (2003). (41) RePEc:cdl:oplwec:229216 The Power of Positional Concerns: A Panel Analysis (2006). (42) RePEc:cdl:oplwec:272630 The Choice between Income and Consumption Taxes: A Primer (2006). (43) RePEc:cdl:oplwec:12360 Damages and Injunctions in the Protection of Proprietary Research Tools (1999). (44) RePEc:cdl:oplwec:7752 Stability and Change in International Customary Law (2003). (45) RePEc:cdl:oplwec:13093 Gatekeeper Failure and Reform: The Challenge of Fashioning Relevant Reforms (2004). (46) RePEc:cdl:oplwec:236726 Agency Costs of Venture Capitalist Control in Startups (2006). (47) RePEc:cdl:oplwec:12357 Corruption and Optimal Law Enforcement (1999). (48) RePEc:cdl:oplwec:30619 Improving the Legal Environment for Start-Up Financing by Rationalizing Rule 144 (2004). (49) RePEc:cdl:oplwec:1530647 Experimental Evidence of Tax Framing Effects on the Work/Leisure Decision (2010). (50) RePEc:cdl:oplwec:44 Do Good Laws Make Good Citizens? An Economic Analysis of Internalizing Legal Values (2000). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:roc:wallis:wp59 Information and Voting: the Wisdom of the Experts versus the Wisdom of the Masses (2008). Wallis Working Papers Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:ces:ceswps:_1806 Shadow Economies and Corruption all over the World: What do we really Know? (2006). CESifo Working Paper Series (2) RePEc:fip:fedhwp:wp-06-17 How did the 2003 dividend tax cut affect stock prices? (2006). Working Paper Series (3) RePEc:iza:izadps:dp2315 Shadow Economies and Corruption All Over the World: What Do We Really Know? (2006). IZA Discussion Papers (4) RePEc:jku:econwp:2006_17 Shadow Economies and Corruption all over the World: What do we really know? (2006). Economics working papers (5) RePEc:kud:epruwp:06-07 The Theory of Optimal Taxation: What is the Policy Relevance? (2006). EPRU Working Paper Series (6) RePEc:lmu:muenec:1202 Social Norms and Conditional Cooperative Taxpayers (2006). Discussion Papers in Economics (7) RePEc:ses:arsjes:2006-iii-4 Tax Morale: A Survey with a Special Focus on Switzerland (2006). Swiss Journal of Economics and Statistics (SJES) Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||