|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

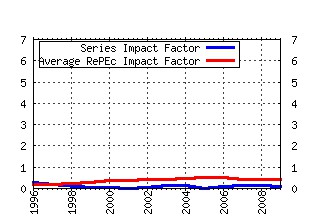

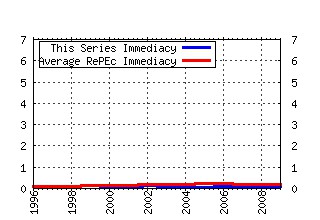

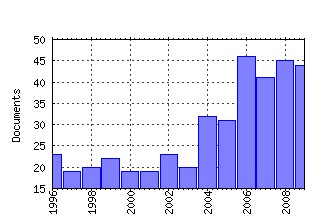

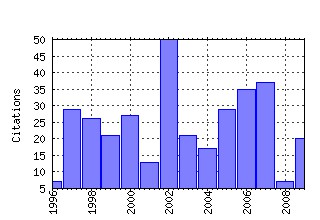

European Journal of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:eurjfi:v:1:y:1995:i:1:p:18-20 Comment (1995). (2) RePEc:taf:eurjfi:v:3:y:1997:i:4:p:291-309 The numeraire portfolio: a new perspective on financial theory (1997). (3) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:371-401 Modelling the demand for M3 in the Euro area (2002). (4) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:163-175 The effects of trading activity on market volatility (2000). (5) RePEc:taf:eurjfi:v:8:y:2002:i:2:p:152-175 An analysis of the causes of recent banking crises (2002). (6) RePEc:taf:eurjfi:v:1:y:1995:i:1:p:37-40 Rejoinder (1995). (7) RePEc:taf:eurjfi:v:13:y:2007:i:2:p:123-143 Efficiency of Banks: Recent Evidence from the Transition Economies of Europe, 1993-2000 (2007). (8) RePEc:taf:eurjfi:v:11:y:2005:i:1:p:59-74 Which factors affect corporate bonds pricing? Empirical evidence from eurobonds primary market spreads (2005). (9) RePEc:taf:eurjfi:v:1:y:1995:i:4:p:383-403 Heterogeneous real-time trading strategies in the foreign exchange market (1995). (10) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:291-304 Board size and corporate performance: evidence from European countries (1998). (11) RePEc:taf:eurjfi:v:11:y:2005:i:3:p:169-181 Generating science-based growth: an econometric analysis of the impact of organizational incentives on university-industry technology transfer (2005). (12) RePEc:taf:eurjfi:v:1:y:1995:i:2:p:129-164 Estimating the time Varying Components of international stock markets risk (1995). (13) RePEc:taf:eurjfi:v:12:y:2006:i:6-7:p:473-494 Small sample properties of GARCH estimates and persistence (2006). (14) RePEc:taf:eurjfi:v:8:y:2002:i:4:p:402-421 Forecasting inflation in the European Monetary Union: A disaggregated approach by countries and by sectors (2002). (15) RePEc:taf:eurjfi:v:1:y:1995:i:1:p:79-93 Calendar effects in the London Stock Exchange FT-SE indices (1995). (16) RePEc:taf:eurjfi:v:13:y:2007:i:3:p:227-252 Conducting Event Studies on a Small Stock Exchange (2007). (17) RePEc:taf:eurjfi:v:9:y:2003:i:5:p:514-532 Evaluating capital mobility in the EU: a new approach using swaps data (2003). (18) RePEc:taf:eurjfi:v:8:y:2002:i:2:p:187-205 New evidence on the implied-realized volatility relation (2002). (19) RePEc:taf:eurjfi:v:9:y:2003:i:4:p:343-357 Asset pricing implications of benchmarking: a two-factor CAPM (2003). (20) RePEc:taf:eurjfi:v:3:y:1997:i:1:p:73-85 Implied volatility skews and stock return skewness and kurtosis implied by stock option prices (1997). (21) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:249-274 Time varying country risk: an assessment of alternative modelling techniques (2002). (22) RePEc:taf:eurjfi:v:5:y:1999:i:4:p:331-341 Modelling normal returns in event studies: a model-selection approach and pilot study (1999). (23) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:213-224 Beta lives - some statistical perspectives on the capital asset pricing model (1999). (24) RePEc:taf:eurjfi:v:10:y:2004:i:2:p:105-122 Employee stock option plans and stock market reaction: evidence from Finland (2004). (25) RePEc:taf:eurjfi:v:6:y:2000:i:2:p:196-224 Further insights on the puzzle of technical analysis profitability (2000). (26) RePEc:taf:eurjfi:v:7:y:2001:i:2:p:165-183 Bank failure: a multidimensional scaling approach (2001). (27) RePEc:taf:eurjfi:v:4:y:1998:i:3:p:233-256 A survey of corporate perceptions of short-termism among analysts and fund managers (1998). (28) RePEc:taf:eurjfi:v:7:y:2001:i:1:p:63-91 Derivatives usage in UK non-financial listed companies (2001). (29) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:302-321 Forecasting stock market volatility and the informational efficiency of the DAX-index options market (2002). (30) RePEc:taf:eurjfi:v:11:y:2005:i:6:p:493-509 Determinants of corporate debt securities in the Euro area (2005). (31) RePEc:taf:eurjfi:v:13:y:2007:i:7:p:621-644 Volatility as an Asset Class: European Evidence (2007). (32) RePEc:taf:eurjfi:v:10:y:2004:i:5:p:329-344 Predictability of stock markets with disequilibrium trading (2004). (33) RePEc:taf:eurjfi:v:15:y:2009:i:3:p:337-363 Stochastic volatility and time-varying country risk in emerging markets (2009). (34) RePEc:taf:eurjfi:v:15:y:2009:i:7-8:p:777-795 Pricing bivariate option under GARCH-GH model with dynamic copula: application for Chinese market (2009). (35) RePEc:taf:eurjfi:v:1:y:1995:i:1:p:31-36 Comment (1995). (36) RePEc:taf:eurjfi:v:5:y:1999:i:1:p:73-94 Volatility forecasting in the framework of the option expiry cycle (1999). (37) RePEc:taf:eurjfi:v:9:y:2003:i:3:p:290-300 Variance ratio tests of the random walk hypothesis for European emerging stock markets (2003). (38) RePEc:taf:eurjfi:v:12:y:2006:i:1:p:77-94 Ownership structure and open market stock repurchases in France (2006). (39) RePEc:taf:eurjfi:v:3:y:1997:i:4:p:277-289 Dividend yield strategies in the British stock market (1997). (40) RePEc:taf:eurjfi:v:7:y:2001:i:3:p:198-230 Implied volatility surfaces: uncovering regularities for options on financial futures (2001). (41) RePEc:taf:eurjfi:v:12:y:2006:i:1:p:41-59 Stochastic Volatility and GARCH: a Comparison Based on UK Stock Data (2006). (42) RePEc:taf:eurjfi:v:13:y:2007:i:8:p:705-715 Assessing the Time-Varying Interest Rate Sensitivity of Real Estate Securities (2007). (43) RePEc:taf:eurjfi:v:5:y:1999:i:3:p:202-212 Is beta still alive? Conclusive evidence from the Swiss stock market (1999). (44) RePEc:taf:eurjfi:v:9:y:2003:i:5:p:499-513 Basis variations and regime shifts in the oil futures market (2003). (45) RePEc:taf:eurjfi:v:12:y:2006:i:5:p:401-420 The impact of monetary policy on the financing behaviour of firms in the Euro area and the UK (2006). (46) RePEc:taf:eurjfi:v:4:y:1998:i:1:p:29-59 Seasoned equity offers and rights issues: a review of the evidence (1998). (47) RePEc:taf:eurjfi:v:11:y:2005:i:4:p:325-337 Uncovering long memory in high frequency UK futures (2005). (48) RePEc:taf:eurjfi:v:8:y:2002:i:3:p:322-343 World capital markets and Finnish stock returns (2002). (49) RePEc:taf:eurjfi:v:1:y:1995:i:1:p:41-56 Short-term performance pressures: is there a consensus view? (1995). (50) RePEc:taf:eurjfi:v:12:y:2006:i:4:p:361-377 Which factors determine sovereign credit ratings? (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:ffe:journl:v:6:y:2009:i:1:p:26-50 Forecasting VaR and Expected Shortfall Using Dynamical Systems: A Risk Management Strategy (2009). Frontiers in Finance and Economics (2) RePEc:hal:cesptp:halshs-00375765 Forecasting VaR and Expected Shortfall using Dynamical Systems: A Risk Management Strategy (2009). Université Paris1 Panthéon-Sorbonne (Post-Print and Working Papers) (3) RePEc:hhs:hacerc:2009-005 AN ANALYSIS OF DYNAMIC RISK IN THE GREATER CHINA EQUITY MARKETS (2009). Working Paper Series (4) RePEc:sol:wpaper:09-014 Sovereign Bonds and Socially Responsible Investment (2009). Working Papers CEB (5) RePEc:spr:alstar:v:93:y:2009:i:3:p:295-306 Statistical inference procedure for the meanvariance efficient frontier with estimated parameters (2009). AStA Advances in Statistical Analysis Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:kap:jrefec:v:35:y:2007:i:3:p:315-331 Monetary Shocks and REIT Returns (2007). The Journal of Real Estate Finance and Economics (2) RePEc:taf:eurjfi:v:13:y:2007:i:1:p:65-87 A Better Asymmetric Model of Changing Volatility in Stock and Exchange Rate Returns: Trend-GARCH (2007). European Journal of Finance Recent citations received in: 2006 (1) RePEc:dij:revfcs:v:9:y:2006:i:q4:p:5-32 Les rachats dactions au Canada:motivations et impact de lactivité économique (2006). Revue Finance Contrôle Stratégie (2) RePEc:hhs:gunwpe:0230 Ten Years of Misleading Information - Investment Advice in Printed Media (2006). Working Papers in Economics (3) RePEc:kap:fmktpm:v:20:y:2006:i:2:p:123-151 Signaling Power of Open Market Share Repurchases in Germany (2006). Financial Markets and Portfolio Management (4) RePEc:pra:mprapa:302 Stock market volatiltity around national elections (2006). MPRA Paper (5) RePEc:taf:eurjfi:v:12:y:2006:i:5:p:449-453 Volatility clustering and event-induced volatility: Evidence from UK mergers and acquisitions (2006). European Journal of Finance Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||