|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

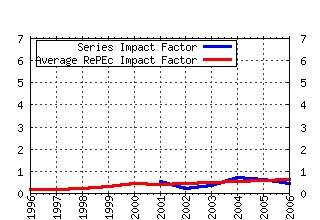

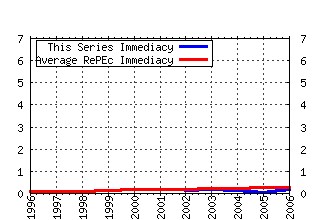

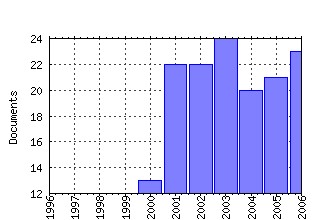

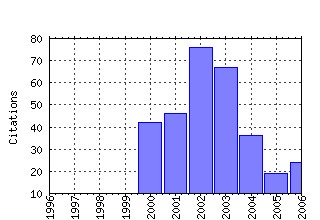

Emerging Markets Review Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:ememar:v:1:y:2000:i:2:p:101-126 Before the fall: were East Asian currencies overvalued? (2000). (2) RePEc:eee:ememar:v:3:y:2002:i:4:p:429-448 Research in emerging markets finance: looking to the future (2002). (3) RePEc:eee:ememar:v:2:y:2001:i:2:p:89-108 The corporate governance behavior and market value of Russian firms (2001). (4) RePEc:eee:ememar:v:3:y:2002:i:2:p:107-133 Leading indicators of currency crises for emerging countries (2002). (5) RePEc:eee:ememar:v:3:y:2002:i:1:p:69-83 International portfolio diversification: US and Central European equity markets (2002). (6) RePEc:eee:ememar:v:4:y:2003:i:4:p:330-339 Debt composition and balance sheet effects of currency depreciation: a summary of the micro evidence (2003). (7) RePEc:eee:ememar:v:5:y:2004:i:2:p:217-240 Private benefits and cross-listings in the United States (2004). (8) RePEc:eee:ememar:v:4:y:2003:i:4:p:397-416 Debt composition and balance sheet effects of exchange rate depreciations: a firm-level analysis for Chile (2003). (9) RePEc:eee:ememar:v:4:y:2003:i:4:p:417-449 Dollar debt in Colombian firms: are sinners punished during devaluations? (2003). (10) RePEc:eee:ememar:v:4:y:2003:i:4:p:368-396 Debt composition and exchange rate balance sheet effect in Brazil: a firm level analysis (2003). (11) RePEc:eee:ememar:v:2:y:2001:i:2:p:138-160 State of corruption in transition: case of the Czech Republic (2001). (12) RePEc:eee:ememar:v:5:y:2004:i:2:p:241-266 The risk and predictability of equity returns of the EU accession countries (2004). (13) RePEc:eee:ememar:v:1:y:2000:i:2:p:127-151 Country and industry factors in returns: evidence from emerging markets stocks (2000). (14) RePEc:eee:ememar:v:3:y:2002:i:3:p:245-268 Assessing the effects of corruption and crime on firm performance: evidence from Latin America (2002). (15) RePEc:eee:ememar:v:3:y:2002:i:4:p:380-408 Emerging market bond spreads and sovereign credit ratings: reconciling market views with economic fundamentals (2002). (16) RePEc:eee:ememar:v:1:y:2000:i:1:p:21-52 The Korean financial crisis: an asymmetric information perspective (2000). (17) RePEc:eee:ememar:v:4:y:2003:i:4:p:340-367 Financial dollarization and debt deflation under a currency board (2003). (18) RePEc:eee:ememar:v:5:y:2004:i:1:p:39-59 Consolidation and market structure in emerging market banking systems (2004). (19) RePEc:eee:ememar:v:3:y:2002:i:4:p:365-379 Systematic risk in emerging markets: the (2002). (20) RePEc:eee:ememar:v:4:y:2003:i:4:p:450-471 Debt composition and balance sheet effects of exchange rate volatility in Mexico: a firm level analysis (2003). (21) RePEc:eee:ememar:v:4:y:2003:i:1:p:25-38 Leaders and followers: emerging market fund behavior during tranquil and turbulent times (2003). (22) RePEc:eee:ememar:v:7:y:2006:i:3:p:228-243 The unexplained part of public debt (2006). (23) RePEc:eee:ememar:v:4:y:2003:i:3:p:248-272 What drives financial crises in emerging markets? (2003). (24) RePEc:eee:ememar:v:4:y:2003:i:1:p:53-72 The Internet and the ability to innovate in Latin America (2003). (25) RePEc:eee:ememar:v:2:y:2001:i:2:p:109-137 Privatisation: politics, institutions, and financial markets (2001). (26) RePEc:eee:ememar:v:4:y:2003:i:3:p:225-247 Returns on ADRs and arbitrage in emerging markets (2003). (27) RePEc:eee:ememar:v:1:y:2000:i:1:p:53-81 Implications of the euro for Latin Americas financial and banking systems (2000). (28) RePEc:eee:ememar:v:8:y:2007:i:4:p:299-310 Public debt and social expenditure: Friends or foes? (2007). (29) RePEc:eee:ememar:v:2:y:2001:i:4:p:418-430 The real exchange rate and the output response in four EU accession countries (2001). (30) RePEc:eee:ememar:v:7:y:2006:i:2:p:129-146 European Union enlargement and equity markets in accession countries (2006). (31) RePEc:eee:ememar:v:3:y:2002:i:1:p:84-105 Economic determinants of emerging stock market interdependence (2002). (32) RePEc:eee:ememar:v:6:y:2005:i:1:p:21-43 Coexceedances in financial markets--a quantile regression analysis of contagion (2005). (33) RePEc:eee:ememar:v:2:y:2001:i:2:p:161-183 Poland: a successful transition to budget sustainability? (2001). (34) RePEc:eee:ememar:v:6:y:2005:i:2:p:192-209 Competition and concentration in the banking sector of the South Eastern European region (2005). (35) RePEc:eee:ememar:v:4:y:2003:i:4:p:472-496 Exchange rate volatility and economic performance in Peru: a firm level analysis (2003). (36) RePEc:eee:ememar:v:7:y:2006:i:2:p:176-190 Did financial liberalization ease financing constraints? Evidence from Indian firm-level data (2006). (37) RePEc:eee:ememar:v:5:y:2004:i:1:p:61-82 International reserve-holding in the developing world: self insurance in a crisis-prone era? (2004). (38) RePEc:eee:ememar:v:4:y:2003:i:1:p:39-51 Firm-level access to international capital markets: evidence from Chilean equities (2003). (39) RePEc:eee:ememar:v:6:y:2005:i:3:p:289-307 Fear of floating and domestic liability dollarization (2005). (40) RePEc:eee:ememar:v:5:y:2004:i:3:p:341-359 Financial liberalization, prudential supervision, and the onset of banking crises (2004). (41) RePEc:eee:ememar:v:8:y:2007:i:1:p:20-37 The impact of macroeconomic announcements on emerging market bonds (2007). (42) RePEc:eee:ememar:v:2:y:2001:i:3:p:218-243 How to reduce inflation: an independent central bank or a currency board? The experience of the Baltic countries (2001). (43) RePEc:eee:ememar:v:7:y:2006:i:4:p:361-379 Corporate governance indices and firms market values: Time series evidence from Russia (2006). (44) RePEc:eee:ememar:v:3:y:2002:i:1:p:31-50 Predicting bank failures using a hazard model: the Venezuelan banking crisis (2002). (45) RePEc:eee:ememar:v:6:y:2005:i:2:p:138-169 Financing choices of firms in EU accession countries (2005). (46) RePEc:eee:ememar:v:2:y:2001:i:1:p:17-33 The profitability of moving average trading rules in South Asian stock markets (2001). (47) RePEc:eee:ememar:v:3:y:2002:i:4:p:325-337 Measuring transparency and disclosure at firm-level in emerging markets (2002). (48) RePEc:eee:ememar:v:1:y:2000:i:3:p:229-251 Novelties of financial crises in the 1990s and the search for new indicators (2000). (49) RePEc:eee:ememar:v:2:y:2001:i:1:p:34-49 Is foreign direct investment a safer form of financing? (2001). (50) RePEc:eee:ememar:v:3:y:2002:i:2:p:135-164 The long-term performance of privatization-related ADR issues (2002). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:dgr:kubcen:200646 Business groups, taxes and accruals management (2006). Tilburg University, Center for Economic Research / Discussion Paper (2) RePEc:idb:wpaper:1019 Public Debt around the World: A New Dataset of Central Government Debt (2006). Inter-American Development Bank, Research Department / Working Papers (3) RePEc:idb:wpaper:4461 Public Debt around the World: A New Dataset of Central Government Debt (2006). Inter-American Development Bank, Research Department / Working Papers (4) RePEc:idb:wpaper:4462 La deuda pública en el mundo (2006). Inter-American Development Bank, Research Department / Working Papers Recent citations received in: 2005 (1) RePEc:kud:kuiedp:0503 Rational Fear of Floating: A Simple Model of Exchange Rates and Income Distribution (2005). University of Copenhagen. Department of Economics (formerly Institute of Economics) / Discussion Papers Recent citations received in: 2004 (1) RePEc:ecl:upafin:05-4 Are There Permanent Valuation Gains to Overseas Listing? Evidence from Market Sequencing and Selection (2004). University of Pennsylvania, Wharton School, Weiss Center / Working Papers (2) RePEc:fip:fedgif:815 Look at me now: the role of cross-listing in attracting U.S. investors (2004). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (3) RePEc:mmf:mmfc04:26 Competition and Concentration (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 Recent citations received in: 2003 (1) RePEc:fip:fedgif:771 U.S. investors emerging market equity portfolios: a security-level analysis (2003). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (2) RePEc:imf:imfwpa:03/238 U.S. Investors Emerging Market Equity Portfolios: A Security-Level Analysis (2003). International Monetary Fund / IMF Working Papers (3) RePEc:udt:wpbsdt:tres Finantial Dollarization and Debt Deflation under a Currency Board (2003). Universidad Torcuato Di Tella / Business School Working Papers (4) RePEc:una:unccee:wp1203 Exchange Rate Volatility and Economic Performance in Peru: A Firm Level Analysis (2003). School of Economics and Business Administration, University of Navarra / Faculty Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||