|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

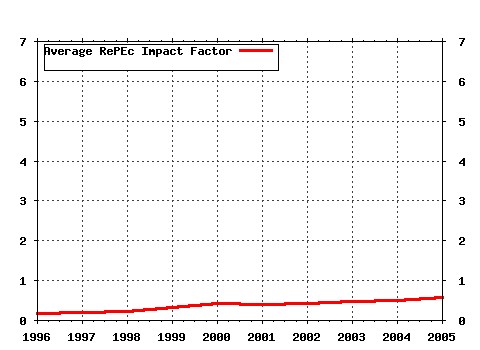

Applied Financial Economics Letters Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Latest citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apfelt:v:2:y:2006:i:2:p:123-130 Flexible Dynamic Conditional Correlation multivariate GARCH models for asset allocation (2006). (2) RePEc:taf:apfelt:v:1:y:2005:i:3:p:157-163 The impact of financial deregulation on monetary aggregates and interest rates in Australia (2005). (3) RePEc:taf:apfelt:v:1:y:2005:i:1:p:1-4 Measuring half-lives: using a non-parametric bootstrap approach (2005). (4) RePEc:taf:apfelt:v:1:y:2005:i:1:p:31-35 Temporal stability of estimates of risk aversion (2005). (5) RePEc:taf:apfelt:v:1:y:2005:i:1:p:41-46 Empirical identification of currency crises: differences and similarities between indicators (2005). (6) RePEc:taf:apfelt:v:1:y:2005:i:6:p:381-385 On the relationship between central bank independence and inflation: some more bad news (2005). (7) RePEc:taf:apfelt:v:1:y:2005:i:5:p:263-268 Does the credit risk premium lead the stock market? (2005). (8) RePEc:taf:apfelt:v:1:y:2005:i:4:p:205-210 Forecast performance of neural networks and business cycle asymmetries (2005). (9) RePEc:taf:apfelt:v:1:y:2005:i:3:p:151-156 An affine three-factor model of the German term structure of interest rates with macroeconomic content (2005). (10) RePEc:taf:apfelt:v:2:y:2006:i:1:p:1-7 Random walk versus multiple trend breaks in stock prices: evidence from 15 European markets (2006). (11) RePEc:taf:apfelt:v:1:y:2005:i:6:p:343-347 An alternative method to test for contagion with an application to the Asian financial crisis (2005). (12) RePEc:taf:apfelt:v:1:y:2005:i:4:p:211-216 Internal corporate governance mechanisms and corporate performance: evidence for UK firms (2005). (13) RePEc:taf:apfelt:v:2:y:2006:i:3:p:179-182 The equity premium puzzle and decreasing relative risk aversion (2006). (14) RePEc:taf:apfelt:v:2:y:2006:i:1:p:65-68 Do common variations in liquidity exhibit a U-shaped pattern across weekdays? (2006). Latest citations received in: | 2005 | 2004 | 2003 | 2002 Latest citations received in: 2005 (1) RePEc:aea:aecrev:v:95:y:2005:i:3:p:897-901 Risk Aversion and Incentive Effects: Comment (2005). American Economic Review Latest citations received in: 2004 Latest citations received in: 2003 Latest citations received in: 2002 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |