|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

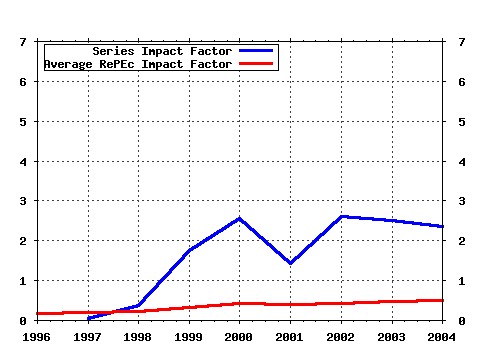

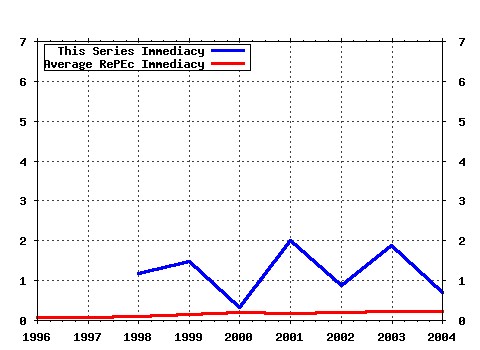

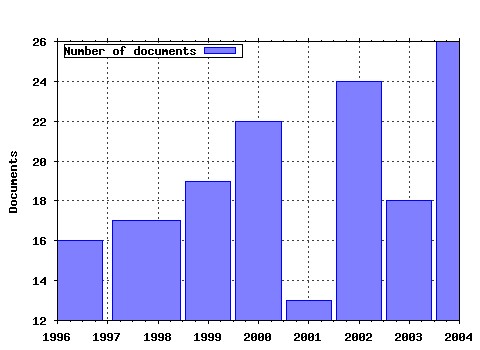

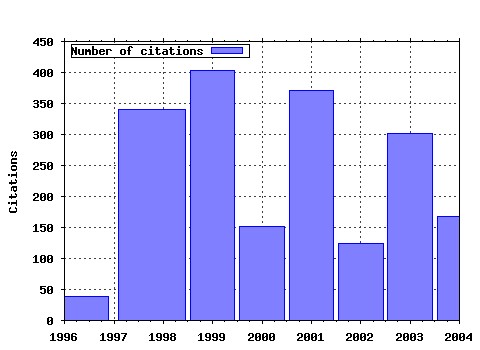

Proceedings Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fip:fedfpr:y:1998:i:mar:x:2 Policy rules for inflation targeting (1998). (2) RePEc:fip:fedfpr:y:1999:x:2 Optimal monetary policy inertia (1999). (3) RePEc:fip:fedfpr:y:2001:i:jun:x:5 Nominal rigidities and the dynamic effects of a shock to monetary policy (2001). (4) RePEc:fip:fedfpr:y:2003:i:nov:x:7 The skill content of recent technological change: an empirical exploration (2003). (5) RePEc:fip:fedfpr:y:2004:i:jun:x:7 On the empirics of Sudden Stops: the relevance of balance-sheet effects (2004). (6) RePEc:fip:fedfpr:y:2003:i:mar:x:4 What does the yield curve tell us about GDP growth? (2003). (7) RePEc:fip:fedfpr:y:1999:i:sep:x:2 Banking and currency crises; how common are twins? (1999). (8) RePEc:fip:fedfpr:y:2005:x:17 International financial adjustment (2005). (9) RePEc:fip:fedfpr:y:1999:x:1 Monetary policy issues for the Eurosystem (1999). (10) RePEc:fip:fedfpr:y:2000:x:4 Near-rationality and inflation in two monetary regimes (2000). (11) RePEc:fip:fedfpr:y:1998:i:mar:x:3 Monetary policy rules in practice (1998). (12) RePEc:fip:fedfpr:y:2003:i:mar:x:8 The excess sensitivity of long-term interest rates: evidence and implications for macroeconomic models (2003). (13) RePEc:fip:fedfpr:y:2005:x:27 Learning about a new technology: pineapple in Ghana (2005). (14) RePEc:fip:fedfpr:y:2003:i:mar:x:5 A joint econometric model of macroeconomic and term structure (2003). (15) RePEc:fip:fedfpr:y:2001:i:mar Forecasting output and inflation: the role of asset prices (2001). (16) RePEc:fip:fedfpr:y:2000:x:3 Indicator variables for optimal policy (2000). (17) RePEc:fip:fedfpr:y:2005:x:14 No-arbitrage Taylor rules (2005). (18) RePEc:fip:fedfpr:y:2001:i:mar:x:2 Simple monetary policy rules and exchange rate uncertainty (2001). (19) RePEc:fip:fedfpr:y:2002:i:mar:x:3 An optimizing model of U.S. wage and price dynamics (2002). (20) RePEc:fip:fedfpr:y:2002:i:mar:x:6 Macroeconomic switching (2002). (21) RePEc:fip:fedfpr:y:2001:i:jun:x:2 Sticky information versus sticky prices: a proposal to replace the new Keynesian Phillips curve (2001). (22) RePEc:fip:fedfpr:y:2001:i:jun:x:1 Optimal fiscal and monetary policy under sticky prices (2001). (23) RePEc:fip:fedfpr:y:2004:i:mar:x:8 A macro-finance model of the term structure, monetary policy, and the economy (2004). (24) RePEc:fip:fedfpr:y:2004:i:mar:x:6 Empirical and policy performance of a forward-looking monetary model (2004). (25) RePEc:fip:fedfpr:y:2003:i:nov:x:5 Relative prices and relative prosperity (2003). (26) RePEc:fip:fedfpr:y:2001:i:mar:x:6 Monetary policy rules for an open economy (2001). (27) RePEc:fip:fedfpr:y:2001:i:mar:x:4 External constraints on monetary policy and the financial accelerator (2001). (28) RePEc:fip:fedfpr:y:2006:x:5 Unemployment fluctuations with staggered Nash wage bargaining (2006). (29) RePEc:fip:fedfpr:y:1998:i:sep:x:1 Liquidity risk, liquidity creation and financial fragility: a theory of banking (1998). (30) RePEc:fip:fedfpr:y:2000:i:apr:x:4 Stock prices and fundamentals (2000). (31) RePEc:fip:fedfpr:y:2003:i:mar:x:2 The case for open-market purchases in a liquidity trap (2003). (32) RePEc:fip:fedfpr:y:2005:i:feb:x:6 The unsustainable U.S. current account position revisited (2005). (33) RePEc:fip:fedfpr:y:2006:i:jun Saving and interest rates in Japan: Why they have fallen and why they will remain low (2006). (34) RePEc:fip:fedfpr:y:2005:x:9 Estimating the effects of fiscal policy in OECD countries (2005). (35) RePEc:fip:fedfpr:y:1980:p:43-104 The financial valuation of the return to capital (1980). (36) RePEc:fip:fedfpr:y:1986:x:8 Agency costs, collateral, and business fluctuations (1986). (37) RePEc:fip:fedfpr:y:1999:x:5 Robust monetary policy under model uncertainty in a small model of the U.S. economy (1999). (38) RePEc:fip:fedfpr:y:2005:x:19 International reserves: precautionary versus mercantilist views, theory and evidence (2005). (39) RePEc:fip:fedfpr:y:2001:i:jun:x:3 Closed and open economy models of business cycles with marked-up and sticky prices (2001). (40) RePEc:fip:fedfpr:y:2000:x:1 The resurgence of growth in the late 1990s: is information technology the story? (2000). (41) RePEc:fip:fedfpr:y:1998:i:mar:x:5 Performance of operational policy rules in an estimated semi-classical structural model (1998). (42) RePEc:fip:fedfpr:y:2002:i:mar:x:5 Inflation dynamics, marginal cost, and the output gap: evidence from three countries (2002). (43) RePEc:fip:fedfpr:y:1999:x:4 A model of the lender of last resort (1999). (44) RePEc:fip:fedfpr:y:1991:i:nov Money and business cycles (1991). (45) RePEc:fip:fedfpr:y:2004:i:mar:x:1 Future prices as risk-adjusted forecasts of monetary policy (2004). (46) RePEc:fip:fedfpr:y:2003:i:nov:x:1 Tracking the new economy: using growth theory to detect changes in trend productivity (2003). (47) RePEc:fip:fedfpr:y:2001:i:mar:x:5 Inflation targeting and the liquidity trap (2001). (48) RePEc:fip:fedfpr:y:2005:x:16 The unsustainable U.S. current account position revisited (2005). (49) RePEc:fip:fedfpr:y:2002:i:mar:x:2 Monetary policy in an estimated stochastic dynamic general equilibrium model of the Euro area (2002). (50) RePEc:fip:fedfpr:y:1999:x:3 Uncertainty and the Taylor rule in a simple model of the Euro-area economy (1999). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:bca:bocawp:04-47 The Monetary Origins of Asymmetric Information in International Equity Markets (2004). Bank of Canada / Working Papers (2) RePEc:cdl:ucsdec:2004-16 Maturity Mismatch and Financial Crises: Evidence from Emerging Market Corporations (2004). Department of Economics, UC San Diego / University of California at San Diego, Economics Working Paper Series (3) RePEc:chb:bcchwp:292 External Conditions and Growth Performance (2004). Central Bank of Chile / Working Papers Central Bank of Chile (4) RePEc:col:000094:001915 A Framework for Macroeconomic Stability in Emerging Market Economies (2004). TITULARIZADORA COLOMBIANA / INFORMES (5) RePEc:ecb:ecbwps:20040322 Modelling inflation in the euro area (2004). European Central Bank / Working Paper Series (6) RePEc:fip:fedawp:2004-37 On the fit and forecasting performance of new Keynesian models (2004). Federal Reserve Bank of Atlanta / Working Paper (7) RePEc:fip:fedawp:2004-38 Policy predictions if the model doesnt fit (2004). Federal Reserve Bank of Atlanta / Working Paper (8) RePEc:fip:fedfap:2004-25 The recent shift in term structure behavior from a no-arbitrage macro-finance perspective (2004). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (9) RePEc:fip:fedgif:808 The information content of forward and futures prices: market expectations and the price of risk (2004). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (10) RePEc:hhs:rbnkwp:0173 Excess Sensitivity and Volatility of Long Interest Rates: The Role of Limited Information in Bond Markets (2004). Sveriges Riksbank (Central Bank of Sweden) / Working Paper Series (11) RePEc:nbr:nberwo:10555 Growth Effects of the Exchange-Rate Regime and the Capital-Account Openness in A Crisis-Prone World Market: A Nuanced View (2004). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:nbr:nberwo:10734 Emerging Market Business Cycles: The Cycle is the Trend (2004). National Bureau of Economic Research, Inc / NBER Working Papers (13) RePEc:nbr:nberwo:10747 Targeting Rules vs. Instrument Rules for Monetary Policy: What is Wrong with McCallum and Nelson? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (14) RePEc:nbr:nberwo:10845 Dollar Shortages and Crises (2004). National Bureau of Economic Research, Inc / NBER Working Papers (15) RePEc:nbr:nberwo:10957 Does Openness to Trade Make Countries More Vulnerable to Sudden Stops, Or Less? Using Gravity to Establish Causality (2004). National Bureau of Economic Research, Inc / NBER Working Papers (16) RePEc:ore:uoecwp:2004-14 Currency Mismatch, Openness and Exchange Rate Regime Choice (2004). University of Oregon Economics Department / University of Oregon Economics Department Working Papers (17) RePEc:ore:uoecwp:2004-15 Exchange Rate Regime Choice and Country Characteristics: an Empirical Investigation into the Role of Openness (2004). University of Oregon Economics Department / University of Oregon Economics Department Working Papers (18) RePEc:zbw:bubdp2:4254 How will Basel II affect bank lending to emerging markets? An analysis based on German bank level data (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Latest citations received in: 2003 (1) RePEc:aea:jecper:v:17:y:2003:i:1:p:155-180 Beyond Incentive Pay: Insiders Estimates of the Value of Complementary Human Resource Management Practices (2003). Journal of Economic Perspectives (2) RePEc:cdl:scciec:1011 Empirical Exchange Rate Models of the Nineties: Are Any Fit to Survive? (2003). Center for International Economics, UC Santa Cruz / Santa Cruz Center for International Economics, Working Paper Series (3) RePEc:cdl:ucscec:1033 Empirical Exchange Rate Models of the Nineties: Are Any Fit to Survive? (2003). Department of Economics, UC Santa Cruz / Santa Cruz Department of Economics, Working Paper Series (4) RePEc:cep:cepdps:dp0604 Lousy and Lovely Jobs: the Rising Polarization of Work in Britain (2003). Centre for Economic Performance, LSE / CEP Discussion Papers (5) RePEc:cfs:cfswop:wp200341 Permanent and Transitory Policy Shocks in an Empirical Macro Model with Asymmetric Information (2003). Center for Financial Studies / CFS Working Paper Series (6) RePEc:cpr:ceprdp:3767 Dynastic Management (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (7) RePEc:cpr:ceprdp:3854 Monopoly Rights can Reduce Income Big Time (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cpr:ceprdp:3902 The Elusive Gains from International Financial Integration (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (9) RePEc:cpr:ceprdp:4096 The Demand for Coordination (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (10) RePEc:cpr:ceprdp:4111 Optimal Monetary Policy Under Commitment with a Zero Bound on Nominal Interest Rates (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:4147 Job Tenure, Wages and Technology: A Reassessment Using Matched Worker-Firm Panel Data (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:eti:dpaper:03022 Deflation Caused by Bank Insolvency (2003). Research Institute of Economy, Trade and Industry (RIETI) / Discussion papers (13) RePEc:fip:fedbwp:03-3 Diversification and development (2003). Federal Reserve Bank of Boston / Working Papers (14) RePEc:fip:fedfap:2003-04 Importing technology (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (15) RePEc:fip:fedfap:2003-17 A macro-finance model of the term structure, monetary policy, and the economy (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (16) RePEc:fip:fedfap:2003-18 The macroeconomy and the yield curve: a nonstructural analysis (2003). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (17) RePEc:fip:fedgfe:2003-55 Central bank talk: does it matter and why? (2003). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (18) RePEc:fip:fedgif:784 The high-frequency response of exchange rates and interest rates to macroeconomic announcements (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (19) RePEc:fip:fedhwp:wp-03-15 Measuring productivity growth in Asia: do market imperfections matter? (2003). Federal Reserve Bank of Chicago / Working Paper Series (20) RePEc:fip:fedkrw:rwp03-09 Permanent and transitory policy shocks in an empirical macro model with asymmetric information (2003). Federal Reserve Bank of Kansas City / Research Working Paper (21) RePEc:fip:fedpwp:04-1 Local, open economies within the U.S.: how do industries respond to immigration? (2003). Federal Reserve Bank of Philadelphia / Working Papers (22) RePEc:kud:epruwp:03-18 Do Exchange Rates Respond to Day-to-Day Changes in Monetary Policy Expectations? Evidence from the Federal Funds Futures Market. (2003). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics (formerly Institute of Economics) / EPRU Working Paper Series (23) RePEc:lev:wrkpap:380 How Long Can the U.S. Consumers Carry the Economy on Their Shoulders? (2003). Levy Economics Institute, The / Economics Working Paper Archive (24) RePEc:nbr:nberwo:10056 The Demand for Coordination (2003). National Bureau of Economic Research, Inc / NBER Working Papers (25) RePEc:nbr:nberwo:10195 Escaping from a Liquidity Trap and Deflation: The Foolproof Way and Others (2003). National Bureau of Economic Research, Inc / NBER Working Papers (26) RePEc:nbr:nberwo:9442 Dynastic Management (2003). National Bureau of Economic Research, Inc / NBER Working Papers (27) RePEc:nsr:niesrd:222 Skill Heterogeneity and Equilibrium Unemployment (2003). National Institute of Economic and Social Research / NIESR Discussion Papers (28) RePEc:nzt:nztwps:03/31 Competition Policy in Small Distant Open Economies: Some Lessons from the Economics Literature (2003). New Zealand Treasury / Treasury Working Paper Series (29) RePEc:pen:papers:03-034 TRIPS, externalities, trade agreements, hostages (2003). Penn Institute for Economic Research, Department of Economics, University of Pennsylvania / PIER Working Paper Archive (30) RePEc:tor:tecipa:diegor-03-01 Agriculture and Aggregate Productivity: A Quantitative Cross-Country Analysis (2003). University of Toronto, Department of Economics / Working Papers (31) RePEc:wpa:wuwpgt:0306003 How Long Can the U.S. Consumers Carry the economy on Their Shoulders? (2003). EconWPA / General Economics and Teaching (32) RePEc:wpa:wuwpma:0304001 Entry Costs, Intermediation, and Capital Flows (2003). EconWPA / Macroeconomics (33) RePEc:wpa:wuwpmi:0312004 Incentives and spillovers in R&D activities: an agency-theoretic analysis of industry-university relations (2003). EconWPA / Microeconomics (34) RePEc:zbw:zewdip:1680 IT, Organizational Change and Wages (2003). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Latest citations received in: 2002 (1) RePEc:cpr:ceprdp:3212 Markups, Gaps and the Welfare Costs of Business Fluctuations (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:cpr:ceprdp:3458 Monetary Policy and Stagflation in the UK (2002). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:ecb:ecbwps:20020128 Openness: imperfect exchange rate pass-through and monetary policy. (2002). European Central Bank / Working Paper Series (4) RePEc:ecb:ecbwps:20020181 Inflation dynamics and international linkages: a model of the United States, the euro area and Japan. (2002). European Central Bank / Working Paper Series (5) RePEc:fip:fedawp:2002-19 Modest policy interventions (2002). Federal Reserve Bank of Atlanta / Working Paper (6) RePEc:fip:fedfpb:02-07 Post-crisis exchange rate policy in five Asian countries: filling in the hollow middle? (2002). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (7) RePEc:fip:fedfpb:02-11 Loans to Japanese borrowers (2002). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (8) RePEc:fip:fedfpr:y:2002:i:mar:x:3 An optimizing model of U.S. wage and price dynamics (2002). Proceedings (9) RePEc:fip:fedfpr:y:2002:i:mar:x:4 Should monetary policy target labors share of income? (2002). Proceedings (10) RePEc:fip:fedfpr:y:2002:i:mar:x:5 Inflation dynamics, marginal cost, and the output gap: evidence from three countries (2002). Proceedings (11) RePEc:fip:fedgif:745 Inflation dynamics and international linkages: a model of the United States, the euro area, and Japan (2002). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (12) RePEc:fip:fedgif:749 Inflation persistence and optimal monetary policy in the euro area (2002). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (13) RePEc:fip:fedlwp:2002-018 Modeling Volcker as a non-absorbing state: agnostic identification of a Markov-switching VAR (2002). Federal Reserve Bank of St. Louis / Working Papers (14) RePEc:fip:fedpwp:02-13 Self-fulfilling expectations and the inflation of the 1970s: evidence from the Livingston Survey (2002). Federal Reserve Bank of Philadelphia / Working Papers (15) RePEc:hhs:bofrdp:2002_020 Inflation dynamics in the euro area and the role of expectations (2002). Bank of Finland / Research Discussion Papers (16) RePEc:iae:iaewps:wp2002n21 Regime Switches in GDP Growth and Volatility: Some International Evidence and Implications for Modelling Business Cycles (2002). Melbourne Institute of Applied Economic and Social Research, The University of Melbourne / Melbourne Institute Working Paper Series (17) RePEc:nbb:reswpp:200203 Openness, imperfect exchange rate pass-through and monetary policy (2002). National Bank of Belgium / Research series (18) RePEc:nbr:nberwo:8850 Markups, Gaps, and the Welfare Costs of Business Fluctuations (2002). National Bureau of Economic Research, Inc / NBER Working Papers (19) RePEc:nbr:nberwo:9192 Modest Policy Interventions (2002). National Bureau of Economic Research, Inc / NBER Working Papers (20) RePEc:oxf:wpaper:108 Monetary Policy with an Endogenous Capital Stock when Inflation is Persistent (2002). University of Oxford, Department of Economics / Economics Series Working Papers (21) RePEc:oxf:wpaper:109 New Keynesian Microfundations Revisited: A Generalised Calvo-Taylor Model and the Desirability of Inflation vs. Price Level Targeting (2002). University of Oxford, Department of Economics / Economics Series Working Papers Latest citations received in: 2001 (1) RePEc:cpr:ceprdp:2874 Exchange Rates and Monetary Policy in Emerging Market Economies (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:cpr:ceprdp:2923 The Liquidity Trap in an Open Economy (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:cpr:ceprdp:2942 Optimal Fiscal and Monetary Policy Under Sticky Prices (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:cpr:ceprdp:3047 What Does the UKs Monetary Policy and Inflation Experience Tell Us About the Transmission Mechanism? (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:cre:crefwp:137 An Econometric U.S. Business Cycle Model with Nominal and Real Rigidities (2001). CREFE, Université du Québec à Montréal / Cahiers de recherche CREFE / CREFE Working Papers (6) RePEc:cre:crefwp:145 Input-Output Structure and Nominal Staggering: The Persistence Problem Revisited (2001). CREFE, Université du Québec à Montréal / Cahiers de recherche CREFE / CREFE Working Papers (7) RePEc:fip:fedcwp:0116 Taylor rules in a model that satisfies the natural rate hypothesis (2001). Federal Reserve Bank of Cleveland / Working Paper (8) RePEc:fip:fedfap:2001-09 Optimal policy in rational-expectations models: new solution algorithms (2001). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (9) RePEc:fip:fedfpb:01-05 Structural changes and the scope of inflation targeting in Korea (2001). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (10) RePEc:fip:fedfpr:y:2001:i:jun:x:2 Sticky information versus sticky prices: a proposal to replace the new Keynesian Phillips curve (2001). Proceedings (11) RePEc:fip:fedgfe:2001-30 New tests of the new-Keynesian Phillips curve (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (12) RePEc:fip:fedkpr:y:2001:p:297-370 Monetary policy in the information economy (2001). Proceedings (13) RePEc:fip:fedkrw:rwp01-12 Implications of real-time data for forecasting and modeling expectations (2001). Federal Reserve Bank of Kansas City / Research Working Paper (14) RePEc:fip:fedpwp:01-12 Expectations and the effects of monetary policy (2001). Federal Reserve Bank of Philadelphia / Working Papers (15) RePEc:hhs:hastef:0478 Incomplete Exchange Rate Pass-Through and Simple Monetary Policy Rules (2001). Stockholm School of Economics / Working Paper Series in Economics and Finance (16) RePEc:hhs:osloec:2001_009 A note on inflation persistence (2001). Oslo University, Department of Economics / Memorandum (17) RePEc:ihs:ihsesp:95 Interest Rate Policy and the Price Puzzle in a Quantitative Business Cycle Model (2001). Institute for Advanced Studies / Economics Series (18) RePEc:mpc:wpaper:05 Monetary Policy for an Open Economy: An Alternative Framework with Optimising Agents and Sticky Prices (2001). Monetary Policy Committee Unit, Bank of England / Discussion Papers (19) RePEc:mpc:wpaper:06 The Lag from Monetary Policy Actions to Inflation: Friedman Revisited (2001). Monetary Policy Committee Unit, Bank of England / Discussion Papers (20) RePEc:nbr:nberwo:8428 A Vertical Analysis of Crises and Intervention: Fear of Floating and Ex-ante Problems (2001). National Bureau of Economic Research, Inc / NBER Working Papers (21) RePEc:nbr:nberwo:8614 Sticky Information: A Model of Monetary Nonneutrality and Structural Slumps (2001). National Bureau of Economic Research, Inc / NBER Working Papers (22) RePEc:nbr:nberwo:8690 A Note on Inflation Persistence (2001). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:rut:rutres:200105 Optimal Fiscal and Monetary Policy Under Sticky Prices (2001). Rutgers University, Department of Economics / Departmental Working Papers (24) RePEc:tcd:tcdceg:20017 Exchange Rates and Monetary Policy in Emerging Market Economies (2001). Trinity College Dublin, Department of Economics / CEG Working Papers (25) RePEc:tcd:tcduee:200111 Exchange Rates and Monetary Policy in Emerging Market Economies (2001). Trinity College Dublin, Department of Economics / Trinity Economics Papers (26) RePEc:upf:upfgen:170 Optimal Taxation without State-Contingent Debt (2001). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |