|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

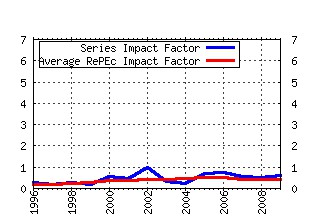

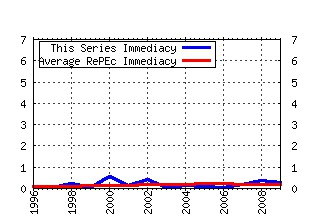

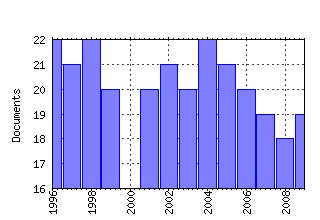

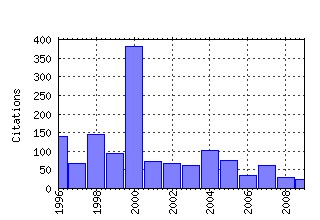

Fiscal Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ifs:fistud:v:21:y:2000:i:1:p:75-103 The labour market impact of the working familiesâ tax credit (2000). (2) RePEc:ifs:fistud:v:21:y:2000:i:4:p:427-468 Evaluation methods for non-experimental data (2000). (3) RePEc:ifs:fistud:v:19:y:1998:i:4:p:347-374 Does it pay to work in the public sector? (1998). (4) RePEc:ifs:fistud:v:14:y:1993:i:2:p:15-36 The welfare economics of tax co-ordination in the European Community : a survey (1993). (5) RePEc:ifs:fistud:v:20:y:1999:i:1:p:1-23 Human capital investment: the returns from education and training to the individual, the firm and the economy (1999). (6) RePEc:ifs:fistud:v:17:y:1996:i:1:p:37-58 Fighting international tax avoidance (1996). (7) RePEc:ifs:fistud:v:15:y:1994:i:2:p:19-43 Carbon taxes, consumer demand and carbon dioxide emissions: a simulation analysis for the UK (1994). (8) RePEc:ifs:fistud:v:13:y:1992:i:3:p:15-40 Labour supply and taxation: a survey (1992). (9) RePEc:ifs:fistud:v:19:y:1998:i:1:p:1-37 The balance between specific and ad valorem taxation (1998). (10) RePEc:ifs:fistud:v:12:y:1991:i:3:p:1-15 A general neutral profits tax (1991). (11) RePEc:ifs:fistud:v:24:y:2003:i:3:p:237-274 Fiscal Decentralisation and Economic Growth in High-Income OECD Countries (2003). (12) RePEc:ifs:fistud:v:25:y:2004:i:2:p:159-200 Ageing and the tax implied in public pension schemes: simulations for selected OECD countries (2004). (13) RePEc:ifs:fistud:v:17:y:1996:i:2:p:1-36 The gender earnings gap: evidence from the UK (1996). (14) RePEc:ifs:fistud:v:15:y:1994:i:3:p:109-28 Monetary policy in the UK (1994). (15) RePEc:ifs:fistud:v:25:y:2004:i:4:p:367-388 Why has the UK corporation tax raised so much revenue? (2004). (16) RePEc:ifs:fistud:v:21:y:2000:i:2:p:207-229 Public investment, the Stability Pact and the âgolden ruleâ (2000). (17) RePEc:ifs:fistud:v:15:y:1994:i:1:p:24-43 Retirement behaviour in Britain (1994). (18) RePEc:ifs:fistud:v:16:y:1995:i:4:p:23-68 Corporation tax: a survey (1995). (19) RePEc:ifs:fistud:v:19:y:1998:i:3:p:221-247 Global and regional public goods: a prognosis for collective action (1998). (20) RePEc:ifs:fistud:v:23:y:2002:i:3:p:401-418 The Croatian profit tax: an ACE in practice (2002). (21) RePEc:ifs:fistud:v:17:y:1996:i:3:p:21-38 Carbon taxation, prices and inequality in Australia (1996). (22) RePEc:ifs:fistud:v:16:y:1995:i:3:p:40-54 Income, expenditure and the living standards of UK households (1995). (23) RePEc:ifs:fistud:v:20:y:1999:i:3:p:305-320 Combining input-output analysis and micro-simulation to assess the effects of carbon taxation on Spanish households (1999). (24) RePEc:ifs:fistud:v:25:y:2004:i:3:p:279-303 The Take-Up of Multiple Means-Tested Benefits by British Pensioners: Evidence from the Family Resources Survey (2004). (25) RePEc:ifs:fistud:v:19:y:1998:i:4:p:375-402 Equity and ecotax reform in the EU: achieving a 10 per cent reduction in CO2 emissions using excise duties (1998). (26) RePEc:ifs:fistud:v:22:y:2001:i:1:p:41-77 Comparing in-work benefits and the reward to work for families with children in the US and the UK (2001). (27) RePEc:ifs:fistud:v:1:y:1980:i:3:p:1-28 The economic implications of North Sea Oil Revenues (1980). (28) RePEc:ifs:fistud:v:25:y:2004:i:2:p:129-158 Inequality and two decades of British tax and benefit reform (2004). (29) RePEc:ifs:fistud:v:7:y:1986:i:4:p:69-87 Competitive tendering and efficiency: the case of refuse collection (1986). (30) RePEc:ifs:fistud:v:21:y:2000:i:3:p:329-347 Expenditure incidence in Africa: microeconomic evidence (2000). (31) RePEc:ifs:fistud:v:26:y:2005:i:2:p:197-224 The elasticity of marginal utility of consumption: estimates for 20 OECD countries (2005). (32) RePEc:ifs:fistud:v:17:y:1996:i:3:p:1-19 The impact of compulsory competitive tendering on refuse collection services (1996). (33) RePEc:ifs:fistud:v:14:y:1993:i:1:p:15-41 Optimal taxation as a guide to tax policy: a survey (1993). (34) RePEc:ifs:fistud:v:13:y:1992:i:4:p:21-57 Taxation and the environment: a survey (1992). (35) RePEc:ifs:fistud:v:17:y:1996:i:1:p:1-18 Profit-sharing regulation: an economic appraisal (1996). (36) RePEc:ifs:fistud:v:15:y:1994:i:2:p:1-18 Financial constraints and company investment (1994). (37) RePEc:ifs:fistud:v:19:y:1998:i:2:p:175-196 The dynamics of male retirement behaviour (1998). (38) RePEc:ifs:fistud:v:26:y:2005:i:4:p:423-470 Immigrants in the British labour market (2005). (39) RePEc:ifs:fistud:v:28:y:2007:i:2:p:143-170 Understanding Pensions: Cognitive Function, Numerical Ability and Retirement Saving* (2007). (40) RePEc:ifs:fistud:v:18:y:1997:i:3:p:225-247 Wage structures in the private and public sectors in West Germany (1997). (41) RePEc:ifs:fistud:v:28:y:2007:i:4:p:463-495 Why Are Mothers Working Longer Hours in Austria than in Germany? A Comparative Microsimulation Analysis* (2007). (42) RePEc:ifs:fistud:v:16:y:1995:i:2:p:94-114 Bringing it all back home: alcohol taxation and cross-border shopping (1995). (43) RePEc:ifs:fistud:v:13:y:1992:i:1:p:1-21 Lone mothers, family credit and paid work (1992). (44) RePEc:ifs:fistud:v:23:y:2002:i:1:p:1-49 Unemployment and workers compensation programmes: rationale, design, labour supply and income support . (2002). (45) RePEc:ifs:fistud:v:31:y:2010:i:1:p:43-79 Tax and the Crisis (2010). (46) RePEc:ifs:fistud:v:21:y:2000:i:3:p:375-399 Evidence on the relationship between income and poor health: is the government doing enough? (2000). (47) RePEc:ifs:fistud:v:28:y:2007:i:1:p:103-120 Is Government Expenditure Volatility Harmful for Growth? A Cross-Country Analysis (2007). (48) RePEc:ifs:fistud:v:17:y:1996:i:4:p:31-48 Minimum wages: possible effects on the distribution of income (1996). (49) RePEc:ifs:fistud:v:24:y:2003:i:4:p:451-476 Ownership and Production Costs: Choosing between Public Production and Contracting-Out in the Case of Swedish Refuse Collection (2003). (50) RePEc:ifs:fistud:v:16:y:1995:i:1:p:1-17 On the European Union VAT proposals: the superiority of origin over destination taxation (1995). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:ecb:ecbwps:20091133 Fiscal policy shocks in the euro area and the US: an empirical assessment. (2009). Working Paper Series (2) RePEc:ifs:ifsewp:09/01 Are two cheap, noisy measures better than one expensive, accurate one? (2009). IFS Working Papers (3) RePEc:iis:dispap:iiisdp336 International Differences in Fiscal Policy During the Global Crisis (2009). The Institute for International Integration Studies Discussion Paper Series (4) RePEc:kap:sbusec:v:33:y:2009:i:2:p:207-227 Absorptive capacity and R&D tax policy: Are in-house and external contract R&D substitutes or complements? (2009). Small Business Economics (5) RePEc:ukc:ukcedp:0925 Tax Policy for Economic Recovery and Growth. (2009). Studies in Economics Recent citations received in: 2008 (1) RePEc:btx:wpaper:0812 Increased efficiency through consolidation and formula apportionment in the European Union? (2008). Working Papers (2) RePEc:btx:wpaper:0827 Strategic Consolidation under Formula Apportionment (2008). Working Papers (3) RePEc:ces:ceswps:_2484 Strategic Consolidation under Formula Apportionment (2008). CESifo Working Paper Series (4) RePEc:ces:ifofor:v:9:y:2008:i:2:p:46-52 Harmonizing Corporate Income Taxes in the US and the EU: Legislative, Judicial, Soft Law and Cooperative Approaches (2008). CESifo Forum (5) RePEc:mrr:papers:wp175 Forecasting Labor Force Participation and Economic Resources of the Early Baby Boomers (2008). Working Papers (6) RePEc:mrr:papers:wp198 Does the Rise in the Full Retirement Age Encourage Disability Benefits Applications? Evidence from the Health and Retirement Study (2008). Working Papers (7) RePEc:nuf:esohwp:_074 British Manual Workers: From Producers to Consumers, c. 19502000 (2008). Oxford University Economic and Social History Series Recent citations received in: 2007 (1) RePEc:cdh:commen:242 Excess Baggage: Measuring Air Transportations Fiscal Burden (2007). C.D. Howe Institute Commentary (2) RePEc:iza:izadps:dp2988 As SIMPL As That: Introducing a Tax-Benefit Microsimulation Model for Poland (2007). IZA Discussion Papers (3) RePEc:iza:izadps:dp3157 Safety Net Still in Transition: Labour Market Incentive Effects of Extending Social Support in Poland (2007). IZA Discussion Papers (4) RePEc:lbo:lbowps:2007_18 Volatile public spending in a model of money and sustainable growth (2007). Discussion Paper Series Recent citations received in: 2006 (1) RePEc:pra:mprapa:1867 A family of big brother that do not talk esch other (2006). MPRA Paper Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||