|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

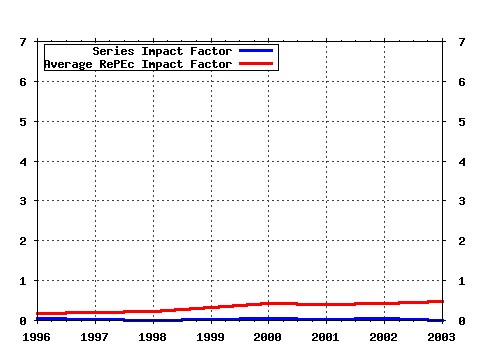

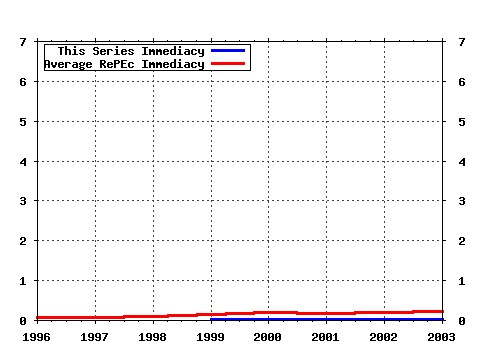

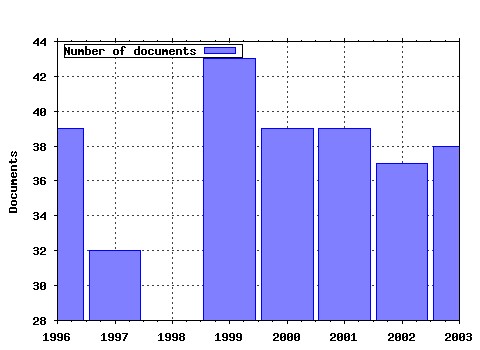

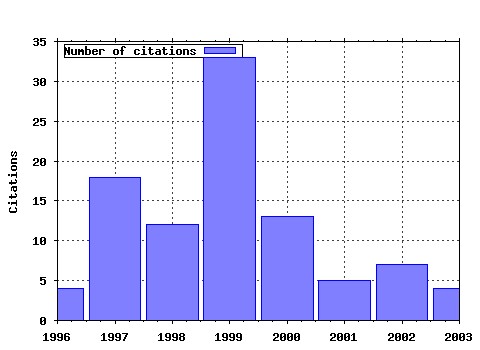

Review of Quantitative Finance and Accounting Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:rqfnac:v:13:y:1999:i:2:p:111-35

Estimating and Testing Exponential-Affine Term Structure Models by Kalman Filter. (1999). Review of Quantitative Finance and Accounting (2) RePEc:kap:rqfnac:v:9:y:1997:i:3:p:251-67

Nonparametric Smoothing of Yield Curves. (1997). Review of Quantitative Finance and Accounting (3) RePEc:kap:rqfnac:v:9:y:1997:i:1:p:53-70

Asset Allocation via the Conditional First Exit Time or How to Avoid Outliving Your Money. (1997). Review of Quantitative Finance and Accounting (4) RePEc:kap:rqfnac:v:10:y:1998:i:3:p:269-84

Product Quality and Payment Policy. (1998). Review of Quantitative Finance and Accounting (5) RePEc:kap:rqfnac:v:13:y:1999:i:1:p:39-62

Review of Categorical Models for Classification Issues in Accounting and Finance. (1999). Review of Quantitative Finance and Accounting (6) RePEc:kap:rqfnac:v:15:y:2000:i:3:p:259-76

A Neural Network Approach for Analyzing Small Business Lending Decisions. (2000). Review of Quantitative Finance and Accounting (7) RePEc:kap:rqfnac:v:9:y:1997:i:2:p:131-46

The Relation between Patent Citations and Tobins Q in the Semiconductor Industry. (1997). Review of Quantitative Finance and Accounting (8) RePEc:kap:rqfnac:v:20:y:2003:i:1:p:49-62

Are All Rivals Affected Equally by Bond Rating Downgrades? (2003). Review of Quantitative Finance and Accounting (9) RePEc:kap:rqfnac:v:19:y:2002:i:2:p:155-80

Intraday Return Volatility Process: Evidence from NASDAQ Stocks. (2002). Review of Quantitative Finance and Accounting (10) RePEc:kap:rqfnac:v:8:y:1997:i:1:p:69-81

Do Interest Rates Follow Unit-Root Processes? Evidence from Cross-Maturity Treasury Bill Yields. (1997). Review of Quantitative Finance and Accounting (11) RePEc:kap:rqfnac:v:15:y:2000:i:2:p:107-26

The Effects of Downsizing on Operating Performance. (2000). Review of Quantitative Finance and Accounting (12) RePEc:kap:rqfnac:v:15:y:2000:i:4:p:349-70

The Valuation Accuracy of the Price-Earnings and Price-Book Benchmark Valuation Methods. (2000). Review of Quantitative Finance and Accounting (13) RePEc:kap:rqfnac:v:13:y:1999:i:2:p:171-88

Random Walks and Market Efficiency Tests: Evidence from Emerging Equity Markets. (1999). Review of Quantitative Finance and Accounting (14) RePEc:kap:rqfnac:v:22:y:2004:i:2:p:79-95 Value-at-Risk Analysis for Taiwan Stock Index Futures: Fat Tails and Conditional Asymmetries in Return Innovations (2004). Review of Quantitative Finance and Accounting (15) RePEc:kap:rqfnac:v:16:y:2001:i:3:p:223-50

Bank Managers Heterogeneous Decisions on Discretionary Loan Loss Provisions. (2001). Review of Quantitative Finance and Accounting (16) RePEc:kap:rqfnac:v:10:y:1998:i:3:p:285-302

Volume and Volatility in Foreign Currency Futures Markets. (1998). Review of Quantitative Finance and Accounting (17) RePEc:kap:rqfnac:v:19:y:2002:i:4:p:399-416

A Generalized Method for Detecting Abnormal Returns and Changes in Systematic Risk. (2002). Review of Quantitative Finance and Accounting (18) RePEc:kap:rqfnac:v:13:y:1999:i:4:p:323-45

Predicting Corporate Financial Distress: A Time-Series CUSUM Methodology. (1999). Review of Quantitative Finance and Accounting (19) RePEc:kap:rqfnac:v:12:y:1999:i:1:p:89-96

A Note on Perceptions of Finance Journal Quality. (1999). Review of Quantitative Finance and Accounting (20) RePEc:kap:rqfnac:v:29:y:2007:i:1:p:1-24 Disclosure and the cost of equity in international cross-listing (2007). Review of Quantitative Finance and Accounting (21) RePEc:kap:rqfnac:v:10:y:1998:i:1:p:95-113

Fractionally Integrated Models with ARCH Errors: With an Application to the Swiss One-Month Euromarket Interest Rate. (1998). Review of Quantitative Finance and Accounting (22) RePEc:kap:rqfnac:v:18:y:2002:i:2:p:95-118

Estimating Beta. (2002). Review of Quantitative Finance and Accounting (23) RePEc:kap:rqfnac:v:7:y:1996:i:1:p:65-79

Refining the Bootstrap Method of Stochastic Dominance Analysis: The Case of the January Effect. (1996). Review of Quantitative Finance and Accounting (24) RePEc:kap:rqfnac:v:11:y:1998:i:3:p:293-310

Corporate Policy and Market Value: A q-Theory Approach. (1998). Review of Quantitative Finance and Accounting (25) RePEc:kap:rqfnac:v:22:y:2004:i:1:p:15-28 (). Review of Quantitative Finance and Accounting (26) RePEc:kap:rqfnac:v:12:y:1999:i:4:p:351-70

On the Nonlinear Specifications of Short-Term Interest Rate Behavior: Evidence from Euro-Currency Markets. (1999). Review of Quantitative Finance and Accounting (27) RePEc:kap:rqfnac:v:17:y:2001:i:3:p:283-300

Market Imperfections as the Cause of Accounting Income Smoothing--The Case of Differential Capital Access. (2001). Review of Quantitative Finance and Accounting (28) RePEc:kap:rqfnac:v:6:y:1996:i:2:p:103-31

Sequential Parameter Nonstationarity in Stock Market Returns. (1996). Review of Quantitative Finance and Accounting (29) RePEc:kap:rqfnac:v:11:y:1998:i:2:p:165-82

Information Asymmetry around Earnings Announcements. (1998). Review of Quantitative Finance and Accounting (30) RePEc:kap:rqfnac:v:15:y:2000:i:1:p:21-35

Valuation Implications of Investment Opportunities and Earnings Permanence. (2000). Review of Quantitative Finance and Accounting (31) RePEc:kap:rqfnac:v:12:y:1999:i:3:p:283-301

Predicting UK Takeover Targets: Some Methodological Issues and an Empirical Study. (1999). Review of Quantitative Finance and Accounting (32) RePEc:kap:rqfnac:v:16:y:2001:i:2:p:103-15

The Relationship between REITs Returns and Inflation: A Vector Error Correction Approach. (2001). Review of Quantitative Finance and Accounting (33) RePEc:kap:rqfnac:v:5:y:1995:i:2:p:179-201

Options and Efficiency: Some Experimental Evidence. (1995). Review of Quantitative Finance and Accounting (34) RePEc:kap:rqfnac:v:14:y:2000:i:1:p:17-43

U.S. Banking Sector Risk in an Era of Regulatory Change: A Bivariate GARCH Approach. (2000). Review of Quantitative Finance and Accounting (35) RePEc:kap:rqfnac:v:12:y:1999:i:2:p:135-57

The Estimation of Systematic Risk under Differentiated Risk Aversion: A Mean-Extended Gini Approach. (1999). Review of Quantitative Finance and Accounting (36) RePEc:kap:rqfnac:v:5:y:1995:i:1:p:55-70

Simultaneous Estimation of the Demand and Supply of Differentiated Audits. (1995). Review of Quantitative Finance and Accounting (37) RePEc:kap:rqfnac:v:10:y:1998:i:2:p:207-26

Companies Modest Claims about the Value of CEO Stock Option Awards. (1998). Review of Quantitative Finance and Accounting (38) RePEc:kap:rqfnac:v:18:y:2002:i:3:p:273-91

The Usefulness of Derivative-Related Accounting Disclosures. (2002). Review of Quantitative Finance and Accounting (39) RePEc:kap:rqfnac:v:7:y:1996:i:2:p:177-86

Optimal Growth Portfolios Reconciling Theory and Practice. (1996). Review of Quantitative Finance and Accounting (40) RePEc:kap:rqfnac:v:12:y:1999:i:1:p:21-34

Stochastic Discount Rates, Productivity Shocks and Capital Asset Pricing. (1999). Review of Quantitative Finance and Accounting (41) RePEc:kap:rqfnac:v:15:y:2000:i:2:p:169-85

Managerial Ownership and Accounting Disclosures: An Empirical Study. (2000). Review of Quantitative Finance and Accounting (42) RePEc:kap:rqfnac:v:17:y:2001:i:3:p:301-18

Empirical Analysis of Stock Returns and Volatility: Evidence from Seven Asian Stock Markets Based on TAR-GARCH Model. (2001). Review of Quantitative Finance and Accounting (43) RePEc:kap:rqfnac:v:6:y:1996:i:2:p:133-47

CVP under Uncertainty and the Managers Utility Function. (1996). Review of Quantitative Finance and Accounting (44) RePEc:kap:rqfnac:v:11:y:1998:i:3:p:269-91

Rationalizable and Coalition Proof Shareholder Tendering Strategies in Corporate Takeovers. (1998). Review of Quantitative Finance and Accounting (45) RePEc:kap:rqfnac:v:15:y:2000:i:1:p:37-55

Are There Sectoral Anomalies Too? The Pitfalls of Unreported Multiple Hypothesis Testing and a Simple Solution. (2000). Review of Quantitative Finance and Accounting (46) RePEc:kap:rqfnac:v:20:y:2003:i:1:p:5-34

Trade-Off Model of Debt Maturity Structure. (2003). Review of Quantitative Finance and Accounting (47) RePEc:kap:rqfnac:v:9:y:1997:i:1:p:71-88

Financial Ratio Adjustment: Industry-Wide Effects or Strategic Management. (1997). Review of Quantitative Finance and Accounting (48) RePEc:kap:rqfnac:v:12:y:1999:i:4:p:341-50

The Determinants of Debt Maturity: The Case of Bank Financing in Singapore. (1999). Review of Quantitative Finance and Accounting (49) RePEc:kap:rqfnac:v:5:y:1995:i:4:p:365-73

The Early Exercise Premia of American Put Options on Stocks. (1995). Review of Quantitative Finance and Accounting (50) RePEc:kap:rqfnac:v:14:y:2000:i:4:p:361-80

A Complete Nonparametric Event Study Approach. (2000). Review of Quantitative Finance and Accounting Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 (1) RePEc:lar:wpaper:2003-02 Contagion effects of successive bond rating downgrades (2003). Laboratoire de Recherche en Gestion et Economie, Université Louis Pasteur, Strasbourg (France) / Working Papers of LaRGE (Laboratoire de Recherche en Latest citations received in: 2002 (1) RePEc:tky:fseres:2002cf171 Concept and Relevance of Income (2002). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series Latest citations received in: 2001 Latest citations received in: 2000 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |