|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

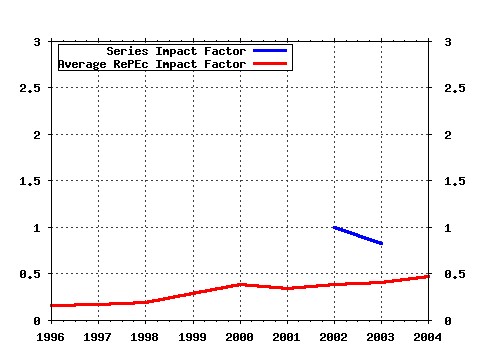

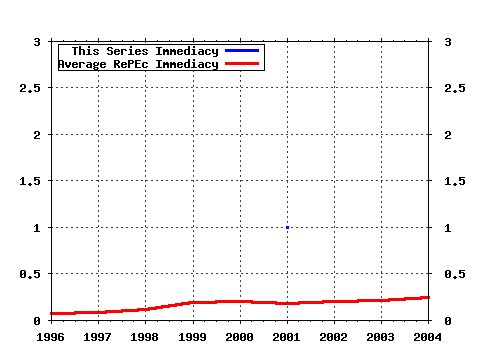

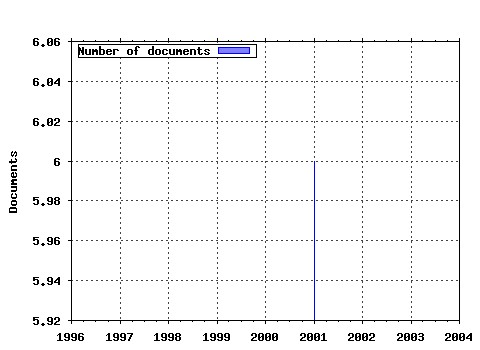

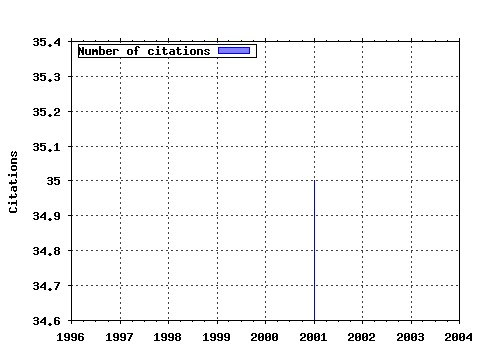

Manitoba - Department of Economics / Manitoba - Department of Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:manito:34 Variable Selection for Portfolio Choice. (2001). (2) RePEc:fth:manito:32 Portfolio Diversification: Alive and well In Euroland. (2001). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 (1) RePEc:cdl:anderf:1003 Dynamic Portfolio Choice: A Simulation Approach (2001). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (2) RePEc:cpr:ceprdp:3070 A Multivariate Model of Strategic Asset Allocation (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:cte:wbrepe:wb012308 OPTIMAL DEMAND FOR LONG-TERM BONDS WHEN RETURNS ARE PREDICTABLE (2001). Universidad Carlos III, Departamento de Economía de la Empresa / Business Economics Working Papers (4) RePEc:may:mayecw:n1080301 A Risk Management Approach to Optimal Asset Allocation (2001). Department of Economics, National University of Ireland - Maynooth / Economics Department Working Paper Series (5) RePEc:nbr:nberwo:8566 A Multivariate Model of Strategic Asset Allocation (2001). National Bureau of Economic Research, Inc / NBER Working Papers (6) RePEc:wop:safiwp:01-11-064 Decisionmetrics: A Decision-Based Approach to Econometric Modeling (2001). Santa Fe Institute / Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |