|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

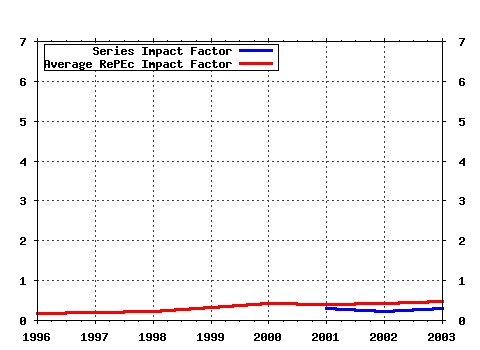

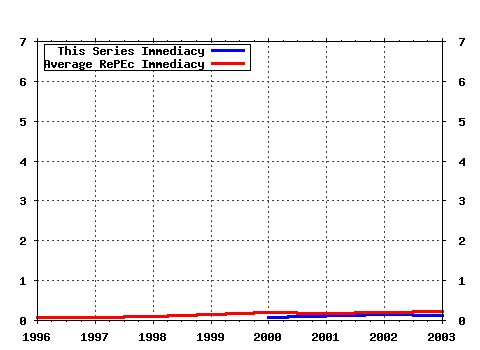

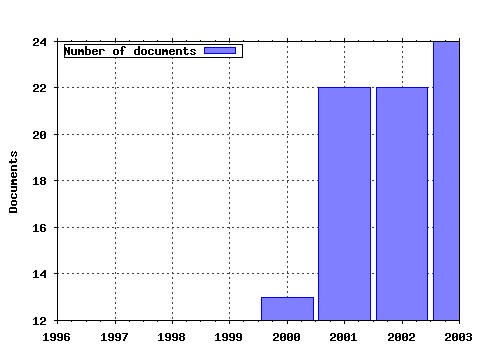

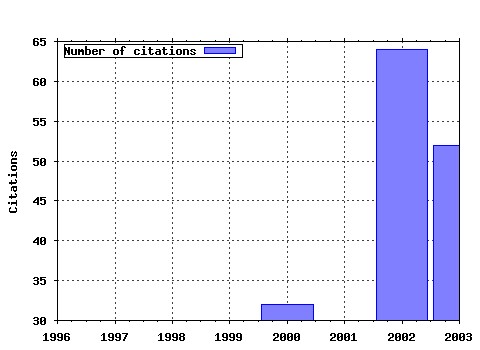

Emerging Markets Review Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:ememar:v:1:y:2000:i:2:p:101-126 Before the fall: were East Asian currencies overvalued? (2000). Emerging Markets Review (2) RePEc:eee:ememar:v:3:y:2002:i:4:p:429-448 Research in emerging markets finance: looking to the future (2002). Emerging Markets Review (3) RePEc:eee:ememar:v:4:y:2003:i:4:p:330-339 Debt composition and balance sheet effects of currency depreciation: a summary of the micro evidence (2003). Emerging Markets Review (4) RePEc:eee:ememar:v:4:y:2003:i:4:p:397-416 Debt composition and balance sheet effects of exchange rate depreciations: a firm-level analysis for Chile (2003). Emerging Markets Review (5) RePEc:eee:ememar:v:3:y:2002:i:1:p:69-83 International portfolio diversification: US and Central European equity markets (2002). Emerging Markets Review (6) RePEc:eee:ememar:v:4:y:2003:i:4:p:417-449 Dollar debt in Colombian firms: are sinners punished during devaluations? (2003). Emerging Markets Review (7) RePEc:eee:ememar:v:5:y:2004:i:2:p:217-240 Private benefits and cross-listings in the United States (2004). Emerging Markets Review (8) RePEc:eee:ememar:v:3:y:2002:i:2:p:107-133 Leading indicators of currency crises for emerging countries (2002). Emerging Markets Review (9) RePEc:eee:ememar:v:5:y:2004:i:2:p:241-266 The risk and predictability of equity returns of the EU accession countries (2004). Emerging Markets Review (10) RePEc:eee:ememar:v:2:y:2001:i:2:p:138-160 State of corruption in transition: case of the Czech Republic (2001). Emerging Markets Review (11) RePEc:eee:ememar:v:3:y:2002:i:4:p:365-379 Systematic risk in emerging markets: the (2002). Emerging Markets Review (12) RePEc:eee:ememar:v:3:y:2002:i:3:p:245-268 Assessing the effects of corruption and crime on firm performance: evidence from Latin America (2002). Emerging Markets Review (13) RePEc:eee:ememar:v:4:y:2003:i:1:p:25-38 Leaders and followers: emerging market fund behavior during tranquil and turbulent times (2003). Emerging Markets Review (14) RePEc:eee:ememar:v:4:y:2003:i:4:p:450-471 Debt composition and balance sheet effects of exchange rate volatility in Mexico: a firm level analysis (2003). Emerging Markets Review (15) RePEc:eee:ememar:v:2:y:2001:i:2:p:89-108 The corporate governance behavior and market value of Russian firms (2001). Emerging Markets Review (16) RePEc:eee:ememar:v:4:y:2003:i:4:p:340-367 Financial dollarization and debt deflation under a currency board (2003). Emerging Markets Review (17) RePEc:eee:ememar:v:1:y:2000:i:1:p:21-52 The Korean financial crisis: an asymmetric information perspective (2000). Emerging Markets Review (18) RePEc:eee:ememar:v:3:y:2002:i:4:p:380-408 Emerging market bond spreads and sovereign credit ratings: reconciling market views with economic fundamentals (2002). Emerging Markets Review (19) RePEc:eee:ememar:v:1:y:2000:i:2:p:127-151 Country and industry factors in returns: evidence from emerging markets stocks (2000). Emerging Markets Review (20) RePEc:eee:ememar:v:1:y:2000:i:1:p:53-81 Implications of the euro for Latin Americas financial and banking systems (2000). Emerging Markets Review (21) RePEc:eee:ememar:v:4:y:2003:i:1:p:53-72 The Internet and the ability to innovate in Latin America (2003). Emerging Markets Review (22) RePEc:eee:ememar:v:4:y:2003:i:4:p:368-396 Debt composition and exchange rate balance sheet effect in Brazil: a firm level analysis (2003). Emerging Markets Review (23) RePEc:eee:ememar:v:4:y:2003:i:3:p:248-272 What drives financial crises in emerging markets? (2003). Emerging Markets Review (24) RePEc:eee:ememar:v:2:y:2001:i:2:p:161-183 Poland: a successful transition to budget sustainability? (2001). Emerging Markets Review (25) RePEc:eee:ememar:v:4:y:2003:i:3:p:225-247 Returns on ADRs and arbitrage in emerging markets (2003). Emerging Markets Review (26) RePEc:eee:ememar:v:3:y:2002:i:1:p:84-105 Economic determinants of emerging stock market interdependence (2002). Emerging Markets Review (27) RePEc:eee:ememar:v:3:y:2002:i:1:p:31-50 Predicting bank failures using a hazard model: the Venezuelan banking crisis (2002). Emerging Markets Review (28) RePEc:eee:ememar:v:2:y:2001:i:4:p:418-430 The real exchange rate and the output response in four EU accession countries (2001). Emerging Markets Review (29) RePEc:eee:ememar:v:5:y:2004:i:1:p:39-59 Consolidation and market structure in emerging market banking systems (2004). Emerging Markets Review (30) RePEc:eee:ememar:v:7:y:2006:i:2:p:129-146 European Union enlargement and equity markets in accession countries (2006). Emerging Markets Review (31) RePEc:eee:ememar:v:2:y:2001:i:2:p:109-137 Privatisation: politics, institutions, and financial markets (2001). Emerging Markets Review (32) RePEc:eee:ememar:v:4:y:2003:i:4:p:472-496 Exchange rate volatility and economic performance in Peru: a firm level analysis (2003). Emerging Markets Review (33) RePEc:eee:ememar:v:7:y:2006:i:1:p:52-66 An assessment of the case for monetary union or official dollarization in five Latin American countries (2006). Emerging Markets Review (34) RePEc:eee:ememar:v:3:y:2002:i:2:p:135-164 The long-term performance of privatization-related ADR issues (2002). Emerging Markets Review (35) RePEc:eee:ememar:v:3:y:2002:i:4:p:338-364 The persistence of emerging market equity flows (2002). Emerging Markets Review (36) RePEc:eee:ememar:v:7:y:2006:i:4:p:361-379 Corporate governance indices and firms market values: Time series evidence from Russia (2006). Emerging Markets Review (37) RePEc:eee:ememar:v:5:y:2004:i:1:p:61-82 International reserve-holding in the developing world: self insurance in a crisis-prone era? (2004). Emerging Markets Review (38) RePEc:eee:ememar:v:7:y:2006:i:3:p:228-243 The unexplained part of public debt (2006). Emerging Markets Review (39) RePEc:eee:ememar:v:8:y:2007:i:4:p:299-310 Public debt and social expenditure: Friends or foes? (2007). Emerging Markets Review (40) RePEc:eee:ememar:v:2:y:2001:i:1:p:34-49 Is foreign direct investment a safer form of financing? (2001). Emerging Markets Review (41) RePEc:eee:ememar:v:6:y:2005:i:1:p:21-43 Coexceedances in financial markets--a quantile regression analysis of contagion (2005). Emerging Markets Review (42) RePEc:eee:ememar:v:4:y:2003:i:2:p:145-164 Understanding reserve volatility in emerging markets: a look at the long-run (2003). Emerging Markets Review (43) RePEc:eee:ememar:v:7:y:2006:i:4:p:380-397 Risks of investing in the Russian stock market: Lessons of the first decade (2006). Emerging Markets Review (44) RePEc:eee:ememar:v:3:y:2002:i:4:p:325-337 Measuring transparency and disclosure at firm-level in emerging markets (2002). Emerging Markets Review (45) RePEc:eee:ememar:v:6:y:2005:i:2:p:192-209 Competition and concentration in the banking sector of the South Eastern European region (2005). Emerging Markets Review (46) RePEc:eee:ememar:v:4:y:2003:i:1:p:39-51 Firm-level access to international capital markets: evidence from Chilean equities (2003). Emerging Markets Review (47) RePEc:eee:ememar:v:6:y:2005:i:2:p:138-169 Financing choices of firms in EU accession countries (2005). Emerging Markets Review (48) RePEc:eee:ememar:v:4:y:2003:i:3:p:273-286 Intra-industry trade of transition countries: trends and determinants (2003). Emerging Markets Review (49) RePEc:eee:ememar:v:6:y:2005:i:1:p:69-84 Assessing institutional efficiency, growth and integration (2005). Emerging Markets Review (50) RePEc:eee:ememar:v:8:y:2007:i:3:p:206-217 Banks, stock markets, and Chinas `great leap forward (2007). Emerging Markets Review Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:fip:fedgif:771 U.S. investors emerging market equity portfolios: a security-level analysis (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (2) RePEc:imf:imfwpa:03/238 U.S. Investors Emerging Market Equity Portfolios: A Security-Level Analysis (2003). International Monetary Fund / IMF Working Papers (3) RePEc:udt:wpbsdt:tres Finantial Dollarization and Debt Deflation under a Currency Board (2003). Universidad Torcuato Di Tella / Business School Working Papers Latest citations received in: 2002 (1) RePEc:kie:kieliw:1137 Trade Effects of Monetary Integration in Large, Mature Economies: A Primer on the European Monetary Union (2002). Kiel Institute for World Economics / Working Papers (2) RePEc:wdi:papers:2002-469 Barriers to Investment by Russian Firms: Property Protection or Credit Constraints? (2002). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (3) RePEc:wpa:wuwpfi:0209001 The Impact of News, Oil Prices, and International Spillovers on Russian Financial Markets (2002). EconWPA / Finance Latest citations received in: 2001 Latest citations received in: 2000 (1) RePEc:rio:texdis:420 The Russian default and the contagion to Brazil. (2000). Department of Economics PUC-Rio (Brazil) / Textos para discussão Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |