|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

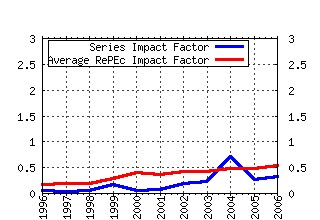

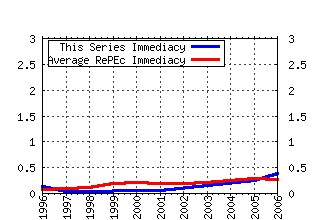

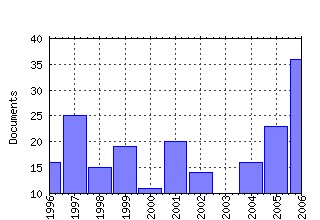

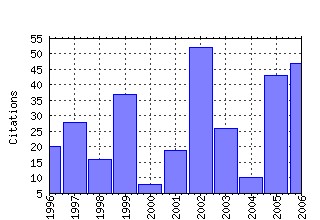

Centre for Economic Policy Research, RSSS, ANU / Discussion Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:auu:dpaper:458 What Fundamentals Drive World Migration? (2002). (2) RePEc:auu:dpaper:364 Performance Related Pay. (1997). (3) RePEc:auu:dpaper:325 The Macro Economy and the Growth of Ghettos and Urban Poverty in Australia. (1995). (4) RePEc:auu:dpaper:465 Estimating The Causal Effect of Income on Health: Evidence from Post Reunification East Germany (2003). (5) RePEc:auu:dpaper:406 Children and the Changing Labour Market: Joblessness in Families with Dependent Children. (1999). (6) RePEc:auu:dpaper:405 Unemployment Insurance Benefit Levels and Consumption Changes. (1999). (7) RePEc:auu:dpaper:510 Is There a Glass Ceiling over Europe? Exploring the Gender Pay Gap across the Wages Distribution (2006). (8) RePEc:auu:dpaper:514 The Distribution of Top Incomes in Australia (2006). (9) RePEc:auu:dpaper:554 A Comparative Analysis of the Nativity Wealth Gap (2007). (10) RePEc:auu:dpaper:464 Gender, Time Use and Models of the Household (2003). (11) RePEc:auu:dpaper:226 CAN ECONOMIC THEORY EXPLAIN WHY AUSTRALIAN WOMEN ARE SO WELL PAID RELATIVE TO THEIR U.S. COUNTERPARTS?. (1990). (12) RePEc:auu:dpaper:519 The Wealth of Mexican Americans (2006). (13) RePEc:auu:dpaper:409 Reassessing the Role of Child Care Costs in the Work and Care Decisions of Australian Families (1999). (14) RePEc:auu:dpaper:341 The Worldwide Market for Skilled Migrants: Can Australia Compete? (1996). (15) RePEc:auu:dpaper:494 Who Benefits from the Earned Income Tax Credit? Incidence Among Recipients, Coworkers and Firms (2005). (16) RePEc:auu:dpaper:503 The Distribution of Top Incomes in New Zealand (2005). (17) RePEc:auu:dpaper:346 Trade with Asia and Skill Upgrading: Effects on Factor Markets in the Older Industrial Countries. (1996). (18) RePEc:auu:dpaper:434 Australian Higher Education Financing: Issues for Reform (2001). (19) RePEc:auu:dpaper:500 Gender, Time Use and Public Policy Over the Life Cycle (2005). (20) RePEc:auu:dpaper:529 Born on the First of July: An (Un)natural Experiment in Birth Timing (2006). (21) RePEc:auu:dpaper:506 Birth Order Matters: The Effect of Family Size and Birth Order on Educational Attainment (2005). (22) RePEc:auu:dpaper:449 Income-Contingent Financing of Student Charges for Higher Education: Assessing the Australian Innovation (2002). (23) RePEc:auu:dpaper:491 Income Contingent Loans for Higher Education: International Reform (2005). (24) RePEc:auu:dpaper:291 Immigrant Wage Differentials and the Role of Self-Employment in Australia. (1993). (25) RePEc:auu:dpaper:342 The Decline in Unskilled Employment in UK Manufacturing. (1996). (26) RePEc:auu:dpaper:389 Earnings Inequality in Australia. (1998). (27) RePEc:auu:dpaper:338 Estimating the Benefits of Hilmer and Related Reforms. (1995). (28) RePEc:auu:dpaper:559 The Taxation of Couples (2007). (29) RePEc:auu:dpaper:524 Family Taxation: An Unfair and Inefficient System (2006). (30) RePEc:auu:dpaper:482 Back-to-front Down-under? Part-time/Full-time Wage Differentials in Australia (2004). (31) RePEc:auu:dpaper:463 The Access Implications of Income Contingent Charges for Higher Education: Lessons from Australia (2003). (32) RePEc:auu:dpaper:401 Labour Market Outcomes in the UK, NZ, Australia and the US: Observations on the Impact of Labour Market and Economic Reforms. (1999). (33) RePEc:auu:dpaper:431 Why an Earned Income Tax Credit Program is a Mistake for Australia (2001). (34) RePEc:auu:dpaper:540 The Retirement Expectations of Middle-Aged

Individuals (2006). (35) RePEc:auu:dpaper:571 Immigrant Selection in the OECD (2008). (36) RePEc:auu:dpaper:372 A wage Curve for Australia? (1997). (37) RePEc:auu:dpaper:230 THE ROLE OF FERTILITY AND POPULATION IN ECONOMIC GROWTH: NEW RESULTS FROM AGGREGATE CROSS-NATIONAL DATA. (1990). (38) RePEc:auu:dpaper:388 Dimensions, Structure and History of Australian Unemployment (1998). (39) RePEc:auu:dpaper:445 Long-term Unemployment and Work Deprived Individuals: Issues and Policies (2001). (40) RePEc:auu:dpaper:221 AN ANALYSIS OF THE AUSTRALIAN CONSENSUAL INCOMES POLICY: THE PRICES AND INCOMES ACCORD. (1990). (41) RePEc:auu:dpaper:359 Young Australians in Unemployment : Despair by any Other Name. (1997). (42) RePEc:auu:dpaper:488 Optimal Design of Earned Income Tax Credits: Evidence from a British Natural Experiment (2005). (43) RePEc:auu:dpaper:513 Does Equality Lead to Fraternity? (2006). (44) RePEc:auu:dpaper:387 Prospects for Output and Employment Growth with Steady Inflation (1998). (45) RePEc:auu:dpaper:249 The Incidence of Long Term Unemployment in Australia. (1991). (46) RePEc:auu:dpaper:419 The Effects of Unemployment on the Earnings of Young Australians (2000). (47) RePEc:auu:dpaper:452 Human Capital Accumulation: Education and Immigration (2002). (48) RePEc:auu:dpaper:390 Earnings Inequality in Australia: Changes, Causes and Consequences. (1998). (49) RePEc:auu:dpaper:274 Long Term Unemployment : Projections and Policy. (1992). (50) RePEc:auu:dpaper:522 Increasing Returns to Education: Theory and Evidence (2006). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:auu:dpaper:511 Trust, Inequality, and Ethnic Heterogeneity (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (2) RePEc:auu:dpaper:528 Bargaining Over Labor: Do Patients have any Power? (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (3) RePEc:auu:dpaper:530 Did the Death of Australian Inheritance Taxes Affect Deaths? (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (4) RePEc:auu:dpaper:531 The Millennium Bub (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (5) RePEc:auu:dpaper:541 The New Discrimination and Childcare (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (6) RePEc:auu:dpaper:542 The Glass Ceiling in Europe: Why Are Women Doing Badly in the Labour Market? (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (7) RePEc:auu:dpaper:543 A Microfoundation for Increasing Returns in Human Capital Accumulation and the Under-Participation Trap (2006). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (8) RePEc:bep:eaptop:v:6:y:2006:i:1:p:1654-1654 Did the Death of Australian Inheritance Taxes Affect Deaths? (2006). Topics in Economic Analysis & Policy (9) RePEc:hhs:hastef:0625 The Evolution of Top Incomes in an Egalitarian Society: Sweden, 1903â2004 (2006). Stockholm School of Economics / Working Paper Series in Economics and Finance (10) RePEc:hhs:iuiwop:0667 The Evolution of Top Incomes in an Egalitarian Society; Sweden, 1903â2004 (2006). The Research Institute of Industrial Economics / IUI Working Paper Series (11) RePEc:inq:inqwps:ecineq2006-25 The measurement of gender wage discrimination: The distributional approach revisited (2006). ECINEQ, Society for the Study of Economic Inequality / Working Papers (12) RePEc:iza:izadps:dp2219 Quantifying the Cost of Passive Smoking on Child Health: Evidence from Childrenâs Cotinine Samples (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (13) RePEc:iza:izadps:dp2276 Employee Training, Wage Dispersion and Equality in Britain (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (14) RePEc:yor:yorken:06/14 Employee Training, Wage Dispersion and Equality in Britain (2006). Department of Economics, University of York / Discussion Papers Recent citations received in: 2005 (1) RePEc:auu:dpaper:488 Optimal Design of Earned Income Tax Credits: Evidence from a British Natural Experiment (2005). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (2) RePEc:auu:dpaper:490 Can Redistributive State Taxes Reduce Inequality? (2005). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (3) RePEc:auu:dpaper:498 Overcrowding and Indigenous Health in Australia (2005). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (4) RePEc:nbr:nberwo:11626 Distributional Impacts of the Self-Sufficiency Project (2005). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:nbr:nberwo:11729 Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply (2005). National Bureau of Economic Research, Inc / NBER Working Papers (6) RePEc:pri:indrel:883 The Mid-1990s EITC Expansion: Aggregate Labor Supply Effects and Economic Incidence (2005). Princeton University, Department of Economics, Industrial Relations Section. / Working Papers Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||