|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

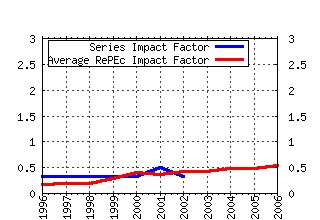

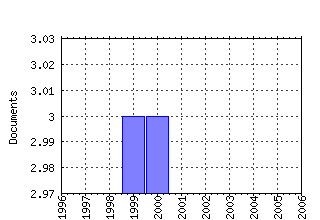

Cambridge - Risk, Information & Quantity Signals / Cambridge - Risk, Information & Quantity Signals Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:cambri:183 Incomplete Written Contracts: Undescribable States of Nature. (1993). (2) RePEc:fth:cambri:47 What Drives Private Saving Across the World? (1999). (3) RePEc:fth:cambri:61 Optimal Monetary Policy Rules Under Inflation Range Targeting. (2000). (4) RePEc:fth:cambri:186 Path Dependence and Learning from Neighbours. (1993). (5) RePEc:fth:cambri:150 SOCIAL EQUILIBRIUM. (1990). (6) RePEc:fth:cambri:62 Bank Concentration: Chile and International Comparisons. (2000). (7) RePEc:fth:cambri:165 Indeterminacy and Increasing Returns. (1991). (8) RePEc:fth:cambri:63 Household Saving in Chile: Microeconomic Evidence. (2000). (9) RePEc:fth:cambri:164 The Aggregate Effects of Monetary Externalities. (1991). (10) RePEc:fth:cambri:156 AVERAGE BEHAVIOUR IN LEARNING MODELS. (1990). (11) RePEc:fth:cambri:159 COMMUNICATION, COMPUTABILITY AND COMMON INTEREST GAMES. (1990). (12) RePEc:fth:cambri:179 A Remark on Incomplete Market Equilibrium. (1992). (13) RePEc:fth:cambri:200 Endogenous Agency Problems (1995). (14) RePEc:fth:cambri:155 ON STATIONARY MONETARY EQUILIBRIA IN OVERLAPPING GENERATIONS MODELS WITH INCOMPLETE MARKETS. (1990). (15) RePEc:fth:cambri:166 Incomplete Market Economy. (1992). (16) RePEc:fth:cambri:50 The Effect of Capital Controls on Interest Rate Differentials. (1999). (17) RePEc:fth:cambri:151 SOME REMARKS ON MISSING MARKETS. (1990). (18) RePEc:fth:cambri:178 Price Uncertainty and Derivative Securities in a General Equilibrium Model. (1992). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||