|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

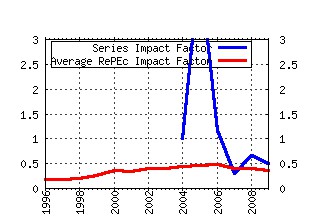

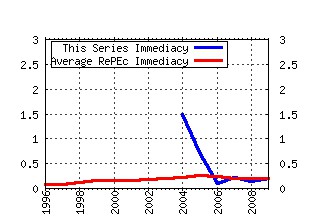

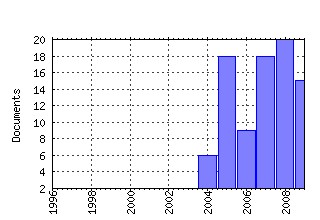

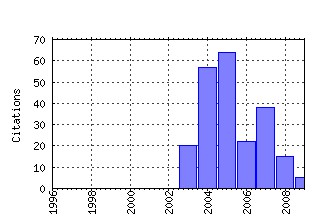

Discussion Paper Series 2: Banking and Financial Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:zbw:bubdp2:2227 Forecasting Credit Portfolio Risk (2004). (2) RePEc:zbw:bubdp2:4264 Accounting for distress in bank mergers (2005). (3) RePEc:zbw:bubdp2:2226 Credit Risk Factor Modeling and the Basel II IRB Approach (2003). (4) RePEc:zbw:bubdp2:5355 Slippery slopes of stress: ordered failure events in German banking (2007). (5) RePEc:zbw:bubdp2:4269 Time series properties of a rating system based on financial ratios (2005). (6) RePEc:zbw:bubdp2:4262 Banks regulatory capital buffer and the business cycle: evidence for German savings and cooperative banks (2005). (7) RePEc:zbw:bubdp2:2225 Measuring the Discriminative Power of Rating Systems (2003). (8) RePEc:zbw:bubdp2:6352 Asset correlations and credit portfolio risk: an empirical analysis (2007). (9) RePEc:zbw:bubdp2:5156 Sector concentration in loan portfolios and economic capital (2006). (10) RePEc:zbw:bubdp2:6927 Creditor concentration: an empirical investigation (2007). (11) RePEc:zbw:bubdp2:4270 Inefficient or just different? Effects of heterogeneity on bank efficiency scores (2005). (12) RePEc:zbw:bubdp2:5353 Granularity adjustment for Basel II (2007). (13) RePEc:zbw:bubdp2:4251 Systematic Risk in Recovery Rates: An Empirical Analysis of US Corporate Credit Exposures (2004). (14) RePEc:zbw:bubdp2:5157 The cost efficiency of German banks: a comparison of SFA and DEA (2006). (15) RePEc:zbw:bubdp2:4536 Does diversification improve the performance of German banks? Evidence from individual bank loan portfolios (2006). (16) RePEc:zbw:bubdp2:4252 Does capital regulation matter for bank behaviour? Evidence for German savings banks (2004). (17) RePEc:zbw:bubdp2:6799 Relationship lending: empirical evidence for Germany (2007). (18) RePEc:zbw:bubdp2:4358 Finance and growth in a bank-based economy: is it quantity or quality that matters? (2005). (19) RePEc:zbw:bubdp2:4267 Evaluating the German bank merger wave (2005). (20) RePEc:zbw:bubdp2:200820 Sturm und Drang in money market funds: when money market funds cease to be narrow (2008). (21) RePEc:zbw:bubdp2:4771 Banks regulatory buffers, liquidity networks and monetary policy transmission (2006). (22) RePEc:zbw:bubdp2:5576 Diversification and the banks risk-return-characteristics: evidence from loan portfolios of German banks (2007). (23) RePEc:zbw:bubdp2:4268 Incorporating prediction and estimation risk in point-in-time credit portfolio models (2005). (24) RePEc:zbw:bubdp2:5575 Open-end real estate funds in Germany: genesis and crisis (2007). (25) RePEc:zbw:bubdp2:6929 Profitability of Western European banking systems: panel evidence on structural and cyclical determinants (2007). (26) RePEc:zbw:bubdp2:7219 Monetary policy and bank distress: an integrated micro-macro approach (2008). (27) RePEc:zbw:bubdp2:4266 Financial integration and systemic risk (2005). (28) RePEc:zbw:bubdp2:7320 Determinants of European banks engagement in loan securitization (2008). (29) RePEc:zbw:bubdp2:5096 The stability of efficiency rankings when risk-preferences and objectives are different (2006). (30) RePEc:zbw:bubdp2:5904 Time-varying contributions by the corporate bond and CDS markets to credit risk price discovery (2007). (31) repec:zbw:bubdp2:200904 (). (32) RePEc:zbw:bubdp2:4772 Empirical risk analysis of pension insurance: the case of Germany (2006). (33) RePEc:zbw:bubdp2:4255 Estimating probabilities of default for German savings banks and credit cooperatives (2004). (34) RePEc:zbw:bubdp2:7118 Analyzing the interest rate risk of banks using time series of accounting-based data: evidence from Germany (2008). (35) RePEc:zbw:bubdp2:5224 Limits to international banking consolidation (2006). (36) RePEc:zbw:bubdp2:7317 Which interest rate scenario is the worst one for a bank? Evidence from a tracking bank approach for German savings and cooperative banks (2008). (37) RePEc:zbw:bubdp2:200914 The dependency of the banks assets and liabilities: evidence from Germany (2009). (38) RePEc:zbw:bubdp2:4254 How will Basel II affect bank lending to emerging markets? An analysis based on German bank level data (2004). (39) RePEc:zbw:bubdp2:6930 Estimating probabilities of default with support vector machines (2007). (40) RePEc:zbw:bubdp2:7325 The implications of latent technology regimes for competition and efficiency in banking (2008). (41) RePEc:zbw:bubdp2:6153 The quality of banking and regional growth (2007). (42) RePEc:zbw:bubdp2:4261 Cyclical implications of minimum capital requirements (2005). (43) RePEc:zbw:bubdp2:7316 The success of bank mergers revisited: an assessment based on a matching strategy (2008). (44) RePEc:zbw:bubdp2:200912 Margins of international banking: is there a productivity pecking order in banking, too? (2009). (45) RePEc:zbw:bubdp2:4253 German bank lending during emerging market crises: A bank level analysis (2004). (46) RePEc:zbw:bubdp2:7324 Regulatory capital for market and credit risk interaction: is current regulation always conservative? (2008). (47) RePEc:zbw:bubdp2:5905 Banking consolidation and small businessfinance: empirical evidence for Germany (2007). (48) RePEc:zbw:bubdp2:4257 The supervisors portfolio: the market price risk of German banks from 2001 to 2003 - Analysis and models for risk aggregation (2005). (49) RePEc:zbw:bubdp2:200909 Income diversification in the German banking industry (2009). (50) RePEc:zbw:bubdp2:201012 Interbank tiering and money center banks (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:pqs:wpaper:042009 Off-Balance-Sheet Activities and the Shadow Banking System: An Application of the Hausman Test with Higher Moments Instruments (2009). (2) RePEc:zbw:bubdp2:200905 Why do savings banks transform sight deposits into illiquid assets less intensively than the regulation allows? (2009). Discussion Paper Series 2: Banking and Financial Studies (3) RePEc:zbw:bubdp2:200915 What macroeconomic shocks affect the German banking system? Analysis in an integrated micro-macro model (2009). Discussion Paper Series 2: Banking and Financial Studies Recent citations received in: 2008 (1) RePEc:cnb:wpaper:2008/8 Monetary Policy Rules with Financial Instability (2008). Working Papers (2) RePEc:zbw:bubdp2:7317 Which interest rate scenario is the worst one for a bank? Evidence from a tracking bank approach for German savings and cooperative banks (2008). Discussion Paper Series 2: Banking and Financial Studies (3) RePEc:zbw:bubdp2:7449 Real estate markets and bank distress (2008). Discussion Paper Series 2: Banking and Financial Studies Recent citations received in: 2007 (1) RePEc:cpr:ceprdp:6514 Hazardous Times for Monetary Policy: What Do Twenty-Three Million Bank Loans Say About the Effects of Monetary Policy on Credit Risk? (2007). CEPR Discussion Papers (2) RePEc:kap:jfsres:v:32:y:2007:i:1:p:17-38 Basel II: Correlation Related Issues (2007). Journal of Financial Services Research (3) RePEc:rdg:repxwp:rep-wp2007-05 German Open Ended Funds: Was there a Valuation Problem? (2007). (4) RePEc:zbw:bubdp2:5608 Modelling dynamic portfolio risk using risk drivers of elliptical processes (2007). Discussion Paper Series 2: Banking and Financial Studies Recent citations received in: 2006 (1) RePEc:zbw:fsfmwp:73 Distressed debt in Germany: whats next?: Possible innovative exit strategies (2006). Frankfurt School - Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||