|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

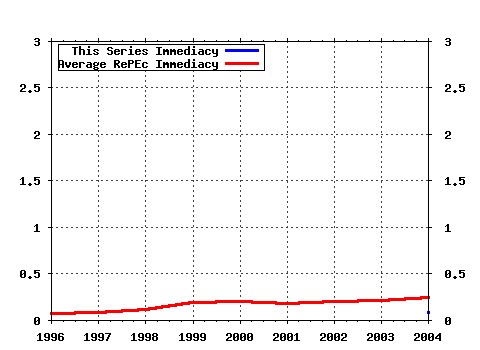

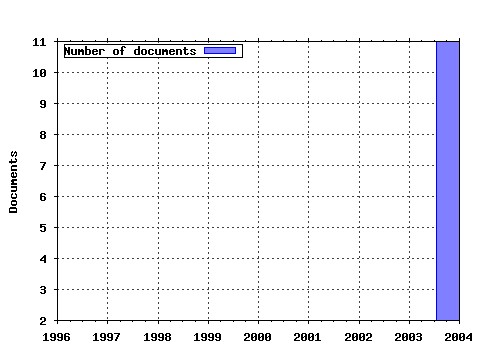

University of Copenhagen. Institute of Economics. Finance Research Unit / FRU Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kud:kuiefr:200606 Testing the Conditional Mean Function of Autoregressive Conditional Duration Models (2006). (2) RePEc:kud:kuiefr:200403 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). (3) RePEc:kud:kuiefr:200412 The Timing of Bets and the Favorite-Longshot Bias (2004). (4) RePEc:kud:kuiefr:200701 Aggregation of Information and Beliefs in Prediction Markets (2007). (5) RePEc:kud:kuiefr:200402 A General Theory of Decision Making (2003). (6) RePEc:kud:kuiefr:200405 The Strategy of Professional Forecasting (2004). (7) RePEc:kud:kuiefr:200504 Order Aggressiveness and Order Book Dynamics (2004). (8) RePEc:kud:kuiefr:200406 Bayesian Learning in Financial Markets Testing for the Relevance of Information Precision in Price Discovery (2004). (9) RePEc:kud:kuiefr:200507 How to Invest Optimally in Corporate Bonds: A Reduced-Form Approach (2005). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 (1) RePEc:fip:fedlwp:2004-025 Near-rational exuberance (2004). Federal Reserve Bank of St. Louis / Working Papers Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |