|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

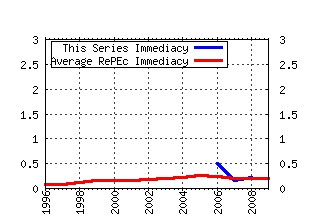

DISCE - Quaderni dell'Istituto di Economia e Finanza Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ctc:serie3:ief0064 International Financial Instability in a World of Currencies Hierarchy (2005). (2) RePEc:ctc:serie3:ief0073 The Social Value of Public Information with Costly Information Acquisition (2007). (3) RePEc:ctc:serie3:ief0072 Productivity shocks and Optimal Monetary Policy in a Unionized Labor Market Economy (2007). (4) RePEc:ctc:serie3:ief0067 Stock-bond correlation and the bond quality ratio: Removing the discount factor to generate a deflated stock index (2006). (5) RePEc:ctc:serie3:ief0075 Corporate Governance as a Commitmente and Signalling Device (2007). (6) RePEc:ctc:serie3:ief0074 When do Thick Venture Capital Markets Foster Innovation? An Evolutionary Analysis (2007). (7) RePEc:ctc:serie3:ief0076 The Role of the Local Business Environment in Banking Consolidation (2008). (8) RePEc:ctc:serie3:ief0082 Long-run Phillips Curve and Disinfation Dynamics: Calvo vs. Rotemberg Price Setting (2008). (9) RePEc:ctc:serie3:ief0080 Complementary Assets, Start-Ups and Incentives to Innovate (2008). (10) RePEc:ctc:serie3:ief0084 Constitutional reforms, fiscal decentralization and regional fiscal flows in Italy (2008). (11) RePEc:ctc:serie3:ief0070 Lessons from the ECB experience: Frankfurt still matters! (2007). (12) RePEc:ctc:serie3:ief0093 Is the Leverage of European Commercial Banks Pro-Cyclical? (2010). (13) RePEc:ctc:serie3:ief0092 Taxation and Predatory Prices in a Spatial Model (2010). (14) RePEc:ctc:serie3:ief69 (). (15) RePEc:ctc:serie3:ief0086 Persistent disequilibrium dynamics and economic policy (2009). (16) RePEc:ctc:serie3:ief0096 The efficiency view of corporate boards: theory and evidence (2010). (17) RePEc:ctc:serie3:ief0078 Labour market imperfections, divine coincidence and the volatility of employment and inflation (2008). (18) RePEc:ctc:serie3:ief0095 Bertrand and Cournot in the unidirectional Hotelling model (2010). (19) RePEc:ctc:serie3:ief0090 Pricing Policy and Partial Collusion (2009). (20) RePEc:ctc:serie3:ief0101 Equity in the City: On Measuring Urban (Ine)Quality of Life (2011). (21) RePEc:ctc:serie3:ief0094 Who do you blame in local finance? An analysis of municipal financing in Italy (2010). (22) RePEc:ctc:serie3:ief0088 On the determinants of the degree of openness of Open Source firms: An entry model (2009). (23) RePEc:ctc:serie3:ief0100 The Welfare Implications of Costly Information Provision (2011). (24) RePEc:ctc:serie3:ief0087 Moderating Political Extremism: Single Round vs Runoff Elections under Plurality Rule (2009). (25) RePEc:ctc:serie3:ief0099 The importance of electoral rule: Evidence from Italy (2011). (26) RePEc:ctc:serie3:ief0091 Liquidity crunch in the interbank market: is it credit or liquidity risk, or both? (2009). (27) RePEc:ctc:serie3:ief0103 Marking-to-Market Government Guarantees to Financial Systems.Theory and Evidence for Europe (2011). (28) RePEc:ctc:serie3:ief0081 Shareholders agreements and voting power. Evidence from Italian listed firms (2008). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:ctc:serie3:ief0083 The intraday interest rate under a liquidity crisis: the case of August 2007 (2008). DISCE - Quaderni dell'Istituto di Economia e Finanza (2) RePEc:ctc:serie3:ief0084 Constitutional reforms, fiscal decentralization and regional fiscal flows in Italy (2008). DISCE - Quaderni dell'Istituto di Economia e Finanza Recent citations received in: 2007 (1) RePEc:ctc:serie3:ief0074 When do Thick Venture Capital Markets Foster Innovation? An Evolutionary Analysis (2007). DISCE - Quaderni dell'Istituto di Economia e Finanza Recent citations received in: 2006 (1) RePEc:ctc:serie3:ief0069 Entry into a network industry: consumers expectations and firms pricing policies (2006). DISCE - Quaderni dell'Istituto di Economia e Finanza Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||