|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

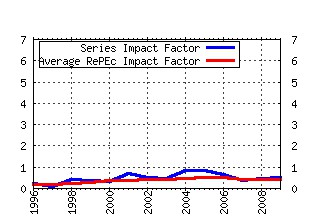

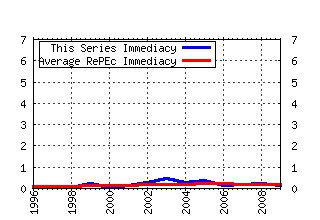

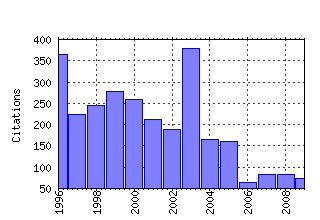

Journal of Financial and Quantitative Analysis Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cup:jfinqa:v:22:y:1987:i:01:p:109-126_01 The Relation between Price Changes and Trading Volume: A Survey (1987). (2) RePEc:cup:jfinqa:v:31:y:1996:i:03:p:377-397_00 Firm Performance and Mechanisms to Control Agency Problems between Managers and Shareholders (1996). (3) RePEc:cup:jfinqa:v:24:y:1989:i:02:p:241-256_01 International Transmission of Stock Market Movements (1989). (4) RePEc:cup:jfinqa:v:20:y:1985:i:04:p:391-405_01 The Determinants of Firms Hedging Policies (1985). (5) RePEc:cup:jfinqa:v:38:y:2003:i:01:p:1-36_00 International Corporate Governance (2003). (6) RePEc:cup:jfinqa:v:34:y:1999:i:04:p:465-487_00 Autoregressive Conditional Skewness (1999). (7) RePEc:cup:jfinqa:v:33:y:1998:i:03:p:335-359_00 The Determinants of Corporate Liquidity: Theory and Evidence (1998). (8) RePEc:cup:jfinqa:v:36:y:2001:i:01:p:1-24_00 The Debt-Equity Choice (2001). (9) RePEc:cup:jfinqa:v:38:y:2003:i:01:p:87-110_00 Corporate Governance and the Home Bias (2003). (10) RePEc:cup:jfinqa:v:19:y:1984:i:02:p:127-140_01 Optimal Hedging Policies (1984). (11) RePEc:cup:jfinqa:v:31:y:1996:i:01:p:85-107_00 Another Look at Models of the Short-Term Interest Rate (1996). (12) RePEc:cup:jfinqa:v:25:y:1990:i:02:p:203-214_00 Stock Returns and Volatility (1990). (13) RePEc:cup:jfinqa:v:12:y:1977:i:04:p:541-552_02 The Valuation of Corporate Liabilities as Compound Options (1977). (14) RePEc:cup:jfinqa:v:37:y:2002:i:01:p:63-91_00 Portfolio and Consumption Decisions under Mean-Reverting Returns: An Exact Solution for Complete Markets (2002). (15) RePEc:cup:jfinqa:v:34:y:1999:i:01:p:33-55_00 Volatility in Emerging Stock Markets (1999). (16) RePEc:cup:jfinqa:v:2:y:1967:i:02:p:76-84_01 Portfolio Analysis (1967). (17) RePEc:cup:jfinqa:v:38:y:2003:i:01:p:111-133_00 International Corporate Governance and Corporate Cash Holdings (2003). (18) RePEc:cup:jfinqa:v:12:y:1977:i:04:p:627-627_02 Abstract: An Equilibrium Characterization of the Term Structure (1977). (19) RePEc:cup:jfinqa:v:16:y:1981:i:04:p:581-600_00 The Determinants of Bank Interest Margins: Theory and Empirical Evidence (1981). (20) RePEc:cup:jfinqa:v:23:y:1988:i:03:p:269-283_01 The Dependence between Hourly Prices and Trading Volume (1988). (21) RePEc:cup:jfinqa:v:26:y:1991:i:03:p:363-376_00 The Pricing of Exchange Rate Risk in the Stock Market (1991). (22) RePEc:cup:jfinqa:v:35:y:2000:i:04:p:577-600_00 Market Segmentation and the Cost of the Capital in International Equity Markets (2000). (23) RePEc:cup:jfinqa:v:36:y:2001:i:04:p:523-543_00 Economic News and Bond Prices: Evidence from the U.S. Treasury Market (2001). (24) RePEc:cup:jfinqa:v:31:y:1996:i:03:p:419-439_00 Evidence on Corporate Hedging Policy (1996). (25) RePEc:cup:jfinqa:v:34:y:1999:i:02:p:211-239_00 Of Smiles and Smirks: A Term Structure Perspective (1999). (26) RePEc:cup:jfinqa:v:38:y:2003:i:01:p:159-184_00 Equity Ownership and Firm Value in Emerging Markets (2003). (27) RePEc:cup:jfinqa:v:15:y:1980:i:04:p:907-929_01 Analyzing Convertible Bonds (1980). (28) RePEc:cup:jfinqa:v:33:y:1998:i:03:p:383-408_00 The Effects of Macroeconomic News on High Frequency Exchange Rate Behavior (1998). (29) RePEc:cup:jfinqa:v:21:y:1986:i:03:p:279-292_01 Bayes-Stein Estimation for Portfolio Analysis (1986). (30) RePEc:cup:jfinqa:v:32:y:1997:i:01:p:91-115_00 Recovering an Assets Implied PDF from Option Prices: An Application to Crude Oil during the Gulf Crisis (1997). (31) RePEc:cup:jfinqa:v:18:y:1983:i:01:p:53-65_01 A Simplified Jump Process for Common Stock Returns (1983). (32) RePEc:cup:jfinqa:v:28:y:1993:i:04:p:535-551_00 Time-Varying Distributions and Dynamic Hedging with Foreign Currency Futures (1993). (33) RePEc:cup:jfinqa:v:40:y:2005:i:02:p:373-401_00 Volatility Spillover Effects in European Equity Markets (2005). (34) RePEc:cup:jfinqa:v:30:y:1995:i:01:p:117-134_00 The Short-Run Dynamics of the Price Adjustment to New Information (1995). (35) RePEc:cup:jfinqa:v:21:y:1986:i:04:p:459-471_01 Financial Innovation: The Last Twenty Years and the Next (1986). (36) RePEc:cup:jfinqa:v:32:y:1997:i:04:p:405-426_00 Is Technical Analysis in the Foreign Exchange Market Profitable? A Genetic Programming Approach (1997). (37) RePEc:cup:jfinqa:v:17:y:1982:i:03:p:301-329_01 An Equilibrium Model of Bond Pricing and a Test of Market Efficiency (1982). (38) RePEc:cup:jfinqa:v:25:y:1990:i:04:p:441-468_00 The Dynamics of Stock Index and Stock Index Futures Returns (1990). (39) RePEc:cup:jfinqa:v:23:y:1988:i:02:p:135-151_01 International Listings and Stock Returns: Some Empirical Evidence (1988). (40) RePEc:cup:jfinqa:v:34:y:1999:i:01:p:115-130_00 Kalman Filtering of Generalized Vasicek Term Structure Models (1999). (41) RePEc:cup:jfinqa:v:29:y:1994:i:03:p:419-444_00 A Study of Monthly Mutual Fund Returns and Performance Evaluation Techniques (1994). (42) RePEc:cup:jfinqa:v:28:y:1993:i:02:p:235-254_00 One-Factor Interest-Rate Models and the Valuation of Interest-Rate Derivative Securities (1993). (43) RePEc:cup:jfinqa:v:32:y:1997:i:01:p:47-69_00 An Empirical Analysis of the Determinants of Corporate Debt Ownership Structure (1997). (44) RePEc:cup:jfinqa:v:32:y:1997:i:03:p:331-344_00 Reciprocally Interlocking Boards of Directors and Executive Compensation (1997). (45) RePEc:cup:jfinqa:v:20:y:1985:i:04:p:407-422_01 Differential Information and Security Market Equilibrium (1985). (46) RePEc:cup:jfinqa:v:24:y:1989:i:04:p:409-425_01 Executive Stock Option Plans and Corporate Dividend Policy (1989). (47) RePEc:cup:jfinqa:v:33:y:1998:i:02:p:159-188_00 The Risk and Return from Factors (1998). (48) RePEc:cup:jfinqa:v:31:y:1996:i:01:p:143-159_00 The Maximum Entropy Distribution of an Asset Inferred from Option Prices (1996). (49) RePEc:cup:jfinqa:v:22:y:1987:i:02:p:127-141_01 Transaction Data Tests of the Mixture of Distributions Hypothesis (1987). (50) RePEc:cup:jfinqa:v:27:y:1992:i:04:p:575-589_00 The Role of Asset Structure, Ownership Structure, and Takeover Defenses in Determining Acquisition Likelihood (1992). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:dgr:kubcen:200937s Auctioned IPOs: The U.S. Evidence (2009). Discussion Paper (2) RePEc:eee:jfinec:v:92:y:2009:i:1:p:1-24 The on-the-run liquidity phenomenon (2009). Journal of Financial Economics (3) RePEc:hhs:stavef:2009_035 The information content of market liquidity: An empirical analysis of liquidity at the Oslo Stock Exchange (2009). UiS Working Papers in Economics and Finance (4) RePEc:nbr:nberwo:14890 Do Regulations Based on Credit Ratings Affect a Firms Cost of Capital? (2009). NBER Working Papers (5) RePEc:nbr:nberwo:15502 Art and Money (2009). NBER Working Papers (6) RePEc:nbr:nberwo:15529 Trust and Delegation (2009). NBER Working Papers (7) RePEc:pra:mprapa:22525 Capital Structure Decisions: Which Factors are Reliably Important? (2009). MPRA Paper (8) RePEc:zur:iewwpx:405 Momentum in stock market returns, risk premia on foreign currencies and international financial integration (2009). IEW - Working Papers Recent citations received in: 2008 (1) RePEc:acb:camaaa:2008-32 EARNINGS VALUATION AND SOURCES OF GROWTH (2008). CAMA Working Papers (2) RePEc:ecl:ohidic:2008-9 Estimating the Effects of Large Shareholders Using a Geographic Instrument (2008). Working Paper Series (3) RePEc:fip:fedgfe:2008-49 Do behavioral biases adversely affect the macro-economy? (2008). Finance and Economics Discussion Series (4) RePEc:hhs:nhhfms:2008_003 Modeling International Financial Returns with a Multivariate Regime Switching Copula (2008). Discussion Papers (5) RePEc:hum:wpaper:sfb649dp2008-062 Nonlinear Modeling of Target Leverage with Latent Determinant Variables â New Evidence on the Trade-off Theory (2008). SFB 649 Discussion Papers (6) RePEc:kap:revdev:v:11:y:2008:i:3:p:205-244 The cross-section of average delta-hedge option returns under stochastic volatility (2008). Review of Derivatives Research (7) RePEc:pra:mprapa:11401 Dependence Structures in Chinese and U.S. Financial Markets -- A Time-varying Conditional Copula Approach (2008). MPRA Paper (8) RePEc:smu:ecowpa:0808 Dependence Structures in Chinese and U.S. Financial Markets: A Time-varying Conditional Copula Approach (2008). Departmental Working Papers (9) RePEc:ste:nystbu:08-21 Information Acquisition and Under-Diversification (2008). Recent citations received in: 2007 (1) RePEc:anp:en2007:108 CHARACTERIZING THE BRAZILIAN TERM STRUCTURE OF INTEREST RATES (2007). Anais do XXXV Encontro Nacional de Economia [Proceedings of the 35th Brazilian Economics Meeting] (2) RePEc:cbr:cbrwps:wp357 UK Corporate Governance and Takeover Performance (2007). ESRC Centre for Business Research - Working Papers (3) RePEc:cpr:ceprdp:6445 The Expectation Hypothesis of the Term Structure of Very Short-Term Rates: Statistical Tests and Economic Value (2007). CEPR Discussion Papers (4) RePEc:ebl:ecbull:v:5:y:2007:i:12:p:1-12 Investment behavior, observable expectations, and internal funds: a comment on Cummins et al. (AER, 2006) (2007). Economics Bulletin (5) RePEc:fgv:epgewp:657 The Role of No-Arbitrage on Forecasting: Lessons from a Parametric Term Structure Model (2007). Economics Working Papers (Ensaios Economicos da EPGE) (6) RePEc:fip:fedlwp:2006-061 The expectation hypothesis of the term structure of very short-term rates: statistical tests and economic value (2007). Working Papers (7) RePEc:han:dpaper:dp-357 Whose trades convey information? Evidence from a cross-section of traders (2007). Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hannover (8) RePEc:hum:wpaper:sfb649dp2007-011 Media Coverage and Macroeconomic Information Processing (2007). SFB 649 Discussion Papers Recent citations received in: 2006 (1) RePEc:dgr:kubcen:200655 How do Mergers and Acquisitions Affect Bondholders in Europe? Evidence on the Impact and Spillover of Governance and Legal Standards (2006). Discussion Paper (2) RePEc:dgr:kubcen:20066 Mergers and Acquisitions in Europe (2006). Discussion Paper (3) RePEc:fip:fedlwp:2006-036 The relation between time-series and cross-sectional effects of idiosyncratic variance on stock returns in G7 countries (2006). Working Papers (4) RePEc:nbr:nberwo:12626 The Performance of Reverse Leveraged Buyouts (2006). NBER Working Papers (5) RePEc:spr:finsto:v:10:y:2006:i:3:p:303-330 A jump to default extended CEV model: an application of Bessel processes (2006). Finance and Stochastics (6) RePEc:yor:yorken:06/08 The Role of Cash Holdings in Reducing Investment-Cash Flow Sensitivity: Evidence from a Financial Crisis Period in an Emerging Market (2006). Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||