|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

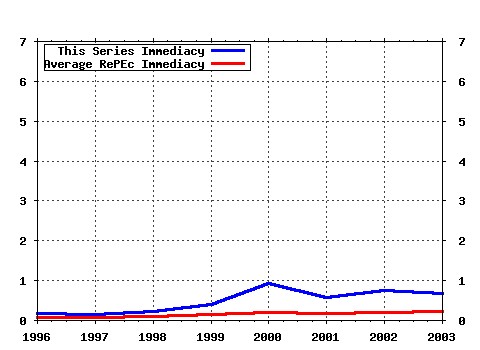

Journal of Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jfinec:v:3:y:1976:i:4:p:305-360 Theory of the firm: Managerial behavior, agency costs and ownership structure (1976). Journal of Financial Economics (2) RePEc:eee:jfinec:v:13:y:1984:i:2:p:187-221 Corporate financing and investment decisions when firms have information that investors do not have (1984). Journal of Financial Economics (3) RePEc:eee:jfinec:v:33:y:1993:i:1:p:3-56 Common risk factors in the returns on stocks and bonds (1993). Journal of Financial Economics (4) RePEc:eee:jfinec:v:5:y:1977:i:2:p:147-175 Determinants of corporate borrowing (1977). Journal of Financial Economics (5) RePEc:eee:jfinec:v:5:y:1977:i:2:p:177-188 An equilibrium characterization of the term structure (1977). Journal of Financial Economics (6) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:261-300 Finance and the sources of growth (2000). Journal of Financial Economics (7) RePEc:eee:jfinec:v:22:y:1988:i:1:p:3-25 Dividend yields and expected stock returns (1988). Journal of Financial Economics (8) RePEc:eee:jfinec:v:19:y:1987:i:1:p:3-29 Expected stock returns and volatility (1987). Journal of Financial Economics (9) RePEc:eee:jfinec:v:25:y:1989:i:1:p:23-49 Business conditions and expected returns on stocks and bonds (1989). Journal of Financial Economics (10) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:3-27 Investor protection and corporate governance (2000). Journal of Financial Economics (11) RePEc:eee:jfinec:v:20:y:1988:i::p:293-315 Management ownership and market valuation : An empirical analysis (1988). Journal of Financial Economics (12) RePEc:eee:jfinec:v:22:y:1988:i:1:p:27-59 Mean reversion in stock prices : Evidence and Implications (1988). Journal of Financial Economics (13) RePEc:eee:jfinec:v:18:y:1987:i:2:p:373-399 Stock returns and the term structure (1987). Journal of Financial Economics (14) RePEc:eee:jfinec:v:27:y:1990:i:2:p:595-612 Additional evidence on equity ownership and corporate value (1990). Journal of Financial Economics (15) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:125-144 Option pricing when underlying stock returns are discontinuous (1976). Journal of Financial Economics (16) RePEc:eee:jfinec:v:14:y:1985:i:1:p:3-31 Using daily stock returns : The case of event studies (1985). Journal of Financial Economics (17) RePEc:eee:jfinec:v:5:y:1977:i:2:p:115-146 Asset returns and inflation (1977). Journal of Financial Economics (18) RePEc:eee:jfinec:v:7:y:1979:i:3:p:265-296 An intertemporal asset pricing model with stochastic consumption and investment opportunities (1979). Journal of Financial Economics (19) RePEc:eee:jfinec:v:17:y:1986:i:2:p:223-249 Asset pricing and the bid-ask spread (1986). Journal of Financial Economics (20) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:81-112 The separation of ownership and control in East Asian Corporations (2000). Journal of Financial Economics (21) RePEc:eee:jfinec:v:11:y:1983:i:1-4:p:5-50 The market for corporate control : The scientific evidence (1983). Journal of Financial Economics (22) RePEc:eee:jfinec:v:7:y:1979:i:3:p:229-263 Option pricing: A simplified approach (1979). Journal of Financial Economics (23) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:145-166 The valuation of options for alternative stochastic processes (1976). Journal of Financial Economics (24) RePEc:eee:jfinec:v:8:y:1980:i:4:p:323-361 On estimating the expected return on the market : An exploratory investigation (1980). Journal of Financial Economics (25) RePEc:eee:jfinec:v:27:y:1990:i:1:p:67-88 The role of banks in reducing the costs of financial distress in Japan (1990). Journal of Financial Economics (26) RePEc:eee:jfinec:v:17:y:1986:i:2:p:357-390 Predicting returns in the stock and bond markets (1986). Journal of Financial Economics (27) RePEc:eee:jfinec:v:60:y:2001:i:2-3:p:187-243 The theory and practice of corporate finance: evidence from the field (2001). Journal of Financial Economics (28) RePEc:eee:jfinec:v:29:y:1991:i:1:p:97-112 The consumption of stockholders and nonstockholders (1991). Journal of Financial Economics (29) RePEc:eee:jfinec:v:14:y:1985:i:1:p:71-100 Bid, ask and transaction prices in a specialist market with heterogeneously informed traders (1985). Journal of Financial Economics (30) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:187-214 Financial markets and the allocation of capital (2000). Journal of Financial Economics (31) RePEc:eee:jfinec:v:19:y:1987:i:2:p:217-235 Some evidence on the uniqueness of bank loans (1987). Journal of Financial Economics (32) RePEc:eee:jfinec:v:47:y:1998:i:3:p:243-277 Venture capital and the structure of capital markets: banks versus stock markets (1998). Journal of Financial Economics (33) RePEc:eee:jfinec:v:20:y:1988:i::p:431-460 Outside directors and CEO turnover (1988). Journal of Financial Economics (34) RePEc:eee:jfinec:v:26:y:1990:i:1:p:3-27 Managerial discretion and optimal financing policies (1990). Journal of Financial Economics (35) RePEc:eee:jfinec:v:61:y:2001:i:1:p:43-76 The distribution of realized stock return volatility (2001). Journal of Financial Economics (36) RePEc:eee:jfinec:v:37:y:1995:i:1:p:39-65 Diversifications effect on firm value (1995). Journal of Financial Economics (37) RePEc:eee:jfinec:v:9:y:1981:i:1:p:3-18 The relationship between return and market value of common stocks (1981). Journal of Financial Economics (38) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:167-179 The pricing of commodity contracts (1976). Journal of Financial Economics (39) RePEc:eee:jfinec:v:5:y:1977:i:3:p:309-327 Estimating betas from nonsynchronous data (1977). Journal of Financial Economics (40) RePEc:eee:jfinec:v:27:y:1990:i:2:p:473-521 The structure and governance of venture-capital organizations (1990). Journal of Financial Economics (41) RePEc:eee:jfinec:v:32:y:1992:i:3:p:263-292 The investment opportunity set and corporate financing, dividend, and compensation policies (1992). Journal of Financial Economics (42) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:141-186 Corporate governance in the Asian financial crisis (2000). Journal of Financial Economics (43) RePEc:eee:jfinec:v:7:y:1979:i:2:p:117-161 On financial contracting : An analysis of bond covenants (1979). Journal of Financial Economics (44) RePEc:eee:jfinec:v:43:y:1997:i:1:p:29-77 Emerging equity market volatility (1997). Journal of Financial Economics (45) RePEc:eee:jfinec:v:54:y:1999:i:3:p:375-421 Predictive regressions (1999). Journal of Financial Economics (46) RePEc:eee:jfinec:v:42:y:1996:i:1:p:27-62 Modeling the conditional distribution of interest rates as a regime-switching process (1996). Journal of Financial Economics (47) RePEc:eee:jfinec:v:20:y:1988:i::p:25-54 Managerial control of voting rights : Financing policies and the market for corporate control (1988). Journal of Financial Economics (48) RePEc:eee:jfinec:v:66:y:2002:i:1:p:3-27 Investor protection and equity markets (2002). Journal of Financial Economics (49) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:301-334 Do stock market liberalizations cause investment booms? (2000). Journal of Financial Economics (50) RePEc:eee:jfinec:v:53:y:1999:i:3:p:353-384 Understanding the determinants of managerial ownership and the link between ownership and performance (1999). Journal of Financial Economics Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:bru:bruppp:03-18 The Impact of Risk on the Decision to Exercise an ESO (2003). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers (2) RePEc:cdl:anderf:1242 Comovement as an Investment Tool (2003). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (3) RePEc:ces:ceswps:_1111 Intra-and International Risk-Sharing in the Short Run and the Long Run (2003). CESifo GmbH / CESifo Working Paper Series (4) RePEc:cfs:cfswop:wp200316 The Role of Accounting in the German Financial System (2003). Center for Financial Studies / CFS Working Paper Series (5) RePEc:cfs:cfswop:wp200335 Some Like it Smooth, and Some Like it Rough: Untangling Continuous and Jump Components in Measuring, Modeling, and Forecasting Asset Return Volatility (2003). Center for Financial Studies / CFS Working Paper Series (6) RePEc:chb:bcchwp:222 Denying Foreign Bank Entry: Implications For Bank Interest Margins (2003). Central Bank of Chile / Working Papers Central Bank of Chile (7) RePEc:cpr:ceprdp:3914 The Political Economy of Bank and Equity Dominance (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cpr:ceprdp:3996 Credit, Wages and Bankruptcy Laws (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (9) RePEc:cpr:ceprdp:4160 Strategic Asset Allocation in a Continuous Time VAR Model (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (10) RePEc:cpr:ceprdp:4163 Conflicts of Interest and Efficient Contracting in IPOs (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cra:wpaper:2003-03 Political Relationships, Global Financing and Corporate Transparency (2003). Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series (12) RePEc:dnb:staffs:110 Corporate Investment and Financing Constraints: Connections with Cash management (2003). Netherlands Central Bank / DNB Staff Reports (discontinued) (13) RePEc:ebg:heccah:0781 R&D Productivty: an International Study (2003). Groupe HEC / Les Cahiers de Recherche (14) RePEc:fip:fedawp:2003-9 Are TIPS really tax disadvantaged? Rethinking the tax treatment of U.S. Treasury Inflation Indexed Securities (2003). Federal Reserve Bank of Atlanta / Working Paper (15) RePEc:fip:fedgif:757 Foreign portfolio investment, foreign bank lending, and economic growth (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (16) RePEc:fip:fedgif:758 Was there front running during the LTCM crisis (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (17) RePEc:fip:fedhep:y:2003:i:qiii:p:2-18:n:v.27no.3 Banking relationships during financial distress: the evidence from Japan (2003). Economic Perspectives (18) RePEc:hhs:sifrwp:0017 Dealer Behavior and Trading Systems in Foreign Exchange Markets (2003). Swedish Institute for Financial Research / SIFR Research Report Series (19) RePEc:hit:hitcei:2003-19 Connected Lending: Thailand before the Financial Crisis (2003). Institute of Economic Research, Hitotsubashi University / Working Paper Series (20) RePEc:huj:dispap:dp355 Adding the Noise: A Theory of Compensation-Driven Earnings Management (2003). Center for Rationality and Interactive Decision Theory, Hebrew University, Jerusalem / Discussion Paper Series (21) RePEc:nbr:nberwo:10009 Financial Asset Returns, Direction-of-Change Forecasting, and Volatility Dynamics (2003). National Bureau of Economic Research, Inc / NBER Working Papers (22) RePEc:nbr:nberwo:10026 Efficient Tests of Stock Return Predictability (2003). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:nbr:nberwo:10064 Domestic Capital Market Reform and Access to Global Finance: Making Markets Work (2003). National Bureau of Economic Research, Inc / NBER Working Papers (24) RePEc:nbr:nberwo:10101 Stakeholder, Transparency and Capital Structure (2003). National Bureau of Economic Research, Inc / NBER Working Papers (25) RePEc:nbr:nberwo:9542 A Catering Theory of Dividends (2003). National Bureau of Economic Research, Inc / NBER Working Papers (26) RePEc:nbr:nberwo:9579 Categorical Cognition: A Psychological Model of Categories and Identification in Decision Making (2003). National Bureau of Economic Research, Inc / NBER Working Papers (27) RePEc:nbr:nberwo:9614 Migration, Spillovers,and Trade Diversion: The Impact of Internationalization on Stock Market Liquidity (2003). National Bureau of Economic Research, Inc / NBER Working Papers (28) RePEc:nbr:nberwo:9711 The Neighbors Portfolio: Word-of-Mouth Effects in the Holdings and Trade of Money Managers (2003). National Bureau of Economic Research, Inc / NBER Working Papers (29) RePEc:nbr:nberwo:9882 What Works in Securities Law? (2003). National Bureau of Economic Research, Inc / NBER Working Papers (30) RePEc:nbr:nberwo:9934 Unbundling Institutions (2003). National Bureau of Economic Research, Inc / NBER Working Papers (31) RePEc:nbr:nberwo:9949 Propping and Tunneling (2003). National Bureau of Economic Research, Inc / NBER Working Papers (32) RePEc:ore:uoecwp:2003-24 CEO Turnover and Foreign Market Participation (2003). University of Oregon Economics Department / University of Oregon Economics Department Working Papers (33) RePEc:stn:sotoec:0404 Financial Institutions and the Wealth of Nations: Tales of Development (2003). Economics Division, School of Social Sciences, University of Southampton / Discussion Paper Series In Economics And Econometrics (34) RePEc:tky:fseres:2003cf239 Does Relationship Banking Matter? Japanese Bank-Borrower Ties in Good Times and Bad (2003). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series (35) RePEc:uma:periwp:wp56 Capital Management Techniques In Developing Countries: An Assessment of Experiences from the 1990s and Lessons For the Future. (2003). Political Economy Research Institute, University of Massachusetts at Amherst / Working Papers (36) RePEc:uwa:wpaper:03-21 Institutions, Technical Change and Macroeconomic Volatility, Crises and Growth: A Robust Causation (2003). The University of Western Australia, Department of Economics / Economics Discussion / Working Papers (37) RePEc:wbk:wbrwps:3127 Small and Medium Enterprises across the Globe: A New Database (2003). The World Bank / Policy Research Working Paper Series (38) RePEc:wdi:papers:2003-605 Culture Rules: The Foundations of the Rule of Law and Other Norms of Governance (2003). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (39) RePEc:wdi:papers:2003-623 Firm-Specific Variation and Openness in Emerging Markets (2003). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (40) RePEc:wpa:wuwpfi:0307003 International Evidence on Financial Derivatives Usage (2003). EconWPA / Finance (41) RePEc:wpa:wuwpfi:0311011 Bidder Asymmetry in Takeover Contests: The Role of Deal Protection Devices (2003). EconWPA / Finance Latest citations received in: 2002 (1) RePEc:aea:aecrev:v:92:y:2002:i:2:p:422-427 Exchange-Traded Funds: A New Investment Option for Taxable Investors (2002). American Economic Review (2) RePEc:bca:bocawp:02-35 The Impact of Common Currencies on Financial Markets: A Literature Review and Evidence from the Euro Area (2002). Bank of Canada / Working Papers (3) RePEc:cdl:oplwec:1074 Does Confidential Proxy Voting Matter? (2002). Berkeley Olin Program in Law & Economics / Berkeley Olin Program in Law & Economics, Working Paper Series (4) RePEc:chb:bcchwp:157 Finance and Growth: New Evidence and Policy Analyses for Chile (2002). Central Bank of Chile / Working Papers Central Bank of Chile (5) RePEc:chf:rpseri:rp63 Understanding the Economic Value of Legal Covenants in Investment Contracts: A Real-Options Approach to Venture Equity Contracts (2002). Swiss Finance Institute / Swiss Finance Institute Research Paper Series (6) RePEc:cir:cirwor:2002s-59 Tests for Breaks in the Conditional Co-movements of Asset Returns (2002). CIRANO / CIRANO Working Papers (7) RePEc:cir:cirwor:2002s-92 ARMA Representation of Two-Factor Models (2002). CIRANO / CIRANO Working Papers (8) RePEc:cla:princt:98734966f1c1a57373801367fbdf0a4b Overconfidence, Short-Sale Constraints and Bubbles (2002). UCLA Department of Economics / Princeton Economic Theory Working Papers (9) RePEc:cpr:ceprdp:3203 Venture Capital Contracts and Market Structure (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (10) RePEc:cpr:ceprdp:3234 Family Firms (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:3644 Bids and Allocations in European IPO Bookbuilding (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cte:wbrepe:wb026022 ASSET PRICING AND SYSTEMATIC LIQUIDITY RISK: AN EMPIRICAL INVESTIGATION OF THE SPANISH STOCK MARKET (2002). Universidad Carlos III, Departamento de Economía de la Empresa / Business Economics Working Papers (13) RePEc:dgr:uvatin:20020060 Evolution of Organizational Scale and Scope (2002). Tinbergen Institute / Tinbergen Institute Discussion Papers (14) RePEc:dij:wpfarg:020701 Au-delà de lapproche juridico-financière:le rôle cognitif des actionnaires et ses conséquences sur lanalyse de la structure de propriété et de la gouvernance (2002). Université de Bourgogne - Latec/Fargo (Research center in Finance,organizational ARchitecture and GOvernance) / Working Papers FARGO (15) RePEc:fip:fedawp:2002-16 Emerging market liberalization and the impact on uncovered interest rate parity (2002). Federal Reserve Bank of Atlanta / Working Paper (16) RePEc:fip:fedfpr:y:2002:i:sep:x:6 The value of banking relationships during a financial crisis: evidence from failures of Japanese banks (2002). Proceedings (17) RePEc:fip:fedhwp:wp-02-20 The value of banking relationships during a financial crisis: evidence from failures of Japanese banks (2002). Federal Reserve Bank of Chicago / Working Paper Series (18) RePEc:fip:fedlsp:2002-05 Do jumbo-CD holders care about anything? (2002). Federal Reserve Bank of St. Louis / Supervisory Policy Analysis Working Papers (19) RePEc:hhs:bofrdp:2002_002 Forecasting the macroeconomy with current financial market information: Europe and the United States (2002). Bank of Finland / Research Discussion Papers (20) RePEc:hhs:cbsnow:2002_012 The Impact of a Break-Through Rule on European Firms (2002). Copenhagen Business School, Department of Economics / Working Papers (21) RePEc:hhs:sifrwp:0010 Which Investors Fear Expropriation? (2002). Swedish Institute for Financial Research / SIFR Research Report Series (22) RePEc:hhs:sifrwp:0011 Corporate Governance and the Home Bias (2002). Swedish Institute for Financial Research / SIFR Research Report Series (23) RePEc:ide:wpaper:1037 Efficient Estimation of Jump Diffusions and General Dynamic Models with a Continuum of Moment Conditions (2002). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (24) RePEc:lau:crdeep:00.22 Banking, Commerce, and Antitrust (2002). Université de Lausanne, Ecole des HEC, DEEP / Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) (25) RePEc:lau:crdeep:02.07 Cannibalization & Incentives in Venture Financing (2002). Université de Lausanne, Ecole des HEC, DEEP / Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) (26) RePEc:msh:ebswps:2002-2 Bayesian Estimation of a Stochastic Volatility Model Using Option and Spot Prices. (2002). Monash University, Department of Econometrics and Business Statistics / Monash Econometrics and Business Statistics Working Papers (27) RePEc:nbr:nberte:0286 Estimating Affine Multifactor Term Structure Models Using Closed-Form Likelihood Expansions (2002). National Bureau of Economic Research, Inc / NBER Technical Working Papers (28) RePEc:nbr:nberwo:8776 Family Firms (2002). National Bureau of Economic Research, Inc / NBER Working Papers (29) RePEc:nbr:nberwo:8816 Market Liquidity as a Sentiment Indicator (2002). National Bureau of Economic Research, Inc / NBER Working Papers (30) RePEc:nbr:nberwo:8982 Industry Growth and Capital Allocation: Does Having a Market- or Bank-Based System Matter? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (31) RePEc:nbr:nberwo:8990 The Market Price of Credit Risk: An Empirical Analysis of Interest Rate Swap Spreads (2002). National Bureau of Economic Research, Inc / NBER Working Papers (32) RePEc:nbr:nberwo:9126 Does Confidential Proxy Voting Matter? (2002). National Bureau of Economic Research, Inc / NBER Working Papers (33) RePEc:nbr:nberwo:9178 Bond Risk Premia (2002). National Bureau of Economic Research, Inc / NBER Working Papers (34) RePEc:nbr:nberwo:9277 Anomalies and Market Efficiency (2002). National Bureau of Economic Research, Inc / NBER Working Papers (35) RePEc:nbr:nberwo:9359 Judging Fund Managers by the Company They Keep (2002). National Bureau of Economic Research, Inc / NBER Working Papers (36) RePEc:nbr:nberwo:9392 Mutual Fund Performance with Learning Across Funds (2002). National Bureau of Economic Research, Inc / NBER Working Papers (37) RePEc:sbs:wpsefe:2002fe01 Stock Based Compensation: Firm-specific risk, Efficiency and Incentives (2002). Oxford Financial Research Centre / OFRC Working Papers Series (38) RePEc:una:unccee:wp0102 Stock Market Cycles and Stock Market Development in Spain (2002). School of Economics and Business Administration, University of Navarra / Faculty Working Papers (39) RePEc:wbk:wbrwps:2818 Corporate Governance, Investor Protection, and Performance in Emerging Markets (2002). The World Bank / Policy Research Working Paper Series (40) RePEc:wfo:wpaper:y:2002:i:181 Financial Development and Output Growth Fluctuation. Evidence from OECD Countries (2002). WIFO / WIFO Working Papers (41) RePEc:wop:pennin:02-30 The Scarcity of Effective Monitors and Its Implications For Corporate Takeovers and Ownership Structures (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (42) RePEc:wop:pennin:03-05 Venture Capital and Corporate Governance (2002). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (43) RePEc:wpa:wuwpfi:0207011 Time-Changed Levy Processes and Option Pricing (2002). EconWPA / Finance (44) RePEc:wpa:wuwpfi:0207013 Are Interest Rate Derivatives Spanned by the Term Structure of Interest Rates? (2002). EconWPA / Finance Latest citations received in: 2001 (1) RePEc:aah:aarhec:2001-4 Semiparametric Analysis of Stationary Fractional Cointegration and the Implied-Realized Volatility Relation in High-Frequency Options Data (2001). Department of Economics, University of Aarhus / Department of Economics, Working Papers (2) RePEc:ces:ceswps:_559 Insurance Contracts and Securitization (2001). CESifo GmbH / CESifo Working Paper Series (3) RePEc:cir:cirwor:2001s-71 A Theoretical Comparison Between Integrated andRealized Volatilities / A Theoretical Comparison Between Integrated and Realized Volatilities (2001). CIRANO / CIRANO Working Papers (4) RePEc:cpr:ceprdp:3033 Foreigners Trading and Price Effects Across Firms (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:cpr:ceprdp:3070 A Multivariate Model of Strategic Asset Allocation (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:del:abcdef:2001-08 The Determinants of Cross-Border Equity Flows. (2001). DELTA (Ecole normale supérieure) / DELTA Working Papers (7) RePEc:dgr:eureri:2001146 The Dividend and Share Repurchase Policies of Canadian Firms (2001). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (8) RePEc:dgr:kubcen:20011 On the sequencing of projects, reputation building, and relationship finance (2001). Tilburg University, Center for Economic Research / Discussion Paper (9) RePEc:dgr:kubcen:200141 Borrower poaching and information display in credit markets (2001). Tilburg University, Center for Economic Research / Discussion Paper (10) RePEc:fip:fedgfe:2001-49 Estimating stochastic volatility diffusion using conditional moments of integrated volatility (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (11) RePEc:fip:fedgfe:2001-57 Who benefits from a bull market? an analysis of employee stock option grants and stock prices (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (12) RePEc:fip:fedhpr:y:2001:i:may:p:262-276 Firms and their distressed banks: lessons from the Norwegian banking crisis (1988-1991) (2001). Proceedings (13) RePEc:fip:fedkpr:y:2001:p:125-160 Technology, information production, and market efficiency (2001). Proceedings (14) RePEc:fip:fednsr:133 Measuring treasury market liquidity (2001). Federal Reserve Bank of New York / Staff Reports (15) RePEc:fip:fedreq:y:2001:i:fall:p:1-25 On the size distribution of banks (2001). Economic Quarterly (16) RePEc:hhs:bofitp:2001_006 International investors, contagion and the Russian crisis (2001). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (17) RePEc:hhs:iuiwop:0566 The Transformation of Ownership Policy and Structure in Sweden: Convergence towards the Anglo-Saxon Model? (2001). The Research Institute of Industrial Economics / IUI Working Paper Series (18) RePEc:hhs:sifrwp:0001 Foreigners´ Trading and Price Effects Across Firms (2001). Swedish Institute for Financial Research / SIFR Research Report Series (19) RePEc:imf:imfstp:v:47:y:2001:i:3:p:1 Herd Behavior in Financial Markets (2001). IMF Staff Papers (20) RePEc:nbr:nberwo:8160 Modeling and Forecasting Realized Volatility (2001). National Bureau of Economic Research, Inc / NBER Working Papers (21) RePEc:nbr:nberwo:8167 Expectation Puzzles, Time-varying Risk Premia, and Dynamic Models of the Term Structure (2001). National Bureau of Economic Research, Inc / NBER Working Papers (22) RePEc:nbr:nberwo:8363 A No-Arbitrage Vector Autoregression of Term Structure Dynamics with Macroeconomic and Latent Variables (2001). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:nbr:nberwo:8472 The Information Content of International Portfolio Flows (2001). National Bureau of Economic Research, Inc / NBER Working Papers (24) RePEc:nbr:nberwo:8641 The Modigliani and Miller Theorem and Market Efficiency (2001). National Bureau of Economic Research, Inc / NBER Working Papers (25) RePEc:nbr:nberwo:8678 Expectations of Equity Risk Premia, Volatility and Asymmetry from a Corporate Finance Perspective (2001). National Bureau of Economic Research, Inc / NBER Working Papers (26) RePEc:ntd:wpaper:2001-13 Selección de proveedores y tipos de fondos: TeorÃa y evidencia empÃrica con datos de panel (2001). Interuniversitary Doctorate Program New Trends on Business Administration, Universities of Valladolid, Burgos and Salamanca (Spain). Programa de Docto (27) RePEc:nuf:econwp:0101 Integrated OU Processes (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (28) RePEc:nuf:econwp:0104 Econometric analysis of realised volatility and its use in estimating stochastic volatility models (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (29) RePEc:nuf:econwp:0116 How accurate is the asymptotic approximation to the distribution of realised volatility? (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (30) RePEc:nuf:econwp:0118 Realised power variation and stochastic volatility models (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (31) RePEc:nuf:econwp:0120 Estimating quadratic variation using realised volatility (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (32) RePEc:nuf:econwp:0125 Some recent developments in stochastic volatility modelling (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (33) RePEc:oxf:wpaper:071 Econometric Analysis of Realised Volatility and Its Use in Estimating Stochastic Volatility Models (2001). University of Oxford, Department of Economics / Economics Series Working Papers (34) RePEc:rif:dpaper:781 Exiting Venture Capital Investments: Lessons from Finland (2001). The Research Institute of the Finnish Economy / Discussion Papers (35) RePEc:wop:pennin:01-01 Modeling and Forecasting Realized Volatility (2001). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Latest citations received in: 2000 (1) RePEc:aea:aecrev:v:90:y:2000:i:2:p:22-27 Tunneling (2000). American Economic Review (2) RePEc:aub:autbar:453.00 ANTI-COMPETITIVE FINANCIAL CONTRACTING: THE DESIGN OF FINANCIAL CLAIMS. (2000). Unitat de Fonaments de l'Anà lisi Econòmica (UAB) and Institut d'Anà lisi Econòmica (CSIC) / UFAE and IAE Working Papers (3) RePEc:bdr:borrec:322 Crédito, Represión Financiera y Flujos de Capitales en Colombia 1974-2003 (2000). Banco de la Republica de Colombia / Borradores de Economia (4) RePEc:bep:yaloln:yale_lepp-1021 Event Studies and the Law--Part I: Technique and Corporate Litigation (2000). Yale Law School John M. Olin Center for Studies in Law, Economics, and Public Policy / Yale Law School John M. Olin Center for Studies in Law, Economi (5) RePEc:cdl:anderf:1059 Tax Loss Trading and Wash Sales (2000). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (6) RePEc:cdl:anderf:1068 Liquidity Dynamics Across Small and Large Firms (2000). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (7) RePEc:cdl:anderf:1076 The Market Price of Credit Risk: An Empirical Analysis of Interest Rate Swap Spreads (2000). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (8) RePEc:cdl:anderf:1080 Order Imbalance and Individual Stock Returns (2000). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (9) RePEc:cdl:anderf:1082 The Risk and Return of Venture Capital (2000). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (10) RePEc:chb:bcchec:v:3:y:2000:i:1:p:25-55 Are bank-based or market-based financial systems better? (2000). Journal Economía Chilena (The Chilean Economy) (11) RePEc:clm:clmeco:2000-39 The SECs Fair Value Standard for Mutual Fund Investment in Restricted Shares and Other Illiquid Securities (2000). Claremont Colleges / Claremont Colleges Working Papers (12) RePEc:cpr:ceprdp:2484 Has the Introduction of Bookbuilding Increased the Efficiency of International IPOs? (2000). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:dgr:kubcen:200016 The dividend and share repurchase policies of Canadian firms : empirical evidence based on a new research design (2000). Tilburg University, Center for Economic Research / Discussion Paper (14) RePEc:dgr:kubcen:200036 Index option pricing models with stochastic volatility and stochastic interest rates (2000). Tilburg University, Center for Economic Research / Discussion Paper (15) RePEc:dgr:kubcen:200093 The performance of multi-factor term structure models for pricing and hedging caps and swaptions (2000). Tilburg University, Center for Economic Research / Discussion Paper (16) RePEc:eab:microe:143 Corporate Leverage, Bankcruptcy and Output Adjustment in Post-Crisis East Asia (2000). East Asian Bureau of Economic Research / Microeconomics Working Papers (17) RePEc:ecb:ecbwps:20000034 Capital market development, corporate governance and the credibility of exchange rate pegs. (2000). European Central Bank / Working Paper Series (18) RePEc:ecm:wc2000:0807 Expropriation and Incentives for Team Production (2000). Econometric Society / Econometric Society World Congress 2000 Contributed Papers (19) RePEc:ema:worpap:2000-12 Recovering the Probability Density Function of Asset Prices using Garch as Diffusion Approximations (2000). THEMA / Working papers (20) RePEc:ema:worpap:2000-39 Fundamental Properties of Bond Prices in Models of the Short-Term Rate (2000). THEMA / Working papers (21) RePEc:fip:fedbcp:y:2000:i:jun:p:187-221:n:44 Coase and the reform of securities markets (2000). Conference Series ; [Proceedings] (22) RePEc:fip:fedbcp:y:2000:i:jun:p:89-112:n:44 The role of financial reporting in reducing financial risks in the market (2000). Conference Series ; [Proceedings] (23) RePEc:fip:fedgfe:2000-29 Corporate share repurchases in the 1990s: what role do stock options play? (2000). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (24) RePEc:fip:fedgfe:2000-42 Using Treasury STRIPS to measure the yield curve (2000). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (25) RePEc:fip:fedgif:670 Finance and macroeconomic volatility (2000). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (26) RePEc:fip:fedgif:686 Firms and their distressed banks: lessons from the Norwegian banking crisis (1988-1991) (2000). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (27) RePEc:fth:harver:1906 Investor Protection and Equity Markets (2000). Harvard - Institute of Economic Research / Harvard Institute of Economic Research Working Papers (28) RePEc:fth:nystfi:98-069 Credit Risk and the Pricing of Japanese Yen Interest Rate Swaps (2000). New York University, Leonard N. Stern School of Business- / New York University, Leonard N. Stern School Finance Department Working Paper Seires (29) RePEc:fth:pennfi:1-00 Liquidity Provision during Circuit Breakers and Extreme Market Movements (2000). Wharton School Rodney L. White Center for Financial Research / Rodney L. White Center for Financial Research Working Papers (30) RePEc:hhs:cbsnow:2000_015 AN ECONOMIC ANALYSIS OF INVESTOR PROTECTION IN CORPORATIONS WITH CONCENTRATED OWNERSHIP (2000). Copenhagen Business School, Department of Economics / Working Papers (31) RePEc:hit:hitcei:2000-4 Expropriation of Minority Shareholders in East Asia (2000). Institute of Economic Research, Hitotsubashi University / Working Paper Series (32) RePEc:hit:hitcei:2000-5 The Costs of Group Affiliation: Evidence from East Asia (2000). Institute of Economic Research, Hitotsubashi University / Working Paper Series (33) RePEc:kie:kieliw:982 The Positive Economics of Corporatism and Corporate Governance (2000). Kiel Institute for World Economics / Working Papers (34) RePEc:mod:modena:0004 Banks inefficiency and economic growth: a micro-macro approach (2000). Universita di Modena e Reggio Emilia, Dipartimento di Economia Politica / Heterogeneity and monetary policy (35) RePEc:mod:modena:0005 Legal system efficiency, information production, and technological choice: a banking model (2000). Universita di Modena e Reggio Emilia, Dipartimento di Economia Politica / Heterogeneity and monetary policy (36) RePEc:nbr:nberwo:7807 The Asian Flu and Russian Virus: Firm-level Evidence on How Crises are Transmitted Internationally (2000). National Bureau of Economic Research, Inc / NBER Working Papers (37) RePEc:nbr:nberwo:7945 Class Struggle Inside the Firm: A Study of German Codetermination (2000). National Bureau of Economic Research, Inc / NBER Working Papers (38) RePEc:nbr:nberwo:7974 Investor Protection and Equity Markets (2000). National Bureau of Economic Research, Inc / NBER Working Papers (39) RePEc:qed:wpaper:997 Registered trader participation during the Toronto Stock Exchanges pre-opening session (2000). Queen's University, Department of Economics / Working Papers (40) RePEc:sbs:wpsefe:2000fe04 Has the introduction of bookbuilding increased the efficiency of international IPOs? (2000). Oxford Financial Research Centre / OFRC Working Papers Series (41) RePEc:sfi:sfiwpa:500028 Herd behavior and aggregate fluctuations in financial markets (2000). Science & Finance, Capital Fund Management / Science & Finance (CFM) working paper archive (42) RePEc:wbk:wbrwps:2271 Corporate risk around the world (2000). The World Bank / Policy Research Working Paper Series (43) RePEc:wbk:wbrwps:2325 Banking systems around the globe : do regulation and ownership affect the performance and stability? (2000). The World Bank / Policy Research Working Paper Series (44) RePEc:wbk:wbrwps:2423 Financial Structure and Economic Development: Firm, Industry, and Country Evidence (2000). The World Bank / Policy Research Working Paper Series (45) RePEc:wdi:papers:2002-455 Russian Financial Transition: The Development of Institutions and Markets for Growth (2000). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (46) RePEc:wop:chispw:528 Can the Market Add and Subtract'DONE' Mispricing in Tech Stock Carve-outs (2000). Center for Research in Security Prices, Graduate School of Business, University of Chicago / CRSP working papers (47) RePEc:wop:chispw:530 Newly Listed Firms: Fundamentals, Survival Rates, and Returns (2000). Center for Research in Security Prices, Graduate School of Business, University of Chicago / CRSP working papers (48) RePEc:wop:chispw:532 Investing in Equity Mutual Funds (2000). Center for Research in Security Prices, Graduate School of Business, University of Chicago / CRSP working papers (49) RePEc:wvu:wpaper:05-05 Productivity-Based Asset Pricing: Theory and Evidence (2000). Department of Economics, West Virginia University / Working Papers (50) RePEc:zbw:zewdip:5322 New economy accounting : why are broad-based stock option plans so attractive? (2000). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |