|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Columbia - Center for Futures Markets / Columbia - Center for Futures Markets Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

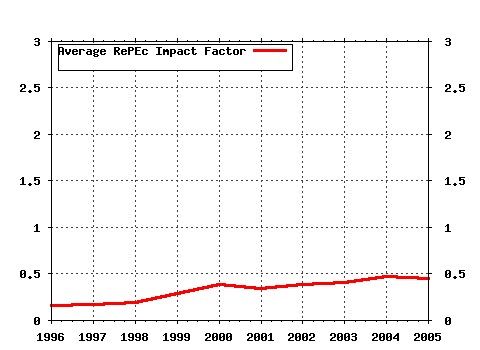

Most cited documents in this series: (1) RePEc:fth:colufu:t12 WHEN FINANCIAL MARKETS WORK TOO WELL : A CAUTIOUS CASE FOR A SECURITIES TRANSACTIONS TAX. (1989). (2) RePEc:fth:colufu:t2 USING TAX POLICY TO CURB SPECULATIVE SHORT-TERM TRADING. (1989). (3) RePEc:fth:colufu:t10 PRICE VOLATILITY, INTERNATIONAL MARKET LINKS, AND THEIR IMPLICATIONS FOR REGULATORY POLICIES. (1989). (4) RePEc:fth:colufu:169 TRADING STRUCTURES AND ASSET PRICING: EVIDENCE FROM THE TREASURY BILL MARKETS. (1988). (5) RePEc:fth:colufu:t7 VOLATILITY, PRICE RESOLUTION, AND THE EFFECTIVENESS OF PRICE LIMITS. (1989). (6) RePEc:fth:colufu:t3 COMMENTARY: USING TAX POLICY TO CURB SPECULATIVE SHORT-TERM TRADING. (1989). (7) RePEc:fth:colufu:188 FUTURES TRADING, TRANSACTION COSTS, AND STOCK MARKET VOLATILITY. (1989). (8) RePEc:fth:colufu:t6 MARGIN REQUIREMENTS AND STOCK VOLATILITY. (1989). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |