|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

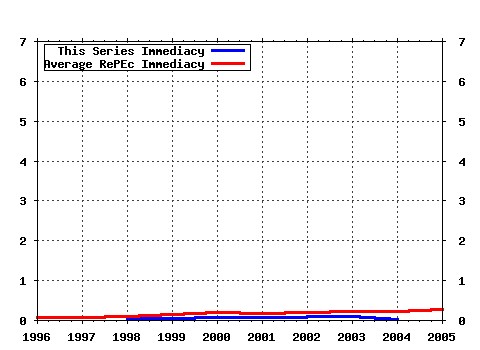

International Review of Financial Analysis Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finana:v:10:y:2001:i:3:p:203-218 What drives contagion: Trade, neighborhood, or financial links? (2001). (2) RePEc:eee:finana:v:7:y:1998:i:2:p:95-111 Two puzzles in the analysis of foreign exchange market efficiency (1998). (3) RePEc:eee:finana:v:1:y:1992:i:3:p:179-193 Prices and hedge ratios of average exchange rate options (1992). (4) RePEc:eee:finana:v:11:y:2002:i:1:p:1-27 The explanatory power of political risk in emerging markets (2002). (5) RePEc:eee:finana:v:11:y:2002:i:2:p:219-227 The aggregate credit spread and the business cycle (2002). (6) RePEc:eee:finana:v:10:y:2001:i:2:p:135-156 Trading rule profits in Latin American currency spot rates (2001). (7) RePEc:eee:finana:v:13:y:2004:i:5:p:633-647 Equity market integration in Central European emerging markets: A cointegration analysis with shifting regimes (2004). (8) RePEc:eee:finana:v:6:y:1997:i:3:p:179-192 The Big Mac: More than a junk asset allocator? (1997). (9) RePEc:eee:finana:v:8:y:1999:i:2:p:123-138 Scaling laws in variance as a measure of long-term dependence (1999). (10) RePEc:eee:finana:v:13:y:2004:i:5:p:571-583 International equity market integration: Theory, evidence and implications (2004). (11) RePEc:eee:finana:v:8:y:1999:i:1:p:35-52 Size and book-to-market factors in a multivariate GARCH-in-mean asset pricing application (1999). (12) RePEc:eee:finana:v:11:y:2002:i:2:p:111-138 Dividend policy theories and their empirical tests (2002). (13) RePEc:eee:finana:v:11:y:2002:i:1:p:29-38 The volatility of Japanese interest rates: evidence for Certificate of Deposit and Gensaki rates (2002). (14) RePEc:eee:finana:v:11:y:2002:i:4:p:407-431 Stochastic chaos or ARCH effects in stock series?: A comparative study (2002). (15) RePEc:eee:finana:v:8:y:1999:i:1:p:67-82 Forecasting currency prices using a genetically evolved neural network architecture (1999). (16) RePEc:eee:finana:v:11:y:2002:i:1:p:39-57 The costs of bankruptcy: A review (2002). (17) RePEc:eee:finana:v:2:y:1993:i:2:p:121-141 The event study: An industrial strength method (1993). (18) RePEc:eee:finana:v:11:y:2002:i:3:p:375-406 Corporate bankruptcy prognosis: An attempt at a combined prediction of the bankruptcy event and time interval of its occurrence (2002). (19) RePEc:eee:finana:v:9:y:2000:i:3:p:235-245 On the conditional relationship between beta and return in international stock returns (2000). (20) RePEc:eee:finana:v:10:y:2001:i:2:p:175-185 Response asymmetries in the Latin American equity markets (2001). (21) RePEc:eee:finana:v:13:y:2004:i:2:p:227-244 Private benefits, block transaction premiums and ownership structure (2004). (22) RePEc:eee:finana:v:9:y:2000:i:2:p:163-174 International acquisitions and shareholder wealth Evidence from the Netherlands (2000). (23) RePEc:eee:finana:v:10:y:2001:i:1:p:87-96 Dynamic interdependence and volatility transmission of Asian stock markets: Evidence from the Asian crisis (2001). (24) RePEc:eee:finana:v:13:y:2004:i:5:p:649-668 Equity market integration in Latin America: A time-varying integration score analysis (2004). (25) RePEc:eee:finana:v:8:y:1999:i:2:p:177-197 Agency problems and the simultaneity of financial decision making: The role of institutional ownership (1999). (26) RePEc:eee:finana:v:11:y:2002:i:3:p:331-344 Scaling the volatility of credit spreads: Evidence from Australian dollar eurobonds (2002). (27) RePEc:eee:finana:v:10:y:2001:i:4:p:395-406 Multiperiod hedging in the presence of stochastic volatility (2001). (28) RePEc:eee:finana:v:5:y:1996:i:1:p:19-38 Prospect theory: A literature review (1996). (29) RePEc:eee:finana:v:10:y:2001:i:2:p:99-122 A nonparametric approach to model the term structure of interest rates: The case of Chile (2001). (30) RePEc:eee:finana:v:12:y:2003:i:1:p:25-34 Continuous time and nonparametric modelling of U.S. interest rate models (2003). (31) RePEc:eee:finana:v:9:y:2000:i:1:p:21-43 Pre-bid price run-ups and insider trading activity: Evidence from Canadian acquisitions (2000). (32) RePEc:eee:finana:v:12:y:2003:i:4:p:349-377 The dividend and share repurchase policies of Canadian firms: empirical evidence based on an alternative research design (2003). (33) RePEc:eee:finana:v:11:y:2002:i:3:p:297-309 An empirical analysis of credit default swaps (2002). (34) RePEc:eee:finana:v:6:y:1997:i:3:p:229-240 International interest rates linkages: Evidence from OECD countries (1997). (35) RePEc:eee:finana:v:12:y:2003:i:5:p:563-577 An empirical examination of the impact of market microstructure changes on the determinants of option bid-ask spreads (2003). (36) RePEc:eee:finana:v:16:y:2007:i:1:p:22-40 Evidence of an asymmetry in the relationship between volatility and autocorrelation (2007). (37) RePEc:eee:finana:v:13:y:2004:i:5:p:621-632 Equity market integration in the Asia-Pacific region: A smooth transition analysis (2004). (38) RePEc:eee:finana:v:6:y:1997:i:1:p:37-47 The lead-lag structure of stock returns and accounting earnings: Implications to the returns-earnings relation in Finland (1997). (39) RePEc:eee:finana:v:12:y:2003:i:3:p:223-239 iShares Australia: a clinical study in international behavioral finance (2003). (40) RePEc:eee:finana:v:15:y:2006:i:3:p:203-219 The CAPM and value at risk at different time-scales (2006). (41) RePEc:eee:finana:v:13:y:2004:i:3:p:349-366 Is idiosyncratic volatility priced?: Evidence from the Shanghai Stock Exchange (2004). (42) RePEc:eee:finana:v:9:y:2000:i:3:p:315-326 Corporate diversification, ownership structure, and firm value: The Singapore evidence (2000). (43) RePEc:eee:finana:v:12:y:2003:i:2:p:135-155 The interrelatedness of global equity markets, money markets, and foreign exchange markets (2003). (44) RePEc:eee:finana:v:14:y:2005:i:5:p:508-532 Put-call parity and cross-markets efficiency in the index options markets: evidence from the Italian market (2005). (45) RePEc:eee:finana:v:7:y:1998:i:3:p:191-206 Forecasting U.K. and U.S. interest rates using continuous time term structure models (1998). (46) RePEc:eee:finana:v:13:y:2004:i:3:p:265-276 Long memory in the U.S. interest rate (2004). (47) RePEc:eee:finana:v:9:y:2000:i:2:p:197-218 Restructuring the Japanese banking system Has Japan gone far enough? (2000). (48) RePEc:eee:finana:v:14:y:2005:i:1:p:1-22 Trends in analyst earnings forecast properties (2005). (49) RePEc:eee:finana:v:7:y:1998:i:1:p:83-94 Investment implications of the korean financial market reform (1998). (50) RePEc:eee:finana:v:11:y:2002:i:1:p:101-110 The relationship between conditional stock market volatility and conditional macroeconomic volatility: Empirical evidence based on UK data (2002). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 Latest citations received in: 2004 (1) RePEc:qut:dpaper:170 Equity Premium: - Does it exist? Evidence from Germany and United Kingdom (2004). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series Latest citations received in: 2003 (1) RePEc:dgr:kubcen:200328 Why individual investors want dividends (2003). Tilburg University, Center for Economic Research / Discussion Paper (2) RePEc:qut:dpaper:159 Weak-form market efficiency in European emerging and developed stock markets (2003). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series (3) RePEc:taf:apeclt:v:10:y:2003:i:10:p:643-645 An empirical comparison of interest rates using an interest rate model and nonparametric methods (2003). Applied Economics Letters Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |