|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

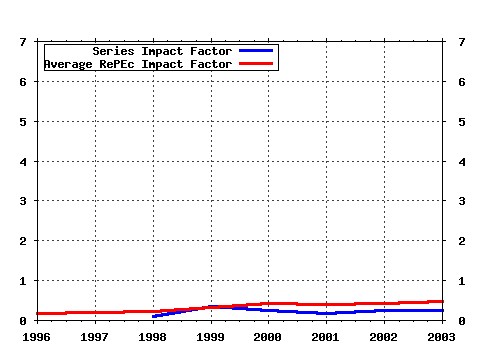

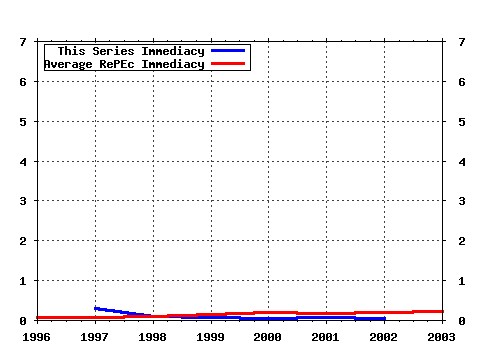

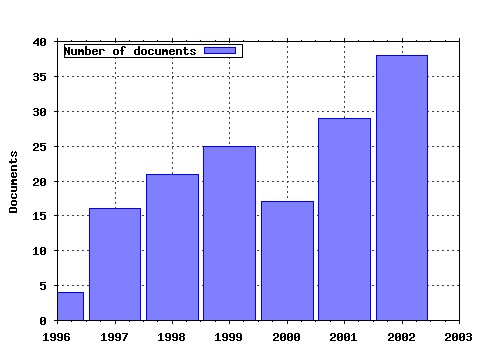

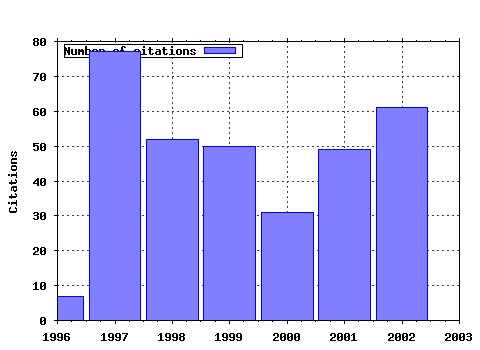

Finance and Stochastics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:spr:finsto:v:1:y:1997:i:4:p:293-330 LIBOR and swap market models and measures (*) (1997). Finance and Stochastics (2) RePEc:spr:finsto:v:1:y:1997:i:2:p:95-129 From the birds eye to the microscope: A survey of new stylized facts of the intra-daily foreign exchange markets (*) (1997). Finance and Stochastics (3) RePEc:spr:finsto:v:6:y:2002:i:4:p:429-447 Convex measures of risk and trading constraints (2002). Finance and Stochastics (4) RePEc:spr:finsto:v:1:y:1997:i:4:p:261-291 Continuous-time term structure models: Forward measure approach (*) (1997). Finance and Stochastics (5) RePEc:spr:finsto:v:2:y:1998:i:4:p:409-440 Optimization of consumption with labor income (1998). Finance and Stochastics (6) RePEc:spr:finsto:v:5:y:2001:i:3:p:327-341 The numeraire portfolio for unbounded semimartingales (2001). Finance and Stochastics (7) RePEc:spr:finsto:v:3:y:1999:i:4:p:451-482 On dynamic measures of risk (1999). Finance and Stochastics (8) RePEc:spr:finsto:v:6:y:2002:i:1:p:49-61 Fourier series method for measurement of multivariate volatilities (2002). Finance and Stochastics (9) RePEc:spr:finsto:v:2:y:1998:i:3:p:295-310 Optimal time to invest when the price processes are geometric Brownian motions (1998). Finance and Stochastics (10) RePEc:spr:finsto:v:1:y:1996:i:1:p:69-89 Irreversible investment and industry equilibrium (*) (1996). Finance and Stochastics (11) RePEc:spr:finsto:v:2:y:1998:i:2:p:143-172 Asymptotic arbitrage in large financial markets (1998). Finance and Stochastics (12) RePEc:spr:finsto:v:1:y:1997:i:2:p:131-140 On the range of options prices (*) (1997). Finance and Stochastics (13) RePEc:spr:finsto:v:5:y:2001:i:2:p:237-257 Forward rate dependent Markovian transformations of the Heath-Jarrow-Morton term structure model (2001). Finance and Stochastics (14) RePEc:spr:finsto:v:6:y:2002:i:4:p:449-471 An analysis of a least squares regression method for American option pricing (2002). Finance and Stochastics (15) RePEc:spr:finsto:v:3:y:1999:i:4:p:413-432 Minimal realizations of interest rate models (1999). Finance and Stochastics (16) RePEc:spr:finsto:v:4:y:2000:i:2:p:117-146 Efficient hedging: Cost versus shortfall risk (2000). Finance and Stochastics (17) RePEc:spr:finsto:v:3:y:1999:i:3:p:251-273 Quantile hedging (1999). Finance and Stochastics (18) RePEc:spr:finsto:v:3:y:1999:i:4:p:391-412 Applications of Malliavin calculus to Monte Carlo methods in finance (1999). Finance and Stochastics (19) RePEc:spr:finsto:v:3:y:1999:i:2:p:237-248 Hedging and liquidation under transaction costs in currency markets (1999). Finance and Stochastics (20) RePEc:spr:finsto:v:5:y:2001:i:1:p:61-82 A solution approach to valuation with unhedgeable risks (2001). Finance and Stochastics (21) RePEc:spr:finsto:v:6:y:2002:i:2:p:173-196 A multicurrency extension of the lognormal interest rate Market Models (2002). Finance and Stochastics (22) RePEc:spr:finsto:v:5:y:2001:i:3:p:389-412 A general characterization of one factor affine term structure models (2001). Finance and Stochastics (23) RePEc:spr:finsto:v:1:y:1997:i:4:p:331-344 Option pricing in the presence of natural boundaries and a quadratic diffusion term (*) (1997). Finance and Stochastics (24) RePEc:spr:finsto:v:4:y:2000:i:1:p:35-68 Arbitrage-free discretization of lognormal forward Libor and swap rate models (1999). Finance and Stochastics (25) RePEc:spr:finsto:v:2:y:1998:i:4:p:349-367 Path dependent options on yields in the affine term structure model (1998). Finance and Stochastics (26) RePEc:spr:finsto:v:5:y:2001:i:2:p:259-272 Utility maximization in incomplete markets with random endowment (2001). Finance and Stochastics (27) RePEc:spr:finsto:v:3:y:1999:i:3:p:345-369 Bounds on prices of contingent claims in an intertemporal economy with proportional transaction costs and general preferences (1999). Finance and Stochastics (28) RePEc:spr:finsto:v:3:y:1999:i:1:p:35-54 A closed-form solution to the problem of super-replication under transaction costs (1998). Finance and Stochastics (29) RePEc:spr:finsto:v:2:y:1998:i:3:p:259-273 Local martingales and the fundamental asset pricing theorems in the discrete-time case (1998). Finance and Stochastics (30) RePEc:spr:finsto:v:4:y:2000:i:4:p:371-389 Bond pricing in a hidden Markov model of the short rate (2000). Finance and Stochastics (31) RePEc:spr:finsto:v:2:y:1998:i:2:p:173-198 Mean-variance hedging for continuous processes: New proofs and examples (1998). Finance and Stochastics (32) RePEc:spr:finsto:v:3:y:1999:i:2:p:227-236 Optimal stopping for a diffusion with jumps (1999). Finance and Stochastics (33) RePEc:spr:finsto:v:2:y:1998:i:2:p:115-141 Perfect option hedging for a large trader (1998). Finance and Stochastics (34) RePEc:spr:finsto:v:4:y:2000:i:2:p:223-250 Irreversible investment problems (2000). Finance and Stochastics (35) RePEc:spr:finsto:v:4:y:2000:i:2:p:189-207 Discrete time option pricing with flexible volatility estimation (2000). Finance and Stochastics (36) RePEc:spr:finsto:v:3:y:1999:i:3:p:295-322 Exercise regions of American options on several assets (1999). Finance and Stochastics (37) RePEc:spr:finsto:v:4:y:2000:i:3:p:343-369 Modelling of stock price changes: A real analysis approach (2000). Finance and Stochastics (38) RePEc:spr:finsto:v:2:y:1997:i:1:p:41-68 Processes of normal inverse Gaussian type (1997). Finance and Stochastics (39) RePEc:spr:finsto:v:4:y:2000:i:2:p:209-222 Incompleteness of markets driven by a mixed diffusion (2000). Finance and Stochastics (40) RePEc:spr:finsto:v:6:y:2002:i:4:p:473-493 Optimal stopping and perpetual options for Lévy processes (2002). Finance and Stochastics (41) RePEc:spr:finsto:v:5:y:2001:i:2:p:131-154 The relaxed investor and parameter uncertainty (2001). Finance and Stochastics (42) RePEc:spr:finsto:v:2:y:1998:i:4:p:369-397 Option pricing with transaction costs and a nonlinear Black-Scholes equation (1998). Finance and Stochastics (43) RePEc:spr:finsto:v:3:y:1999:i:2:p:167-185 A generalization of the mutual fund theorem (1999). Finance and Stochastics (44) RePEc:spr:finsto:v:4:y:2000:i:4:p:465-496 White noise generalizations of the Clark-Haussmann-Ocone theorem with application to mathematical finance (2000). Finance and Stochastics (45) RePEc:spr:finsto:v:5:y:2001:i:4:p:487-509 Existence and structure of stochastic equilibria with intertemporal substitution (2001). Finance and Stochastics (46) RePEc:spr:finsto:v:6:y:2002:i:2:p:237-263 Optimal capital structure and endogenous default (2002). Finance and Stochastics (47) RePEc:spr:finsto:v:4:y:2000:i:4:p:391-408 Markov-functional interest rate models (2000). Finance and Stochastics (48) RePEc:spr:finsto:v:3:y:1999:i:1:p:111-134 Hedging contingent claims on semimartingales (1998). Finance and Stochastics (49) RePEc:spr:finsto:v:5:y:2001:i:3:p:343-355 Fractional Brownian motion, random walks and binary market models (2001). Finance and Stochastics (50) RePEc:spr:finsto:v:6:y:2002:i:1:p:63-90 Stochastic volatility, jumps and hidden time changes (2002). Finance and Stochastics Latest citations received in: | 2003 | 2002 | 2001 | 2000 Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:dgr:kubcen:200299 An irregular grid approach for pricing high-dimensional American options (2002). Tilburg University, Center for Economic Research / Discussion Paper (2) RePEc:uts:rpaper:79 Extracting the Joint Volatility Structure of Foreign Exchange and Interest Rates from Option Prices (2002). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2001 (1) RePEc:uts:rpaper:52 State Variables and the Affine Nature of Markovian HJM Term Structure Models (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (2) RePEc:uts:rpaper:65 On Filtering in Markovian Term Structure Models (An Approximation Approach) (2001). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Latest citations received in: 2000 (1) RePEc:knz:cofedp:0026 Global Adapted Solution of One-Dimensional Backward Stochastic Riccati Equations, with Application to the Mean-Variance Hedging (2000). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |