|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

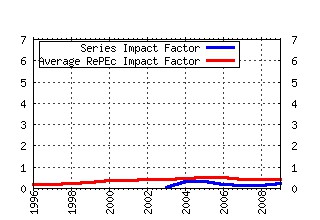

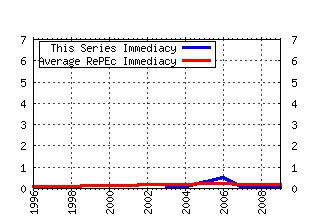

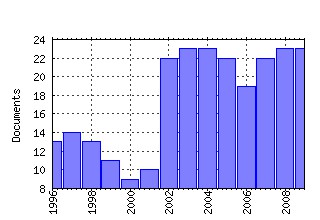

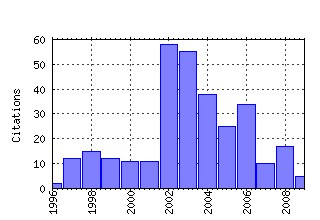

Review of Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:revfin:v:11:y:2002:i:2:p:91-108 Interrelationships among regional stock indices (2002). (2) RePEc:eee:revfin:v:11:y:2002:i:2:p:119-130 Long-term nominal interest rates and domestic fundamentals (2002). (3) RePEc:eee:revfin:v:11:y:2002:i:2:p:131-150 Financial development and economic growth: Another look at the evidence from developing countries (2002). (4) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:41-63 Portuguese banking: A structural model of competition in the deposits market (2004). (5) RePEc:eee:revfin:v:15:y:2006:i:3:p:193-221 Financial deregulation and efficiency: An empirical analysis of Indian banks during the post reform period (2006). (6) RePEc:eee:revfin:v:7:y:1998:i:1:p:1-19 Founding family controlled firms: Efficiency and value (1998). (7) RePEc:eee:revfin:v:17:y:2008:i:4:p:315-337 Profit sharing and investment by regulated utilities: A welfare analysis (2008). (8) RePEc:eee:revfin:v:15:y:2006:i:4:p:289-304 The impact of macroeconomic uncertainty on non-financial firms demand for liquidity (2006). (9) RePEc:eee:revfin:v:12:y:2003:i:4:p:363-380 The day of the week effect on stock market volatility and volume: International evidence (2003). (10) RePEc:eee:revfin:v:11:y:2002:i:4:p:299-315 Long-term trends and cycles in ASEAN stock markets (2002). (11) RePEc:eee:revfin:v:13:y:2004:i:3:p:245-258 Fractional cointegration and tests of present value models (2004). (12) RePEc:eee:revfin:v:15:y:2006:i:1:p:28-48 Fractional integration in daily stock market indexes (2006). (13) RePEc:eee:revfin:v:12:y:2003:i:2:p:191-205 The macroeconomic determinants of technology stock price volatility (2003). (14) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:255-279 Real options, irreversible investment and firm uncertainty: New evidence from U.S. firms (2005). (15) RePEc:eee:revfin:v:12:y:2003:i:3:p:301-313 Dollar exchange rate and stock price: evidence from multivariate cointegration and error correction model (2003). (16) RePEc:eee:revfin:v:8:y:1999:i:1:p:41-60 An empirical analysis of the equity markets in China (1999). (17) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:7-39 Consolidation in US banking: Which banks engage in mergers? (2004). (18) RePEc:eee:revfin:v:14:y:2005:i:1:p:81-91 Non-linear dynamics in international stock market returns (2005). (19) RePEc:eee:revfin:v:10:y:2001:i:3:p:191-212 Twenty-five years of corporate governance research ... and counting (2001). (20) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:371-393 Flexibility and technology choice in gas fired power plant investments (2005). (21) RePEc:eee:revfin:v:9:y:2000:i:2:p:101-120 Market perception of efficiency in bank holding company mergers: the roles of the DEA and SFA models in capturing merger potential (2000). (22) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:323-351 The option value of patent litigation: Theory and evidence (2005). (23) RePEc:eee:revfin:v:11:y:2002:i:1:p:37-46 Membership growth, multiple membership groups and agency control at credit unions (2002). (24) RePEc:eee:revfin:v:12:y:2003:i:1:p:35-47 Do credit unions use their tax advantage to benefit members? Evidence from a cost function (2003). (25) RePEc:eee:revfin:v:8:y:1999:i:1:p:25-39 An analysis of nontraditional activities at U.S. commercial banks (1999). (26) RePEc:eee:revfin:v:12:y:2003:i:2:p:207-231 Macroeconomic influences on optimal asset allocation (2003). (27) RePEc:eee:revfin:v:12:y:2003:i:1:p:7-33 The failure of new entrants in commercial banking markets: a split-population duration analysis (2003). (28) RePEc:eee:revfin:v:9:y:2000:i:2:p:121-128 Microeconomic foundations of an optimal currency area (2000). (29) RePEc:eee:revfin:v:12:y:2003:i:3:p:247-270 Return predictability in African stock markets (2003). (30) RePEc:eee:revfin:v:12:y:2003:i:2:p:161-172 Corporate governance and market valuation of capital and R&D investments (2003). (31) RePEc:eee:revfin:v:16:y:2007:i:3:p:259-273 Fatal attraction: Using distance to measure contagion in good times as well as bad (2007). (32) RePEc:eee:revfin:v:6:y:1997:i:2:p:187-198 A nonparametric investigation of the 90-day t-bill rate (1997). (33) RePEc:eee:revfin:v:12:y:2003:i:2:p:131-159 Is presidential cycle in security returns merely a reflection of business conditions? (2003). (34) RePEc:eee:revfin:v:4:y:1995:i:2:p:141-155 Inter-industry differences and the impact of operating and financial leverages on equity risk (1995). (35) RePEc:eee:revfin:v:12:y:2003:i:4:p:327-344 Explaining credit rating differences between Japanese and U.S. agencies (2003). (36) RePEc:eee:revfin:v:18:y:2009:i:1:p:33-46 The effects of tax policy on financial markets: G3 evidence (2009). (37) RePEc:eee:revfin:v:12:y:2003:i:1:p:99-126 The Basel Committee proposals for a new capital accord: implications for Italian banks (2003). (38) RePEc:eee:revfin:v:15:y:2006:i:4:p:331-349 Variations in effects of monetary policy on stock market returns in the past four decades (2006). (39) RePEc:eee:revfin:v:6:y:1997:i:1:p:95-112 Foreign trade and exchange-rate risk in the G-7 countries: Cointegration and error-correction models (1997). (40) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:79-102 The impact of banks expanded securities powers on small-business lending (2004). (41) RePEc:eee:revfin:v:9:y:2000:i:1:p:1-13 Effectiveness of CEO pay-for-performance (2000). (42) RePEc:eee:revfin:v:15:y:2006:i:4:p:305-321 Testing for international equity market integration using regime switching cointegration techniques (2006). (43) RePEc:eee:revfin:v:6:y:1997:i:1:p:57-75 Listing of put options: Is there any volatility effect? (1997). (44) RePEc:eee:revfin:v:11:y:2002:i:4:p:263-285 The performance persistence of foreign closed-end funds (2002). (45) RePEc:eee:revfin:v:12:y:2003:i:2:p:173-189 The impact of firm size on bank debt use (2003). (46) RePEc:eee:revfin:v:4:y:1995:i:2:p:197-210 Financial variables contributing to savings and loan failures from 1980-1989 (1995). (47) RePEc:eee:revfin:v:16:y:2007:i:3:p:291-304 Foreign participation in local currency bond markets (2007). (48) RePEc:eee:revfin:v:13:y:2004:i:3:p:269-281 Relative risk aversion among the elderly (2004). (49) RePEc:eee:revfin:v:17:y:2008:i:3:p:213-227 A comparative analysis of proxies for an optimal leverage ratio (2008). (50) RePEc:eee:revfin:v:7:y:1998:i:2:p:143-155 The effect of ownership structure on firm performance: Additional evidence (1998). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:wfo:wpaper:y:2009:i:352 A General Financial Transaction Tax: The Concept, its Justification and Effects (2009). WIFO Working Papers Recent citations received in: 2008 (1) RePEc:ubs:wpaper:0801 Delay is not the answer: waiting time in health care & income redistribution (2008). Working Papers Recent citations received in: 2007 (1) RePEc:nbr:nberwo:13074 The Stability of Large External Imbalances: The Role of Returns Differentials (2007). NBER Working Papers Recent citations received in: 2006 (1) RePEc:boc:bocoec:634 Uncertainty Determinants of Corporate Liquidity (2006). Boston College Working Papers in Economics (2) RePEc:boc:bocoec:637 The Effects of Industry-Level Uncertainty on Cash Holdings: The Case of Germany (2006). Boston College Working Papers in Economics (3) RePEc:diw:diwwpp:dp637 Macroeconomic Uncertainty and Bank Lending: The Case of Ukraine (2006). Discussion Papers of DIW Berlin (4) RePEc:diw:diwwpp:dp638 The Effects of Industry-Level Uncertainty on Cash Holdings: The Case of Germany (2006). Discussion Papers of DIW Berlin (5) RePEc:fem:femwpa:2006.22 On the Robustness of Robustness Checks of the Environmental Kuznets Curve (2006). Working Papers (6) RePEc:gla:glaewp:2006_8 Reexamining the linkages between inflation and output growth: A bivariate ARFIMA-FIGARCH approach (2006). Working Papers (7) RePEc:lbo:lbowps:2006_18 Non-Parametric Analysis of Efficiency Gains from Bank Mergers in India (2006). Discussion Paper Series (8) RePEc:pra:mprapa:252 Long memory and non-linearity in Stock Markets (2006). MPRA Paper (9) RePEc:tcb:wpaper:0606 The Determinants and Implications of Financial Asset Holdings of Non-Financial Firms in Turkey : An Emprical Investigation (2006). Working Papers (10) RePEc:tcb:wpaper:0607 Corporate Sector Financial Structure in Turkey : A Descriptive Analysis (2006). Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||