|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

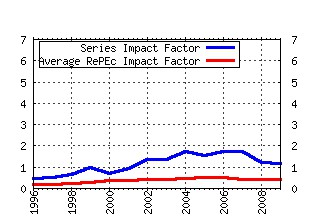

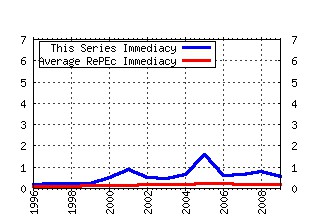

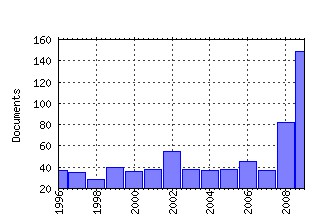

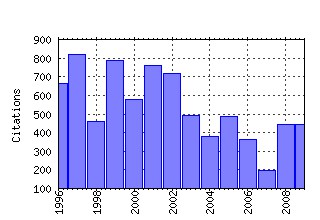

Review of Financial Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:oup:rfinst:v:1:y:1988:i:3:p:195-228 The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors (1988). (2) RePEc:oup:rfinst:v:1:y:1988:i:1:p:41-66 Stock Market Prices do not Follow Random Walks: Evidence from a Simple Specification Test (1988). (3) RePEc:oup:rfinst:v:1:y:1988:i:1:p:3-40 A Theory of Intraday Patterns: Volume and Price Variability (1988). (4) RePEc:oup:rfinst:v:3:y:1990:i:1:p:5-33 Transmission of Volatility between Stock Markets. (1990). (5) RePEc:oup:rfinst:v:5:y:1992:i:3:p:357-86 Dividend Yields and Expected Stock Returns: Alternative Procedures for Inference and Measurement. (1992). (6) RePEc:oup:rfinst:v:3:y:1990:i:2:p:281-307 Correlations in Price Changes and Volatility across International Stock Markets. (1990). (7) RePEc:oup:rfinst:v:3:y:1990:i:4:p:573-92 Pricing Interest-Rate-Derivative Securities. (1990). (8) RePEc:oup:rfinst:v:12:y:1999:i:4:p:687-720 Modeling Term Structures of Defaultable Bonds. (1999). (9) RePEc:oup:rfinst:v:6:y:1993:i:2:p:327-43 A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options. (1993). (10) RePEc:oup:rfinst:v:13:y:2000:i:4:p:959-84 The Interaction between Product Market and Financing Strategy: The Role of Venture Capital. (2000). (11) RePEc:oup:rfinst:v:9:y:1996:i:1:p:69-107 Jumps and Stochastic Volatility: Exchange Rate Processes Implicit in Deutsche Mark Options. (1996). (12) RePEc:oup:rfinst:v:10:y:1997:i:2:p:481-523 A Markov Model for the Term Structure of Credit Risk Spreads. (1997). (13) RePEc:oup:rfinst:v:6:y:1993:i:3:p:527-66 The Risk and Predictability of International Equity Returns. (1993). (14) RePEc:oup:rfinst:v:5:y:1992:i:2:p:153-80 Dynamic Equilibrium and the Real Exchange Rate in a Spatially Separated World. (1992). (15) RePEc:oup:rfinst:v:15:y:2002:i:4:p:1137-1187 International Asset Allocation With Regime Shifts (2002). (16) RePEc:oup:rfinst:v:5:y:1992:i:2:p:199-242 Stock Prices and Volume. (1992). (17) RePEc:oup:rfinst:v:8:y:1995:i:3:p:773-816 Predictable Risk and Returns in Emerging Markets. (1995). (18) RePEc:oup:rfinst:v:14:y:2001:i:3:p:659-80 Familiarity Breeds Investment. (2001). (19) RePEc:oup:rfinst:v:6:y:1993:i:3:p:473-506 Differences of Opinion Make a Horse Race. (1993). (20) RePEc:oup:rfinst:v:10:y:1997:i:3:p:661-91 Trade Credit: Theories and Evidence. (1997). (21) RePEc:oup:rfinst:v:21:y:2008:i:4:p:1455-1508 A Comprehensive Look at The Empirical Performance of Equity Premium Prediction (2008). (22) RePEc:oup:rfinst:v:9:y:1996:i:2:p:385-426 Testing Continuous-Time Models of the Spot Interest Rate. (1996). (23) RePEc:oup:rfinst:v:16:y:2003:i:3:p:765-791 Financial Development and Financing Constraints: International Evidence from the Structural Investment Model (2003). (24) RePEc:oup:rfinst:v:14:y:2001:i:1:p:1-27 Learning to be Overconfident. (2001). (25) RePEc:oup:rfinst:v:13:y:2000:i:1:p:1-42 Asymmetric Volatility and Risk in Equity Markets. (2000). (26) RePEc:oup:rfinst:v:4:y:1991:i:4:p:727-52 Stock Price Distributions with Stochastic Volatility: An Analytic Approach. (1991). (27) RePEc:oup:rfinst:v:1:y:1988:i:4:p:427-445 On Jump Processes in the Foreign Exchange and Stock Markets (1988). (28) RePEc:oup:rfinst:v:5:y:1992:i:4:p:553-80 Survivorship Bias in Performance Studies. (1992). (29) RePEc:oup:rfinst:v:7:y:1994:i:1:p:125-48 The Value of the Voting Right: A Study of the Milan Stock Exchange Experience. (1994). (30) RePEc:oup:rfinst:v:2:y:1989:i:1:p:73-89 Intertemporally Dependent Preferences and the Volatility of Consumption and Wealth. (1989). (31) RePEc:oup:rfinst:v:5:y:1992:i:1:p:1-33 On the Estimation of Beta-Pricing Models. (1992). (32) RePEc:oup:rfinst:v:19:y:2006:i:3:p:967-1000 Competition and Strategic Information Acquisition in Credit Markets (2006). (33) RePEc:oup:rfinst:v:5:y:1992:i:4:p:531-52 A Theory of the Nominal Term Structure of Interest Rates. (1992). (34) RePEc:oup:rfinst:v:3:y:1990:i:2:p:175-205 When Are Contrarian Profits Due to Stock Market Overreaction? (1990). (35) RePEc:oup:rfinst:v:7:y:1994:i:4:p:631-51 Transactions, Volume, and Volatility. (1994). (36) RePEc:oup:rfinst:v:11:y:1998:i:2:p:309-41 An Equilibrium Model with Restricted Stock Market Participation. (1998). (37) RePEc:oup:rfinst:v:6:y:1993:i:3:p:659-81 The Informational Content of Implied Volatility. (1993). (38) RePEc:oup:rfinst:v:16:y:2003:i:3:p:717-763 A New Approach to Measuring Financial Contagion (2003). (39) RePEc:oup:rfinst:v:13:y:2000:i:2:p:433-51 Recovering Risk Aversion from Option Prices and Realized Returns. (2000). (40) RePEc:oup:rfinst:v:15:y:2002:i:1:p:243-288 Quadratic Term Structure Models: Theory and Evidence (2002). (41) RePEc:oup:rfinst:v:9:y:1996:i:1:p:141-61 Dynamic Nonmyopic Portfolio Behavior. (1996). (42) RePEc:oup:rfinst:v:12:y:1999:i:1:p:197-226 Estimating the Price of Default Risk. (1999). (43) RePEc:oup:rfinst:v:6:y:1993:i:4:p:733-64 Auctions of Divisible Goods: On the Rationale for the Treasury Experiment. (1993). (44) RePEc:oup:rfinst:v:18:y:2005:i:2:p:491-533 Consumption and Portfolio Choice over the Life Cycle (2005). (45) RePEc:oup:rfinst:v:12:y:1999:i:4:p:653-86 Conflict of Interest and the Credibility of Underwriter Analyst Recommendations. (1999). (46) RePEc:oup:rfinst:v:11:y:1998:i:4:p:817-44 Modeling Asymmetric Comovements of Asset Returns. (1998). (47) RePEc:oup:rfinst:v:18:y:2005:i:2:p:351-416 How Often to Sample a Continuous-Time Process in the Presence of Market Microstructure Noise (2005). (48) RePEc:oup:rfinst:v:12:y:1999:i:3:p:579-607 Deposits and Relationship Lending. (1999). (49) RePEc:oup:rfinst:v:12:y:1999:i:2:p:405-28 Implementing Statistical Criteria to Select Return Forecasting Models: What Do We Learn? (1999). (50) RePEc:oup:rfinst:v:3:y:1990:i:1:p:115-31 The Stock Market and Investment. (1990). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:arx:papers:0910.2367 Risk Concentration and Diversification: Second-Order Properties (2009). Quantitative Finance Papers (2) RePEc:boc:bocoec:726 The Effects of Uncertainty and Corporate Governance on Firms Demand for Liquidity (2009). Boston College Working Papers in Economics (3) RePEc:cdf:accfin:2009/7 Disentangling the Link Between Stock and Accounting Performance in Acquisitions (2009). Cardiff Accounting and Finance Working Papers (4) RePEc:cdp:texdis:td361 The spatial structure of the financial development in Brazil (2009). Textos para Discussão Cedeplar-UFMG (5) RePEc:ces:ceswps:_2801 State Ownership and Control in the Czech Republic (2009). CESifo Working Paper Series (6) RePEc:ces:ceswps:_2880 Taxation and Market Power (2009). CESifo Working Paper Series (7) RePEc:cir:cirwor:2009s-33 Option-Implied Measures of Equity Risk (2009). CIRANO Working Papers (8) RePEc:crf:wpaper:09-07 Behavioral Heterogeneity in the Option Market (2009). LSF Research Working Paper Series (9) RePEc:csl:devewp:273 The wage impact of immigration in Germany - new evidence for skill groups and occupations (2009). Development Working Papers (10) RePEc:cwl:cwldpp:1715 The Leverage Cycle (2009). Cowles Foundation Discussion Papers (11) RePEc:dgr:kubcen:200934 Where Angels Fear to Trade: The Role of Religion in Household Finance (2009). Discussion Paper (12) RePEc:dgr:kubcen:200937s Auctioned IPOs: The U.S. Evidence (2009). Discussion Paper (13) RePEc:dgr:kubcen:200945s Back to Basics in Banking? A Micro-Analysis of Banking System Stability (2009). Discussion Paper (14) RePEc:dgr:kubcen:200947s Understanding Internal Capital Markets and Corporate Policies (2009). Discussion Paper (15) RePEc:dgr:kubcen:200963 Gender and Banking: Are Women Better Loan Officers? (2009). Discussion Paper (16) RePEc:dij:wpfarg:1090701 La convergence des systèmes nationaux de gouvernance:une perspective contingente (2009). Working Papers FARGO (17) RePEc:diw:diwfin:diwfin02020 Bank Ownership, Firm Value and Firm Capital Structure in Europe (2009). Working Paper / FINESS (18) RePEc:dnb:dnbwpp:230 When liquidity risk becomes a macro-prudential issue: Empirical evidence of bank behaviour (2009). DNB Working Papers (19) RePEc:eab:financ:22887 Financial Leverage and Market Volatility with Diverse Beliefs (2009). Finance Working Papers (20) RePEc:ecb:ecbwps:20091126 Liquidity Hoarding and Interbank Market Spreads: The Role of Counterparty Risk. (2009). Working Paper Series (21) RePEc:ecb:ecbwps:20091131 What explains the surge in euro area sovereign spreads during the financial crisis of 2007-09? (2009). Working Paper Series (22) RePEc:ecl:ohidic:2009-21 The State of Corporate Governance Research (2009). Working Paper Series (23) RePEc:erg:wpaper:495 POST-PRIVATIZATION CORPORATE GOVERNANCE AND FIRM PERFORMANCE: THE ROLE OF PRIVATE OWNERSHIP CONCENTRATION, IDENTITY AND BOARD COMPOSITION (2009). Working Papers (24) RePEc:fip:fedcwp:0909 Competition or collaboration? The reciprocity effect in loan syndication (2009). Working Paper (25) RePEc:fip:fedhep:y:2009:i:qii:p:18-37:n:v.33no.2 Comparing patterns of default among prime and subprime mortgages (2009). Economic Perspectives (26) RePEc:fip:fednsr:406 Broker-dealer risk appetite and commodity returns (2009). Staff Reports (27) RePEc:fiu:wpaper:0913 Selection and Serial Entrepreneurs (2009). Working Papers (28) RePEc:hpe:journl:y:2009:v:190:i:3:p:127-156 Financial market failures and public policies (2009). Hacienda Pública Española (29) RePEc:hum:wpaper:sfb649dp2009-024 Incorporating the Dynamics of Leverage into Default Prediction (2009). SFB 649 Discussion Papers (30) RePEc:iis:dispap:iiisdp299 Innovation and Financial Globalisation (2009). The Institute for International Integration Studies Discussion Paper Series (31) RePEc:ijc:ijcjou:y:2009:q:4:a:1 Interbank Lending, Credit-Risk Premia, and Collateral (2009). International Journal of Central Banking (32) RePEc:imf:imfwpa:09/222 Euro Area Sovereign Risk During the Crisis (2009). IMF Working Papers (33) RePEc:imf:imfwpa:09/230 Global Market Conditions and Systemic Risk (2009). IMF Working Papers (34) RePEc:imf:imfwpa:09/231 Three Cycles: Housing, Credit, and Real Activity (2009). IMF Working Papers (35) RePEc:kap:apfinm:v:16:y:2009:i:2:p:141-168 Informational Efficiency: Which Institutions Matter? (2009). Asia-Pacific Financial Markets (36) RePEc:kap:jrefec:v:38:y:2009:i:2:p:105-114 The Long-Horizon Performance of REIT Mergers (2009). The Journal of Real Estate Finance and Economics (37) RePEc:kap:jrefec:v:39:y:2009:i:1:p:39-57 The Determinants of REIT Cash Holdings (2009). The Journal of Real Estate Finance and Economics (38) RePEc:kap:revdev:v:12:y:2009:i:1:p:55-79 Option market making under inventory risk (2009). Review of Derivatives Research (39) RePEc:lmu:msmdpa:10979 Do S&Ps Corporate Ratings Reflect Credit Shocks? (2009). Discussion Papers in Business Administration (40) RePEc:may:mayecw:n2000109 Market Dispersion and the Profitability of Hedge Funds (2009). Economics, Finance and Accounting Department Working Paper Series (41) RePEc:may:mayecw:n2021009.pdf The sequencing of stock market liberalization events and corporate financing decisions (2009). Economics, Finance and Accounting Department Working Paper Series (42) RePEc:nbb:reswpp:200906-26 Back to the basics in banking ? A micro-analysis of banking system stability (2009). Working Paper Research (43) RePEc:nbr:nberwo:14646 Learning in Financial Markets (2009). NBER Working Papers (44) RePEc:nbr:nberwo:14843 Financial Openness and Productivity (2009). NBER Working Papers (45) RePEc:nbr:nberwo:14845 A Unified Theory of Tobins q, Corporate Investment, Financing, and Risk Management (2009). NBER Working Papers (46) RePEc:nbr:nberwo:14863 Credit Market Shocks and Economic Fluctuations: Evidence from Corporate Bond and Stock Markets (2009). NBER Working Papers (47) RePEc:nbr:nberwo:14877 Does Corporate Governance Matter in Competitive Industries? (2009). NBER Working Papers (48) RePEc:nbr:nberwo:14943 Unstable Banking (2009). NBER Working Papers (49) RePEc:nbr:nberwo:14972 Legal Protection in Retail Financial Markets (2009). NBER Working Papers (50) RePEc:nbr:nberwo:15026 Computing DSGE Models with Recursive Preferences (2009). NBER Working Papers (51) RePEc:nbr:nberwo:15184 Capital Budgeting vs. Market Timing: An Evaluation Using Demographics (2009). NBER Working Papers (52) RePEc:nbr:nberwo:15242 Screening in New Credit Markets: Can Individual Lenders Infer Borrower Creditworthiness in Peer-to-Peer Lending? (2009). NBER Working Papers (53) RePEc:nbr:nberwo:15248 Investment and Capital Constraints: Repatriations Under the American Jobs Creation Act (2009). NBER Working Papers (54) RePEc:nbr:nberwo:15324 Dynamic Incentive Accounts (2009). NBER Working Papers (55) RePEc:nbr:nberwo:15335 Risk and Expected Returns of Private Equity Investments: Evidence Based on Market Prices (2009). NBER Working Papers (56) RePEc:nbr:nberwo:15336 Hedge Funds as Liquidity Providers: Evidence from the Lehman Bankruptcy (2009). NBER Working Papers (57) RePEc:nbr:nberwo:15353 Towards a Common European Monetary Union Risk Free Rate (2009). NBER Working Papers (58) RePEc:nbr:nberwo:15487 A Preferred-Habitat Model of the Term Structure of Interest Rates (2009). NBER Working Papers (59) RePEc:nbr:nberwo:15504 An Empirical Evaluation of the Long-Run Risks Model for Asset Prices (2009). NBER Working Papers (60) RePEc:nbr:nberwo:15518 The Carry Trade and Fundamentals: Nothing to Fear But FEER Itself (2009). NBER Working Papers (61) RePEc:nbr:nberwo:15532 Cash-out or flame-out! Opportunity cost and entrepreneurial strategy: Theory, and evidence from the information security industry (2009). NBER Working Papers (62) RePEc:nbr:nberwo:15537 The State of Corporate Governance Research (2009). NBER Working Papers (63) RePEc:nbr:nberwo:15542 How Debt Markets have Malfunctioned in the Crisis (2009). NBER Working Papers (64) RePEc:nbr:nberwo:15611 Liaisons Dangereuses: Increasing Connectivity, Risk Sharing, and Systemic Risk (2009). NBER Working Papers (65) RePEc:ner:ucllon:http://discovery.ucl.ac.uk/17323/ Bargaining over bets. (2009). Open Access publications from University College London (66) RePEc:pen:papers:09-018 Computing DSGE Models with Recursive Preferences (2009). PIER Working Paper Archive (67) RePEc:pra:mprapa:12800 The Case for Mandatory Ownership Disclosure (2009). MPRA Paper (68) RePEc:pra:mprapa:13449 Managerial Power, Stock-Based Compensation, and Firm Performance: Theory and Evidence (2009). MPRA Paper (69) RePEc:pra:mprapa:14139 The Case for Mandatory Ownership Disclosure (2009). MPRA Paper (70) RePEc:pra:mprapa:16134 Commonality in Misvaluation, Equity Financing, and the Cross Section of Stock Returns (2009). MPRA Paper (71) RePEc:pra:mprapa:17521 Recovery Rates and Macroeconomic Conditions: The Role of Loan Covenants (2009). MPRA Paper (72) RePEc:pra:mprapa:17676 Who Pulls the Plug? Theory and Evidence on Corporate Bankruptcy Decisions (2009). MPRA Paper (73) RePEc:pra:mprapa:18872 Bank liquidity and the board of directors (2009). MPRA Paper (74) RePEc:pra:mprapa:23216 Borrowing Constraint as an Optimal Contract (2009). MPRA Paper (75) RePEc:pra:mprapa:32070 Does activity mix and funding strategy vary across ownership? Evidence from Indian banks (2009). MPRA Paper (76) RePEc:rug:rugwps:09/579 Back to the Basics in Banking? A Micro-Analysis of Banking System Stability (2009). Working Papers of Faculty of Economics and Business Administration, Ghent University, Belgium (77) RePEc:use:tkiwps:0921 Theory and Evidence on Mergers and Acquisitions by Small and Medium Enterprises (2009). Working Papers (78) RePEc:vlg:vlgwps:2009-09 The value of excess cash and corporate governance: evidence from u.s. cross-listings (2009). Vlerick Leuven Gent Management School Working Paper Series (79) RePEc:zbw:bubdp2:200905 Why do savings banks transform sight deposits into illiquid assets less intensively than the regulation allows? (2009). Discussion Paper Series 2: Banking and Financial Studies (80) RePEc:zbw:bubdp2:200914 The dependency of the banks assets and liabilities: evidence from Germany (2009). Discussion Paper Series 2: Banking and Financial Studies (81) RePEc:zbw:cefswp:200905 Capital structure decisions in family firms: empirical evidence from a bank-based economy (2009). CEFS Working Paper Series (82) RePEc:zbw:cefswp:200912 Net asset value discounts in listed private equity funds (2009). CEFS Working Paper Series (83) RePEc:zbw:cfrwps:0907 The information content of implied volatilities and model-free volatility expectations: Evidence from options written on individual stocks (2009). CFR Working Papers (84) RePEc:zbw:dbrrns:32 Unterschiedliche Markteinschätzungen von Spekulanten als Determinante des Rohölpreises (2009). Research Notes (85) RePEc:zbw:dbrrns:32e Do speculators drive crude oil prices? Dispersion in beliefs as a price determinant (2009). Research Notes (86) RePEc:zbw:fsfmwp:133 Rating opaque borrowers: why are unsolicited ratings lower? (2009). Frankfurt School - Working Paper Series (87) RePEc:zbw:hwwirp:1-23 The wage impact of immigration in Germany: New evidence for skill groups and occupations (2009). HWWI Research Papers Recent citations received in: 2008 (1) RePEc:aah:create:2008-47 Mean Reversion in US and International Short Rates (2008). CREATES Research Papers (2) RePEc:aah:create:2008-48 Expected Stock Returns and Variance Risk Premia (2008). CREATES Research Papers (3) RePEc:aah:create:2008-49 Glossary to ARCH (GARCH) (2008). CREATES Research Papers (4) RePEc:bos:wpaper:wp2008-016 Time-series predictability in the disaster model (2008). Boston University - Department of Economics - Working Papers Series (5) RePEc:brd:wpaper:37 Return Predictability under Equilibrium Constraints on the Equity Premium (2008). Working Papers (6) RePEc:cmf:wpaper:wp2008_0807 THE ECONOMETRICS OF MEAN-VARIANCE EFFICIENCY TESTS: A SURVEY (2008). Working Papers (7) RePEc:cpr:ceprdp:6714 Why so Glum? The Meese-Rogoff Methodology Meets the Stock Market (2008). CEPR Discussion Papers (8) RePEc:cpr:ceprdp:6915 Individual Investors and Volatility (2008). CEPR Discussion Papers (9) RePEc:cpr:ceprdp:6959 Sovereign Wealth Funds: Their Investment Strategies and Performance (2008). CEPR Discussion Papers (10) RePEc:cpr:ceprdp:6971 Assessing the Accuracy of the Aggregate Law of Motion in Models with Heterogeneous Agents (2008). CEPR Discussion Papers (11) RePEc:cpr:ceprdp:7013 Free Flows, Limited Diversification: Explaining the Fall and Rise of Stock Market Correlations, 1890-2001 (2008). CEPR Discussion Papers (12) RePEc:cpr:ceprdp:7083 Firm Default and Aggregate Fluctuations (2008). CEPR Discussion Papers (13) RePEc:ctc:serie3:ief0081 Shareholders agreements and voting power. Evidence from Italian listed firms (2008). DISCE - Quaderni dell'Istituto di Economia e Finanza (14) RePEc:doj:compad:200809 Should Banking Be Kept Separate from Commerce (2008). EAG Competition Advocacy Papers (15) RePEc:doj:eagpap:200809 Should Banking Be Kept Separate from Commerce (2008). EAG Discussions Papers (16) RePEc:ebg:heccah:0899 Individual investors and volatility (2008). Les Cahiers de Recherche (17) RePEc:ebg:iesewp:d-0773 The European venture capital and private equity country attractiveness index(es) (2008). IESE Research Papers (18) RePEc:ebl:ecbull:v:7:y:2008:i:13:p:1-8 Forecasting aggregate stock returns using the number of initial public offerings as a predictor (2008). Economics Bulletin (19) RePEc:ecl:ohidic:2008-13 Securities Laws, Disclosure, and National Capital Markets in the Age of Financial Globalization (2008). Working Paper Series (20) RePEc:ecl:ohidic:2008-19 Estimating Affine Multifactor Term Structure Models Using Closed-Form Likelihood Expansions (2008). Working Paper Series (21) RePEc:emp:wpaper:wp08-12 The effect of relative wealth concerns on the cross-section of stock returns (2008). Working Papers Economia (22) RePEc:fip:fedfwp:2008-28 Chinas exporters and importers: firms, products, and trade partners (2008). Working Paper Series (23) RePEc:fip:fedgfe:2008-37 Temporal risk aversion and asset prices (2008). Finance and Economics Discussion Series (24) RePEc:fip:fedgfe:2008-55 Specification analysis of structural credit risk models (2008). Finance and Economics Discussion Series (25) RePEc:fip:fedgif:932 Jackknifing stock return predictions (2008). International Finance Discussion Papers (26) RePEc:fip:fedgif:940 Friends or foes? The stock price impact of sovereign wealth fund investments and the price of keeping secrets (2008). International Finance Discussion Papers (27) RePEc:fip:fedhwp:wp-08-04 Bank lending, financing constraints and SME investment (2008). Working Paper Series (28) RePEc:fip:fedlwp:2008-005 Equity portfolio diversification under time-varying predictability and comovements: evidence from Ireland, the US, and the UK (2008). Working Papers (29) RePEc:fip:fedpwp:08-21 Firm default and aggregate fluctuations (2008). Working Papers (30) RePEc:fir:econom:wp2008_03 Comparison of Volatility Measures: a Risk Management Perspective (2008). Econometrics Working Papers Archive (31) RePEc:hal:journl:halshs-00365942 Corporate Venturing, Allocation of Talent, and Competition for Star Managers (2008). Post-Print (32) RePEc:han:dpaper:dp-407 Investor sentiment and stock returns: Some international evidence (2008). Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hannover (33) RePEc:hhs:vxcafo:2009_010 Do Macroeconomic Variables Forecast Changes in Liquidity? An Out-of-sample Study on the Order-driven Stock Markets in Scandinavia (2008). CAFO Working Papers (34) RePEc:hhs:vxcafo:2009_011 Liquidity on the Scandinavian Order-driven Stock Exchanges (2008). CAFO Working Papers (35) RePEc:hkg:wpaper:0801 Predicting Stock Market Returns by Combining Forecasts (2008). Working Papers (36) RePEc:hum:wpaper:sfb649dp2008-036 Expected Inflation, Expected Stock Returns, and Money Illusion: What can we learn from Survey Expectations? (2008). SFB 649 Discussion Papers (37) RePEc:igi:igierp:345 Demographics and fluctuations in Dividend/Price (2008). Working Papers (38) RePEc:ijf:ijfiec:v:13:y:2008:i:1:p:14-25 What determines transaction costs in foreign exchange markets? (2008). International Journal of Finance & Economics (39) RePEc:imf:imfwpa:08/229 Banks and Labor as Stakeholders: Impact on Economic Performance (2008). IMF Working Papers (40) RePEc:imf:imfwpa:08/261 Strategic Considerations for First-Time Sovereign Bond Issuers (2008). IMF Working Papers (41) RePEc:ivi:wpasec:2008-04 Optimal CEO compensation and stock options (2008). Working Papers. Serie EC (42) RePEc:iza:izadps:dp3857 Not So Lucky Any More: CEO Compensation in Financially Distressed Firms (2008). IZA Discussion Papers (43) RePEc:kap:jbuset:v:80:y:2008:i:4:p:771-789 Religion, Opportunism, and International Market Entry Via Non-Equity Alliances or Joint Ventures (2008). Journal of Business Ethics (44) RePEc:kap:jfsres:v:34:y:2008:i:1:p:35-59 Information, Credit Risk, Lender Specialization and Loan Pricing: Evidence from the DIP Financing Market (2008). Journal of Financial Services Research (45) RePEc:mia:wpaper:0906 Not So Lucky Any More: CEO Compensation in Financially Distressed Firms (2008). Working Papers (46) RePEc:nbr:nberch:5371 Inflation Illusion, Credit, and Asset Prices (2008). NBER Chapters (47) RePEc:nbr:nberwo:13724 Variable Rare Disasters: An Exactly Solved Framework for Ten Puzzles in Macro-Finance (2008). NBER Working Papers (48) RePEc:nbr:nberwo:13804 Predictive Systems: Living with Imperfect Predictors (2008). NBER Working Papers (49) RePEc:nbr:nberwo:14111 Inexperienced Investors and Bubbles (2008). NBER Working Papers (50) RePEc:nbr:nberwo:14113 Bank Governance, Regulation, and Risk Taking (2008). NBER Working Papers (51) RePEc:nbr:nberwo:14218 Securities Laws, Disclosure, and National Capital Markets in the Age of Financial Globalization (2008). NBER Working Papers (52) RePEc:nbr:nberwo:14290 Real and Financial Industry Booms and Busts (2008). NBER Working Papers (53) RePEc:nbr:nberwo:14342 Costly External Finance: Implications for Capital Markets Anomalies (2008). NBER Working Papers (54) RePEc:nbr:nberwo:14543 Asset Pricing Tests with Long Run Risks in Consumption Growth (2008). NBER Working Papers (55) RePEc:nbr:nberwo:14571 Forecasting Stock Market Returns: The Sum of the Parts is More than the Whole (2008). NBER Working Papers (56) RePEc:nbr:nberwo:14609 Informed Trading, Liquidity Provision, and Stock Selection by Mutual Funds (2008). NBER Working Papers (57) RePEc:ner:maastr:urn:nbn:nl:ui:27-20507 Tournaments in the UK mutual fund industry. (2008). Open Access publications from Maastricht University (58) RePEc:ner:maastr:urn:nbn:nl:ui:27-23095 Long memory and the term structure of risk. (2008). Open Access publications from Maastricht University (59) RePEc:nuf:econwp:0802 Measuring downside risk-realised semivariance (2008). Economics Papers (60) RePEc:oxf:wpaper:382 Measuring downside risk - realised semivariance (2008). Economics Series Working Papers (61) RePEc:pen:papers:08-042 Bounds on Revenue Distributions in Counterfactual Auctions with Reserve Prices (2008). PIER Working Paper Archive (62) RePEc:pra:mprapa:15204 Market Bubbles and Chrashes (2008). MPRA Paper (63) RePEc:pra:mprapa:8325 Cross-Sectional Dispersion of Firm Valuations and Expected Stock Returns (2008). MPRA Paper (64) RePEc:ris:apltrx:0025 Credit Risk Management (2008). Applied Econometrics (65) RePEc:ucr:wpaper:200803 Nonlinear Time Series in Financial Forecasting (2008). Working Papers (66) RePEc:zbw:bubdp2:7318 Market conditions, default risk and credit spreads (2008). Discussion Paper Series 2: Banking and Financial Studies (67) RePEc:zbw:zewdip:7358 International Stock Return Predictability Under Model Uncertainty (2008). ZEW Discussion Papers Recent citations received in: 2007 (1) RePEc:bos:wpaper:wp2007-037 Resuscitating The Businessman Risk: A Rationale For Familiarity-Based Portfolios (2007). Boston University - Department of Economics - Working Papers Series (2) RePEc:cfi:fseres:cf115 Strategic Default Jump as Impulse Control in Continuous Time ( Revised in February 2008 ) (2007). CARF F-Series (3) RePEc:cpr:ceprdp:6136 Asset Pricing with Limited Risk Sharing and Heterogeneous Agents (2007). CEPR Discussion Papers (4) RePEc:cpr:ceprdp:6161 Robust Portfolio Optimisation with Multiple Experts (2007). CEPR Discussion Papers (5) RePEc:cpr:ceprdp:6473 Financial Exchange Rates and International Currency Exposures (2007). CEPR Discussion Papers (6) RePEc:ecl:ohidic:2007-5 The Impact of Shareholder Power on Bondholders: Evidence from Mergers and Acquisitions (2007). Working Paper Series (7) RePEc:fip:fedgif:903 Trading activity and exchange rates in high-frequency EBS data (2007). International Finance Discussion Papers (8) RePEc:fip:fedmsr:398 The international diversification puzzle is not as bad as you think (2007). Staff Report (9) RePEc:fip:fednsr:297 Vesting and control in venture capital contracts (2007). Staff Reports (10) RePEc:kap:apfinm:v:14:y:2007:i:4:p:299-324 A Factor Allocation Approach to Optimal Bond Portfolio (2007). Asia-Pacific Financial Markets (11) RePEc:lvl:lacicr:0729 On Debt Service and Renegotiation when Debt-holders Are More Strategic (2007). Cahiers de recherche (12) RePEc:mie:wpaper:573 Contract Enforcement and Firmsd5 FinancingContract Enforcement and Firmsd5 Financing (2007). Working Papers (13) RePEc:min:wpaper:2007-3 The International Diversification Puzzle Is Not as Bad as You Think (2007). Working Papers (14) RePEc:nbr:nberwo:13014 Human Capital, Bankruptcy and Capital Structure (2007). NBER Working Papers (15) RePEc:nbr:nberwo:13251 Agency Conflicts, Investment, and Asset Pricing (2007). NBER Working Papers (16) RePEc:nbr:nberwo:13430 Linearity-Generating Processes: A Modelling Tool Yielding Closed Forms for Asset Prices (2007). NBER Working Papers (17) RePEc:nbr:nberwo:13433 Financial Exchange Rates and International Currency Exposures (2007). NBER Working Papers (18) RePEc:nbr:nberwo:13483 The International Diversification Puzzle Is Not As Bad As You Think (2007). NBER Working Papers (19) RePEc:ner:leuven:urn:hdl:123456789/175483 Home bias in international equity portfolios: a review. (2007). Open Access publications from Katholieke Universiteit Leuven (20) RePEc:ner:leuven:urn:hdl:123456789/203006 Stock market liquidity: Determinants and implications. (2007). Open Access publications from Katholieke Universiteit Leuven (21) RePEc:nys:sunysb:07-08 Financing Constraints and Firm Dynamics with Durable Capital (2007). Department of Economics Working Papers (22) RePEc:pra:mprapa:3110 Driven to distraction: Extraneous events and underreaction to earnings news (2007). MPRA Paper (23) RePEc:ven:wpaper:2007_17 Dynamic Risk Exposure in Hedge Funds (2007). Working Papers (24) RePEc:yor:yorken:07/07 Mind Coskewness: A Performance Measure for Prudent, Long-Term Investors (2007). Discussion Papers (25) RePEc:zbw:cciehs:50 Information production and bidding in IPOs: An experimental analysis of auctions and fixed-price offerings (2007). Working Papers Recent citations received in: 2006 (1) RePEc:aea:aecrev:v:96:y:2006:i:3:p:552-576 Can Information Heterogeneity Explain the Exchange Rate Determination Puzzle? (2006). American Economic Review (2) RePEc:bca:bocawp:06-45 The Role of Debt and Equity Finance over the Business Cycle (2006). Working Papers (3) RePEc:bdi:opques:qef_2_06 The recent behaviour of financial market volatility (2006). Questioni di Economia e Finanza (Occasional Papers) (4) RePEc:bis:bisbps:29 The recent behaviour of financial market volatility (2006). BIS Papers (5) RePEc:cdx:dpaper:2006-05 Uniform price auctions and fixed price offerings in IPOs: an experimental comparison (2006). Discussion Papers (6) RePEc:cpr:ceprdp:5695 A Lender-Based Theory of Collateral (2006). CEPR Discussion Papers (7) RePEc:cpr:ceprdp:5901 Information Acquisition and Portfolio Performance (2006). CEPR Discussion Papers (8) RePEc:cte:wbrepe:wb063310 CREDIT SPREADS: THEORY AND EVIDENCE ABOUT THE INFORMATION CONTENT OF STOCKS, BONDS AND CDSs (2006). Business Economics Working Papers (9) RePEc:dgr:kubcen:200667 The Impact of Organizational Structure and Lending Technology on Banking Competition (2006). Discussion Paper (10) RePEc:dgr:kubcen:200668 The Impact of Competition on Bank Orientation (2006). Discussion Paper (11) RePEc:ecb:ecbwps:20060706 What drives investorsâ behaviour in different FX market segments? A VAR-based return decomposition analysis (2006). Working Paper Series (12) RePEc:fip:fedcwp:0616 Bank branch presence and access to credit in low-to-moderate income neighborhoods (2006). Working Paper (13) RePEc:fip:fedcwp:0617 Foreclosures: relationship lending in the consumer market and its aftermath (2006). Working Paper (14) RePEc:fip:fedgif:886 Global asset prices and FOMC announcements (2006). International Finance Discussion Papers (15) RePEc:fip:fedlwp:2006-047 Does aggregate relative risk aversion change countercyclically over time? evidence from the stock market (2006). Working Papers (16) RePEc:hhs:bofrdp:2006_027 Rating targeting and the confidence levels implicit in bank capital (2006). Research Discussion Papers (17) RePEc:kap:annfin:v:2:y:2006:i:3:p:259-285 Heterogeneous Beliefs, the Term Structure and Time-varying Risk Premia (2006). Annals of Finance (18) RePEc:kap:jfsres:v:29:y:2006:i:3:p:177-210 Macroeconomic Conditions, Firm Characteristics, and Credit Spreads (2006). Journal of Financial Services Research (19) RePEc:lmu:muenec:1208 Entry of Foreign Banks and their Impact on Host Countries (2006). Discussion Papers in Economics (20) RePEc:nbr:nberwo:12360 A Skeptical Appraisal of Asset-Pricing Tests (2006). NBER Working Papers (21) RePEc:nbr:nberwo:12365 Why Has CEO Pay Increased So Much? (2006). NBER Working Papers (22) RePEc:nbr:nberwo:12555 Financially Constrained Stock Returns (2006). NBER Working Papers (23) RePEc:nbr:nberwo:12766 Can Housing Collateral Explain Long-Run Swings in Asset Returns? (2006). NBER Working Papers (24) RePEc:nbr:nberwo:12781 Heterogeneous Expectations and Bond Markets (2006). NBER Working Papers (25) RePEc:pra:mprapa:247 Risk Premia, diverse belief and beauty contests (2006). MPRA Paper (26) RePEc:rut:rutres:200610 Highs and Lows: A Behavioral and Technical Analysis (2006). Departmental Working Papers (27) RePEc:sef:csefwp:167 Information Acquisition and Portfolio Performance (2006). CSEF Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||