|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

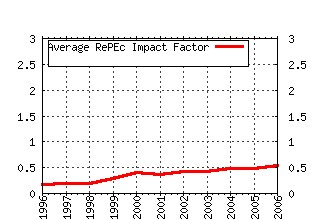

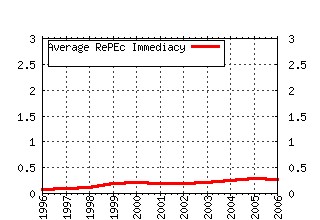

Oxford University Centre for Business Taxation / Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:btx:wpaper:0803 What determines the use of holding companies and ownership chains? (2008). (2) RePEc:btx:wpaper:0702 (). (3) RePEc:btx:wpaper:0715 (). (4) RePEc:btx:wpaper:0811 Firm-specific Forward-looking Effective Tax Rates (2008). (5) RePEc:btx:wpaper:0815 Firms financial choices and thin capitalization rules under corporate tax competition (2008). (6) RePEc:btx:wpaper:0711 (). (7) RePEc:btx:wpaper:0804 Thin Capitalization Rules in the Context of the CCCTB (2008). (8) RePEc:btx:wpaper:0719 (). (9) RePEc:btx:wpaper:0712 (). (10) RePEc:btx:wpaper:0812 Increased efficiency through consolidation and formula apportionment in the European Union? (2008). (11) RePEc:btx:wpaper:0706 (). (12) RePEc:btx:wpaper:0810 Economic integration and the relationship between profit and wage taxes (2008). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||