|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

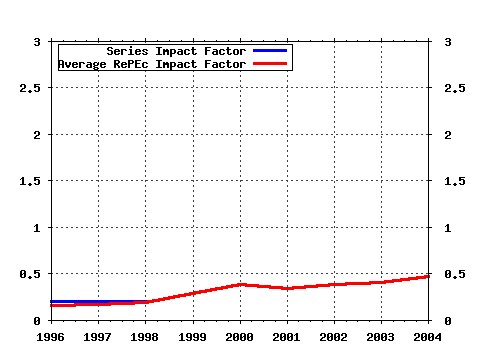

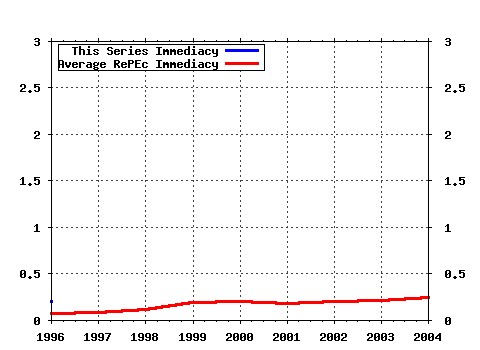

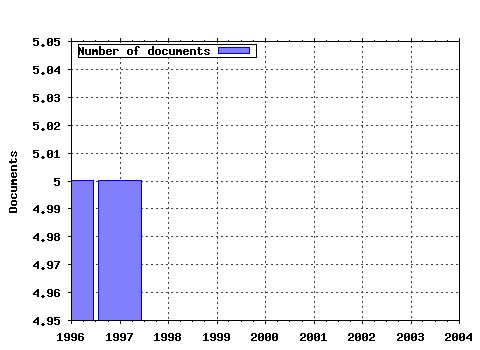

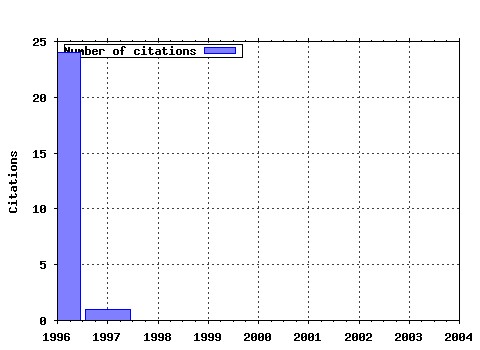

Rochester, Business - Financial Research and Policy Studies / Rochester, Business - Financial Research and Policy Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:robufr:91-02 The Effects of Board Composition and Direct Incentives on Firm Performance. (1991). (2) RePEc:fth:robufr:96-02 Approximating the Asset Pricing Kernel. (1996). (3) RePEc:fth:robufr:96-01 A Market-Based Evaluation of Discretionary-Accrual Models. (1996). (4) RePEc:fth:robufr:96-03 The Incentives to Hedge. (1996). (5) RePEc:fth:robufr:92-02 The Investment Oppotunity set and Corporate Financing, Dividend and Compensation Policies. (1992). (6) RePEc:fth:robufr:95-04 The Value of Labor Force Flexibility. (1995). (7) RePEc:fth:robufr:95-02 Corporate Leadership Structure: On the Separation of the Positions of CEO and Chairman of the Board. (1995). (8) RePEc:fth:robufr:92-09 The Life-Cycle of Competitive Industry. (1992). (9) RePEc:fth:robufr:97-06 Economics, Demography and Communication. (1997). (10) RePEc:fth:robufr:92-10 Price-Earnings Regressions in the Presence of prices Leading Earnings: Earnings Level Versus Change Specifications and Alternative Deflators. (1992). (11) RePEc:fth:robufr:92-08 Competitive Diffusion. (1991). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |