|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

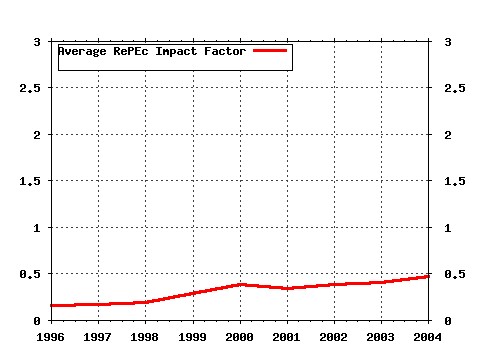

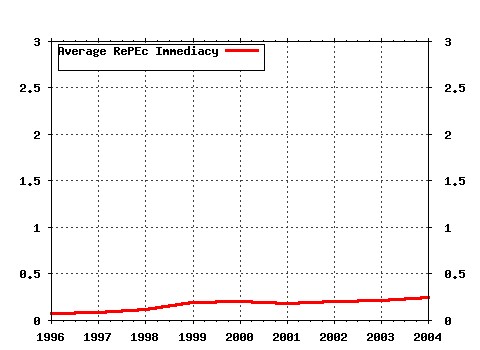

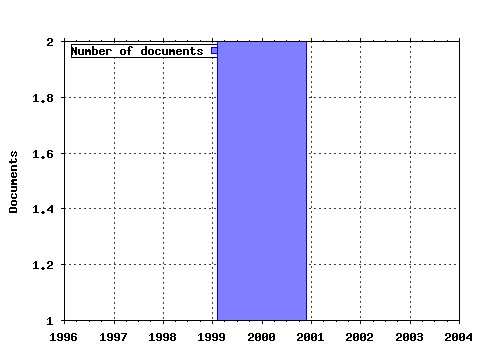

University of Cologne, CPE - Cologne Center for Public Economics / FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:zbw:uoccpe:5140 Die Evaluation von Steuerreformen durch Simulationsmodelle (2005). (2) RePEc:zbw:uoccpe:5142 Dokumentation FiFoSiM: Integriertes Steuer-Transfer-Mikrosimulations- und CGE-Modell (2005). (3) RePEc:zbw:uoccpe:5152 Documentation FiFoSiM : integrated tax benefit microsimulation and CGE model (2006). (4) RePEc:zbw:uoccpe:5147 Does tax simplification yield more equity and efficiency? An empirical analysis for Germany (2006). (5) RePEc:zbw:uoccpe:5143 Führt Steuervereinfachung zu einer gerechteren Einkommensverteilung? Eine empirische Analyse für

Deutschland (2006). (6) RePEc:zbw:uoccpe:5151 Measuring distributional effects of fiscal reforms (2006). (7) RePEc:zbw:uoccpe:5148 Die Flat Tax: Wer gewinnt? Wer verliert? Eine empirische Analyse für Deutschland (2006). (8) RePEc:zbw:uoccpe:5144 Numerische Gleichgewichtsmodelle - Grundlagen und Anwendungsgebiete (2006). (9) RePEc:zbw:uoccpe:5150 Reformoptionen der Familienbesteuerung - Aufkommens-, Verteilungs- und Arbeitsangebotseffekte (2006). Latest citations received in: | 2004 | 2003 | 2002 | 2001 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Latest citations received in: 2001 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |