|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

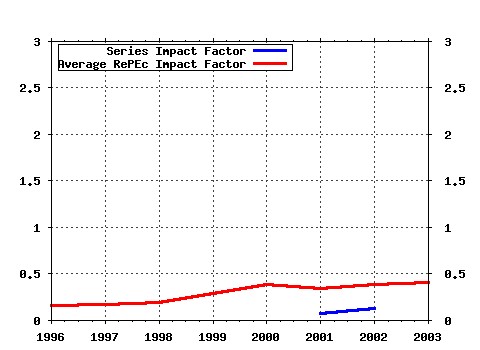

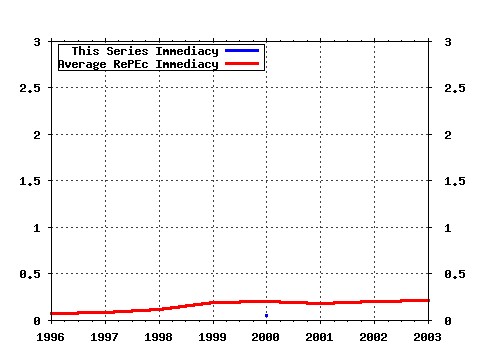

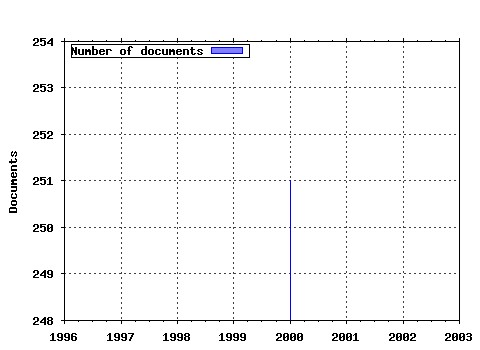

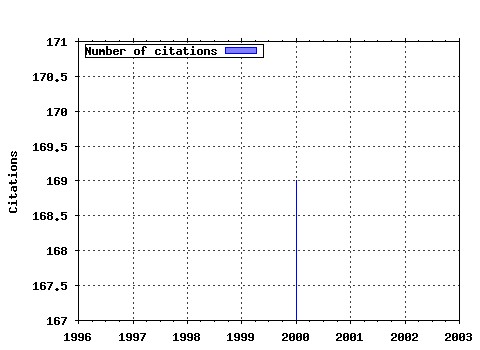

Society for Computational Economics / Computing in Economics and Finance 2000 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf0:134 PREDICTING UK BUSINESS CYCLE REGIMES (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (2) RePEc:sce:scecf0:361 MONETARY POLICY RULES FOR AN OPEN ECONOMY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (3) RePEc:sce:scecf0:92 WHAT WILL HAPPEN TO FINANCIAL MARKETS WHEN THE BABY BOOMERS RETIRE? (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (4) RePEc:sce:scecf0:317 HEDGING HOUSE PRICE RISK WITH INCOMPLETE MARKETS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (5) RePEc:sce:scecf0:186 OPTIMAL MONETARY POLICY IN AN OPEN ECONOMY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (6) RePEc:sce:scecf0:306 OPTIMAL MONETARY POLICY IN A MODEL WITH HABIT FORMATION (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (7) RePEc:sce:scecf0:24 A COMPARISON OF DISCRETE AND PARAMETRIC METHODS FOR CONTINUOUS-STATE DYNAMIC PROGRAMMING PROBLEMS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (8) RePEc:sce:scecf0:320 REQUIEM FOR THE REPRESENTATIVE CONSUMER? AGGREGATE IMPLICATIONS OF MICROECONOMIC CONSUMPTION BEHAVIOR (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (9) RePEc:sce:scecf0:3 EMPLOYMENT AND WELFARE EFFECTS OF A TWO-TIER UNEMPLOYMENT COMPENSATION SYSTEM (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (10) RePEc:sce:scecf0:282 FINANCIAL FRAGILITY, PATTERNS OF FIRMS ENTRY AND EXIT AND AGGREGATE DYNAMICS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (11) RePEc:sce:scecf0:297 PORTFOLIO CHOICE AND LIQUIDITY CONSTRAINTS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (12) RePEc:sce:scecf0:40 NON-PARAMETRIC SPECIFICATION TESTS FOR CONDITIONAL DURATION MODELS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (13) RePEc:sce:scecf0:180 INFLATION TARGETING UNDER POTENTIAL OUTPUT UNCERTAINTY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (14) RePEc:sce:scecf0:145 ADAPTIVE POLAR SAMPLING WITH AN APPLICATION TO A BAYES MEASURE OF VALUE-AT-RISK (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (15) RePEc:sce:scecf0:z133 IPOS AND THE GROWTH OF FIRMS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (16) RePEc:sce:scecf0:299 LEARNING-INDUCED SECURITIES PRICE VOLATILITY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (17) RePEc:sce:scecf0:203 THE PERFORMANCE OF FORECAST-BASED MONETARY POLICY RULES UNDER MODEL UNCERTAINTY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (18) RePEc:sce:scecf0:272 WAS HAYEK AN ACE? (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (19) RePEc:sce:scecf0:346 CAPITAL VERSUS LABOR INCOME TAXATION WITH HETEROGENEOUS AGENTS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (20) RePEc:sce:scecf0:372 THE BUDGETARY AND ECONOMIC CONSEQUENCES OF AGEING IN THE NETHERLANDS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (21) RePEc:sce:scecf0:160 A COMPARATIVE STUDY OF ALTERNATIVE ECONOMETRIC PACKAGES: AN APPLICATION TO ITALIAN DEPOSIT INTEREST RATES (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (22) RePEc:sce:scecf0:303 MONETARY POLICY IN AN ESTIMATED OPTIMIZATION-BASED MODEL WITH STICKY PRICES AND WAGES (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (23) RePEc:sce:scecf0:85 PROFITABILITY AND MARKET STABILITY: FUNDAMENTALS AND TECHNICAL TRADING RULES (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (24) RePEc:sce:scecf0:319 ASSET PRICES AND BUSINESS CYCLES UNDER LIMITED COMMITMENT (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (25) RePEc:sce:scecf0:128 A DYNAMIC MODEL OF LABOR SUPPLY, CONSUMPTION/SAVING, AND ANNUITY DECISIONS UNDER UNCERTAINTY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (26) RePEc:sce:scecf0:318 ENDOGENOUS CREDIT CONSTRAINTS AND HUMAN CAPITAL FORMATION (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (27) RePEc:sce:scecf0:130 INCOMPLETE MARKETS, TRANSITORY SHOCKS AND WELFARE (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (28) RePEc:sce:scecf0:184 AN ENCOMPASSING FRAMEWORK FOR EVALUATING SIMPLE MONETARY POLICY RULES (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (29) RePEc:sce:scecf0:309 EVALUATING REAL BUSINESS CYCLE MODELS USING LIKELIHOOD METHODS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (30) RePEc:sce:scecf0:107 FOREIGN AID AND THE BUSINESS CYCLE (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (31) RePEc:sce:scecf0:276 A DECENTRALIZED AGENT-BASED PLATFORM FOR AUTOMATED TRADE AND ITS SIMULATION (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (32) RePEc:sce:scecf0:349 THE IMPORTANCE OF THE NUMBER OF DIFFERENT AGENTS IN A HETEROGENEOUS ASSET-PRICING MODEL (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (33) RePEc:sce:scecf0:253 MACROECONOMIC EFFECTS OF SECTORAL SHOCKS IN US, UK AND GERMANY: A BVAR-GARCH-M APPROACH (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (34) RePEc:sce:scecf0:338 TOWARD AN INTEGRATION OF SOCIAL LEARNING AND INDIVIDUAL LEARNING IN AGENT-BASED COMPUTATIONAL STOCK MARKETS:THE APPROACH BASED ON POPULATION GENETIC PROGRAMMING (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (35) RePEc:sce:scecf0:142 A SYSTEMATIC COMPARISON OF ALTERNATIVE LINEAR RATIONAL EXPECTATION MODEL SOLUTION TECHNIQUES (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (36) RePEc:sce:scecf0:132 THIS IS WHAT THE LEADING INDICATORS LEAD (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (37) RePEc:sce:scecf0:289 HEURISTIC APPROACHES FOR PORTFOLIO OPTIMIZATION (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (38) RePEc:sce:scecf0:58 TESTING THE PRICING-TO-MARKET HYPOTHESIS CASE OF THE TRANSPORTATION EQUIPMENT INDUSTRY (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (39) RePEc:sce:scecf0:202 THE FED IS NOT AS IGNORANT AS YOU THINK (2000). Society for Computational Economics / Computing in Economics and Finance 2000 (40) RePEc:sce:scecf0:284 THE EVOLUTION OF INDUSTRIAL CLUSTERS- SIMULATING SPATIAL DYNAMICS (2000). Society for Computational Economics / Computing in Economics and Finance 2000 Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Latest citations received in: 2000 (1) RePEc:asu:wpaper:2133377 Convergence Properties of Policy Iteration (2000). Department of Economics, W. P. Carey School of Business, Arizona State University / Working Papers (2) RePEc:boc:bocoec:466 Alternative Monetary Rules for a Small Open Economy: The Case of Canada (2000). Boston College Department of Economics / Boston College Working Papers in Economics (3) RePEc:cla:uclaol:300 Housing Collateral, Consumption Insurance and Risk Premia: an Empirical Perspective (joint with Stijn Van Nieuwerburgh), forthcoming Journal of Finance (2000). UCLA Department of Economics / UCLA Economics Online Papers (4) RePEc:cre:crefwp:124 Magnitude X on the Richter Scale: Welfare Cost of Business Cycles in Developing Countries (2000). CREFE, Université du Québec à Montréal / Cahiers de recherche CREFE / CREFE Working Papers (5) RePEc:dgr:eureir:2000206 On the variation of hedging decisions in daily currency risk management (2000). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (6) RePEc:ecm:wc2000:0953 Predicting UK Business Cycle Regimes (2000). Econometric Society / Econometric Society World Congress 2000 Contributed Papers (7) RePEc:fip:fedhwp:wp-00-2 The effects of health, wealth, and wages on labor supply and retirement behavior (2000). Federal Reserve Bank of Chicago / Working Paper Series (8) RePEc:man:cgbcrp:02 Predicting UK Business Cycle Regimes (2000). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (9) RePEc:nsr:niesrd:168 Choosing the regime: macroeconomic effects of UK entry into EMU (2000). National Institute of Economic and Social Research / NIESR Discussion Papers (10) RePEc:nwu:cmsems:1285 Incomplete Markets, Transitory Shocks, and Welfare (2000). Northwestern University, Center for Mathematical Studies in Economics and Management Science / Discussion Papers (11) RePEc:sce:cplx03:06 MACRO AND MICRO DYNAMICS IN AN ARTIFICIAL SOCIETY: AN AGENT BASED APPROACH (2000). Society for Computational Economics / Modeling, Computing, and Mastering Complexity 2003 (12) RePEc:wop:safiwp:00-12-069 The Price Dynamics of Common Trading Strategies (2000). Santa Fe Institute / Working Papers (13) RePEc:xrs:gkwopa:1999-10 Optimal Capital Income Taxation and Redistribution (2000). Post Graduate Programme Allocation on Financial Markets, University of Mannheim / GK working paper series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |