|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

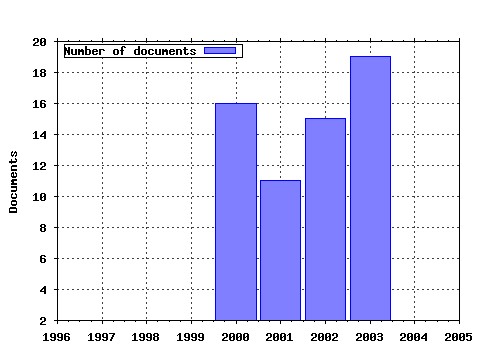

Aarhus School of Business, Department of Finance / Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:hhb:aarfin:2002_019 Multivariate Term Structure Models with Level and Heteroskedasticity

Effects (2003). (2) RePEc:hhb:aarfin:2002_017 Efficient Control Variates for Monte-Carlo Valuation of American

Options (2002). (3) RePEc:hhb:aarfin:2002_003 Revisiting the shape of the yield curve: the effect of interest rate

volatility. (2002). (4) RePEc:hhb:aarfin:2000_002 Uncovered Interest Parity and Policy Behavior New Evidence. (2000). (5) RePEc:hhb:aarfin:2002_001 The comovement of US and UK stock markets. (2002). (6) RePEc:hhb:aarfin:2001_005 A Finite Difference Approach to the Valuation of Path Dependent Life

Insurance Liabilities. (2001). (7) RePEc:hhb:aarfin:2002_013 Regime Switching in the Yield Curve (2002). (8) RePEc:hhb:aarfin:2002_010 Deposit Insurance and the Risk Premium in Bank Deposit Rates (2003). (9) RePEc:hhb:aarfin:2000_007 Boundary and Bias Correction in Kernel Hazard Estimation (2000). (10) RePEc:hhb:aarfin:2002_012 Testing for Multiple Types of Marginal Investor in Ex-day Pricing (2002). (11) RePEc:hhb:aarfin:2000_001 Implied Volatility of Interest Rate Options: An Empirical

Investigation of the Market Model. (2000). (12) RePEc:hhb:aarfin:2000_014 Credit Spreads and the Term Structure of Interest Rates. (2000). (13) RePEc:hhb:aarfin:2003_003 Denmark - A chapter on the Danish Bond Market (2003). (14) RePEc:hhb:aarfin:2001_012 Long Maturity Forward Rates. (2001). (15) RePEc:hhb:aarfin:2002_014 Long-Run Forecasting in Multicointegrated Systems (2002). (16) RePEc:hhb:aarfin:2001_002 Estimating Multiplicative and Additive Hazard Functions by Kernel

Methods. (2001). (17) RePEc:hhb:aarfin:2000_009 The Relation Between Asset Returns and Inflation at Short and Long

Horizons. (2000). (18) RePEc:hhb:aarfin:2003_004 Evaluating Danish Mutual Fund Performance (2003). (19) RePEc:hhb:aarfin:2002_009 The Educational Asset Market: A Finance Perspective on Human Capital

Investment (2003). (20) RePEc:hhb:aarfin:2000_003 Longevity Studies Based on Kernel Hazard Estimation. (2000). (21) RePEc:hhb:aarfin:2002_023 Efficient Control Variates and Strategies for Bermudan Swaptions in

a Libor Market Model (2002). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 Latest citations received in: 2004 Latest citations received in: 2003 (1) RePEc:may:mayecw:n1271003 Compensating Wage Differentials for Schooling Risk in Denmark (2003). Department of Economics, National University of Ireland - Maynooth / Economics Department Working Paper Series Latest citations received in: 2002 (1) RePEc:hhb:aarfin:2002_023 Efficient Control Variates and Strategies for Bermudan Swaptions in a Libor Market Model (2002). Aarhus School of Business, Department of Finance / Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |