|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

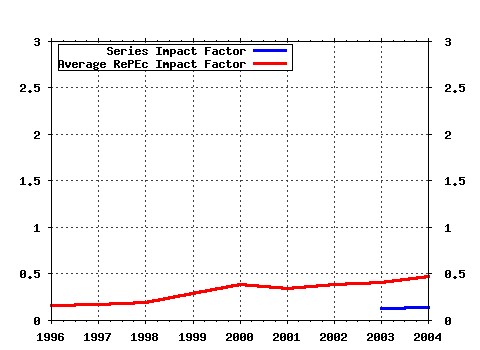

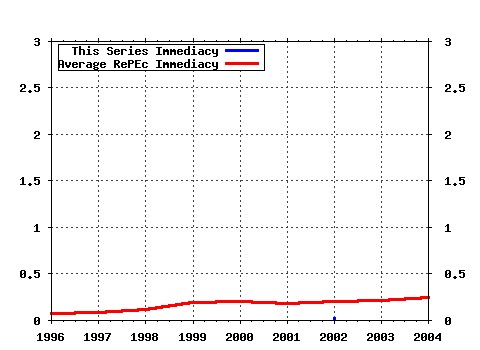

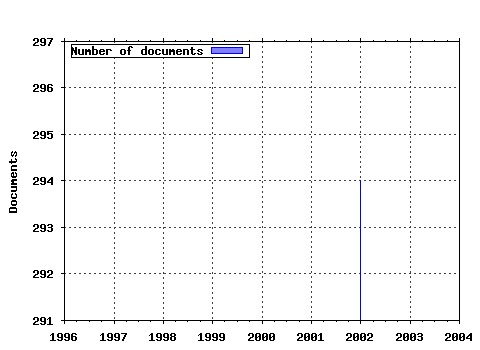

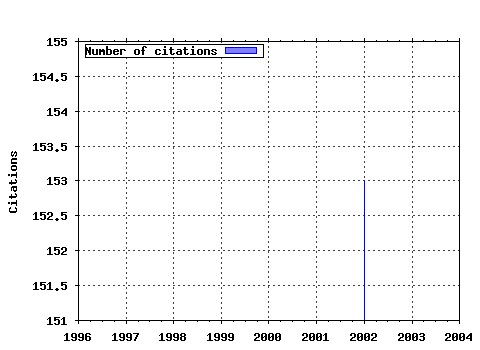

Society for Computational Economics / Computing in Economics and Finance 2002 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf2:343 Optimal Monetary Policy with Durable and Non-Durable Goods (2002). (2) RePEc:sce:scecf2:182 Too Much Too Soon: Instability and Indeterminacy with Forward-Looking Rules (2002). (3) RePEc:sce:scecf2:240 Inflation Dynamics and International Linkages: A Model of the United States, the Euro Area and Japan (2002). (4) RePEc:sce:scecf2:5 A New Class of Multivariate skew Densities, with Application to GARCH Models (2002). (5) RePEc:sce:scecf2:135 An Adaptive Model on Asset Pricing and Wealth Dynamics with Heterogeneous Trading Strategies (2002). (6) RePEc:sce:scecf2:94 The Impact of Macroeconomic Uncertainty on Bank Lending Behavior (2002). (7) RePEc:sce:scecf2:59 Inflation Targeting and Nominal Income Growth Targeting: When and Why Are They Suboptimal? (2002). (8) RePEc:sce:scecf2:307 Adaptive Polar Sampling (2002). (9) RePEc:sce:scecf2:329 Optimal Capital-Labor Taxes under Uncertainty and Limits on Debt (2002). (10) RePEc:sce:scecf2:354 The Joint Dynamics of Networks and Knowledge (2002). (11) RePEc:sce:scecf2:276 Spanish diffusion indexes (2002). (12) RePEc:sce:scecf2:359 How Well Do Alternative Time-Varying Parameter Models of the NAIRU Help Policymakers Forecast Unemployment and Inflation in the OECD Countries? (2002). (13) RePEc:sce:scecf2:51 Heterogeneous Traders and the Tobin Tax (2002). (14) RePEc:sce:scecf2:234 Co-Evolution of Firms and Consumers and the Implications for Market Dominance (2002). (15) RePEc:sce:scecf2:338 The Brazilian Depression in the 1980s and 1990s (2002). (16) RePEc:sce:scecf2:196 Capacity Dynamics and Endogenous Asymmetries in Firm Size (2002). (17) RePEc:sce:scecf2:72 interpolation with a large information set (2002). (18) RePEc:sce:scecf2:335 Monetary Policy, Asset Prices, and Misspecification: the robust approach to bubbles with model uncertainty (2002). (19) RePEc:sce:scecf2:8 Optimal Monetary Policy When Interest Rates are Bounded at Zero (2002). (20) RePEc:sce:scecf2:262 Computer Testbeds and Mechanism Design (2002). (21) RePEc:sce:scecf2:190 Inflation Persistence and Flexible Prices (2002). (22) RePEc:sce:scecf2:355 Output and interest rate gaps: Theory versus practice (2002). (23) RePEc:sce:scecf2:218 Absolute Convergence, Period (2002). (24) RePEc:sce:scecf2:57 Existence of Strongly Rational Expectations Equilibria on Asset Markets with Asymmetric Information (2002). (25) RePEc:sce:scecf2:151 Financial Market in the Laboratory (2002). (26) RePEc:sce:scecf2:301 Traders long-run wealth in an artificial financial market (2002). (27) RePEc:sce:scecf2:223 Comparing the Accuracy of Density Forecasts from Competing Models (2002). (28) RePEc:sce:scecf2:214 Testing for Indeterminacy in Linear Rational Expectations Models (2002). (29) RePEc:sce:scecf2:370 Networks and Farsighted Stability (2002). (30) RePEc:sce:scecf2:318 Programming (2002). (31) RePEc:sce:scecf2:109 New Tools in Micromodeling Retirement Decisions: Overview and Applications to the Italian Case (2002). (32) RePEc:sce:scecf2:18 Volatility of a Market Index and its Components: An Application to Commodity Markets (2002). (33) RePEc:sce:scecf2:345 Computational Issues in the Estimation of Higher-Order Panel Vector Autoregressions (2002). (34) RePEc:sce:scecf2:138 Computing Sunspots in Linear Rational Expectations Models (2002). (35) RePEc:sce:scecf2:300 Are real-time estimates of the output gap reliable? (2002). (36) RePEc:sce:scecf2:47 Household Risk Management and Optimal Mortgage Choice (2002). (37) RePEc:sce:scecf2:87 Time series evidence of international output convergence in Mercosur (2002). (38) RePEc:sce:scecf2:383 The Channels of Monetary Policy: Evidence from Firm Level data in the US and the UK. (2002). (39) RePEc:sce:scecf2:120 Viability of Cooperation in Evolving Interaction Structures (2002). (40) RePEc:sce:scecf2:251 Conditional testing for unit-root bilinearity in financial time series: some theoretical and empirical results (2002). (41) RePEc:sce:scecf2:310 Foreign Exchange Risk Premia (2002). (42) RePEc:sce:scecf2:24 A Percolation Model of Innovation in Complex Technology Spaces (2002). (43) RePEc:sce:scecf2:137 Time Varying Uncertainty and the Credit Channel (2002). (44) RePEc:sce:scecf2:3 Are Capital Markets Efficient? Evidence from the Term Structure of Interest Rates in Europe (2002). (45) RePEc:sce:scecf2:39 Asset Price Bubbles and Crashes With Zero--Intelligence Traders (2002). (46) RePEc:sce:scecf2:127 Probability distribution of returns in the Heston model with stochastic volatility (2002). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 (1) RePEc:aub:autbar:542.02 Can genetic algorithms explain experimental anomalies? An application to common property resources (2002). Unitat de Fonaments de l'Anà lisi Econòmica (UAB) and Institut d'Anà lisi Econòmica (CSIC) / UFAE and IAE Working Papers (2) RePEc:chb:bcchwp:134 On the determinants of the Chilean Economic Growth (2002). Central Bank of Chile / Working Papers Central Bank of Chile (3) RePEc:chb:bcchwp:176 Is There Enough Evidence Against Absolute Convergence? (2002). Central Bank of Chile / Working Papers Central Bank of Chile (4) RePEc:cpd:pd2002:a5-2 Panel VAR Models with Spatial Dependence (2002). International Conferences on Panel Data / 10th International Conference on Panel Data, Berlin, July 5-6, 2002 (5) RePEc:dgr:eureir:2002278 Adaptive polar sampling, a class of flexibel and robust Monte Carlo integration methods (2002). Erasmus University Rotterdam, Econometric Institute / Econometric Institute Report (6) RePEc:fip:fedawp:2002-14 Priors from general equilibrium models for VARs (2002). Federal Reserve Bank of Atlanta / Working Paper (7) RePEc:wbk:wbrwps:2815 Pricing currency risk : facts and puzzles from currency boards (2002). The World Bank / Policy Research Working Paper Series Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |