|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

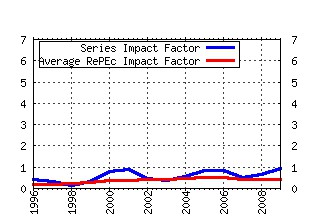

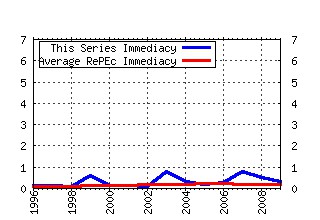

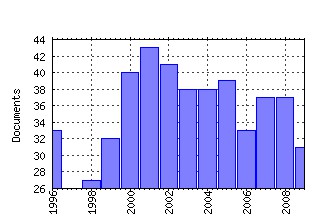

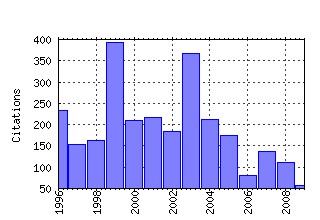

International Tax and Public Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:459-472 Balance Sheets, the Transfer Problem, and Financial Crises (1999). (2) RePEc:kap:itaxpf:v:10:y:2003:i:2:p:107-26 Evaluating Tax Policy for Location Decisions. (2003). (3) RePEc:kap:itaxpf:v:2:y:1995:i:2:p:157-183 Environmental taxation and the double dividend: A readers guide (1995). (4) RePEc:kap:itaxpf:v:2:y:1995:i:2:p:279-293 A core-theoretic solution for the design of cooperative agreements on transfrontier pollution (1995). (5) RePEc:kap:itaxpf:v:10:y:2003:i:6:p:673-93 Taxation and Foreign Direct Investment: A Synthesis of Empirical Research. (2003). (6) RePEc:kap:itaxpf:v:3:y:1996:i:3:p:397-412 Fiscal externalities and the design of intergovernmental grants (1996). (7) RePEc:kap:itaxpf:v:1:y:1994:i:1:p:57-79 From the global income tax to the dual income tax: Recent tax reforms in the Nordic countries (1994). (8) RePEc:kap:itaxpf:v:2:y:1995:i:1:p:85-106 The impact of tax on foreign direct investment: Empirical evidence and the implications for tax integration schemes (1995). (9) RePEc:kap:itaxpf:v:3:y:1996:i:2:p:137-155 Efficiency and the optimal direction of federal-state transfers (1996). (10) RePEc:kap:itaxpf:v:2:y:1995:i:2:p:229-244 Environmental regulation and the location of polluting industries (1995). (11) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:621-639 Role of the Minimal State Variable Criterion in Rational Expectations Models (1999). (12) RePEc:kap:itaxpf:v:15:y:2008:i:4:p:360-394 Public policies against global warming: a supply side approach (2008). (13) RePEc:kap:itaxpf:v:14:y:2007:i:2:p:151-164 Tax incentives and the location of FDI: Evidence from a panel of German multinationals (2007). (14) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:421-443 Green Tax Reforms and the Double Dividend: an Updated Readers Guide (1999). (15) RePEc:kap:itaxpf:v:9:y:2002:i:6:p:631-649 A Tax on Tax Revenue: The Incentive Effects of Equalizing Transfers: Evidence from Germany (2002). (16) RePEc:kap:itaxpf:v:9:y:2002:i:4:p:409-421 Bailouts in a Federation (2002). (17) repec:kap:itaxpf:v:8:y:2001:i:4:p:529-556 (). (18) RePEc:kap:itaxpf:v:1:y:1994:i:3:p:211-225 Taxation of foreign multinationals: A sequential bargaining approach to tax holidays (1994). (19) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:389-410 The Impact of Firing Costs on Turnover and Unemployment: Evidence from the Colombian Labour Market Reform (1999). (20) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:339-360 Getting the Unemployed Back to Work: The Role of Targeted Wage Subsidies (1999). (21) RePEc:kap:itaxpf:v:5:y:1998:i:3:p:429-442 Dual VATs and Cross-Border Trade: Two Problems, One Solution? (1998). (22) RePEc:kap:itaxpf:v:10:y:2003:i:4:p:469-87 Taxing Multinationals. (2003). (23) RePEc:kap:itaxpf:v:10:y:2003:i:4:p:419-34 The Double Dividend of Postponing Retirement. (2003). (24) RePEc:kap:itaxpf:v:2:y:1995:i:3:p:459-468 Spatial productivity spillovers from public infrastructure: Evidence from state highways (1995). (25) RePEc:kap:itaxpf:v:3:y:1996:i:3:p:281-295 Redistributive taxation and social insurance (1996). (26) RePEc:kap:itaxpf:v:12:y:2005:i:4:p:475-492 On Spatial Public Finance Empirics (2005). (27) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:537-577 Simple Monetary Policy Rules Under Model Uncertainty (1999). (28) RePEc:kap:itaxpf:v:4:y:1997:i:4:p:407-427 Income Redistribution with Well-Informed Local Governments (1997). (29) RePEc:kap:itaxpf:v:8:y:2001:i:2:p:119-128 A General Model of the Behavioral Response to Taxation (2001). (30) RePEc:kap:itaxpf:v:10:y:2003:i:3:p:259-80 Is Targeted Tax Competition Less Harmful Than Its Remedies? (2003). (31) RePEc:kap:itaxpf:v:12:y:2005:i:5:p:667-687 Has Tax Competition Emerged in OECD Countries? Evidence from Panel Data (2005). (32) RePEc:kap:itaxpf:v:12:y:2005:i:4:p:493-513 Tax Mimicking and Yardstick Competition Among Local Governments in the Netherlands (2005). (33) RePEc:kap:itaxpf:v:7:y:2000:i:2:p:141-162 Gini Indices and the Redistribution of Income (2000). (34) RePEc:kap:itaxpf:v:8:y:2001:i:2:p:191-210 Reforming Business Taxation: Lessons from Italy? (2001). (35) RePEc:kap:itaxpf:v:3:y:1996:i:1:p:67-81 Anti-tax-avoidance provisions and the size of foreign direct investment (1996). (36) RePEc:kap:itaxpf:v:3:y:1996:i:3:p:259-280 Social insurance, incentives and risk taking (1996). (37) RePEc:kap:itaxpf:v:10:y:2003:i:4:p:489-503 On Forest Rotation under Interest Rate Variability. (2003). (38) RePEc:kap:itaxpf:v:13:y:2006:i:5:p:565-585 Optimal unemployment insurance design: Time limits, monitoring, or workfare? (2006). (39) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:263-287 Tax Reform and Employment in Europe (1999). (40) RePEc:kap:itaxpf:v:11:y:2004:i:4:p:469-485 Economic Effects of Taxing Different Organizational Forms under the Nordic Dual Income Tax (2004). (41) RePEc:kap:itaxpf:v:14:y:2007:i:1:p:7-27 Candidate quality (2007). (42) RePEc:kap:itaxpf:v:10:y:2003:i:6:p:651-71 Tax Competition and Tax Coordination in the European Union. (2003). (43) RePEc:kap:itaxpf:v:11:y:2004:i:5:p:601-622 The Effects of Bilateral Tax Treaties on U.S. FDI Activity (2004). (44) RePEc:kap:itaxpf:v:8:y:2001:i:5:p:753-774 Electoral and Partisan Cycles in Fiscal Policy: An Examination of Canadian Provinces (2001). (45) RePEc:kap:itaxpf:v:5:y:1998:i:3:p:379-396 Pollution, Factor Taxation and Unemployment (1998). (46) RePEc:kap:itaxpf:v:10:y:2003:i:6:p:695-711 Exploring Formula Allocation for the European Union. (2003). (47) RePEc:kap:itaxpf:v:1:y:1994:i:1:p:5-24 When are origin and destination regimes equivalent? (1994). (48) RePEc:kap:itaxpf:v:7:y:2000:i:4:p:547-562 Why Invest in Your Neighbor? Social Contract on Educational Investment (2000). (49) RePEc:kap:itaxpf:v:11:y:2004:i:1:p:71-89 Debating Proposed Reforms of the Taxation of Corporate Income in the European Union (2004). (50) RePEc:kap:itaxpf:v:7:y:2000:i:4:p:445-461 Health Care Reform: Separating Insurance from Income Redistribution (2000). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:aia:aiaswp:wp69 WP 69 - Balancing roles. Bridging the divide between HRM, employee participation and learning in the Dutch knowledge economy (2009). AIAS Working Papers (2) RePEc:btx:wpaper:0931 Corporate Taxation and the Choice of Patent Location within Multinational Firms (2009). Working Papers (3) RePEc:ces:ceswps:_2517 How Low Business Tax Rates Attract Multinational Headquarters: Municipality-Level Evidence from Germany (2009). CESifo Working Paper Series (4) RePEc:ces:ceswps:_2540 FDI and Taxation: A Meta-Study (2009). CESifo Working Paper Series (5) RePEc:ces:ceswps:_2879 Corporate Taxation and the Choice of Patent Location within Multinational Firms (2009). CESifo Working Paper Series (6) RePEc:ces:ceswps:_2892 Debt Financing and Sharp Currency Depreciations: Wholly vs. Partially Owned Multinational Affiliates (2009). CESifo Working Paper Series (7) RePEc:ces:ifofor:v:10:y:2009:i:2:p:37-42 Why Tax Commercial Motor Fuel In The EU Member State Where Its Bought? Why Not Where Its Consumed? (2009). CESifo Forum (8) RePEc:ieb:wpaper:2009/10/doc2009-18 Competition for FDI with vintage investment and agglomeration advantages (2009). Working Papers (9) RePEc:iza:izadps:dp4196 Optimal Redistributive Taxation and Provision of Public Input Goods in an Economy with Outsourcing and Unemployment (2009). IZA Discussion Papers (10) RePEc:ner:maastr:urn:nbn:nl:ui:27-18346 On the exportability of the Dutch pension system to the European Union. (2009). Open Access publications from Maastricht University (11) RePEc:wbk:wbrwps:5053 Revenue managementeffects related to financial flows generated by climate policy (2009). Policy Research Working Paper Series Recent citations received in: 2008 (1) RePEc:ces:ceswps:_2250 Optimal Taxation of Human Capital and theEarnings Function (2008). CESifo Working Paper Series (2) RePEc:ces:ceswps:_2348 Insuring Educational Risk: Opportunities versus Income (2008). CESifo Working Paper Series (3) RePEc:ces:ceswps:_2362 Financing Higher Education and Labor Mobility (2008). CESifo Working Paper Series (4) RePEc:ces:ceswps:_2391 Financing Bologna, the Internationally Mobile Students in European Higher Education (2008). CESifo Working Paper Series (5) RePEc:ces:ceswps:_2451 Optimal Policy and the Risk Properties of Human Capital Reconsidered (2008). CESifo Working Paper Series (6) RePEc:ces:ceswps:_2452 Outsourcing, Unemployment and Welfare Policy (2008). CESifo Working Paper Series (7) RePEc:ces:ceswps:_2477 Corporate Income Tax and Economic Distortions (2008). CESifo Working Paper Series (8) RePEc:ces:ceswps:_2492 Bush Meets Hotelling: Effects of Improved Renewable Energy Technology on Greenhouse Gas Emissions (2008). CESifo Working Paper Series (9) RePEc:ces:ceswps:_2513 Educational and Wage Risk: Social Insurance vs. Quality of Education (2008). CESifo Working Paper Series (10) RePEc:ese:emodwp:em1-08 Wie progressiv ist Deutschland? Das stuer-und transfersystem im europaischen vergleich (2008). EUROMOD Working Papers (11) RePEc:ese:emodwp:em2-08 Effects of flat tax reforms in Western Europe on equity and efficiency (2008). EUROMOD Working Papers (12) RePEc:gla:glaewp:2009_03 International corporate taxation and US multinationals behaviour: an integrated approach (2008). Working Papers (13) RePEc:ifs:ifsewp:08/09 Does welfare reform affect fertility? Evidence from the UK (2008). IFS Working Papers (14) RePEc:kap:itaxpf:v:15:y:2008:i:2:p:145-163 A case for taxing education (2008). International Tax and Public Finance (15) RePEc:kap:jculte:v:32:y:2008:i:1:p:35-58 The impact of central places on spatial spending patterns: evidence from Flemish local government cultural expenditures (2008). Journal of Cultural Economics (16) RePEc:pie:dsedps:2008/73 Technological Change and the Wage Differential between Skilled and Unskilled Workers: Evidence from Italy (2008). Discussion Papers (17) RePEc:pie:dsedps:2008/75 PAYG pensions and economic cycles: exogenous versus endogenous fertility (2008). Discussion Papers (18) RePEc:pra:mprapa:14761 Tax burden by economic function A comparison for the EU Member States (2008). MPRA Paper (19) RePEc:sef:csefwp:205 An Egg Today and a Chicken Tomorrow: A Model of Social Security with Quasi-Hyperbolic Discounting (2008). CSEF Working Papers (20) RePEc:tax:taxtre:2008 Taxation trends in the European Union: 2008 edition (2008). Taxation trends Recent citations received in: 2007 (1) RePEc:ags:eaa106:7928 Impact of the food safety policies on the reduction of poverty in Tunisian rural areas (2007). 106th Seminar, October 25-27, 2007, Montpellier, France (2) RePEc:ays:ispwps:paper0715 Economic Effects of A Personal Capital Income Tax Add-on to a Consumption Tax (2007). International Studies Program Working Paper Series, at AYSPS, GSU (3) RePEc:ays:ispwps:paper0717 Moving Towards Dual Income Taxation in Europe (2007). International Studies Program Working Paper Series, at AYSPS, GSU (4) RePEc:bol:bodewp:604 Exports Versus Horizontal Foreign Direct Investment with Profit Shifting (2007). Working Papers (5) RePEc:bos:iedwpr:dp-164 Outside Income and Moral Hazard: The Elusive Quest for Good Politicians (2007). Boston University - Department of Economics - The Institute for Economic Development Working Papers Series (6) RePEc:btx:wpaper:0702 The Impact of Taxation on the Location of Capital, Firms and Profit: a Survey of Empirical Evidence (2007). Working Papers (7) RePEc:btx:wpaper:0706 The Effects of EU Formula Apportionment on Corporate Tax Revenues (2007). Working Papers (8) RePEc:cdh:commen:254 2007 Tax Competitiveness Report: A Call for Comprehensive Tax Reform (2007). C.D. Howe Institute Commentary (9) RePEc:ces:ceswps:_2005 Income Taxation of Couples and the Tax Unit Choice (2007). CESifo Working Paper Series (10) RePEc:ces:ceswps:_2092 The Optimal Income Taxation of Couples as a Multi-Dimensional Screening Problem (2007). CESifo Working Paper Series (11) RePEc:ces:ceswps:_2097 Tax Competition with Formula Apportionment: The Interaction between Tax Base and Sharing Mechanism (2007). CESifo Working Paper Series (12) RePEc:ces:ceswps:_2114 Exports, Foreign Direct Investment and the Costs of Corporate Taxation (2007). CESifo Working Paper Series (13) RePEc:ces:ceswps:_2121 Estimating Income Responses to Tax Changes: A Dynamic Panel Data Approach (2007). CESifo Working Paper Series (14) RePEc:ces:ceswps:_2122 From Separate Accounting to Formula Apportionment: Analysis in a Dynamic Framework (2007). CESifo Working Paper Series (15) RePEc:cpb:discus:88 Reinventing the Dutch tax-benefit system; exploring the frontier of the equity-efficiency trade-off (2007). CPB Discussion Paper (16) RePEc:cpb:docmnt:153 Immigration policy and welfare state design; a qualitative approach to explore the interaction (2007). CPB Document (17) RePEc:cte:werepe:we073218 Outside income and moral hazard : the elusive quest for good politicians (2007). Economics Working Papers (18) RePEc:diw:diwvjh:76-2-4 Steuerpolitische Perspektiven der Unternehmensteuerreform 2008 (2007). Vierteljahrshefte zur Wirtschaftsforschung / Quarterly Journal of Economic Research (19) RePEc:fer:dpaper:416 Tax Treatment of Dividends and Capital Gains and the Dividend Decision Under Dual Income Tax (2007). Discussion Papers (20) RePEc:fer:dpaper:421 The Increased Revenue from Finnish Corporate Income Tax in the 1990s (2007). Discussion Papers (21) RePEc:gla:glaewp:2007_31 The Tax Sparing Provision Influence: A Credit versus Exempt Investors Analysis (2007). Working Papers (22) RePEc:hhs:uunewp:2007_025 Estimating Income Responses to Tax Changes: A Dynamic Panel Data Approach (2007). Working Paper Series (23) RePEc:iza:izadps:dp3088 Estimating Income Responses to Tax Changes: A Dynamic Panel Data Approach (2007). IZA Discussion Papers (24) RePEc:lmu:muenec:2031 Subsidy Competition and the Role of Firm Ownership (2007). Discussion Papers in Economics (25) RePEc:pas:asarcc:2007-01 Fiscal Policy in Developing Countries: A Synoptic View (2007). ASARC Working Papers (26) RePEc:qed:dpaper:146 Diagnosis of Indirect Taxes and the Taxation of International Trade in the Dominican Republic (2007). Development Discussion Papers (27) RePEc:wly:jintdv:v:19:y:2007:i:8:p:1114-1130 A poverty-focused evaluation of commodity tax options (2007). Journal of International Development (28) RePEc:zbw:uoccpe:7220 Politicians outside earnings and electoral competition (2007). FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge (29) RePEc:zbw:wzbmpg:spii200710 The impact of central places on spatial spending patterns: evidence from Flemish local government cultural expenditures (2007). Discussion Papers, Research Unit: Market Processes and Governance Recent citations received in: 2006 (1) RePEc:ays:ispwps:paper0635 Consumption-Based Direct Taxes: A Guided Tour of the Amusement Park (2006). International Studies Program Working Paper Series, at AYSPS, GSU (2) RePEc:ces:ceswps:_1721 The Capital Structure of Multinational Companies under Tax Competition (2006). CESifo Working Paper Series (3) RePEc:ces:ceswps:_1749 Workfare, Monitoring, and Efficiency Wages (2006). CESifo Working Paper Series (4) RePEc:ces:ceswps:_1793 Can Capital Income Taxes Survive? And Should They? (2006). CESifo Working Paper Series (5) RePEc:kap:itaxpf:v:13:y:2006:i:2:p:163-180 Incentives and Information Exchange in International Taxation (2006). International Tax and Public Finance (6) RePEc:kud:epruwp:06-06 Can Capital Income Taxes Survive? And Should They? (2006). EPRU Working Paper Series (7) RePEc:kud:epruwp:06-07 The Theory of Optimal Taxation: What is the Policy Relevance? (2006). EPRU Working Paper Series (8) RePEc:nbr:nberwo:12802 Which Countries Become Tax Havens? (2006). NBER Working Papers (9) RePEc:pra:mprapa:1867 A family of big brother that do not talk esch other (2006). MPRA Paper (10) RePEc:ubs:wpaper:ubs0606 The Capital Structure of Multinational Companies Under Tax Competition (2006). Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||