|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

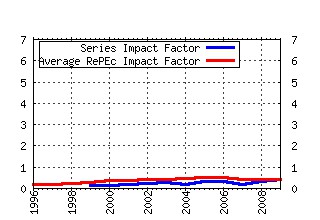

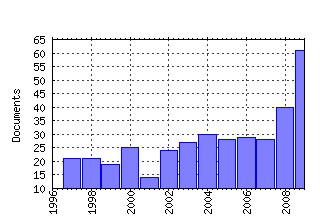

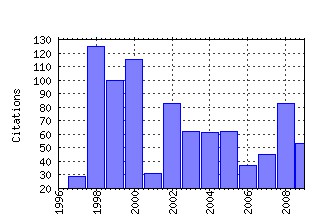

Journal of International Financial Markets, Institutions and Money Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:intfin:v:12:y:2002:i:1:p:33-58 Cost and profit efficiency in European banks (2002). (2) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:393-412 Multimarket trading and liquidity: a transaction data analysis of Canada-US interlistings (1998). (3) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:407-421 Intervention from an information perspective (2000). (4) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:303-322 Central bank intervention and exchange rates: the case of Sweden (2000). (5) RePEc:eee:intfin:v:12:y:2002:i:3:p:183-200 On measuring volatility and the GARCH forecasting performance (2002). (6) RePEc:eee:intfin:v:9:y:1999:i:4:p:377-391 Assessing competitive conditions in the Greek banking system (1999). (7) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:287-302 The United States as an informed foreign-exchange speculator (2000). (8) RePEc:eee:intfin:v:18:y:2008:i:2:p:121-136 Bank-specific, industry-specific and macroeconomic determinants of bank profitability (2008). (9) RePEc:eee:intfin:v:10:y:2000:i:2:p:107-130 Intraday and interday volatility in the Japanese stock market (2000). (10) RePEc:eee:intfin:v:8:y:1998:i:2:p:155-173 An empirical examination of linkages between Pacific-Basin stock markets (1998). (11) RePEc:eee:intfin:v:8:y:1998:i:2:p:117-153 What determines real exchange rates?: The long and the short of it (1998). (12) RePEc:eee:intfin:v:15:y:2005:i:2:p:91-106 Stock market linkages in emerging markets: implications for international portfolio diversification (2005). (13) RePEc:eee:intfin:v:8:y:1998:i:1:p:21-38 The impact of exchange rate volatility on Australian trade flows (1998). (14) RePEc:eee:intfin:v:9:y:1999:i:4:p:359-376 Long memory or structural breaks: can either explain nonstationary real exchange rates under the current float? (1999). (15) RePEc:eee:intfin:v:14:y:2004:i:1:p:25-36 The accuracy of press reports regarding the foreign exchange interventions of the Bank of Japan (2004). (16) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:381-405 Central bank intervention and exchange rate volatility -- Australian evidence (2000). (17) RePEc:eee:intfin:v:17:y:2007:i:3:p:291-306 Why do central banks intervene secretly?: Preliminary evidence from the BoJ (2007). (18) RePEc:eee:intfin:v:13:y:2003:i:2:p:113-136 Models of exchange rate expectations: how much heterogeneity? (2003). (19) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:325-356 Information asymmetry, market segmentation and the pricing of cross-listed shares: theory and evidence from Chinese A and B shares (1998). (20) RePEc:eee:intfin:v:10:y:2000:i:1:p:69-82 Testing for nonlinear Granger causality from fundamentals to exchange rates in the ERM (2000). (21) RePEc:eee:intfin:v:9:y:1999:i:3:p:303-320 Malmquist indices of productivity change in Australian financial services (1999). (22) RePEc:eee:intfin:v:15:y:2005:i:1:p:55-72 Cost efficiency in the Latin American and Caribbean banking systems (2005). (23) RePEc:eee:intfin:v:9:y:1999:i:1:p:61-74 Causal relations among stock returns and macroeconomic variables in a small, open economy (1999). (24) RePEc:eee:intfin:v:14:y:2004:i:3:p:203-219 Banking competition and macroeconomic conditions: a disaggregate analysis (2004). (25) RePEc:eee:intfin:v:9:y:1999:i:2:p:183-193 A test of purchasing power parity for emerging economies (1999). (26) RePEc:eee:intfin:v:17:y:2007:i:3:p:261-276 Fiscal policy events and interest rate swap spreads: Evidence from the EU (2007). (27) RePEc:eee:intfin:v:9:y:1999:i:2:p:163-182 Factor price misspecification in bank cost function estimation (1999). (28) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:225-241 The liquidity of automated exchanges: new evidence from German Bund futures (1998). (29) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:299-324 Two months in the life of several gilt-edged market makers on the London Stock Exchange (1998). (30) RePEc:eee:intfin:v:13:y:2003:i:4:p:383-399 Spillovers of stock return volatility to Asian equity markets from Japan and the US (2003). (31) RePEc:eee:intfin:v:18:y:2008:i:2:p:137-146 The purchasing power parity revisited: New evidence for 16 OECD countries from panel unit root tests with structural breaks (2008). (32) RePEc:eee:intfin:v:8:y:1998:i:1:p:1-19 Monetary-based models of the exchange rate: a panel perspective (1998). (33) RePEc:eee:intfin:v:19:y:2009:i:4:p:662-674 Monetary and financial stability in the euro area: Pro-cyclicality versus trade-off (2009). (34) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:277-298 Inter- and intra-day liquidity patterns on the Stock Exchange of Hong Kong (1998). (35) RePEc:eee:intfin:v:19:y:2009:i:1:p:1-15 Bank modelling methodologies: A comparative non-parametric analysis of efficiency in the Japanese banking sector (2009). (36) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:229-247 Foreign reserve and money dynamics with asset portfolio adjustment: international evidence (2000). (37) RePEc:eee:intfin:v:11:y:2001:i:2:p:199-214 On market efficiency of Asian foreign exchange rates: evidence from a joint variance ratio test and technical trading rules (2001). (38) RePEc:eee:intfin:v:16:y:2006:i:1:p:23-40 Volatility spillovers and dynamic correlation in European bond markets (2006). (39) RePEc:eee:intfin:v:7:y:1997:i:1:p:73-87 The impact of exchange rate volatility on German-US trade flows (1997). (40) RePEc:eee:intfin:v:18:y:2008:i:1:p:46-63 Is bank portfolio riskiness procyclical: Evidence from Italy using a vector autoregression (2008). (41) RePEc:eee:intfin:v:9:y:1999:i:2:p:129-147 Local and global price memory of international stock markets (1999). (42) RePEc:eee:intfin:v:13:y:2003:i:2:p:85-112 Information arrivals and intraday exchange rate volatility (2003). (43) RePEc:eee:intfin:v:13:y:2003:i:2:p:171-186 Contagion and causality: an empirical investigation of four Asian crisis episodes (2003). (44) RePEc:eee:intfin:v:8:y:1998:i:3-4:p:243-260 Price discovery in high and low volatility periods: open outcry versus electronic trading (1998). (45) RePEc:eee:intfin:v:10:y:2000:i:3-4:p:363-379 Deviations from daily uncovered interest rate parity and the role of intervention (2000). (46) RePEc:eee:intfin:v:13:y:2003:i:3:p:271-289 Gold factor exposures in international asset pricing (2003). (47) RePEc:eee:intfin:v:14:y:2004:i:2:p:165-183 Growth, financial development, societal norms and legal institutions* (2004). (48) RePEc:eee:intfin:v:14:y:2004:i:4:p:313-328 Evidence to support the four-factor pricing model from the Canadian stock market (2004). (49) RePEc:eee:intfin:v:12:y:2002:i:2:p:139-155 Before and after international cross-listing: an intraday examination of volume and volatility (2002). (50) RePEc:eee:intfin:v:18:y:2008:i:5:p:483-497 Cost efficiency of the banking industry in the South Eastern European region (2008). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:eee:empfin:v:16:y:2009:i:5:p:862-873 Central bank interventions and implied exchange rate correlations (2009). Journal of Empirical Finance (2) RePEc:eee:intfin:v:19:y:2009:i:5:p:950-968 Capturing the time dynamics of central bank intervention (2009). Journal of International Financial Markets, Institutions and Money (3) RePEc:eee:jjieco:v:23:y:2009:i:4:p:367-394 Announcements, financial operations or both? Generalizing central banks FX reaction functions (2009). Journal of the Japanese and International Economies (4) RePEc:gla:glaewp:2009_17 A New Test of the Real Interest Rate Parity Hypothesis: Bounds Approach and Structural Breaks (2009). Working Papers (5) RePEc:ivi:wpasec:2009-07 Determinants of interest rate exposure of Spanish banking industry (2009). Working Papers. Serie EC (6) RePEc:kyu:dpaper:35 On-Going versus Completed Interventions and Yen/Dollar Expectations - Evidence from Disaggregated Survey Data (2009). Discussion Papers (7) RePEc:lbo:lbowps:2009_20 A New Approach to Dealing With Negative Numbers in Efficiency Analysis: An Application to the Indonesian Banking Sector (2009). Discussion Paper Series (8) RePEc:pqs:wpaper:032009 The Impact of Off-Balance-Sheet Activities on Banks Returns: An Application of the ARCH-M to Canadian Data (2009). (9) RePEc:pqs:wpaper:042009 Off-Balance-Sheet Activities and the Shadow Banking System: An Application of the Hausman Test with Higher Moments Instruments (2009). (10) RePEc:ptu:wpaper:w200904 International comovement of stock market returns: a wavelet analysis (2009). Working Papers Recent citations received in: 2008 (1) RePEc:bog:wpaper:73 Exploring the Nexus between Banking Sector Reform and Performance: Evidence from Newly Acceded EU Countries (2008). Working Papers (2) RePEc:bog:wpaper:92 Assessing Output and Productivity Growth in the Banking Industry (2008). Working Papers (3) RePEc:cii:cepidt:2008-23 Nonlinear Adjustment of the Real Exchange Rate Towards its Equilibrium Value: a Panel Smooth Transition Error Correction Modelling (2008). Working Papers (4) RePEc:gla:glaewp:2008_29 Structural Breaks in the Real Exchange Rate and Real Interest Rate Relationship (2008). Working Papers (5) RePEc:hhs:bofitp:2008_027 Global and local sources of risk in Eastern European emerging stock markets (2008). BOFIT Discussion Papers (6) RePEc:hkg:wpaper:0810 What Drives Hong Kong Dollar Swap Spreads: Credit or Liquidity? (2008). Working Papers (7) RePEc:hum:wpaper:sfb649dp2008-072 Common Influences, Spillover and Integration in Chinese Stock Markets (2008). SFB 649 Discussion Papers (8) RePEc:icr:wpmath:14-2008 International shocks and national house prices (2008). ICER Working Papers - Applied Mathematics Series (9) RePEc:kap:compec:v:31:y:2008:i:3:p:225-241 A Simple Fractionally Integrated Model with a Time-varying Long Memory Parameter d (10) RePEc:kap:jculte:v:32:y:2008:i:3:p:201-214 Purchasing power parity and cultural convergence: evidence from the global video games market (2008). Journal of Cultural Economics (11) RePEc:kie:kieliw:1470 Sentiment Dynamics and Stock Returns: The Case of the German Stock Market (2008). Kiel Working Papers (12) RePEc:mod:wcefin:08014 Indebtedness, macroeconomic conditions and banksâ loan losses: evidence from Italy (2008). Centro Studi di Banca e Finanza (CEFIN) (Center for Studies in Banking and Finance) (13) RePEc:pra:mprapa:11953 Cost and profit efficiency of banks in Haiti: do domestic banks perform better than foreign banks? (2008). MPRA Paper (14) RePEc:pra:mprapa:12788 Stock Market Integration and Volatility Spillover:India and its Major Asian Counterparts (2008). MPRA Paper (15) RePEc:pra:mprapa:13890 Competitive conditions in the Central and Eastern European banking systems (2008). MPRA Paper (16) RePEc:pra:mprapa:16378 Modeling extreme but plausible losses for credit risk: a stress testing framework for the Argentine Financial System (2008). MPRA Paper Recent citations received in: 2007 (1) RePEc:bdi:wptemi:td_629_07 Monetary Policy Shocks in the Euro Area and Global Liquidity Spillovers (2007). Temi di discussione (Economic working papers) (2) RePEc:ijf:ijfiec:v:12:y:2007:i:2:p:155-170 An assessment of some open issues in the analysis of foreign exchange intervention (2007). International Journal of Finance & Economics (3) RePEc:mie:wpaper:561 The Influence of Actual and Unrequited Interventions (2007). Working Papers (4) RePEc:nbr:nberwo:12953 The Influence of Actual and Unrequited Interventions (2007). NBER Working Papers (5) RePEc:pra:mprapa:19807 The stability of money demand function in Japan: Evidence from rolling cointegration approach (2007). MPRA Paper Recent citations received in: 2006 (1) RePEc:kap:atlecj:v:34:y:2006:i:4:p:367-384 The Euro and Other Major Currencies Floating Against the U.S. Dollar (2006). Atlantic Economic Journal (2) RePEc:rbp:esteco:ree-13-01 El efecto traspaso de la tasa de interés y la política monetaria en el Perú: 1995-2004 (2006). Revista Estudios Económicos (3) RePEc:zbw:euvgra:20064 Multiple Priors And No-Transaction Region (2006). Working Paper Series (4) RePEc:zbw:euvgra:20067 Allocative efficiency measurement revisited: Do we really need input prices? (2006). Working Paper Series (5) RePEc:zbw:euvgra:20069 Political Orientation of Government and Stock Market Returns (2006). Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||