|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

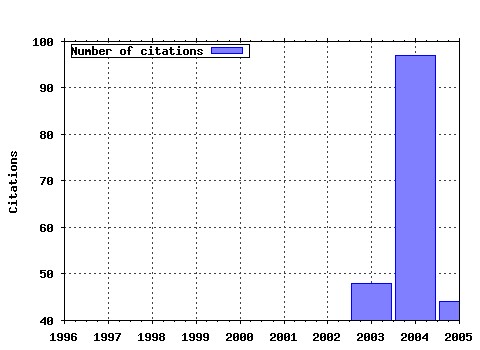

Journal of Financial Econometrics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:oup:jfinec:v:2:y:2004:i:1:p:1-37 Power and Bipower Variation with Stochastic Volatility and Jumps (2004). (2) RePEc:oup:jfinec:v:4:y:2006:i:4:p:537-572 Asymmetric Dynamics in the Correlations of Global Equity and Bond Returns (2006). (3) RePEc:oup:jfinec:v:4:y:2006:i:1:p:1-30 Econometrics of Testing for Jumps in Financial Economics Using Bipower Variation (2006). (4) RePEc:oup:jfinec:v:3:y:2005:i:4:p:525-554 A Realized Variance for the Whole Day Based on Intermittent High-Frequency Data (2005). (5) RePEc:oup:jfinec:v:2:y:2004:i:2:p:211-250 Mixed Normal Conditional Heteroskedasticity (2004). (6) RePEc:oup:jfinec:v:2:y:2004:i:4:p:493-530 A New Approach to Markov-Switching GARCH Models (2004). (7) RePEc:oup:jfinec:v:2:y:2004:i:1:p:130-168 On the Out-of-Sample Importance of Skewness and Asymmetric Dependence for Asset Allocation (2004). (8) RePEc:oup:jfinec:v:5:y:2007:i:1:p:68-104 Integrated Covariance Estimation using High-frequency Data in the Presence of Noise (2007). (9) RePEc:oup:jfinec:v:2:y:2004:i:1:p:84-108 Backtesting Value-at-Risk: A Duration-Based Approach (2004). (10) RePEc:oup:jfinec:v:4:y:2006:i:1:p:53-89 Value-at-Risk Prediction: A Comparison of Alternative Strategies (2006). (11) RePEc:oup:jfinec:v:1:y:2003:i:1:p:96-125 Modeling the U.S. Short-Term Interest Rate by Mixture Autoregressive Processes (2003). (12) RePEc:oup:jfinec:v:2:y:2004:i:2:p:319-342 Persistence and Kurtosis in GARCH and Stochastic Volatility Models (2004). (13) RePEc:oup:jfinec:v:3:y:2005:i:4:p:456-499 The Relative Contribution of Jumps to Total Price Variance (2005). (14) RePEc:oup:jfinec:v:3:y:2005:i:3:p:399-421 Autoregressive Conditional Kurtosis (2005). (15) RePEc:oup:jfinec:v:1:y:2003:i:1:p:26-54 Fourth Moment Structure of Multivariate GARCH Models (2003). (16) RePEc:oup:jfinec:v:1:y:2003:i:2:p:272-289 The Robustness of the Conditional CAPM with Human Capital (2003). (17) RePEc:oup:jfinec:v:1:y:2003:i:2:p:159-188 Trades and Quotes: A Bivariate Point Process (2003). (18) RePEc:oup:jfinec:v:3:y:2005:i:4:p:555-577 Properties of Bias-Corrected Realized Variance Under Alternative Sampling Schemes (2005). (19) RePEc:oup:jfinec:v:2:y:2004:i:4:p:477-492 Pessimistic Portfolio Allocation and Choquet Expected Utility (2004). (20) RePEc:oup:jfinec:v:4:y:2006:i:3:p:450-493 Stochastic Conditional Intensity Processes (2006). (21) RePEc:oup:jfinec:v:1:y:2003:i:1:p:55-95 Time Inhomogeneous Multiple Volatility Modeling (2003). (22) RePEc:oup:jfinec:v:2:y:2004:i:4:p:531-564 Modeling the Conditional Covariance Between Stock and Bond Returns: A Multivariate GARCH Approach (2004). (23) RePEc:oup:jfinec:v:1:y:2003:i:1:p:2-25 Dynamics of Trade-by-Trade Price Movements: Decomposition and Models (2003). (24) RePEc:oup:jfinec:v:1:y:2003:i:3:p:445-470 The Local Whittle Estimator of Long-Memory Stochastic Volatility (2003). (25) RePEc:oup:jfinec:v:4:y:2006:i:2:p:275-309 The Generalized Hyperbolic Skew Students t-Distribution (2006). (26) RePEc:oup:jfinec:v:1:y:2003:i:2:p:189-215 Assessing the Risk of Liquidity Suppliers on the Basis of Excess Demand Intensities (2003). (27) RePEc:oup:jfinec:v:3:y:2005:i:1:p:26-36 New Directions in Risk Management (2005). (28) RePEc:oup:jfinec:v:3:y:2005:i:3:p:422-441 The Stability of Factor Models of Interest Rates (2005). (29) RePEc:oup:jfinec:v:4:y:2006:i:2:p:238-274 Structural Breaks and Predictive Regression Models of Aggregate U.S. Stock Returns (2006). (30) RePEc:oup:jfinec:v:2:y:2004:i:1:p:49-83 How to Forecast Long-Run Volatility: Regime Switching and the Estimation of Multifractal Processes (2004). (31) RePEc:oup:jfinec:v:2:y:2004:i:3:p:370-389 Asset Allocation by Variance Sensitivity Analysis (2004). (32) RePEc:oup:jfinec:v:1:y:2003:i:3:p:365-419 A Closer Look at the Relation between GARCH and Stochastic Autoregressive Volatility (2003). (33) RePEc:oup:jfinec:v:1:y:2003:i:3:p:297-326 Kernel-Based Indirect Inference (2003). (34) RePEc:oup:jfinec:v:3:y:2005:i:3:p:315-343 Asymptotic and Bayesian Confidence Intervals for Sharpe-Style Weights (2005). (35) RePEc:oup:jfinec:v:1:y:2003:i:3:p:420-444 Properties of the Sample Autocorrelations of Nonlinear Transformations in Long-Memory Stochastic Volatility Models (2003). (36) RePEc:oup:jfinec:v:3:y:2005:i:3:p:372-398 Multivariate Lagrange Multiplier Tests for Fractional Integration (2005). (37) RePEc:oup:jfinec:v:4:y:2006:i:4:p:594-616 A Mixture Multiplicative Error Model for Realized Volatility (2006). (38) RePEc:oup:jfinec:v:4:y:2006:i:3:p:413-449 Inequality Constraints in the Fractionally Integrated GARCH Model (2006). (39) RePEc:oup:jfinec:v:4:y:2006:i:4:p:636-670 Long Memory and the Relation Between Implied and Realized Volatility (2006). (40) RePEc:oup:jfinec:v:4:y:2006:i:4:p:573-593 Stationarity of a Markov-Switching GARCH Model (2006). (41) RePEc:oup:jfinec:v:2:y:2004:i:3:p:390-421 Stochastic Conditional Duration Models with Leverage Effect for Financial Transaction Data (2004). (42) RePEc:oup:jfinec:v:3:y:2005:i:1:p:37-55 Optimal Estimation of the Risk Premium for the Long Run and Asset Allocation: A Case of Compounded Estimation Risk (2005). (43) RePEc:oup:jfinec:v:4:y:2006:i:3:p:385-412 Dynamic Asymmetric GARCH (2006). (44) RePEc:oup:jfinec:v:5:y:2007:i:1:p:31-67 Why Do Absolute Returns Predict Volatility So Well? (2007). (45) RePEc:oup:jfinec:v:1:y:2003:i:3:p:327-364 A Pricing and Hedging Comparison of Parametric and Nonparametric Approaches for American Index Options (2003). (46) RePEc:oup:jfinec:v:2:y:2004:i:3:p:451-471 Improving Tests of Abnormal Returns by Bootstrapping the Multivariate Regression Model with Event Parameters (2004). (47) RePEc:oup:jfinec:v:4:y:2006:i:1:p:136-160 Incomplete Information, Heterogeneity, and Asset Pricing (2006). (48) RePEc:oup:jfinec:v:2:y:2004:i:1:p:109-129 Circuit Breakers and the Tail Index of Equity Returns (2004). (49) RePEc:oup:jfinec:v:3:y:2005:i:2:p:227-255 Nonparametric Inference of Value-at-Risk for Dependent Financial Returns (2005). (50) RePEc:oup:jfinec:v:3:y:2005:i:1:p:3-25 The Present and Future of Financial Risk Management (2005). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:crt:wpaper:0521 Conditional autoregressive valu at risk by regression quantile: Estimatingmarket risk for major stock markets (2005). University of Crete, Department of Economics / Working Papers (2) RePEc:dgr:uvatin:20050002 Model-based Measurement of Actual Volatility in High-Frequency Data (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (3) RePEc:fip:fedgfe:2005-63 Explaining credit default swap spreads with the equity volatility and jump risks of individual firms (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series Latest citations received in: 2004 (1) RePEc:cir:cirwor:2004s-19 Predicting Volatility: Getting the Most out of Return Data Sampled at Different Frequencies (2004). CIRANO / CIRANO Working Papers (2) RePEc:cir:cirwor:2004s-26 Monitoring for Disruptions in Financial Markets (2004). CIRANO / CIRANO Working Papers (3) RePEc:cte:wsrepe:ws046315 STOCHASTIC VOLATILITY MODELS AND THE TAYLOR EFFECT (2004). Universidad Carlos III, Departamento de Estadística y Econometría / Statistics and Econometrics Working Papers (4) RePEc:dgr:eureri:30001977 Evaluating Portfolio Value-At-Risk Using Semi-Parametric GARCH Models (2004). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (5) RePEc:dgr:uvatin:20040067 Modeling and Forecasting S&P 500 Volatility: Long Memory, Structural Breaks and Nonlinearity (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (6) RePEc:dnb:dnbwpp:022 A Copula-Based Autoregressive Conditional Dependence Model of International Stock Markets (2004). Netherlands Central Bank, Research Department / DNB Working Papers (7) RePEc:ecm:ausm04:273 Testing and Modelling Market Microstructure Effects with an Application to the Dow Jones Industrial Average (2004). Econometric Society / Econometric Society 2004 Australasian Meetings (8) RePEc:ecm:feam04:559 Estimation of Copula-Based Semiparametric Time Series Models (2004). Econometric Society / Econometric Society 2004 Far Eastern Meetings (9) RePEc:ecm:nasm04:487 Testing and Modelling Market Microstructure Effects with an Application to the Dow Jones Industrial Average (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (10) RePEc:hhs:hastef:0563 Stylized Facts of Financial Time Series and Three Popular Models of Volatility (2004). Stockholm School of Economics / Working Paper Series in Economics and Finance (11) RePEc:iea:carech:0405 Dynamic Optimal Portfolio Selection in a VaR Framework (2004). HEC Montréal, Institut d'économie appliquée / Cahiers de recherche (12) RePEc:iea:carech:0414 Evaluating Portfolio Value-at-Risk using Semi-Parametric GARCH Models (2004). HEC Montréal, Institut d'économie appliquée / Cahiers de recherche (13) RePEc:nbr:nberte:0300 Volatility Comovement: A Multifrequency Approach (2004). National Bureau of Economic Research, Inc / NBER Technical Working Papers (14) RePEc:nbr:nberwo:10914 Predicting Volatility: Getting the Most out of Return Data Sampled at Different Frequencies (2004). National Bureau of Economic Research, Inc / NBER Working Papers (15) RePEc:nuf:econwp:0429 A Central Limit Theorem for Realised Power and Bipower Variations of Continuous Semimartingales (2004). Economics Group, Nuffield College, University of Oxford / Economics Papers (16) RePEc:nuf:econwp:0430 Multipower Variation and Stochastic Volatility (2004). Economics Group, Nuffield College, University of Oxford / Economics Papers (17) RePEc:rut:rutres:200424 Assessing Central Bank Credibility During the EMS Crises: Comparing Option and Spot Market-Based Forecasts (2004). Rutgers University, Department of Economics / Departmental Working Papers (18) RePEc:sbs:wpsefe:2004fe21 A Central Limit Theorem for Realised Power and Bipower Variations of Continuous Semimartingales (2004). Oxford Financial Research Centre / OFRC Working Papers Series (19) RePEc:sbs:wpsefe:2004fe22 Multipower Variation and Stochastic Volatility (2004). Oxford Financial Research Centre / OFRC Working Papers Series (20) RePEc:van:wpaper:0226 Estimation of Copula-Based Semiparametric Time Series Models (2004). Department of Economics, Vanderbilt University / Working Papers (21) RePEc:van:wpaper:0419 Estimation and Model Selection of Semiparametric Copula-Based Multivariate Dynamic Models under Copula Misspecification (2004). Department of Economics, Vanderbilt University / Working Papers (22) RePEc:van:wpaper:0420 Efficient Estimation of Semiparametric Multivariate Copula Models (2004). Department of Economics, Vanderbilt University / Working Papers Latest citations received in: 2003 (1) RePEc:nuf:econwp:0303 Modelling Security Market Events in Continuous Time: Intensity Based, Multivariate Point Process Models (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |