|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

American Institute for Contemporary German Studies- / American Institute for Contemporary German Studies- Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

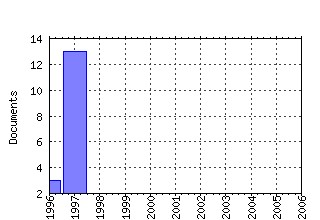

Most cited documents in this series: (1) RePEc:fth:amiger:03 Inflation and Monetary Targeting in Germany. (1995). (2) RePEc:fth:amiger:14 The German System of Corporate Governance - A Model Which Should Not Be Imitated. (1997). (3) RePEc:fth:amiger:5 Integrating the East: The Labor Market Effects of Immigration. (1995). (4) RePEc:fth:amiger:28 Finance, Control, and Profitability : An Evaluation of German Bank Influence. (1997). (5) RePEc:fth:amiger:8 An Economic Assessment of the Integration of Czechoslovakia, Hungary and Poland into the European Union. (1995). (6) RePEc:fth:amiger:6 Impact on German Trade of Increased Division of Labor with Eastern Europe. (1995). (7) RePEc:fth:amiger:10 Potential Trade with Core and Periphery: Industry Differences in Trade Patterns. (1995). (8) RePEc:fth:amiger:16 How is Investment Financed? A Study of Germany, Japan, UK and US. (1997). (9) RePEc:fth:amiger:11 Regional Development, Capital Flows and Trade Policies in an Aging Europe. (1995). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||