|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

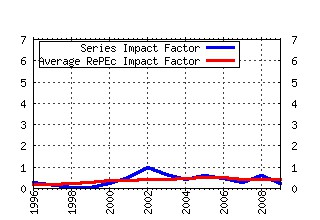

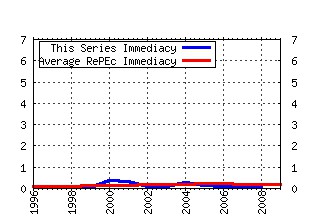

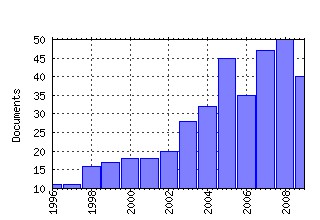

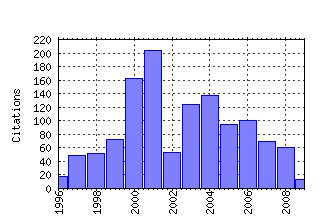

Journal of Corporate Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:corfin:v:7:y:2001:i:3:p:209-233 Ownership structure and corporate performance (2001). (2) RePEc:eee:corfin:v:6:y:2000:i:3:p:241-289 The determinants of venture capital funding: evidence across countries (2000). (3) RePEc:eee:corfin:v:10:y:2004:i:1:p:1-36 Investigating the economic role of mergers (2004). (4) RePEc:eee:corfin:v:9:y:2003:i:5:p:521-534 The optimal portfolio of start-up firms in venture capital finance (2003). (5) RePEc:eee:corfin:v:6:y:2000:i:2:p:117-139 Comparing acquisitions and divestitures (2000). (6) RePEc:eee:corfin:v:7:y:2001:i:1:p:77-99 Determinants of capital structure: new evidence from Spanish panel data (2001). (7) RePEc:eee:corfin:v:3:y:1997:i:3:p:189-220 Leadership structure: Separating the CEO and Chairman of the Board (1997). (8) RePEc:eee:corfin:v:10:y:2004:i:2:p:229-262 Entrepreneurship and financial constraints in Thailand (2004). (9) RePEc:eee:corfin:v:10:y:2004:i:5:p:703-728 Corporate governance, investor protection, and performance in emerging markets (2004). (10) RePEc:eee:corfin:v:7:y:2001:i:3:p:285-306 Convertible securities and optimal exit decisions in venture capital finance (2001). (11) RePEc:eee:corfin:v:9:y:2003:i:3:p:295-316 Earnings management and corporate governance: the role of the board and the audit committee (2003). (12) RePEc:eee:corfin:v:4:y:1998:i:3:p:241-263 Insider reputation and selling decisions: the unwinding of venture capital investments during equity IPOs (1998). (13) RePEc:eee:corfin:v:12:y:2006:i:2:p:321-341 Family ownership and firm performance: Empirical evidence from Western European corporations (2006). (14) RePEc:eee:corfin:v:2:y:1995:i:1-2:p:9-37 The economics of franchise contracts (1995). (15) RePEc:eee:corfin:v:5:y:1999:i:1:p:79-101 Managerial ownership and the performance of firms: Evidence from the UK (1999). (16) RePEc:eee:corfin:v:6:y:2000:i:1:p:71-110 Do occupational pension funds monitor companies in which they hold large stakes? (2000). (17) RePEc:eee:corfin:v:12:y:2006:i:3:p:594-618 Large blocks of stock: Prevalence, size, and measurement (2006). (18) RePEc:eee:corfin:v:8:y:2002:i:2:p:105-122 The link between dividend policy and institutional ownership (2002). (19) RePEc:eee:corfin:v:1:y:1994:i:2:p:139-174 The economics of corporate governance: Beyond the Marshallian firm (1994). (20) RePEc:eee:corfin:v:1:y:1995:i:3-4:p:413-435 Measuring managerial equity ownership: a comparison of sources of ownership data (1995). (21) RePEc:eee:corfin:v:7:y:2001:i:4:p:397-446 The role of hostile stakes in German corporate governance (2001). (22) RePEc:eee:corfin:v:9:y:2003:i:2:p:149-167 The joint determination of leverage and maturity (2003). (23) RePEc:eee:corfin:v:13:y:2007:i:5:p:829-858 Are family firms really superior performers? (2007). (24) RePEc:eee:corfin:v:6:y:2000:i:2:p:189-214 The valuation effects of bank mergers (2000). (25) RePEc:eee:corfin:v:13:y:2007:i:4:p:439-460 Private equity, leveraged buyouts and governance (2007). (26) RePEc:eee:corfin:v:5:y:1999:i:3:p:227-250 On executives of financial institutions as outside directors (1999). (27) RePEc:eee:corfin:v:11:y:2005:i:1-2:p:277-291 The impact of leverage on firm investment: Canadian evidence (2005). (28) RePEc:eee:corfin:v:9:y:2003:i:1:p:3-36 Decentralization of the firm: theory and evidence (2003). (29) RePEc:eee:corfin:v:5:y:1999:i:4:p:341-368 Management succession and financial performance of family controlled firms (1999). (30) RePEc:eee:corfin:v:1:y:1994:i:1:p:33-62 Managerial shareownership, voting power, and cash dividend policy (1994). (31) RePEc:eee:corfin:v:14:y:2008:i:3:p:302-322 The price of ethics and stakeholder governance: The performance of socially responsible mutual funds (2008). (32) RePEc:eee:corfin:v:2:y:1995:i:1-2:p:39-74 The role of risk in franchising (1995). (33) RePEc:eee:corfin:v:12:y:2006:i:2:p:214-245 Legality and venture capital exits (2006). (34) RePEc:eee:corfin:v:7:y:2001:i:3:p:257-284 Investment policy, internal financing and ownership concentration in the UK (2001). (35) RePEc:eee:corfin:v:8:y:2002:i:1:p:49-66 Board leadership structure and CEO turnover (2002). (36) RePEc:eee:corfin:v:10:y:2004:i:2:p:301-326 Entrepreneurial finance: an overview of the issues and evidence (2004). (37) RePEc:eee:corfin:v:12:y:2006:i:3:p:660-691 Predicting firms corporate governance choices: Evidence from Korea (2006). (38) RePEc:eee:corfin:v:11:y:2005:i:3:p:586-608 Sources of funds and investment activities of venture capital funds: evidence from Germany, Israel, Japan and the United Kingdom (2005). (39) RePEc:eee:corfin:v:2:y:1995:i:1-2:p:103-131 Ownership rights and incentives in franchising (1995). (40) RePEc:eee:corfin:v:11:y:2005:i:3:p:550-585 Capital structure in venture finance (2005). (41) RePEc:eee:corfin:v:14:y:2008:i:3:p:257-273 Corporate governance and firm performance (2008). (42) RePEc:eee:corfin:v:5:y:1999:i:2:p:169-191 Financing constraints and internal capital markets: Evidence from Korean chaebols (1999). (43) RePEc:eee:corfin:v:2:y:1996:i:4:p:359-381 International differences in oversubscription and underpricing of IPOs (1996). (44) RePEc:eee:corfin:v:12:y:2006:i:4:p:693-714 Corporate performance and CEO compensation in China (2006). (45) RePEc:eee:corfin:v:7:y:2001:i:3:p:235-256 Determinants of corporate ownership and board structure: evidence from Singapore (2001). (46) RePEc:eee:corfin:v:11:y:2005:i:1-2:p:1-35 Liquidity risk, leverage and long-run IPO returns (2005). (47) RePEc:eee:corfin:v:1:y:1994:i:1:p:91-118 Majority owner-managers and organizational efficiency (1994). (48) RePEc:eee:corfin:v:5:y:1999:i:1:p:35-54 Corporate ownership and the value of a vote in an emerging market (1999). (49) RePEc:eee:corfin:v:9:y:2003:i:2:p:233-269 Workouts, court-supervised reorganization and the choice between private and public debt (2003). (50) RePEc:eee:corfin:v:1:y:1994:i:1:p:63-90 Managerial performance, boards of directors and takeover bidding (1994). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:cpr:ceprdp:7080 The Regulation of Entry: A Survey (2008). CEPR Discussion Papers (2) RePEc:cte:wbrepe:wb083409 The performance of socially responsible mutual funds: the role of fees and management companies (2008). Business Economics Working Papers (3) RePEc:mos:moswps:2008-21 MANAGERIAL POWER, STOCK-BASED COMPENSATION, AND FIRM PERFORMANCE: THEORY AND EVIDENCE (2008). Monash Economics Working Papers (4) RePEc:zbw:cefswp:200805 Economic consequences of private equity investments on the German stock market (2008). CEFS Working Paper Series Recent citations received in: 2007 (1) RePEc:dgr:eureri:300011918 The Impact of Media Attention on the Use of Alternative Earnings Measures (2007). Research Paper (2) RePEc:ecl:ohidic:2007-17 Do Funds Need Governance? Evidence from Variable Annuity-Mutual Fund Twins (2007). Working Paper Series (3) RePEc:ecl:ohidic:2007-9 Has New York Become Less Competitive in Global Markets? Evaluating Foreign Listing Choices over Time (2007). Working Paper Series (4) RePEc:pra:mprapa:4979 The Effect of Contractual Complexity on Technology Sourcing Agreements (2007). MPRA Paper Recent citations received in: 2006 (1) RePEc:ecl:ohidic:2006-12 Financial Globalization, Governance, and the Evolution of the Home Bias (2006). Working Paper Series (2) RePEc:kap:asiapa:v:23:y:2006:i:4:p:419-437 Business groups and their types (2006). Asia Pacific Journal of Management (3) RePEc:nbr:nberwo:12389 Financial Globalization, Governance, and the Evolution of the Home Bias (2006). NBER Working Papers (4) RePEc:ner:leuven:urn:hdl:123456789/121061 The impact of a stock listing on the determinants of firm performance. (2006). Open Access publications from Katholieke Universiteit Leuven Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||