|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

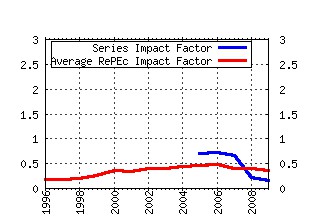

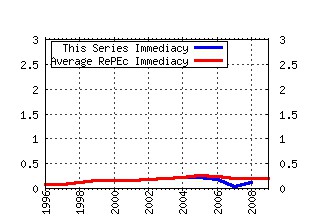

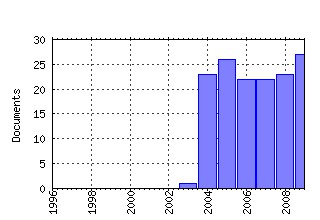

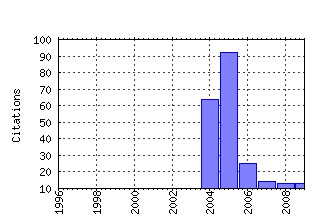

Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ecl:ohidic:2005-1 The Limits of Financial Globalization (2005). (2) RePEc:ecl:ohidic:2004-16 Why Do Countries Matter So Much for Corporate Governance? (2004). (3) RePEc:ecl:ohidic:2005-17 How Much Do Banks Use Credit Derivatives to Reduce Risk? (2005). (4) RePEc:ecl:ohidic:2004-9 Multi-market Trading and Arbitrage (2004). (5) RePEc:ecl:ohidic:2004-18 Do Investors Overvalue Firms with Bloated Balance Sheets? (2004). (6) RePEc:ecl:ohidic:2006-12 Financial Globalization, Governance, and the Evolution of the Home Bias (2006). (7) RePEc:ecl:ohidic:2005-26 Investor Psychology and Tests of Factor Pricing Models (2005). (8) RePEc:ecl:ohidic:2004-21 Disclosure to an Audience with Limited Attention (2004). (9) RePEc:ecl:ohidic:2004-14 The World of Cross-Listings and Cross-Listings of the World: Challenging Conventional Wisdom (2004). (10) RePEc:ecl:ohidic:2004-13 Stock Market Trading and Market Conditions (2004). (11) RePEc:ecl:ohidic:2006-7 How Has CEO Turnover Changed? Increasingly Performance Sensitive Boards and Increasingly Uneasy CEOs (2006). (12) RePEc:ecl:ohidic:2009-13 Bank CEO Incentives and the Credit Crisis (2009). (13) RePEc:ecl:ohidic:2006-3 The Accrual Anomaly: Risk or Mispricing? (2006). (14) RePEc:ecl:ohidic:2006-1 Is There Hedge Fund Contagion? (2006). (15) RePEc:ecl:ohidic:2007-13 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). (16) RePEc:ecl:ohidic:2004-5 Should We Fear Derivatives? (2004). (17) repec:ecl:ohidic:2008-9 (). (18) RePEc:ecl:ohidic:2007-3 Hedge Funds: Past, Present, and Future (2007). (19) RePEc:ecl:ohidic:2007-8 Why Do Private Acquirers Pay So Little Compared to Public Acquirers? (2007). (20) RePEc:ecl:ohidic:2004-12 Understanding Electricity Price Volatility within and across Markets (2004). (21) RePEc:ecl:ohidic:2004-25 Securitization by Banks and Finance Companies: Efficient Financial Contracting or Regulatory Arbitrage? (2004). (22) RePEc:ecl:ohidic:2008-8 Hedge Fund Contagion and Liquidity (2008). (23) RePEc:ecl:ohidic:2005-21 Investor Overconfidence and the Forward Discount Puzzle (2005). (24) RePEc:ecl:ohidic:2008-25 Pricing Kernels with Coskewness and Volatility Risk (2009). (25) RePEc:ecl:ohidic:2010-10 (). (26) RePEc:ecl:ohidic:2006-17 Why Do U.S. Firms Hold So Much More Cash Than They Used To? (2007). (27) RePEc:ecl:ohidic:2007-12 Managerial Ownership Dynamics and Firm Value (2008). (28) RePEc:ecl:ohidic:2004-19 Do Acquirers with More Uncertain Growth Prospects Gain Less from Acquisitions? (2004). (29) RePEc:ecl:ohidic:2009-12 Why Did Some Banks Perform Better during the Credit Crisis? A Cross-Country Study of the Impact of Governance and Regulation (2009). (30) RePEc:ecl:ohidic:2007-7 Do Entrenched Managers Pay Their Workers More? (2007). (31) RePEc:ecl:ohidic:2005-24 Limited Investor Attention and Stock Market Misreactions to Accounting Information (2005). (32) RePEc:ecl:ohidic:2006-5 Price and Volatility Transmission across Borders (2006). (33) RePEc:ecl:ohidic:2006-10 The World Price of Liquidity Risk (2005). (34) RePEc:ecl:ohidic:2004-10 Dividend Policy, Agency Costs, and Earned Equity (2004). (35) RePEc:ecl:ohidic:2010-17 (). (36) RePEc:ecl:ohidic:2008-11 What Determines the Structure of Corporate Debt Issues? (2008). (37) RePEc:ecl:ohidic:2009-16 Credit Default Swaps and the Credit Crisis (2009). (38) RePEc:ecl:ohidic:2011-10 This Time Is the Same: Using Bank Performance in 1998 to Explain Bank Performance during the Recent Financial Crisis (2011). (39) RePEc:ecl:ohidic:2005-2 Private Benefits of Control, Ownership, and the Cross-Listing Decision (2005). (40) RePEc:ecl:ohidic:2011-2 The Role of Securitization in Mortgage Renegotiation (2011). (41) RePEc:ecl:ohidic:2008-10 Why Do Firms Appoint CEOs as Outside Directors? (2008). (42) RePEc:ecl:ohidic:2005-8 Supply and Demand Shifts in the Shorting Market (2005). (43) RePEc:ecl:ohidic:2010-6 Dynamic Dark Pool Trading Strategies in Limit Order Markets (2010). (44) RePEc:ecl:ohidic:2008-18 Risk Management Failures: What Are They and When Do They Happen? (2008). (45) RePEc:ecl:ohidic:2005-19 Terrorism and the Stock Market (2005). (46) RePEc:ecl:ohidic:2009-9 The Role of the Securitization Process in the Expansion of Subprime Credit (2009). (47) RePEc:ecl:ohidic:2006-16 Advertising and Portfolio Choice (2006). (48) RePEc:ecl:ohidic:2011-19 What Do Boards Really Do? Evidence from Minutes of Board Meetings (2011). (49) RePEc:ecl:ohidic:2004-6 Do Domestic Investors Have an Edge? The Trading Experience of Foreign Investors in Korea (2004). (50) RePEc:ecl:ohidic:2010-5 The Credit Crisis around the Globe: Why Did Some Banks Perform Better? (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:ecl:ohidic:2008-11 What Determines the Structure of Corporate Debt Issues? (2008). Working Paper Series (2) RePEc:ecl:ohidic:2008-15 Why Are Buyouts Levered? The Financial Structure of Private Equity Funds (2008). Working Paper Series (3) RePEc:nbr:nberwo:14486 The Role of Boards of Directors in Corporate Governance: A Conceptual Framework and Survey (2008). NBER Working Papers Recent citations received in: 2007 (1) RePEc:doj:eagpap:200709 Consumer Surplus as the Appropriate Standard for Antitrust Enforcement (2007). EAG Discussions Papers Recent citations received in: 2006 (1) RePEc:imf:imfwpa:06/170 How Might a Disorderly Resolution of Global Imbalances Affect Global Wealth? (2006). IMF Working Papers (2) RePEc:nbr:nberwo:12500 Look at Me Now: What Attracts U.S. Shareholders? (2006). NBER Working Papers (3) RePEc:nbr:nberwo:12728 Is Home Bias in Assets Related to Home Bias in Goods? (2006). NBER Working Papers (4) RePEc:ven:wpaper:2006_54 Phase-Locking and Switching Volatility in Hedge Funds (2006). Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||