|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

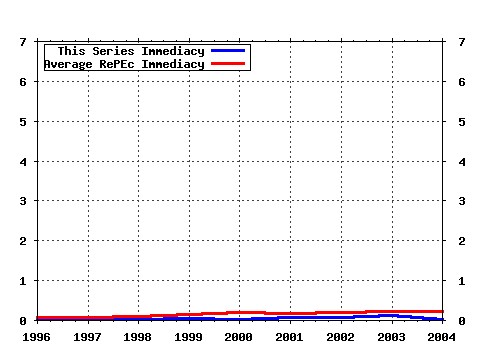

The Journal of Real Estate Finance and Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:jrefec:v:17:y:1998:i:1:p:99-121 A Generalized Spatial Two-Stage Least Squares Procedure for Estimating a Spatial Autoregressive Model with Autoregressive Disturbances. (1998). (2) RePEc:kap:jrefec:v:4:y:1991:i:2:p:175-90 Risk and Return in Real Estate. (1991). (3) RePEc:kap:jrefec:v:6:y:1993:i:3:p:201-22 The Single Family Home in the Investment Portfolio. (1993). (4) RePEc:kap:jrefec:v:15:y:1997:i:2:p:159-80 Consumption and Investment Motives and the Portfolio Choices of Homeowners. (1997). (5) RePEc:kap:jrefec:v:5:y:1992:i:4:p:401-18 The Predictability of Returns on Equity REITs and Their Co-movement with Other Assets. (1992). (6) RePEc:kap:jrefec:v:18:y:1999:i:1:p:9-23 Why Dont We Know More about Housing Supply? (1999). (7) RePEc:kap:jrefec:v:5:y:1992:i:4:p:357-74 Estimating Price Trends for Residential Property: A Comparison of Repeat Sales and Assessed Value Methods. (1992). (8) RePEc:kap:jrefec:v:14:y:1997:i:1-2:p:33-50 Sample Selection Bias and Repeat-Sales Index Estimates. (1997). (9) RePEc:kap:jrefec:v:10:y:1995:i:2:p:95-119 The Persistence of Real Estate Cycles. (1995). (10) RePEc:kap:jrefec:v:17:y:1998:i:1:p:5-13 Spatial Statistics and Real Estate. (1998). (11) RePEc:kap:jrefec:v:4:y:1991:i:2:p:191-208 Real Estate Development as an Option. (1991). (12) RePEc:kap:jrefec:v:9:y:1994:i:3:p:197-215 Bias in Estimates of Discrimination and Default in Mortgage Lending: The Effects of Simultaneity and Self-Selection. (1994). (13) RePEc:kap:jrefec:v:9:y:1994:i:3:p:263-94 Race, Redlining, and Residential Mortgage Loan Performance. (1994). (14) RePEc:kap:jrefec:v:7:y:1993:i:1:p:5-16 Inter-store Externalities and Space Allocation in Shopping Centers. (1993). (15) RePEc:kap:jrefec:v:4:y:1991:i:3:p:327-45 Smoothing in Appraisal-Based Returns. (1991). (16) RePEc:kap:jrefec:v:2:y:1989:i:2:p:101-15 The Impact of the Agencies on Conventional Fixed-Rate Mortgage Yields. (1989). (17) RePEc:kap:jrefec:v:20:y:2000:i:3:p:251-74 Mortgage Default with Asymmetric Information. (2000). (18) RePEc:kap:jrefec:v:23:y:2001:i:3:p:337-63 Credit Scoring and Mortgage Securitization: Implications for Mortgage Rates and Credit Availability. (2001). (19) RePEc:kap:jrefec:v:2:y:1989:i:1:p:47-60 The Effect of Real Rates of Interest on Housing Prices. (1989). (20) RePEc:kap:jrefec:v:19:y:1999:i:1:p:21-47 Home Equity Insurance. (1999). (21) RePEc:kap:jrefec:v:3:y:1990:i:3:p:261-82 The Integration of the Real Estate Market and the Stock Market: Some Preliminary Evidence. (1990). (22) RePEc:kap:jrefec:v:25:y:2002:i:2-3:p:129-50 Measuring Potential GSE Funding Advantages. (2002). (23) RePEc:kap:jrefec:v:2:y:1989:i:1:p:5-30 Housing Vacancies, Thin Markets, and Idiosyncratic Tastes. (1989). (24) RePEc:kap:jrefec:v:5:y:1992:i:3:p:255-67 Timing of Bids at Pooled Real Estate Auctions. (1992). (25) RePEc:kap:jrefec:v:9:y:1994:i:2:p:137-64 Value Indices of Commercial Real Estate: A Comparison of Index Construction Methods. (1994). (26) RePEc:kap:jrefec:v:16:y:1998:i:1:p:55-73 Pricing Residential Amenities: The Value of a View. (1998). (27) RePEc:kap:jrefec:v:12:y:1996:i:1:p:37-58 The Effects of Environmental Liability on Industrial Real Estate Development. (1996). (28) RePEc:kap:jrefec:v:17:y:1998:i:1:p:61-85 Analysis of Spatial Autocorrelation in House Prices. (1998). (29) RePEc:kap:jrefec:v:17:y:1998:i:2:p:179-97 The Dynamic Impact of Macroeconomic Aggregates on Housing Prices and Stock of Houses: A National and Regional Analysis. (1998). (30) RePEc:kap:jrefec:v:25:y:2002:i:2-3:p:243-67 The Role of Interest Rates in Influencing Long-Run Homeownership Rates. (2002). (31) RePEc:kap:jrefec:v:8:y:1994:i:3:p:259-66 Order and Price in a Sequential Auction. (1994). (32) RePEc:kap:jrefec:v:20:y:2000:i:2:p:177-94 Further Evidence on the Integration of REIT, Bond, and Stock Returns. (2000). (33) RePEc:kap:jrefec:v:27:y:2003:i:3:p:279-301 Credit History and the Performance of Prime and Nonprime Mortgages. (2003). (34) RePEc:kap:jrefec:v:10:y:1995:i:3:p:225-59 Real Estate Is Not Normal: A Fresh Look at Real Estate Return Distributions. (1995). (35) RePEc:kap:jrefec:v:14:y:1997:i:1-2:p:203-22 Spatial Dependence and House Price Index Construction. (1997). (36) RePEc:kap:jrefec:v:13:y:1996:i:1:p:57-70 The Cultural Affinity Hypothesis and Mortgage Lending Decisions. (1996). (37) RePEc:kap:jrefec:v:17:y:1998:i:1:p:35-59 Predicting House Prices Using Multiple Listings Data. (1998). (38) RePEc:kap:jrefec:v:13:y:1996:i:1:p:27-43 Putting the Squeeze on a Market for Lemons: Government-Sponsored Mortgage Securitization. (1996). (39) RePEc:kap:jrefec:v:13:y:1996:i:2:p:121-42 Real Estate Return Correlations: Real-World Limitations on Relationships Inferred from NCREIF Data. (1996). (40) RePEc:kap:jrefec:v:12:y:1996:i:2:p:221-34 Zoning and Fiscal Interdependencies. (1996). (41) RePEc:kap:jrefec:v:29:y:2004:i:4:p:393-410 The Neighborhood Distribution of Subprime Mortgage Lending (2004). (42) RePEc:kap:jrefec:v:29:y:2004:i:3:p:341-354 Real Estate Versus Financial Wealth in Consumption (2004). (43) RePEc:kap:jrefec:v:14:y:1997:i:1-2:p:51-73 The Construction of Residential Housing Price Indices: A Comparison of Repeat-Sales, Hedonic-Regression and Hybrid Approaches. (1997). (44) RePEc:kap:jrefec:v:4:y:1991:i:2:p:127-46 Price Formation and the Appraisal Function in Real Estate Markets. (1991). (45) RePEc:kap:jrefec:v:11:y:1995:i:2:p:99-117 Explicit Tests of Contingent Claims Models of Mortgage Default. (1995). (46) RePEc:kap:jrefec:v:22:y:2001:i:2-3:p:319-37 The Benefits of Visibility Improvement: New Evidence from the Los Angeles Metropolitan Area. (2001). (47) RePEc:kap:jrefec:v:5:y:1992:i:2:p:197-217 Microfoundations of a Mortgage Prepayment Function. (1992). (48) RePEc:kap:jrefec:v:14:y:1997:i:1-2:p:173-87 Frequency of Transaction and House Price Modeling. (1997). (49) RePEc:kap:jrefec:v:25:y:2002:i:2-3:p:173-95 The Effects of Purchases of Mortgages and Securitization By Government Sponsored Enterprises on Mortgage Yield Spreads and Volatility. (2002). (50) RePEc:kap:jrefec:v:19:y:1999:i:2:p:147-59 Differences in the Cost of Mortgage Credit Implications for Discrimination. (1999). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:fip:fedgfe:2004-50 The long-run relationship between house prices and rents (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series Latest citations received in: 2003 (1) RePEc:cdl:anderf:1109 Term Structure Estimation in Low-Frequency Transaction Markets: A Kalman Filter Approach with Incomplete Panel-Data (2003). Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management (2) RePEc:cpp:issued:v:29:y:2003:i:2:p:213-225 Intertenancy Rent Decontrol in Ontario (2003). Canadian Public Policy (3) RePEc:fip:fedgwp:1 Loss characteristics of commercial real estate loan portfolios (2003). Board of Governors of the Federal Reserve System (U.S.) / Basel II White Paper (4) RePEc:vpi:wpaper:e07-5 A Framework for Assessing the Value of Downtown Land (2003). Virginia Polytechnic Institute and State University, Department of Economics / Working Papers Latest citations received in: 2002 (1) RePEc:dgr:uvatin:20020003 Residential Mobility and Local Housing Market Differences (2002). Tinbergen Institute / Tinbergen Institute Discussion Papers (2) RePEc:hhs:sifrwp:0007 What Factors Determine International Real Estate Security Returns? (2002). Swedish Institute for Financial Research / SIFR Research Report Series Latest citations received in: 2001 (1) RePEc:fip:fedgfe:2001-26 GSEs, mortgage rates, and the long-run effects of mortgage securitization (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (2) RePEc:wop:wisule:01-4 NIMBYs and Knowledge: Urban Regulation and the New Economy (2001). University of Wisconsin Center for Urban Land Economic Research / Wisconsin-Madison CULER working papers (3) RePEc:wop:wisule:01-6 NIMBYs and Knowledge: Urban Regulation and the New Economy (2001). University of Wisconsin Center for Urban Land Economic Research / Wisconsin-Madison CULER working papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |