|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

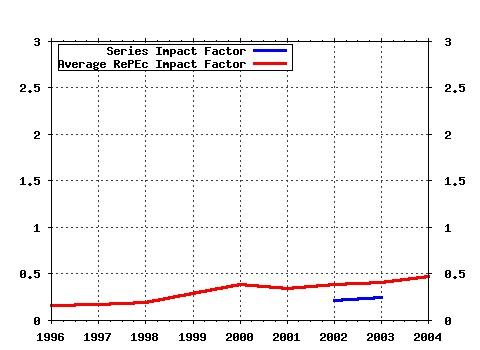

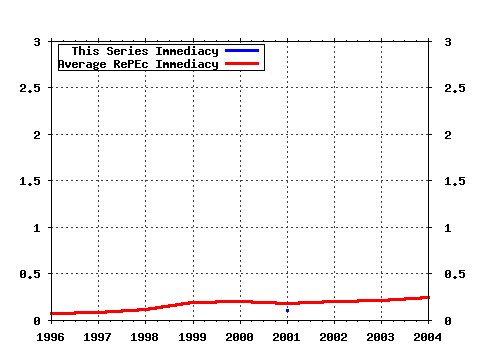

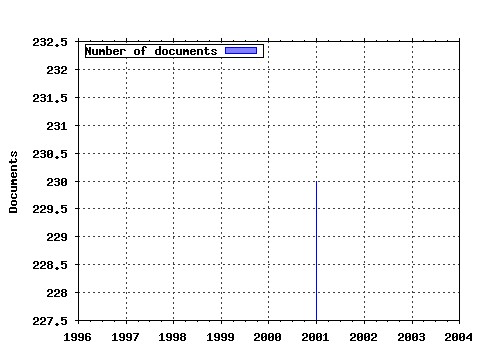

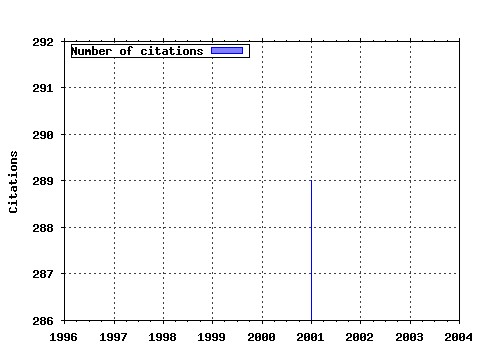

Society for Computational Economics / Computing in Economics and Finance 2001 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf1:19 Imperfect Credibility and Inflation Persistence (2001). (2) RePEc:sce:scecf1:145 The Real Interest Rate Gap as an Inflation Indicator (2001). (3) RePEc:sce:scecf1:35 Measuring the Natural Rate of Interest (2001). (4) RePEc:sce:scecf1:3 Spurious Welfare Reversals in International Business Cycle Models (2001). (5) RePEc:sce:scecf1:8 Uncertain Potential Output: Implications for Monetary Policy (2001). (6) RePEc:sce:scecf1:36 Estimation and Inference in Short Panel Vector Autoregressions with Unit Roots and Cointegration (2001). (7) RePEc:sce:scecf1:259 Chaotic Interest Rate Rules (2001). (8) RePEc:sce:scecf1:194 Calibration and Computation of Household Portfolio Models (2001). (9) RePEc:sce:scecf1:164 General--to--Specific Reductions of Vector Autoregressive Processes (2001). (10) RePEc:sce:scecf1:119 Evolutionary dynamics in financial markets with many trader types (2001). (11) RePEc:sce:scecf1:53 New economy : new policy rules? (2001). (12) RePEc:sce:scecf1:191 Small sample properties of panel time-series estimators with I(1) errors (2001). (13) RePEc:sce:scecf1:257 History Dependence and Global Dynamics in Models with Multiple Equilibria (2001). (14) RePEc:sce:scecf1:127 Spectral Analysis as a Tool for Financial Policy: An Analysis of the Short-End of the British Term Structure (2001). (15) RePEc:sce:scecf1:219 A Partial Equilibrium Model of Option Markets (2001). (16) RePEc:sce:scecf1:247 The Reliability of Inflation Forecasts Based on Output Gaps in Real Time (2001). (17) RePEc:sce:scecf1:2 Testing For Unit Roots Using Economics (2001). (18) RePEc:sce:scecf1:29 Dynamic optimization and Skiba sets in economic examples. (2001). (19) RePEc:sce:scecf1:115 Portfolio Choice, Liquidity Constraints and Stock Market Mean Reversion (2001). (20) RePEc:sce:scecf1:166 Health Insurance, Habits and Health Outcomes: A Dynamic Stochastic Model of Investment in Health (2001). (21) RePEc:sce:scecf1:20 Adaptive Learning and Emergent Coordination in Minority Games (2001). (22) RePEc:sce:scecf1:213 DYNARE: A program for the simulation of rational expectation models (2001). (23) RePEc:sce:scecf1:30 Solving for Optimal Simple Rules in Rational Expectations Models (2001). (24) RePEc:sce:scecf1:96 Unemployment Insurance and Precautionary Savings : Transitional Dynamics vs. Steady State Equilibrium (2001). (25) RePEc:sce:scecf1:151 Multiple Regimes in U.S. Monetary Policy? A Nonparametric Approach (2001). (26) RePEc:sce:scecf1:40 Economic Geography, Trade, and War (2001). (27) RePEc:sce:scecf1:224 Multilateral Negotiations and Formation of Coalitions (2001). (28) RePEc:sce:scecf1:31 Learning Dynamics in an Artificial Currency Market (2001). (29) RePEc:sce:scecf1:98 What Can We Learn From Simulating a Standard Agency Model? (2001). (30) RePEc:sce:scecf1:252 Patterns of Trade between Countries with Differing Age Compositions of Populations: An Overlapping Generations General Equilibrium Analysis (2001). (31) RePEc:sce:scecf1:41 Equilibrium Stock Return Dynamics Under Alternative Rules of Learning About Hidden States (2001). (32) RePEc:sce:scecf1:258 Forecasting with a Real-Time Data Set for Macroeconomists (2001). (33) RePEc:sce:scecf1:254 Monetary Policy with Imperfect Knowledge (2001). (34) RePEc:sce:scecf1:132 Bifurcation Routes and Economic Stability (2001). (35) RePEc:sce:scecf1:104 Holdup and the Evolution of Bargaining Conventions (2001). (36) RePEc:sce:scecf1:123 G@RCH 2.0: An Ox Package for Estimating and Forecasting Various ARCH Models (2001). (37) RePEc:sce:scecf1:85 Exchange Rate Effects on the Volume of Trade Flows: An Empirical Analysis Employing High-Frequency Data (2001). (38) RePEc:sce:scecf1:233 Inference on the Cointegration Rank in Fractionally Integrated Processes (2001). (39) RePEc:sce:scecf1:193 Revolvers for Self-Control (2001). (40) RePEc:sce:scecf1:76 Multimodality and the GARCH Likelihood (2001). (41) RePEc:sce:scecf1:140 Between-Group Dependence in PPP Equations and its Causes: A Principal Components Approach (2001). (42) RePEc:sce:scecf1:7 Patience, Persistence, and Welfare Costs of Incomplete Markets in Open Economies (2001). (43) RePEc:sce:scecf1:135 Can Trade Theory Help Us Understand the Linkages Between International Trade and Business Cycles? (2001). (44) RePEc:sce:scecf1:214 A Statistical Equilibrium Model of Wealth Distribution (2001). (45) RePEc:sce:scecf1:105 Market Efficiency and Learning in an Endogenously Unstable Environment (2001). (46) RePEc:sce:scecf1:55 The Timing of Uncertainty and The Intensity of Policy (2001). (47) RePEc:sce:scecf1:91 Evolutionary Learning in the Ultimatum Game (2001). (48) RePEc:sce:scecf1:162 Learning, Stabilization and Credibility: Optimal Monetary Policy in a Changing Economy (2001). (49) RePEc:sce:scecf1:241 Refining Influence Diagram For Stock Portfolio Selection (2001). (50) RePEc:sce:scecf1:120 Succes and Failure of Technical Trading Strategies in the Cocoa Futures Market (2001). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 (1) RePEc:cpr:ceprdp:2666 Direct Effects of Base Money on Aggregate Demand: Theory and Evidence (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:cpr:ceprdp:2757 Price Stability as a Nash Equilibrium in Monetary Open-Economy Models (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:cpr:ceprdp:2822 Portfolio Choice and Liquidity Constraints (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:cpr:ceprdp:2854 Price Stability with Imperfect Financial Integration (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:cpr:ceprdp:2948 Avoiding Liquidity Traps (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:cpr:ceprdp:2999 UK Inflation in the 1970s and 1980s: The Role of Output Gap Mismeasurement (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (7) RePEc:cpr:ceprdp:3047 What Does the UKs Monetary Policy and Inflation Experience Tell Us About the Transmission Mechanism? (2001). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:dgr:kubcen:200139 The nucleolus as a consistent power index in noncooperative majority games (2001). Tilburg University, Center for Economic Research / Discussion Paper (9) RePEc:dgr:umamet:2001014 Modelling daily value-at-risk using realized volatility and arch type models (2001). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (10) RePEc:ecb:ecbwps:20010068 The performance of forecast-based monetary policy rules under model uncertainty. (2001). European Central Bank / Working Paper Series (11) RePEc:fip:fedgfe:2001-53 Measuring equilibrium real interest rates: what can we learn from yields on indexed bonds? (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (12) RePEc:fip:fedgfe:2001-56 Measuring the natural rate of interest (2001). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (13) RePEc:fip:fedkrw:rwp01-12 Implications of real-time data for forecasting and modeling expectations (2001). Federal Reserve Bank of Kansas City / Research Working Paper (14) RePEc:gco:abcdef:31 Dynamic Processes of Social and Economic Interactions: On the Persistence of Inefficiencies (2001). Grand Coalition Web Site / Grand Coalition (15) RePEc:han:dpaper:dp-234 The Influence of Heterogeneous Preferences on Asset Prices in an Incomplete Market Model (2001). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (16) RePEc:han:dpaper:dp-239 Two Notes on Replication in Evolutionary Modelling (2001). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (17) RePEc:nbr:nberwo:8223 Taxation and Portfolio Structure: Issues and Implications (2001). National Bureau of Economic Research, Inc / NBER Working Papers (18) RePEc:nuf:econwp:0122 Computationally-intensive Econometrics using a Distributed Matrix-programming Language (2001). Economics Group, Nuffield College, University of Oxford / Economics Papers (19) RePEc:nzb:nzbbul:september2001:2 What is the neutral real interest rate, and how can we use it? (2001). Reserve Bank of New Zealand Bulletin (20) RePEc:sce:scecf1:60 The Influence of Heterogeneous Preferences on Asset Prices in an Incomplete Market Model (2001). Society for Computational Economics / Computing in Economics and Finance 2001 (21) RePEc:sie:siegen:87-00 Optimal Monetary Policy in an Optimizing Stochastic Dynamic Model with Sticky Prices (2001). Universitaet Siegen, Fachbereich Wirtschaftswissenschaften / Volkswirtschaftliche Diskussionsbeitraege (22) RePEc:ucy:cypeua:0205 Assets of Cyprus Households: Lessons from the first Cyprus Survey of Consumer Finances (2001). University of Cyprus Department of Economics / University of Cyprus Working Papers in Economics (23) RePEc:wiw:wiwrsa:ersa01p112 Identification of Strategic Industries: A Dynamic Perspective (2001). European Regional Science Association / ERSA conference papers (24) RePEc:wpa:wuwpfi:0109001 Bifurcation Routes in Financial Markets (2001). EconWPA / Finance (25) RePEc:wpa:wuwpma:0110003 Monetary policy and the term structure of interest rates in a small open economy - a model framework approach (2001). EconWPA / Macroeconomics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |