|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

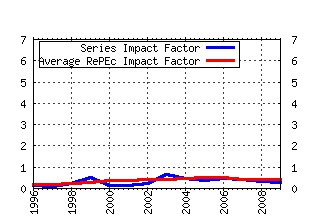

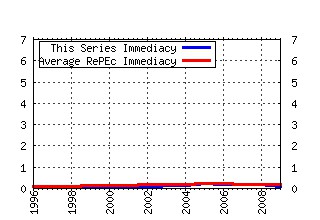

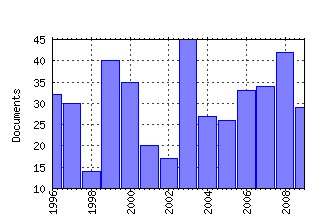

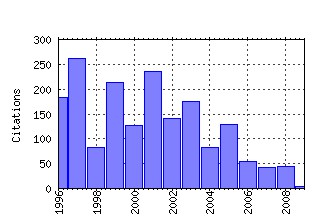

Journal of Accounting and Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jaecon:v:19:y:1995:i:2-3:p:179-208 Complementarities and fit strategy, structure, and organizational change in manufacturing (1995). (2) RePEc:eee:jaecon:v:7:y:1985:i:1-3:p:85-107 The effect of bonus schemes on accounting decisions (1985). (3) RePEc:eee:jaecon:v:24:y:1997:i:2:p:127-127 . (1997). (4) RePEc:eee:jaecon:v:7:y:1985:i:1-3:p:11-42 Corporate performance and managerial remuneration : An empirical analysis (1985). (5) RePEc:eee:jaecon:v:8:y:1986:i:1:p:3-35 Predicting takeover targets : A methodological and empirical analysis (1986). (6) RePEc:eee:jaecon:v:24:y:1997:i:1:p:99-126 Earnings management to avoid earnings decreases and losses (1997). (7) RePEc:eee:jaecon:v:3:y:1981:i:3:p:183-199 Auditor size and audit quality (1981). (8) RePEc:eee:jaecon:v:5:y:1983:i::p:179-194 Discretionary disclosure (1983). (9) RePEc:eee:jaecon:v:29:y:2000:i:1:p:1-51 The effect of international institutional factors on properties of accounting earnings (2000). (10) RePEc:eee:jaecon:v:24:y:1997:i:1:p:3-37 The conservatism principle and the asymmetric timeliness of earnings (1997). (11) RePEc:eee:jaecon:v:40:y:2005:i:1-3:p:3-73 The economic implications of corporate financial reporting (2005). (12) RePEc:eee:jaecon:v:31:y:2001:i:1-3:p:3-75 The relevance of the value-relevance literature for financial accounting standard setting (2001). (13) RePEc:eee:jaecon:v:31:y:2001:i:1-3:p:105-231 Capital markets research in accounting (2001). (14) RePEc:eee:jaecon:v:33:y:2002:i:1:p:3-42 Stock options for undiversified executives (2002). (15) RePEc:eee:jaecon:v:31:y:2001:i:1-3:p:405-440 Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature (2001). (16) RePEc:eee:jaecon:v:21:y:1996:i:1:p:5-43 Employee stock option exercises an empirical analysis (1996). (17) RePEc:eee:jaecon:v:18:y:1994:i:2:p:207-231 Employee stock options (1994). (18) RePEc:eee:jaecon:v:18:y:1994:i:1:p:3-42 Accounting earnings and cash flows as measures of firm performance : The role of accounting accruals (1994). (19) RePEc:eee:jaecon:v:8:y:1986:i:2:p:159-172 Information quality and the valuation of new issues (1986). (20) RePEc:eee:jaecon:v:11:y:1989:i:2-3:p:255-274 Firm characteristics and analyst following (1989). (21) RePEc:eee:jaecon:v:32:y:2001:i:1-3:p:97-180 Essays on disclosure (2001). (22) RePEc:eee:jaecon:v:13:y:1990:i:4:p:305-340 Evidence that stock prices do not fully reflect the implications of current earnings for future earnings (1990). (23) RePEc:eee:jaecon:v:17:y:1994:i:1-2:p:145-176 Debt covenant violation and manipulation of accruals (1994). (24) RePEc:eee:jaecon:v:33:y:2002:i:3:p:401-425 Corporate ownership structure and the informativeness of accounting earnings in East Asia (2002). (25) RePEc:eee:jaecon:v:28:y:1999:i:2:p:151-184 The use of equity grants to manage optimal equity incentive levels (1999). (26) RePEc:eee:jaecon:v:19:y:1995:i:2-3:p:247-277 Incentive compensation in a corporate hierarchy (1995). (27) RePEc:eee:jaecon:v:31:y:2001:i:1-3:p:255-307 Empirical research on accounting choice (2001). (28) RePEc:eee:jaecon:v:36:y:2003:i:1-3:p:235-270 Incentives versus standards: properties of accounting income in four East Asian countries (2003). (29) RePEc:eee:jaecon:v:36:y:2003:i:1-3:p:337-386 Limited attention, information disclosure, and financial reporting (2003). (30) RePEc:eee:jaecon:v:32:y:2001:i:1-3:p:237-333 Financial accounting information and corporate governance (2001). (31) RePEc:eee:jaecon:v:39:y:2005:i:1:p:163-197 Performance matched discretionary accrual measures (2005). (32) RePEc:eee:jaecon:v:16:y:1993:i:1-3:p:55-100 Accounting earnings and top executive compensation (1993). (33) RePEc:eee:jaecon:v:19:y:1995:i:1:p:29-74 Annual bonus schemes and the manipulation of earnings (1995). (34) RePEc:eee:jaecon:v:22:y:1996:i:1-3:p:249-281 The pricing of discretionary accruals (1996). (35) RePEc:eee:jaecon:v:24:y:1997:i:1:p:39-67 Changes in the value-relevance of earnings and book values over the past forty years (1997). (36) RePEc:eee:jaecon:v:20:y:1995:i:3:p:297-322 Auditor brand name reputations and industry specializations (1995). (37) RePEc:eee:jaecon:v:14:y:1991:i:1:p:51-89 Executive incentives and the horizon problem : An empirical investigation (1991). (38) RePEc:eee:jaecon:v:16:y:1993:i:1-3:p:273-315 Financial performance surrounding CEO turnover (1993). (39) RePEc:eee:jaecon:v:16:y:1993:i:1-3:p:349-372 Stock-based incentive compensation and investment behavior (1993). (40) RePEc:eee:jaecon:v:31:y:2001:i:1-3:p:321-387 Empirical tax research in accounting (2001). (41) RePEc:eee:jaecon:v:15:y:1992:i:4:p:445-484 A theory of responsibility centers (1992). (42) RePEc:eee:jaecon:v:39:y:2005:i:1:p:83-128 Earnings quality in UK private firms: comparative loss recognition timeliness (2005). (43) RePEc:eee:jaecon:v:33:y:2002:i:3:p:375-400 Audit committee, board of director characteristics, and earnings management (2002). (44) RePEc:eee:jaecon:v:11:y:1989:i:2-3:p:143-181 An analysis of intertemporal and cross-sectional determinants of earnings response coefficients (1989). (45) RePEc:eee:jaecon:v:2:y:1980:i:1:p:3-28 The information content of security prices (1980). (46) RePEc:eee:jaecon:v:19:y:1995:i:2-3:p:443-470 Corporate research & development investments international comparisons (1995). (47) RePEc:eee:jaecon:v:12:y:1990:i:4:p:341-363 Voluntary disclosure with a strategic opponent (1990). (48) RePEc:eee:jaecon:v:20:y:1995:i:2:p:155-192 Price and return models (1995). (49) RePEc:eee:jaecon:v:23:y:1997:i:2:p:115-139 Smoothing income in anticipation of future earnings (1997). (50) RePEc:eee:jaecon:v:29:y:2000:i:1:p:73-100 CEO stock option awards and the timing of corporate voluntary disclosures (2000). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:bri:uobdis:09/613 To Trade or Not to Trade: The Strategic Trading of Insiders around News Announcements (2009). Bristol Economics Discussion Papers (2) RePEc:fip:fedgfe:2009-30 Does tax policy affect executive compensation? evidence from postwar tax reforms (2009). Finance and Economics Discussion Series (3) RePEc:nbr:nberwo:14971 When are Analyst Recommendation Changes Influential? (2009). NBER Working Papers Recent citations received in: 2008 (1) RePEc:bog:econbl:y:2008:i:31:p:07-30 The determinants for the survival of firms in the Athens Exchange (2008). Economic Bulletin (2) RePEc:ecl:ohidic:2008-14 Why Do Foreign Firms Leave U.S. Equity Markets? An Analysis of Deregistrations under SEC Exchange Act Rule 12h-6 (2008). Working Paper Series (3) RePEc:fip:fedgif:945 Escape from New York: the market impact of SEC Rule 12h-6 (2008). International Finance Discussion Papers (4) RePEc:fip:fednsr:330 Corporate performance, board structure, and their determinants in the banking industry (2008). Staff Reports (5) RePEc:kap:ejlwec:v:25:y:2008:i:2:p:151-165 Intra-country regulation of share markets: does one size fit all? (2008). European Journal of Law and Economics (6) RePEc:kap:jmgtgv:v:12:y:2008:i:2:p:179-200 Behavioral finance in corporate governance: economics and ethics of the devils advocate (2008). Journal of Management and Governance (7) RePEc:nbr:nberwo:14245 Why Do Foreign Firms Leave U.S. Equity Markets? (2008). NBER Working Papers Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:dgr:kubcen:2006103 Agency Theory of Overvalued Equity as an Explanation for the Accrual Anomaly (2006). Discussion Paper (2) RePEc:ecl:ohidic:2006-21 The Economics of Conflicts of Interest in Financial Institutions (2006). Working Paper Series (3) RePEc:fip:fedgif:877 International cross-listing, firm performance and top management turnover: a test of the bonding hypothesis (2006). International Finance Discussion Papers (4) RePEc:hhs:sifrwp:0043 Pay Me Later: Inside Debt and Its Role in Managerial Compensation (2006). SIFR Research Report Series (5) RePEc:nbr:nberwo:12465 How has CEO Turnover Changed? Increasingly Performance Sensitive Boards and Increasingly Uneasy CEOs (2006). NBER Working Papers (6) RePEc:nbr:nberwo:12695 The Economics of Conflicts of Interest in Financial Institutions (2006). NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||