|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

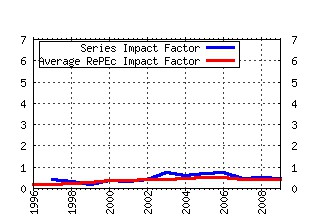

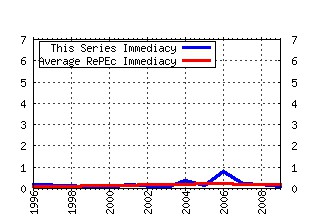

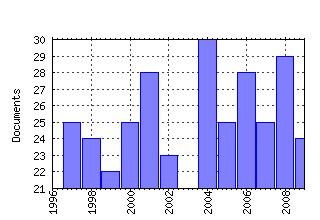

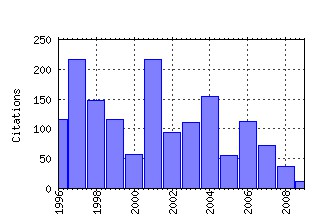

International Journal of Finance & Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ijf:ijfiec:v:2:y:1997:i:1:p:1-16 International Business Cycles and the ERM: Is There a European Business Cycle? (1997). (2) RePEc:ijf:ijfiec:v:9:y:2004:i:4:p:307-313 The revived Bretton Woods system (2004). (3) RePEc:ijf:ijfiec:v:3:y:1998:i:2:p:169-88 The Feldstein-Horioka Puzzle and Capital Mobility: A Review. (1998). (4) RePEc:ijf:ijfiec:v:8:y:2003:i:1:p:11-53 Do indicators of financial crises work? An evaluation of an early warning system (2003). (5) RePEc:ijf:ijfiec:v:4:y:1999:i:1:p:1-26 Perspectives on the Recent Currency Crisis Literature. (1999). (6) RePEc:ijf:ijfiec:v:3:y:1998:i:4:p:279-89 Quasi Purchasing Power Parity. (1998). (7) RePEc:ijf:ijfiec:v:1:y:1996:i:3:p:207-23 Capital Flows and Macroeconomic Management: Tequila Lessons. (1996). (8) RePEc:ijf:ijfiec:v:2:y:1997:i:4:p:307-18 Examining the Use of Technical Currency Analysis. (1997). (9) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:325-42 The ECB Monetary Policy Strategy and the Money Market. (2001). (10) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:343-68 Assessing Inflation Targeting after a Decade of World Experience. (2001). (11) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:315-23 The Empirics of Monetary Policy Rules in Open Economies. (2001). (12) RePEc:ijf:ijfiec:v:7:y:2002:i:3:p:165-93 Financial Market Integration in Europe: On the Effects of EMU on Stock Markets. (2002). (13) RePEc:ijf:ijfiec:v:4:y:1999:i:1:p:27-54 On the Use of Reserve Requirements in Dealing with Capital Flow Problems. (1999). (14) RePEc:ijf:ijfiec:v:11:y:2006:i:4:p:327-338 Extended evidence on the use of technical analysis in foreign exchange (2006). (15) RePEc:ijf:ijfiec:v:2:y:1997:i:4:p:291-305 Switching between Chartists and Fundamentalists: A Markov Regime-Switching Approach. (1997). (16) RePEc:ijf:ijfiec:v:3:y:1998:i:3:p:195-215 Does the Term Structure Predict Recessions? The International Evidence. (1998). (17) RePEc:ijf:ijfiec:v:11:y:2006:i:1:p:81-95 Under the microscope: the structure of the foreign exchange market (2006). (18) RePEc:ijf:ijfiec:v:1:y:1996:i:1:p:55-67 The Distribution of Exchange Rates in the EMS. (1996). (19) RePEc:ijf:ijfiec:v:9:y:2004:i:4:p:289-306 How do UK-based foreign exchange dealers think their market operates? (2004). (20) RePEc:ijf:ijfiec:v:6:y:2001:i:1:p:81-93 Importance of Technical and Fundamental Analysis in the European Foreign Exchange Market. (2001). (21) RePEc:ijf:ijfiec:v:8:y:2003:i:3:p:205-224 Capital account liberalization and growth: was Mr. Mahathir right? (2003). (22) RePEc:ijf:ijfiec:v:1:y:1996:i:3:p:183-95 Managing Risks to Financial Markets from Volatile Capital Flows: The Role of Prudential Regulation. (1996). (23) RePEc:ijf:ijfiec:v:5:y:2000:i:3:p:177-95 Country Funds and Asymmetric Information. (2000). (24) RePEc:ijf:ijfiec:v:4:y:1999:i:2:p:93-111 Alternative Approaches to Real Exchange Rates and Real Interest Rates: Three Up and Three Down. (1999). (25) RePEc:ijf:ijfiec:v:6:y:2001:i:2:p:95-114 Market Structure and the Persistence of Sectoral Real Exchange Rates. (2001). (26) RePEc:ijf:ijfiec:v:11:y:2006:i:3:p:219-228 Look whos talking: ECB communication during the first years of EMU (2006). (27) RePEc:ijf:ijfiec:v:9:y:2004:i:1:p:71-80 Transmission of equity returns and volatility in Asian developed and emerging markets: a multivariate GARCH analysis (2004). (28) RePEc:ijf:ijfiec:v:4:y:1999:i:4:p:271-96 Modelling Emerging Market Risk Premia Using Higher Moments. (1999). (29) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:277-88 The Euro Area and the Single Monetary Policy. (2001). (30) RePEc:ijf:ijfiec:v:11:y:2006:i:2:p:155-171 Foreign exchange intervention and the Australian dollar: has it mattered? (2006). (31) RePEc:ijf:ijfiec:v:5:y:2000:i:4:p:309-30 Political Instability and Economic Vulnerability. (2000). (32) RePEc:ijf:ijfiec:v:6:y:2001:i:3:p:187-200 Real Exchange Rate Effects on the Balance of Trade: Cointegration and the Marshall-Lerner Condition. (2001). (33) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:421-35 Macroeconomic Fundamentals and the DM/$ Exchange Rate: Temporal Instability and the Monetary Model. (2001). (34) RePEc:ijf:ijfiec:v:2:y:1997:i:3:p:189-98 Inflation Convergence within the European Union: A Panel Data Analysis. (1997). (35) RePEc:ijf:ijfiec:v:1:y:1996:i:1:p:1-23 Liberalized Portfolio Capital Inflows in Emerging Markets: Sterilization, Expectations, and the Incompleteness of Interest Rate Convergence. (1996). (36) RePEc:ijf:ijfiec:v:6:y:2001:i:4:p:369-87 Beyond Bipolar: A Three-Dimensional Assessment of Monetary Frameworks. (2001). (37) RePEc:ijf:ijfiec:v:12:y:2007:i:2:p:171-200 The influence of actual and unrequited interventions (2007). (38) RePEc:ijf:ijfiec:v:8:y:2003:i:2:p:109-129 On currency crises and contagion (2003). (39) RePEc:ijf:ijfiec:v:6:y:2001:i:1:p:59-67 Long-Term Memory in Stock Market Returns: International Evidence. (2001). (40) RePEc:ijf:ijfiec:v:7:y:2002:i:2:p:141-55 Monetary Policy Transparency, Inflation and the Sacrifice Ratio. (2002). (41) RePEc:ijf:ijfiec:v:2:y:1997:i:2:p:131-43 Measuring Economic Convergence. (1997). (42) RePEc:ijf:ijfiec:v:1:y:1996:i:4:p:229-50 Alternative Long-Horizon Exchange-Rate Predictors. (1996). (43) RePEc:ijf:ijfiec:v:1:y:1996:i:1:p:25-35 Sovereign Debt, Reputation and Credit Terms. (1996). (44) RePEc:ijf:ijfiec:v:11:y:2006:i:3:p:279-292 Monetary policy and asset prices: to respond or not? (2006). (45) RePEc:ijf:ijfiec:v:6:y:2001:i:1:p:27-39 The Comovements of Stock Markets in Hungary, Poland and the Czech Republic. (2001). (46) RePEc:ijf:ijfiec:v:6:y:2001:i:3:p:201-16 Modelling Fundamentals for Forecasting Capital Flows to Emerging Markets. (2001). (47) RePEc:ijf:ijfiec:v:7:y:2002:i:2:p:97-108 Financial Development and Poverty Reduction in Developing Countries. (2002). (48) RePEc:ijf:ijfiec:v:5:y:2000:i:4:p:253-63 Is There a Base Currency Effect in Long-Run PPP? (2000). (49) RePEc:ijf:ijfiec:v:2:y:1997:i:2:p:87-100 The Reaction of Exchange Rates and Interest Rates to News Releases. (1997). (50) RePEc:ijf:ijfiec:v:12:y:2007:i:2:p:133-154 Myths and reality of foreign exchange interventions: an application to Japan (2007). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:kap:openec:v:20:y:2009:i:5:p:589-605 Fundamentals and Technical Trading: Behavior of Exchange Rates in the CEECs (2009). Open Economies Review (2) RePEc:lbo:lbowps:2009_05 How Far From the Euro Area? Measuring Convergence of Inflation Rates in Eastern Europe (2009). Discussion Paper Series Recent citations received in: 2008 (1) RePEc:ebl:ecbull:v:3:y:2008:i:27:p:1-8 Testing for PPP in Australia: Evidence from unit root test against nonlinear trend stationarity alternatives (2008). Economics Bulletin (2) RePEc:erg:wpaper:401 Parametric and Non-Parametric Approaches to Exits from Fixed Exchange Rate Regimes (2008). Working Papers (3) RePEc:gra:wpaper:08/19 Going Multinational under Exchange Rate Uncertainty (2008). ThE Papers (4) RePEc:nbs:wpaper:2008/8 Nonlinearities in real exchange rate determination: do African exchange rates follow a radom walk? (2008). Working Papers (5) RePEc:pra:mprapa:8917 ä¼ä¸âæå âãææ¯å级ä¸ç»æµç»©æ ââ对ä¸å½å¼ååºäº§ä¸éèçæ§è´¨åå ¶åè¿çå®è¯åæ (2008). MPRA Paper Recent citations received in: 2007 (1) RePEc:ces:ceswps:_1894 Intervention Policy of the BoJ: A Unified Approach (2007). CESifo Working Paper Series (2) RePEc:ces:ceswps:_1962 Modeling Optimism and Pessimism in the Foreign Exchange Market (2007). CESifo Working Paper Series (3) RePEc:cfs:cfswop:wp200716 Gradualism, Transparency and Improved Operational Framework: A Look at the Overnight Volatility Transmission (2007). CFS Working Paper Series (4) RePEc:hhs:bofrdp:2007_019 Long swings and chaos in the exchange rate in a DSGE model with a Taylor rule (2007). Research Discussion Papers (5) RePEc:hhs:bofrdp:2007_021 Optimal monetary policy under heterogeneity in currency trade (2007). Research Discussion Papers (6) RePEc:hhs:bofrdp:2007_022 Instrument rules in monetary policy under heterogeneity in currency trade (2007). Research Discussion Papers Recent citations received in: 2006 (1) RePEc:bno:worpap:2006_01 Evaluation of macroeconomic models for financial stability analysis (2006). Working Paper (2) RePEc:bno:worpap:2006_10 Managing uncertainty through robust-satisficing monetary policy (2006). Working Paper (3) RePEc:bno:worpap:2006_13 Model selection for monetary policy analysis Importance of empirical validity (2006). Working Paper (4) RePEc:cep:cepdps:dp0764 The Impact of Central Bank Announcements on Asset Prices in Real Time: Testing the Efficiency of the Euribor Futures Market (2006). CEP Discussion Papers (5) RePEc:ces:ceswps:_1652 Does Money Matter in the ECB Strategy? New Evidence Based on ECB Communication (2006). CESifo Working Paper Series (6) RePEc:ces:ceswps:_1691 Does Financial Integration Spur EconomicGrowth? New Evidence from the First Era of Financial Globalization (2006). CESifo Working Paper Series (7) RePEc:cpr:ceprdp:5770 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). CEPR Discussion Papers (8) RePEc:ecb:ecbwps:20060679 Monetary policy in the media (2006). Working Paper Series (9) RePEc:eth:wpswif:06-46 Does Financial Integration Spur Economic Growth? New Evidence from the First Era of Financial Globalization (2006). CER-ETH Economics working paper series (10) RePEc:fip:fedfwp:2006-35 Incomplete information processing: a solution to the forward discount puzzle (2006). Working Paper Series (11) RePEc:han:dpaper:dp-351 Price Discovery in Currency Markets (2006). Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hannover (12) RePEc:has:discpr:0615 Central Bank Interventions, Communication and Interest Rate Policy in Emerging European Economies (2006). IEHAS Discussion Papers (13) RePEc:kap:compec:v:27:y:2006:i:2:p:229-259 Measuring the Degree of Convergence among European Business Cycles (2006). Computational Economics (14) RePEc:kof:wpskof:06-125 Does Money Matter in the ECB Strategy? New Evidence Based on ECB Communication (2006). KOF Working papers (15) RePEc:nst:samfok:6806 Evaluation of macroeconomic models for financial stability analysis (2006). Working Paper Series (16) RePEc:pra:mprapa:1123 The effectiveness of official intervention in foreign exchange market in Malawi (2006). MPRA Paper (17) RePEc:sce:scecfa:16 The Coordination Channel of Foreign Exchange Intervention (2006). Computing in Economics and Finance 2006 (18) RePEc:szg:worpap:0604 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). Working Papers (19) RePEc:use:tkiwps:0606 Why are federal central banks more activist? (2006). Working Papers (20) RePEc:wdi:papers:2006-846 Central Bank Interventions, Communication & Interest Rate Policy in Emerging European Economies (2006). William Davidson Institute Working Papers Series (21) RePEc:wrk:warwec:769 The Obstinate Passion of Foreign Exchange Professionals : Technical Analysis (2006). The Warwick Economics Research Paper Series (TWERPS) (22) RePEc:zbw:bubdp1:4245 The coordination channel of foreign exchange intervention: a nonlinear microstructural analysis (2006). Discussion Paper Series 1: Economic Studies Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||