|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

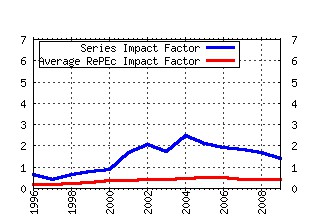

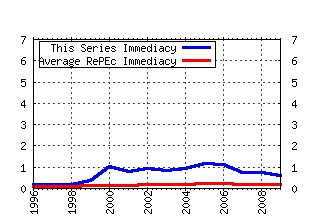

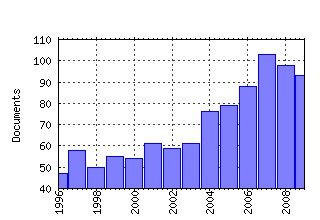

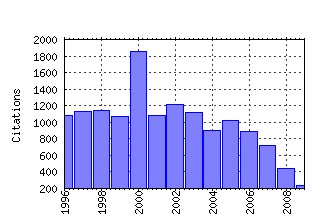

Journal of Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jfinec:v:3:y:1976:i:4:p:305-360 Theory of the firm: Managerial behavior, agency costs and ownership structure (1976). (2) RePEc:eee:jfinec:v:13:y:1984:i:2:p:187-221 Corporate financing and investment decisions when firms have information that investors do not have (1984). (3) RePEc:eee:jfinec:v:33:y:1993:i:1:p:3-56 Common risk factors in the returns on stocks and bonds (1993). (4) RePEc:eee:jfinec:v:5:y:1977:i:2:p:147-175 Determinants of corporate borrowing (1977). (5) RePEc:eee:jfinec:v:5:y:1977:i:2:p:177-188 An equilibrium characterization of the term structure (1977). (6) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:261-300 Finance and the sources of growth (2000). (7) RePEc:eee:jfinec:v:20:y:1988:i::p:293-315 Management ownership and market valuation : An empirical analysis (1988). (8) RePEc:eee:jfinec:v:19:y:1987:i:1:p:3-29 Expected stock returns and volatility (1987). (9) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:3-27 Investor protection and corporate governance (2000). (10) RePEc:eee:jfinec:v:22:y:1988:i:1:p:3-25 Dividend yields and expected stock returns (1988). (11) RePEc:eee:jfinec:v:25:y:1989:i:1:p:23-49 Business conditions and expected returns on stocks and bonds (1989). (12) RePEc:eee:jfinec:v:14:y:1985:i:1:p:3-31 Using daily stock returns : The case of event studies (1985). (13) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:125-144 Option pricing when underlying stock returns are discontinuous (1976). (14) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:81-112 The separation of ownership and control in East Asian Corporations (2000). (15) RePEc:eee:jfinec:v:27:y:1990:i:2:p:595-612 Additional evidence on equity ownership and corporate value (1990). (16) RePEc:eee:jfinec:v:18:y:1987:i:2:p:373-399 Stock returns and the term structure (1987). (17) RePEc:eee:jfinec:v:17:y:1986:i:2:p:223-249 Asset pricing and the bid-ask spread (1986). (18) RePEc:eee:jfinec:v:65:y:2002:i:3:p:365-395 The ultimate ownership of Western European corporations (2002). (19) RePEc:eee:jfinec:v:7:y:1979:i:3:p:229-263 Option pricing: A simplified approach (1979). (20) RePEc:eee:jfinec:v:60:y:2001:i:2-3:p:187-243 The theory and practice of corporate finance: evidence from the field (2001). (21) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:145-166 The valuation of options for alternative stochastic processes (1976). (22) RePEc:eee:jfinec:v:22:y:1988:i:1:p:27-59 Mean reversion in stock prices : Evidence and Implications (1988). (23) RePEc:eee:jfinec:v:61:y:2001:i:1:p:43-76 The distribution of realized stock return volatility (2001). (24) RePEc:eee:jfinec:v:14:y:1985:i:1:p:71-100 Bid, ask and transaction prices in a specialist market with heterogeneously informed traders (1985). (25) RePEc:eee:jfinec:v:5:y:1977:i:2:p:115-146 Asset returns and inflation (1977). (26) RePEc:eee:jfinec:v:11:y:1983:i:1-4:p:5-50 The market for corporate control : The scientific evidence (1983). (27) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:167-179 The pricing of commodity contracts (1976). (28) RePEc:eee:jfinec:v:8:y:1980:i:4:p:323-361 On estimating the expected return on the market : An exploratory investigation (1980). (29) RePEc:eee:jfinec:v:7:y:1979:i:3:p:265-296 An intertemporal asset pricing model with stochastic consumption and investment opportunities (1979). (30) RePEc:eee:jfinec:v:47:y:1998:i:3:p:243-277 Venture capital and the structure of capital markets: banks versus stock markets (1998). (31) RePEc:eee:jfinec:v:5:y:1977:i:3:p:309-327 Estimating betas from nonsynchronous data (1977). (32) RePEc:eee:jfinec:v:77:y:2005:i:1:p:3-55 Does financial liberalization spur growth? (2005). (33) RePEc:eee:jfinec:v:27:y:1990:i:2:p:473-521 The structure and governance of venture-capital organizations (1990). (34) RePEc:eee:jfinec:v:20:y:1988:i::p:431-460 Outside directors and CEO turnover (1988). (35) RePEc:eee:jfinec:v:8:y:1980:i:1:p:3-29 Optimal capital structure under corporate and personal taxation (1980). (36) RePEc:eee:jfinec:v:9:y:1981:i:1:p:3-18 The relationship between return and market value of common stocks (1981). (37) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:187-214 Financial markets and the allocation of capital (2000). (38) RePEc:eee:jfinec:v:26:y:1990:i:1:p:3-27 Managerial discretion and optimal financing policies (1990). (39) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:141-186 Corporate governance in the Asian financial crisis (2000). (40) RePEc:eee:jfinec:v:17:y:1986:i:2:p:357-390 Predicting returns in the stock and bond markets (1986). (41) RePEc:eee:jfinec:v:27:y:1990:i:1:p:67-88 The role of banks in reducing the costs of financial distress in Japan (1990). (42) RePEc:eee:jfinec:v:49:y:1998:i:3:p:307-343 A model of investor sentiment1 (1998). (43) RePEc:eee:jfinec:v:32:y:1992:i:3:p:263-292 The investment opportunity set and corporate financing, dividend, and compensation policies (1992). (44) RePEc:eee:jfinec:v:29:y:1991:i:1:p:97-112 The consumption of stockholders and nonstockholders (1991). (45) RePEc:eee:jfinec:v:43:y:1997:i:1:p:29-77 Emerging equity market volatility (1997). (46) RePEc:eee:jfinec:v:69:y:2003:i:1:p:5-50 The great reversals: the politics of financial development in the twentieth century (2003). (47) RePEc:eee:jfinec:v:54:y:1999:i:3:p:375-421 Predictive regressions (1999). (48) RePEc:eee:jfinec:v:19:y:1987:i:2:p:217-235 Some evidence on the uniqueness of bank loans (1987). (49) RePEc:eee:jfinec:v:66:y:2002:i:1:p:3-27 Investor protection and equity markets (2002). (50) RePEc:eee:jfinec:v:43:y:1997:i:2:p:153-193 Industry costs of equity (1997). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:aah:create:2009-05 Volatility in Equilibrium: Asymmetries and Dynamic Dependencies (2009). CREATES Research Papers (2) RePEc:aah:create:2009-36 The dividend-price ratio does predict dividend growth: International evidence (2009). CREATES Research Papers (3) RePEc:ces:ceswps:_2598 Global Liquidity, Risk Premiums and Growth Opportunities (2009). CESifo Working Paper Series (4) RePEc:ces:ceswps:_2777 Old George Orwell Got it Backward: Some Thoughts on Behavioral Tax Economics (2009). CESifo Working Paper Series (5) RePEc:ces:ceswps:_2898 Economic Growth and Longevity Risk with Adverse Selection (2009). CESifo Working Paper Series (6) RePEc:cpr:ceprdp:7110 The Future of Securities Regulation (2009). CEPR Discussion Papers (7) RePEc:cpr:ceprdp:7225 Exchange Rate Forecasting, Order Flow and Macroeconomic Information (2009). CEPR Discussion Papers (8) RePEc:cpr:ceprdp:7292 Financial Integration and Business Cycle Synchronization (2009). CEPR Discussion Papers (9) RePEc:dgr:eureri:1765017525 Riding Bubbles (2009). Research Paper (10) RePEc:dgr:kubcen:200956 Big Bad Banks? The Winners and Losers From Bank Deregulation in the United States (2009). Discussion Paper (11) RePEc:dsc:wpaper:3 Managerial discretion and optimal financing policies with cash flow uncertainty (2009). Working Papers (12) RePEc:ebg:heccah:0920 Liquidity cycles and make/take fees in electronic markets (2009). Les Cahiers de Recherche (13) RePEc:ecb:ecbwps:20091037 What Do Asset Prices Have to Say About Risk Appetite and Uncertainty? (2009). Working Paper Series (14) RePEc:ecb:ecbwps:20091122 Monetary Policy Shocks and Portfolio Choice. (2009). Working Paper Series (15) RePEc:ecl:ohidic:2009-21 The State of Corporate Governance Research (2009). Working Paper Series (16) RePEc:ecl:stabus:1993r The Economics and Politics of Corporate Social Performance (2009). Research Papers (17) RePEc:eei:rpaper:eeri_rp_2009_09 Corporate Equality and Equity Prices: Doing Well While Doing Good? (2009). EERI Research Paper Series (18) RePEc:fip:fedcwp:0909 Competition or collaboration? The reciprocity effect in loan syndication (2009). Working Paper (19) RePEc:hal:wpaper:hal-00396268 Regulation and Distrust (2009). Working Papers (20) RePEc:hhs:bofitp:2009_003 Does corruption hamper bank lending? Macro and micro evidence (2009). BOFIT Discussion Papers (21) RePEc:hhs:bofitp:2009_007 Asymmetric Information and Loan Spreads in Russia: Evidence from Syndicated Loans (2009). BOFIT Discussion Papers (22) RePEc:hhs:stavef:2009_035 The information content of market liquidity: An empirical analysis of liquidity at the Oslo Stock Exchange (2009). UiS Working Papers in Economics and Finance (23) RePEc:ide:wpaper:21367 Shareholder Activism and Socially Responsible Investors: Equilibrium Changes in Asset Prices and Corporate Behavior (2009). IDEI Working Papers (24) RePEc:imf:imfwpa:09/168 The Challenge of Enforcement in Securities Markets: Mission Impossible? (2009). IMF Working Papers (25) RePEc:iza:izadps:dp4568 Female Hires and the Success of Start-up Firms (2009). IZA Discussion Papers (26) RePEc:iza:izadps:dp4570 Individual and Corporate Social Responsibility (2009). IZA Discussion Papers (27) RePEc:jku:nrnwps:2009_28 Female Hires and the Success of Start-up Firms (2009). NRN working papers (28) RePEc:kap:apfinm:v:16:y:2009:i:2:p:141-168 Informational Efficiency: Which Institutions Matter? (2009). Asia-Pacific Financial Markets (29) RePEc:kap:jbuset:v:89:y:2009:i:1:p:39-49 A Wolf in Sheeps Clothing: The Use of Ethics-Related Terms in 10-K Reports (2009). Journal of Business Ethics (30) RePEc:mcm:deptwp:2009-16 The Impact of Empowering Investors on Trust and Trustworthiness (2009). Department of Economics Working Papers (31) RePEc:nbr:nberwo:14648 Regulation and Distrust (2009). NBER Working Papers (32) RePEc:nbr:nberwo:14843 Financial Openness and Productivity (2009). NBER Working Papers (33) RePEc:nbr:nberwo:14887 Financial Regulation, Financial Globalization and the Synchronization of Economic Activity (2009). NBER Working Papers (34) RePEc:nbr:nberwo:14903 Risk Shifting and Mutual Fund Performance (2009). NBER Working Papers (35) RePEc:nbr:nberwo:14954 Obfuscation, Learning, and the Evolution of Investor Sophistication (2009). NBER Working Papers (36) RePEc:nbr:nberwo:14972 Legal Protection in Retail Financial Markets (2009). NBER Working Papers (37) RePEc:nbr:nberwo:15356 Financial Innovation and Endogenous Growth (2009). NBER Working Papers (38) RePEc:nbr:nberwo:15499 Banking Deregulations, Financing Constraints, and Firm Entry Size (2009). NBER Working Papers (39) RePEc:nbr:nberwo:15510 Heterogeneity in the effect of regulation on entrepreneurship and entry size (2009). NBER Working Papers (40) RePEc:nbr:nberwo:15537 The State of Corporate Governance Research (2009). NBER Working Papers (41) RePEc:nbr:nberwo:15627 Labor Regulations and European Private Equity (2009). NBER Working Papers (42) RePEc:ner:leuven:urn:hdl:123456789/203016 Dynamic order submission strategies with competition between a dealer market and a crossing network. (2009). Open Access publications from Katholieke Universiteit Leuven (43) RePEc:ner:maastr:urn:nbn:nl:ui:27-23349 Does investor recognition predict returns?. (2009). Open Access publications from Maastricht University (44) RePEc:pra:mprapa:14235 Corporate equality and equity prices: Doing well while doing good? (2009). MPRA Paper (45) RePEc:pra:mprapa:17521 Recovery Rates and Macroeconomic Conditions: The Role of Loan Covenants (2009). MPRA Paper (46) RePEc:pra:mprapa:17676 Who Pulls the Plug? Theory and Evidence on Corporate Bankruptcy Decisions (2009). MPRA Paper (47) RePEc:pra:mprapa:32070 Does activity mix and funding strategy vary across ownership? Evidence from Indian banks (2009). MPRA Paper (48) RePEc:rwi:repape:0151 Female Hires and the Success of Start-up Firms (2009). Ruhr Economic Papers (49) RePEc:sol:wpaper:09-055 Labor Regulations and European Private Equity (2009). Working Papers CEB (50) RePEc:tse:wpaper:21964 Shareholder Activism and Socially Responsible Investors: Equilibrium Changes in Asset Prices and Corporate Behavior (2009). TSE Working Papers (51) RePEc:tse:wpaper:22265 Individual and Corporate Social Responsibility (2009). TSE Working Papers (52) RePEc:ubc:bricol:patrick_francois-2009-65 Competition Builds Trust (2009). UBC Departmental Archives (53) RePEc:ubc:bricol:patrick_francois-2009-66 Cultivating Trust: Norms, Institutions and the Implications of Scale (2009). UBC Departmental Archives (54) RePEc:usg:dp2009:2009-24 Option trading strategies based on semi-parametric implied volatility surface prediction (2009). University of St. Gallen Department of Economics working paper series 2009 (55) RePEc:vlg:vlgwps:2009-09 The value of excess cash and corporate governance: evidence from u.s. cross-listings (2009). Vlerick Leuven Gent Management School Working Paper Series (56) RePEc:zbw:cefswp:200915 Structure and determinants of financial covenants in leveraged buyouts - evidence from an economy with strong creditor rights (2009). CEFS Working Paper Series (57) RePEc:zbw:cfrwps:0906 The impact of iceberg orders in limit order books (2009). CFR Working Papers (58) RePEc:zbw:hohrsw:20091 Effects of the IFRS introduction: perspective from an early stadium to the time after the mandatory adoption (2009). Hohenheimer Schriften: Rechnungswesen - Steuern - Wirtschaftsprüfung (59) RePEc:zbw:zewdip:09042 Higher-order beliefs among professional stock market forecasters: some first empirical tests (2009). ZEW Discussion Papers Recent citations received in: 2008 (1) RePEc:aah:create:2008-10 Volatility Components, Affine Restrictions and Non-Normal Innovations (2008). CREATES Research Papers (2) RePEc:alu:journl:v:1:y:2008:i:10:p:1 COMPREHENSIVE INCOME IN EUROPE: VALUATION, PREDICTION AND CONSERVATIVE ISSUES (2008). Annales Universitatis Apulensis Series Oeconomica (3) RePEc:arx:papers:0807.0925 Stochastic resonance and the trade arrival rate of stocks (2008). Quantitative Finance Papers (4) RePEc:bdd:journl:v:2:y:2008:i:2:p:113-135 Dividend Policy of the ISE Industrial Corporations: The Evidence Revisited (1986-2007) (2008). Journal of BRSA Banking and Financial Markets (5) RePEc:bfr:banfra:223 Econometric Asset Pricing Modelling. (2008). Working papers (6) RePEc:btx:wpaper:0820 What Problems and Opportunities are Created by Tax Havens? (2008). Working Papers (7) RePEc:btx:wpaper:0822 Corporate Tax Elasticities A Readers Guide to Empirical Findings (2008). Working Papers (8) RePEc:btx:wpaper:0825 International Taxation and Multinational Firm Location Decisions (2008). Working Papers (9) RePEc:btx:wpaper:0826 International Taxation and Takeover Premiums in Cross-border M&As (2008). Working Papers (10) RePEc:btx:wpaper:0829 Capital Structure, Corporate Taxation and Firm Age (2008). Working Papers (11) RePEc:cen:wpaper:08-13 On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms (2008). Working Papers (12) RePEc:ces:ceswps:_2431 Taxes and the Efficiency Costs of Capital Distortions (2008). CESifo Working Paper Series (13) RePEc:ces:ceswps:_2460 Learning from the Past: Trends in Executive Compensation over the Twentieth Century (2008). CESifo Working Paper Series (14) RePEc:ces:ceswps:_2477 Corporate Income Tax and Economic Distortions (2008). CESifo Working Paper Series (15) RePEc:ces:ceswps:_2503 International Taxation and Multinational Firm Location Decisions (2008). CESifo Working Paper Series (16) RePEc:cir:cirwor:2008s-12 Stock Exchange Markets for New Ventures (2008). CIRANO Working Papers (17) RePEc:cpr:ceprdp:6881 Multi-product Firms and Product Turnover in the Developing World: Evidence from India (2008). CEPR Discussion Papers (18) RePEc:cpr:ceprdp:6915 Individual Investors and Volatility (2008). CEPR Discussion Papers (19) RePEc:cpr:ceprdp:6959 Sovereign Wealth Funds: Their Investment Strategies and Performance (2008). CEPR Discussion Papers (20) RePEc:cpr:ceprdp:7047 International Taxation and Multinational Firm Location Decisions (2008). CEPR Discussion Papers (21) RePEc:cpr:ceprdp:7052 Additions to Market Indices and the Comovement of Stock Returns around the World (2008). CEPR Discussion Papers (22) RePEc:cpr:ceprdp:7097 Employment Laws in Developing Countries (2008). CEPR Discussion Papers (23) RePEc:dgr:kubcen:200830 What is the Role of Legal Systems in Financial Intermediation? Theory and Evidence (2008). Discussion Paper (24) RePEc:dgr:kubcen:200883 Dividend Policies in an Unregulated Market: The London Stock Exchange 1895-1905 (2008). Discussion Paper (25) RePEc:ebg:heccah:0899 Individual investors and volatility (2008). Les Cahiers de Recherche (26) RePEc:ebg:iesewp:d-0749 Expected returns and liquidity risk: Does entrepreneurial income matter? (2008). IESE Research Papers (27) RePEc:ecl:ohidic:2008-10 Why Do Firms Appoint CEOs as Outside Directors? (2008). Working Paper Series (28) RePEc:ecl:ohidic:2008-15 Why Are Buyouts Levered? The Financial Structure of Private Equity Funds (2008). Working Paper Series (29) RePEc:ecl:stabus:1988 Capital Account Liberalization, Real Wages, and Productivity (2008). Research Papers (30) RePEc:emp:wpaper:wp08-12 The effect of relative wealth concerns on the cross-section of stock returns (2008). Working Papers Economia (31) RePEc:fip:fedgif:930 Why do U.S. cross-listings matter? (2008). International Finance Discussion Papers (32) RePEc:fip:fedgif:945 Escape from New York: the market impact of SEC Rule 12h-6 (2008). International Finance Discussion Papers (33) RePEc:geo:guwopa:gueconwpa~08-08-05 Order Flows and The Exchange Rate Disconnect Puzzle (2008). Working Papers (34) RePEc:hhs:nhhfms:2008_007 The Risk Components of Liquidity (2008). Discussion Papers (35) RePEc:hhs:sifrwp:0061 Communication in the boardroom (2008). SIFR Research Report Series (36) RePEc:hhs:vxcafo:2009_011 Liquidity on the Scandinavian Order-driven Stock Exchanges (2008). CAFO Working Papers (37) RePEc:hit:hitcei:2008-4 Board Structure and Price Informativeness (2008). CEI Working Paper Series (38) RePEc:hkg:wpaper:0810 What Drives Hong Kong Dollar Swap Spreads: Credit or Liquidity? (2008). Working Papers (39) RePEc:imf:imfwpa:08/265 Do Financial Sector Reforms Lead to Financial Development? Evidence from a New Dataset (2008). IMF Working Papers (40) RePEc:inn:wpaper:2008-09 Capital Structure, Corporate Taxation and Firm Age (2008). Working Papers (41) RePEc:kap:decono:v:156:y:2008:i:2:p:201-214 Financial Constraints and Other Obstacles: are they a Threat to Innovation Activity? (2008). De Economist (42) RePEc:kap:regeco:v:33:y:2008:i:1:p:87-116 Board monitoring, firm risk, and external regulation (2008). Journal of Regulatory Economics (43) RePEc:kob:dpaper:233 Abnormal Accrual, Informed Trader, and Long-Term Stock Return: Evidence from Japan (2008). Discussion Paper Series (44) RePEc:may:mayecw:n1920508.pdf Investability and Firm Value (2008). Economics, Finance and Accounting Department Working Paper Series (45) RePEc:mos:moswps:2008-21 MANAGERIAL POWER, STOCK-BASED COMPENSATION, AND FIRM PERFORMANCE: THEORY AND EVIDENCE (2008). Monash Economics Working Papers (46) RePEc:nbr:nberwo:13732 Stock-Based Compensation and CEO (Dis)Incentives (2008). NBER Working Papers (47) RePEc:nbr:nberwo:13880 Capital Account Liberalization, Real Wages, and Productivity (2008). NBER Working Papers (48) RePEc:nbr:nberwo:14027 Big Business Stability and Social Welfare (2008). NBER Working Papers (49) RePEc:nbr:nberwo:14087 A Gap-Filling Theory of Corporate Debt Maturity Choice (2008). NBER Working Papers (50) RePEc:nbr:nberwo:14127 Multi-product Firms and Product Turnover in the Developing World: Evidence from India (2008). NBER Working Papers (51) RePEc:nbr:nberwo:14175 Private Information and a Macro Model of Exchange Rates: Evidence from a Novel Data Set (2008). NBER Working Papers (52) RePEc:nbr:nberwo:14193 Housing Supply and Housing Bubbles (2008). NBER Working Papers (53) RePEc:nbr:nberwo:14245 Why Do Foreign Firms Leave U.S. Equity Markets? (2008). NBER Working Papers (54) RePEc:nbr:nberwo:14250 On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms (2008). NBER Working Papers (55) RePEc:nbr:nberwo:14273 Racial Discrimination and Competition (2008). NBER Working Papers (56) RePEc:nbr:nberwo:14486 The Role of Boards of Directors in Corporate Governance: A Conceptual Framework and Survey (2008). NBER Working Papers (57) RePEc:nbr:nberwo:14557 The Evolution of Corporate Ownership After IPO: The Impact of Investor Protection (2008). NBER Working Papers (58) RePEc:ner:maastr:urn:nbn:nl:ui:27-22862 Financial constraints and other obstacles: are they a threat to innovation activity?. (2008). Open Access publications from Maastricht University (59) RePEc:nya:albaec:08-08 On the Objective of Corporate Boards: Theory and Evidence (2008). Discussion Papers (60) RePEc:pra:mprapa:10122 Foreign Currency Exposure and Hedging: Evidence from Foreign Acquisitions (2008). MPRA Paper (61) RePEc:pra:mprapa:14843 The effects of stock options accounting regulation on corporate governance: A comparative European study (2008). MPRA Paper (62) RePEc:pra:mprapa:8226 Mergers, acquisitions and technological regimes: the European experience over the period 2002- 2005 (2008). MPRA Paper (63) RePEc:rug:rugwps:08/537 Agency and similarity effects and the VCâs attitude towards academic spin-out investing (2008). Working Papers of Faculty of Economics and Business Administration, Ghent University, Belgium (64) RePEc:sol:wpaper:08-037 International Taxation and Multinational Firm Location Decisions (2008). Working Papers CEB (65) RePEc:upf:upfgen:1109 A new method for constructing exact tests without making any assumptions (2008). Economics Working Papers (66) RePEc:vlg:vlgwps:2008-09 Towards an evolutionary model of the entrepreneurial financing process: insights from biotechnology startups (2008). Vlerick Leuven Gent Management School Working Paper Series (67) RePEc:vlg:vlgwps:2008-22 Agency and similarity effects and the VCs attitude towards academic spin-out investing (2008). Vlerick Leuven Gent Management School Working Paper Series (68) RePEc:wbk:wbrwps:4649 Bank involvement with SMEs : beyond relationship lending (2008). Policy Research Working Paper Series (69) RePEc:wbk:wbrwps:4687 Patterns of international capital raisings (2008). Policy Research Working Paper Series (70) RePEc:wbk:wbrwps:4770 Crises, capital controls, and financial integration (2008). Policy Research Working Paper Series (71) RePEc:wbk:wbrwps:4788 Drivers and obstacles to banking SMEs : the role of competition and the institutional framework (2008). Policy Research Working Paper Series (72) RePEc:zbw:zewdip:7229 The Impact of Personal and Corporate Taxation on Capital Structure Choices (2008). ZEW Discussion Papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-22 A Discrete-Time Model for Daily S&P500 Returns and Realized Variations: Jumps and Leverage Effects (2007). CREATES Research Papers (2) RePEc:aah:create:2007-37 Models for S&P500 Dynamics: Evidence from Realized Volatility, Daily Returns, and Option Prices (2007). CREATES Research Papers (3) RePEc:boe:boeewp:328 Cash-in-the-market pricing and optimal resolution of bank failures (2007). Bank of England working papers (4) RePEc:bol:bodewp:611 Who are the active investors? Evidence from Venture Capital (2007). Working Papers (5) RePEc:bsu:wpaper:200703 Universal Banking, Conficts of Interest and Firm Growth. (2007). Working Papers (6) RePEc:ces:ifodic:v:5:y:2007:i:1:p:3-9 Diversity in Shareholder Protection in Common Law Countries (2007). CESifo DICE Report (7) RePEc:cpr:ceprdp:6029 Finance and Efficiency: Do Bank Branching Regulations Matter? (2007). CEPR Discussion Papers (8) RePEc:cpr:ceprdp:6202 Finance and Efficiency: Do Bank Branching Regulations Matter? (2007). CEPR Discussion Papers (9) RePEc:cpr:ceprdp:6309 Fire Sales, Foreign Entry and Bank Liquidity (2007). CEPR Discussion Papers (10) RePEc:cpr:ceprdp:6319 Fire-sale FDI (2007). CEPR Discussion Papers (11) RePEc:cpr:ceprdp:6390 Caught On Tape: Institutional Trading, Stock Returns, and Earnings Announcements (2007). CEPR Discussion Papers (12) RePEc:cpr:ceprdp:6480 Finance and Welfare States in Globalizing Markets (2007). CEPR Discussion Papers (13) RePEc:cpr:ceprdp:6489 Pension Reform, Ownership Structure, and Corporate Governance: Evidence from Sweden (2007). CEPR Discussion Papers (14) RePEc:cpr:ceprdp:6514 Hazardous Times for Monetary Policy: What Do Twenty-Three Million Bank Loans Say About the Effects of Monetary Policy on Credit Risk? (2007). CEPR Discussion Papers (15) RePEc:dgr:eureri:300011304 When Do Managers Seek Private Equity Backing in Public-to-Private Transactions? (2007). Research Paper (16) RePEc:dgr:kubtil:2007015 Credit Derivatives and Loan Pricing (2007). Discussion Paper (17) RePEc:dnb:dnbwpp:144 Market timing and corporate capital structure - A transatlantic comparison (2007). DNB Working Papers (18) RePEc:ebg:heccah:0878 Acquisition Values and Optimal Financial (In)Flexibility (2007). Les Cahiers de Recherche (19) RePEc:ecl:ohidic:2006-14 Large Shareholders and Corporate Policies (2007). Working Paper Series (20) RePEc:ecl:ohidic:2006-17 Why Do U.S. Firms Hold So Much More Cash Than They Used To? (2007). Working Paper Series (21) RePEc:ecl:ohidic:2007-13 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). Working Paper Series (22) RePEc:ecl:ohidic:2007-14 Differences in Governance Practices between U.S. and Foreign Firms: Measurement, Causes, and Consequences (2007). Working Paper Series (23) RePEc:ecl:ohidic:2007-6 Complex Times: Asset Pricing and Conditional Moments under Non-affine Diffusions (2007). Working Paper Series (24) RePEc:eti:dpaper:07043 Credit Contagion and Trade Credit Supply: Evidence from Small Business Data in Japan (2007). Discussion papers (25) RePEc:eti:dpaper:07058 How Do Relationship Lenders Price Loans to Small Firms?: Hold-Up Costs, Transparency, and Private and Public Security (2007). Discussion papers (26) RePEc:fem:femwpa:2007.78 Legal Families and Environmental Protection: Is there a Causal Relationship? (2007). Working Papers (27) RePEc:fip:fedbqu:qau07-5 Asset liquidity, debt valuation and credit risk (2007). Quantitative Analysis Unit Working Paper (28) RePEc:fip:fedcwp:0706 Liquidity in asset markets with search frictions (2007). Working Paper (29) RePEc:fip:fedgfe:2007-29 Bank commercial loan fair value practices (2007). Finance and Economics Discussion Series (30) RePEc:fip:fedgfe:2007-39 An efficiency perspective on the gains from mergers and asset purchases (2007). Finance and Economics Discussion Series (31) RePEc:fip:fednsr:290 Has the credit derivatives swap market lowered the cost of corporate debt? (2007). Staff Reports (32) RePEc:hhs:rbnkwp:0210 Acquisition versus greenfield: The impact of the mode of foreign bank entry on information and bank lending rates (2007). Working Paper Series (33) RePEc:hhs:sifrwp:0053 Learning by Investing: Evidence from Venture Capital (2007). SIFR Research Report Series (34) RePEc:ide:wpaper:7373 The Microstructure of the Bond Market in the 20th Century (2007). IDEI Working Papers (35) RePEc:ime:imemes:v:25:y:2007:i:2:p:1-44 Lending Channels and Financial Shocks: The Case of Small and Medium-Sized Enterprise Trade Credit and the Japanese Banking Crisis (2007). Monetary and Economic Studies (36) RePEc:imf:imfwpa:07/186 Financial Reforms, Financial Openness, and Corporate Borrowing: International Evidence (2007). IMF Working Papers (37) RePEc:iza:izadps:dp3237 Credit Constraints as a Barrier to the Entry and Post-Entry Growth of Firms (2007). IZA Discussion Papers (38) RePEc:kap:annfin:v:3:y:2007:i:3:p:369-387 IPO share allocation and conflicts of interest (2007). Annals of Finance (39) RePEc:kap:decono:v:155:y:2007:i:2:p:183-206 Market Timing and Capital Structure: Evidence for Dutch Firms (2007). De Economist (40) RePEc:kap:fmktpm:v:21:y:2007:i:3:p:293-324 Corporate cash holdings: Evidence from Switzerland (2007). Financial Markets and Portfolio Management (41) RePEc:kap:jfsres:v:32:y:2007:i:1:p:1-16 A Critique of Revised Basel II (2007). Journal of Financial Services Research (42) RePEc:kap:jfsres:v:32:y:2007:i:1:p:17-38 Basel II: Correlation Related Issues (2007). Journal of Financial Services Research (43) RePEc:kap:jfsres:v:32:y:2007:i:3:p:141-159 Trading Credit Default Swaps via Interdealer Brokers (2007). Journal of Financial Services Research (44) RePEc:kap:jfsres:v:32:y:2007:i:3:p:177-202 Universal Banking, Conflicts of Interest and Firm Growth (2007). Journal of Financial Services Research (45) RePEc:kap:jrefec:v:35:y:2007:i:4:p:385-410 CEO Involvement in Director Selection: Implications for REIT Dividend Policy (2007). The Journal of Real Estate Finance and Economics (46) RePEc:kap:rqfnac:v:29:y:2007:i:2:p:129-154 Underwriter warrants, underwriter reputation, and growth signaling (2007). Review of Quantitative Finance and Accounting (47) RePEc:knz:cofedp:0709 Securitisation of Mezzanine Capital in Germany (2007). CoFE Discussion Paper (48) RePEc:knz:cofedp:0710 Information asymmetries and securitization design (2007). CoFE Discussion Paper (49) RePEc:lmu:muenec:2007 The Effect of Bank Competition on the Banks Incentive to Collateralize (2007). Discussion Papers in Economics (50) RePEc:lmu:muenec:2028 Creditor Passivity: The Effects of Bank Competition and Institutions on the Strategic Use of Bankruptcy Filings (2007). Discussion Papers in Economics (51) RePEc:mie:wpaper:565 The Case for Financial Sector Liberalization in Ethiopia (2007). Working Papers (52) RePEc:nbr:nberwo:12843 Risk, Return and Dividends (2007). NBER Working Papers (53) RePEc:nbr:nberwo:12874 On the Return to Venture Capital (2007). NBER Working Papers (54) RePEc:nbr:nberwo:13014 Human Capital, Bankruptcy and Capital Structure (2007). NBER Working Papers (55) RePEc:nbr:nberwo:13285 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). NBER Working Papers (56) RePEc:nbr:nberwo:13288 Differences in Governance Practices between U.S. and Foreign Firms: Measurement, Causes, and Consequences (2007). NBER Working Papers (57) RePEc:nbr:nberwo:13420 Psychology and Economics: Evidence from the Field (2007). NBER Working Papers (58) RePEc:nbr:nberwo:13430 Linearity-Generating Processes: A Modelling Tool Yielding Closed Forms for Asset Prices (2007). NBER Working Papers (59) RePEc:nbr:nberwo:13480 Personnel Economics (2007). NBER Working Papers (60) RePEc:nbr:nberwo:13608 The Economic Consequences of Legal Origins (2007). NBER Working Papers (61) RePEc:nbr:nberwo:13660 Financial Structure, Liquidity, and Firm Locations (2007). NBER Working Papers (62) RePEc:nip:nipewp:28/2007 Wealth Shocks and Risk Aversion (2007). NIPE Working Papers (63) RePEc:nip:nipewp:29/2007 Expectations, Shocks, and Asset Returns (2007). NIPE Working Papers (64) RePEc:pra:mprapa:19656 What moves the primary stock and bond markets? Influence of macroeconomic factors on bond and equity issues in Malaysia and Korea (2007). MPRA Paper (65) RePEc:pra:mprapa:23244 Agency Conflicts and Corporate Payout Policies: A Global Study (2007). MPRA Paper (66) RePEc:pra:mprapa:28416 An empirical study of corporate bond pricing with unobserved capital structure dynamics. (2007). MPRA Paper (67) RePEc:pra:mprapa:3110 Driven to distraction: Extraneous events and underreaction to earnings news (2007). MPRA Paper (68) RePEc:pra:mprapa:5101 Larger crises cost more: impact of banking sector instability on output growth (2007). MPRA Paper (69) RePEc:pra:mprapa:6600 The Effects of Corporate Governance and Institutional Environments on Export Behaviour: Evidence from Chinese Listed Firms (2007). MPRA Paper (70) RePEc:pra:mprapa:917 Fair disclosure and investor asymmetric awareness in stock markets (2007). MPRA Paper (71) RePEc:qed:wpaper:1131 Credit Risk Transfer: To Sell or to Insure (2007). Working Papers (72) RePEc:sol:wpaper:07-003 Social justice with credits to the poor (2007). Working Papers CEB (73) RePEc:spr:finsto:v:11:y:2007:i:4:p:495-519 Efficient estimation of drift parameters in stochastic volatility models (2007). Finance and Stochastics (74) RePEc:uct:uconnp:2007-10 Empirical Analysis of Credit Risk Regime Switching and Temporal Conditional Default Correlation in Credit Default Swap Valuation: The Market liquidity effect (2007). Working papers (75) RePEc:wbk:wbrwps:4204 Formal finance and trade credit during Chinas transition (2007). Policy Research Working Paper Series (76) RePEc:wbk:wbrwps:4296 When do creditor rights work? (2007). Policy Research Working Paper Series (77) RePEc:wbk:wbrwps:4435 When do enterprises prefer informal credit ? (2007). Policy Research Working Paper Series Recent citations received in: 2006 (1) RePEc:acb:cbeeco:2006-463 International Prudential Regulation, Regulatory Risk and the Cost of Bank Capital (2006). ANUCBE School of Economics Working Papers (2) RePEc:bca:bocawp:06-44 The Long-Term Effects of Cross-Listing Investor Recognition, and Ownership Structure on Valuation (2006). Working Papers (3) RePEc:bde:wpaper:0606 The joint size and ownership specialization in banks lending (2006). Banco de España Working Papers (4) RePEc:bdm:wpaper:2006-14 Bias in Federal Reserve Inflation Forecasts: Is the Federal Reserve Irrational or Just Cautious? (2006). Working Papers (5) RePEc:boe:boeewp:310 Returns to equity, investment and Q: evidence from the United Kingdom (2006). Bank of England working papers (6) RePEc:bol:bodewp:577 Last Resort Gambles, Risky Debt and Liquidation Policy (2006). Working Papers (7) RePEc:bos:wpaper:wp2006-042 Complementarities in information acquisition with short-term trades (2006). Boston University - Department of Economics - Working Papers Series (8) RePEc:bos:wpaper:wp2006-047 A Habit-Based Explanation of the Exchange Rate Risk Premium (2006). Boston University - Department of Economics - Working Papers Series (9) RePEc:bri:cmpowp:06/153 Is Locking Domestic Funds into the Local Market Beneficial? Evidence from the Polish Pension Reforms (2006). The Centre for Market and Public Organisation (10) RePEc:cbr:cbrwps:wp335 How do family ties, boards and regulation affect pay at the top? Evidence for Indian CEOs (2006). ESRC Centre for Business Research - Working Papers (11) RePEc:cbt:econwp:06/14 A Monte Carlo Evaluation of the Efficiency of the PCSE Estimator (2006). Working Papers in Economics (12) RePEc:cep:cepdps:dp0755 International Financial Integration and Entrepreneurship (2006). CEP Discussion Papers (13) RePEc:cep:stiecm:/2006/509 Estimating Quadratic VariationConsistently in thePresence of Correlated MeasurementError (2006). STICERD - Econometrics Paper Series (14) RePEc:cfs:cfswop:wp200604 Risk Transfer with CDOs and Systemic Risk in Banking (2006). CFS Working Paper Series (15) RePEc:cje:issued:v:39:y:2006:i:4:p:1244-1281 The forward premium anomaly: statistical artefact or economic puzzle? New evidence from robust tests (2006). Canadian Journal of Economics (16) RePEc:cns:cnscwp:200616 What determines entrepreneurial clusters? (2006). Working Paper CRENoS (17) RePEc:cor:louvco:2006088 International stock return predictability: statistical evidence and economic significance (2006). CORE Discussion Papers (18) RePEc:cor:louvco:2006089 The information content of the Bond-Equity Yield Ratio: better than a random walk? (2006). CORE Discussion Papers (19) RePEc:cpr:ceprdp:5449 The Organization of the Innovation Industry: Entrepreneurs, Venture Capitalists and Oligopolists (2006). CEPR Discussion Papers (20) RePEc:cpr:ceprdp:5524 Optimal Asset Allocation and Risk Shifting in Money Management (2006). CEPR Discussion Papers (21) RePEc:cpr:ceprdp:5604 Marketwide Private Information in Stocks: Forecasting Currency Returns (2006). CEPR Discussion Papers (22) RePEc:cpr:ceprdp:5618 Risk Transfer with CDOs and Systemic Risk in Banking (2006). CEPR Discussion Papers (23) RePEc:cpr:ceprdp:5623 Banking Crises, Financial Dependence and Growth (2006). CEPR Discussion Papers (24) RePEc:cpr:ceprdp:5722 Stock Price Informativeness, Cross-Listings and Investment Decisions (2006). CEPR Discussion Papers (25) RePEc:cpr:ceprdp:5758 Conditional Allocation of Control Rights in Venture Capital Firms (2006). CEPR Discussion Papers (26) RePEc:cpr:ceprdp:5770 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). CEPR Discussion Papers (27) RePEc:cpr:ceprdp:5773 Optimal Value and Growth Tilts in Long-Horizon Portfolios (2006). CEPR Discussion Papers (28) RePEc:cpr:ceprdp:5821 Ex Ante Effects of Ex Post Managerial Ownership (2006). CEPR Discussion Papers (29) RePEc:cpr:ceprdp:5946 Liquidity and Expected Returns: Lessons from Emerging Markets (2006). CEPR Discussion Papers (30) RePEc:cpr:ceprdp:5951 Stock and Bond Returns with Moody Investors (2006). CEPR Discussion Papers (31) RePEc:crf:wpaper:06-07 Why Do Banks Ask for Collateral and Which Ones? (2006). LSF Research Working Paper Series (32) RePEc:csl:devewp:219 Trade Openness and Volatility (2006). Development Working Papers (33) RePEc:dgr:kubcen:2006103 Agency Theory of Overvalued Equity as an Explanation for the Accrual Anomaly (2006). Discussion Paper (34) RePEc:dgr:kubcen:200673 How Relevant is Dividend Policy under Low Shareholder Protection? (2006). Discussion Paper (35) RePEc:dgr:kubcen:200678 Optimal Portfolio Choice with Annuitization (2006). Discussion Paper (36) RePEc:dgr:vuarem:2006-3 Splitting orders in overlapping markets: a study of cross-listed stocks (2006). Serie Research Memoranda (37) RePEc:ebg:heccah:0840 Stock price informativeness, cross-listings and investment decisions (2006). Les Cahiers de Recherche (38) RePEc:ebg:iesewp:d-0663 A general formula for the WACC: A correction (2006). IESE Research Papers (39) RePEc:ecb:ecbwps:20060689 The effect of financial development on the investment-cash flow relationship - cross-country evidence from Europe (2006). Working Paper Series (40) RePEc:ecl:ohidic:2004-20 Founder-CEOs, Investment Decisions, and Stock Market Performance (2006). Working Paper Series (41) RePEc:ecl:ohidic:2005-18 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2006). Working Paper Series (42) RePEc:ecl:ohidic:2006-20 Managerial Risk-Taking Behavior and Equity-Based Compensation (2006). Working Paper Series (43) RePEc:ecl:ohidic:2006-21 The Economics of Conflicts of Interest in Financial Institutions (2006). Working Paper Series (44) RePEc:ecl:ohidic:2006-23 R2 and Price Inefficiency (2006). Working Paper Series (45) RePEc:ecl:ohidic:2006-7 How Has CEO Turnover Changed? Increasingly Performance Sensitive Boards and Increasingly Uneasy CEOs (2006). Working Paper Series (46) RePEc:ecl:ohidic:2006-8 Investor Overreaction, Cross-Sectional Dispersion of Firm Valuations, and Expected Stock Returns (2006). Working Paper Series (47) RePEc:ecm:emetrp:v:74:y:2006:i:3:p:681-714 Optimal Inference in Regression Models with Nearly Integrated Regressors (2006). Econometrica (48) RePEc:fip:fedfwp:2006-16 The bond yield conundrum from a macro-finance perspective (2006). Working Paper Series (49) RePEc:fip:fedfwp:2006-35 Incomplete information processing: a solution to the forward discount puzzle (2006). Working Paper Series (50) RePEc:fip:fedfwp:2006-46 Macroeconomic implications of changes in the term premium (2006). Working Paper Series (51) RePEc:fip:fedgfe:2006-11 Credit market competition and capital regulation (2006). Finance and Economics Discussion Series (52) RePEc:fip:fedgfe:2007-11 Expected stock returns and variance risk premia (2006). Finance and Economics Discussion Series (53) RePEc:fip:fedgif:853 New methods for inference in long-run predictive regressions (2006). International Finance Discussion Papers (54) RePEc:fip:fedgif:855 Should we expect significant out-of-sample results when predicting stock returns? (2006). International Finance Discussion Papers (55) RePEc:fip:fedgif:869 Predictive regressions with panel data (2006). International Finance Discussion Papers (56) RePEc:fip:fedgif:877 International cross-listing, firm performance and top management turnover: a test of the bonding hypothesis (2006). International Finance Discussion Papers (57) RePEc:fip:fednsr:252 Visible and hidden risk factors for banks (2006). Staff Reports (58) RePEc:fip:fedreq:y:2006:i:fall:p:317-336:n:v.92no.4 Bond price premiums (2006). Economic Quarterly (59) RePEc:hkm:wpaper:102006 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). Working Papers (60) RePEc:iis:dispap:iiisdp162 The Performance of International Equity Portfolios (2006). The Institute for International Integration Studies Discussion Paper Series (61) RePEc:imf:imfwpa:06/231 Barriers to Retail Competition and Prices: Evidence from Spain (2006). IMF Working Papers (62) RePEc:iza:izadps:dp2086 Reforms, Entry and Productivity: Some Evidence from the Indian Manufacturing Sector (2006). IZA Discussion Papers (63) RePEc:iza:izadps:dp2433 The Economic Effects of Employment Protection: Evidence from International Industry-Level Data (2006). IZA Discussion Papers (64) RePEc:jae:japmet:v:21:y:2006:i:2:p:147-173 Estimation of multivariate models for time series of possibly different lengths (2006). Journal of Applied Econometrics (65) RePEc:kap:annfin:v:2:y:2006:i:1:p:39-50 Stock options and capital structure (2006). Annals of Finance (66) RePEc:kap:revind:v:29:y:2006:i:1:p:93-126 Simple money-based tests for choosing between private and public delivery: a discussion of the issues (2006). Review of Industrial Organization (67) RePEc:knz:cofedp:0609 Wieweit tragen rationale Modelle in der Finanzmarktforschung? (2006). CoFE Discussion Paper (68) RePEc:lar:wpaper:2006-02 Does Collateral Help Mitigate Adverse Selection? A Cross-Country Analysis (2006). Working Papers of LaRGE Research Center (Laboratoire de Recherche en Gestion et Economie) (69) RePEc:lar:wpaper:2006-03 Why Do Banks Ask for Collateral and Which Ones ? (2006). Working Papers of LaRGE Research Center (Laboratoire de Recherche en Gestion et Economie) (70) RePEc:msh:ebswps:2006-10 Assessing the Impact of Market Microstructure Noise and Random Jumps on the Relative Forecasting Performance of Option-Implied and Returns-Based Volatility (2006). Monash Econometrics and Business Statistics Working Papers (71) RePEc:nbb:fsrart:v:4:y:2006:i:1:p:151-173 Cross-border crisis management : a race against the clock or a hurdle race ? (2006). Financial Stability Review (72) RePEc:nbr:nberwo:12026 The Dog That Did Not Bark: A Defense of Return Predictability (2006). NBER Working Papers (73) RePEc:nbr:nberwo:12144 Optimal Decentralized Investment Management (2006). NBER Working Papers (74) RePEc:nbr:nberwo:12151 Why Do IPO Auctions Fail? (2006). NBER Working Papers (75) RePEc:nbr:nberwo:12247 Stock and Bond Returns with Moody Investors (2006). NBER Working Papers (76) RePEc:nbr:nberwo:12346 The Performance of International Equity Portfolios (2006). NBER Working Papers (77) RePEc:nbr:nberwo:12360 A Skeptical Appraisal of Asset-Pricing Tests (2006). NBER Working Papers (78) RePEc:nbr:nberwo:12465 How has CEO Turnover Changed? Increasingly Performance Sensitive Boards and Increasingly Uneasy CEOs (2006). NBER Working Papers (79) RePEc:nbr:nberwo:12671 Testing Models of Low-Frequency Variability (2006). NBER Working Papers (80) RePEc:nbr:nberwo:12695 The Economics of Conflicts of Interest in Financial Institutions (2006). NBER Working Papers (81) RePEc:nbr:nberwo:12781 Heterogeneous Expectations and Bond Markets (2006). NBER Working Papers (82) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3125497 Financial intermediary development and growth volatility: Do intermediaries dampen or magnify shocks?. (2006). Open Access publications from Tilburg University (83) RePEc:ntd:wpaper:2006-14 Dividends: New evidence on the catering theory (2006). Working Papers New Trends on Business Administration. Documentos de Trabajo Nuevas Tendencias en Dirección de Empresas. (84) RePEc:nus:nusewp:wp0603 The Persistence and Predictive Power of the Dividend-Price Ratio (2006). Departmental Working Papers (85) RePEc:pra:mprapa:2508 Does Collateral Help Mitigate Adverse Selection ? A Cross-Country Analysis (2006). MPRA Paper (86) RePEc:qed:wpaper:1107 Work-Related Perks, Agency Problems, and Optimal Incentive Contracts (2006). Working Papers (87) RePEc:qed:wpaper:1108 A Rent Extraction View of Employee Discounts and Benefits (2006). Working Papers (88) RePEc:rdg:icmadp:icma-dp2006-09 Momentum Profits and Time-Varying Unsystematic Risk (2006). (89) RePEc:red:issued:05-109 A Simple Explanation of the Relative Performance Evaluation Puzzle (2006). Review of Economic Dynamics (90) RePEc:rut:rutres:200620 Predictive Density Estimators for Daily Volatility Based on the Use of Realized Measures (2006). Departmental Working Papers (91) RePEc:sip:dpaper:06-013 Are Burdensome Registration Procedures an Important Barrier on Firm Creation? Evidence from Mexico (2006). Discussion Papers (92) RePEc:szg:worpap:0604 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). Working Papers (93) RePEc:upf:upfgen:1009 Testing financing constraints on firm investment using variable capital (2006). Economics Working Papers (94) RePEc:upf:upfgen:1010 Financing constraints and fixed-term employment contracts (2006). Economics Working Papers (95) RePEc:wbk:wbrwps:3856 Creating an efficient financial system : challenges in a global economy (2006). Policy Research Working Paper Series (96) RePEc:wbk:wbrwps:3892 Promoting access to primary equity markets : a legal and regulatory approach (2006). Policy Research Working Paper Series (97) RePEc:wbk:wbrwps:3955 Finance and economic development : policy choices for developing countries (2006). Policy Research Working Paper Series (98) RePEc:wbk:wbrwps:4079 Banking services for everyone ? Barriers to bank access and use around the world (2006). Policy Research Working Paper Series (99) RePEc:wdi:papers:2006-822 Reforms, Entry and Productivity: Some Evidence from the Indian Manufacturing Sector (2006). William Davidson Institute Working Papers Series (100) RePEc:wrk:warwec:772 Internal consistency of survey respondents.forecasts : Evidence based on the Survey of Professional Forecasters (2006). The Warwick Economics Research Paper Series (TWERPS) More than 100 citations. List broken... Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||