|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

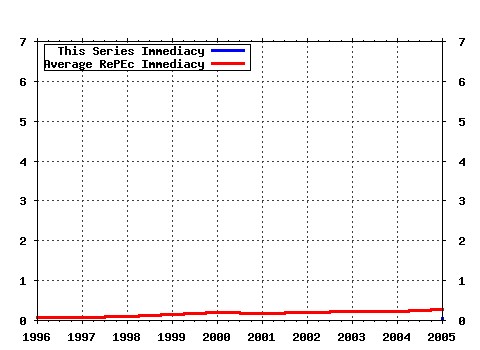

Czech Journal of Economics and Finance (Finance a uver, ISSN: 0015-1920) Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fau:fauart:v:55:y:2005:i:5-6:p:232-252 Equilibrium Exchange Rate in the Czech Republic: How Good is the Czech BEER? (2005). (2) RePEc:fau:fauart:v:57:y:2007:i:7-8:p:324-340 The Impact of EU Regional Support on Growth and Employment (2007). (3) RePEc:fau:fauart:v:55:y:2005:i:1-2:p:68-82 Regional Wage Adjustments and Unemployment: Estimating the Time-Varying Wage Curve (in English) (2005). (4) RePEc:fau:fauart:v:55:y:2005:i:7-8:p:380-394 Inflation Expectations and Monetary Policy (2005). (5) RePEc:fau:fauart:v:55:y:2005:i:5-6:p:206-231 Liberalized Markets Have More Stable Exchange Rates: Short-Run Evidence from Four Transition Countries (2005). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:fau:wpaper:wp075 Real Equilibrium Exchange Rate Estimates: To What Extent Are They Applicable for Setting the Central Parity? (2005). Charles University Prague, Faculty of Social Sciences, Institute of Economic Studies / Working Papers IES (2) RePEc:wpa:wuwpif:0509006 Real Equilibrium Exchange Rate Estimates: To What Extent Applicable for Setting the Central Parity? (2005). EconWPA / International Finance Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |