|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

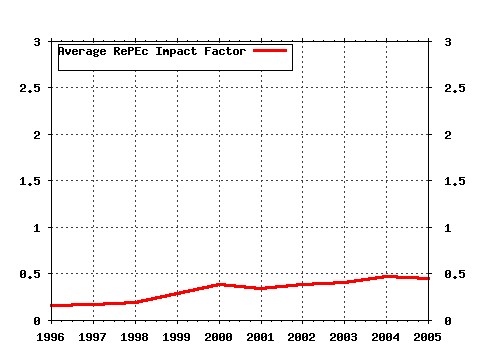

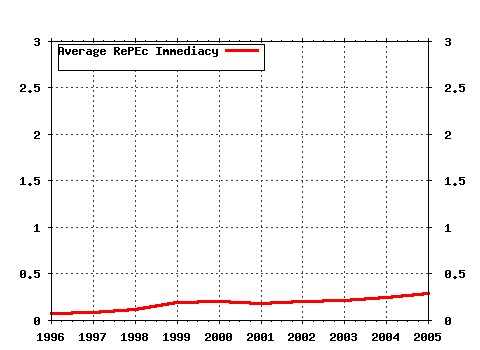

Princeton, Department of Economics - Financial Research Center / Princeton, Department of Economics - Financial Research Center Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:prinec:88 LIQUIDITY AND MARKET STRUCTURE (1988). (2) RePEc:fth:prinec:128 Testing for Price Anomalies in real Estate Auctions. (1992). (3) RePEc:fth:prinec:95 SMART MONEY, NOISE TRADING AND STOCK PRICE BEHAVIOR (1988). (4) RePEc:fth:prinec:91 ENTRY AND EXIT DECISIONS UNDER UNCERTAINTY (1988). (5) RePEc:fth:prinec:137 Testing for Imperfect Competition at the Fulton Fish Market. (1993). (6) RePEc:fth:prinec:100 PREDICTABLE BOND AND STOCK RETURNS IN THE UNITED STATES AND JAPAN: A STUDY OF LONG-TERM MARKET INTEGRATION. (1988). (7) RePEc:fth:prinec:129 Entrepreneurial Decisions and Liquidity Constraints. (1992). (8) RePEc:fth:prinec:118 AN ASYMMETRIC MODEL OF CHANGING VOLATILITY IN STOCK RETURNS. (1990). (9) RePEc:fth:prinec:131 Nonlinearities in Asset Prices and Infrequent Noise Trading. (1992). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |