|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

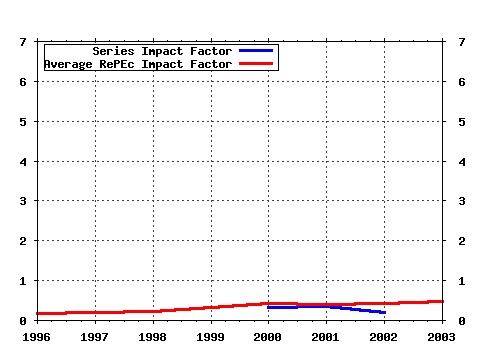

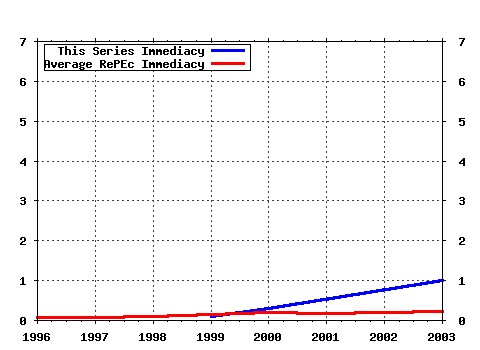

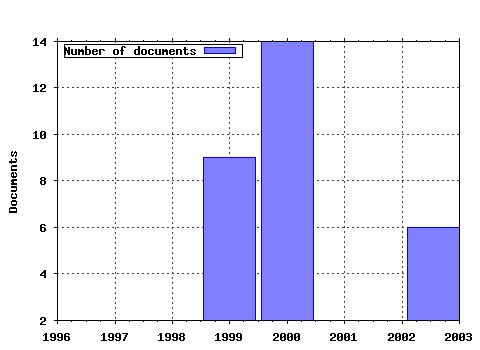

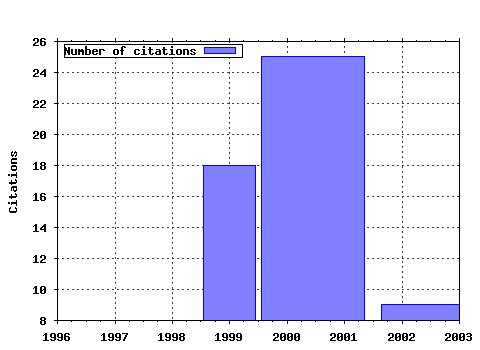

Emerging Issues Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fip:fedhei:y:1999:i:jun:n:sr-99-3r Do markets discipline banks and bank holding companies? evidence from debt pricing (1999). Emerging Issues (2) RePEc:fip:fedhei:y:2000:i:oct:n:sr-2000-8 Depressing recoveries (2000). Emerging Issues (3) RePEc:fip:fedhei:y:2003:i:jun:n:eps-2003-1b Why invest in payment innovations? (2003). Emerging Issues (4) RePEc:fip:fedhei:y:2000:i:may:n:sr-00-6 Why has stored value not caught on? (2000). Emerging Issues (5) RePEc:fip:fedhei:y:2003:n:eps-2003-1c Estimating the volume of payments-driven revenues (2003). Emerging Issues (6) RePEc:fip:fedhei:y:2000:i:apr:n:sr-00-3 Simple forecasts of bank loan quality in the business cycle (2000). Emerging Issues (7) RePEc:fip:fedhei:y:2003:n:eps-2003-1d The importance of payments-driven revenues to franchise value and in estimating bank performance (2003). Emerging Issues (8) RePEc:fip:fedhei:y:2003:n:eps-2003-1e Evolving operational risk management for retail payments (2003). Emerging Issues (9) RePEc:fip:fedhei:y:2000:i:sep:n:sr-2000-14r Market discipline prior to failure (2000). Emerging Issues (10) RePEc:fip:fedhei:y:2000:i:dec:n:sr-2000-11r Merger advisory fees and advisors effort (2000). Emerging Issues (11) RePEc:fip:fedhei:y:1999:i:sep:n:sr-99-8r Stumbling blocks to increasing market discipline in the banking sector: a note on bond pricing and funding strategy prior to failure (1999). Emerging Issues (12) RePEc:fip:fedhei:y:2000:i:sep:n:sr-00-10r Predicting inadequate capitalization: early warning system for bank supervision (2000). Emerging Issues Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:fip:fedhei:y:2003:i:jun:n:eps-2003-1b Why invest in payment innovations? (2003). Emerging Issues (2) RePEc:fip:fedhei:y:2003:n:eps-2003-1a Retail payments innovations and the banking industry (2003). Emerging Issues (3) RePEc:fip:fedhei:y:2003:n:eps-2003-1c Estimating the volume of payments-driven revenues (2003). Emerging Issues (4) RePEc:fip:fedhei:y:2003:n:eps-2003-1d The importance of payments-driven revenues to franchise value and in estimating bank performance (2003). Emerging Issues (5) RePEc:fip:fedhei:y:2003:n:eps-2003-1e Evolving operational risk management for retail payments (2003). Emerging Issues (6) RePEc:fip:fedhei:y:2003:n:eps-2003-1f Network vulnerabilities and risks in the retail payment system (2003). Emerging Issues Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 (1) RePEc:fip:fedhep:y:2000:i:qiv:p:32-48:n:v.25no.4 Why do consumers pay bills electronically? an empirical analysis (2000). Economic Perspectives (2) RePEc:fip:fedhop:eps-2000-1 Why dont consumers use electronic banking products? towards a theory of obstacles, incentives, and opportunities (2000). Federal Reserve Bank of Chicago / Occasional Paper; Emerging Payments (3) RePEc:wop:pennin:03-13 Macroeconomic Dynamics and Credit Risk: A Global Perspective (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers (4) RePEc:wop:pennin:03-14 The New Basel Capital Accord and Questions for Research (2000). Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |