|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

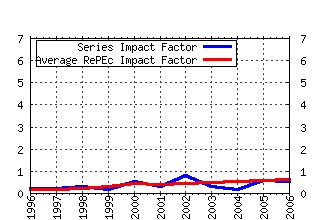

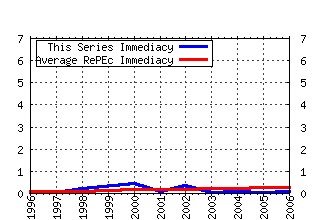

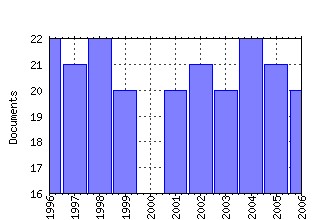

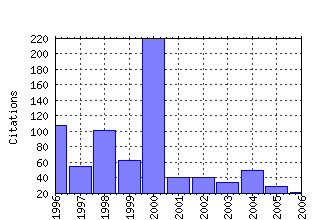

Fiscal Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ifs:fistud:v:21:y:2000:i:1:p:75-103 The labour market impact of the working familiesâ tax credit (2000). (2) RePEc:ifs:fistud:v:21:y:2000:i:4:p:427-468 Evaluation methods for non-experimental data (2000). (3) RePEc:ifs:fistud:v:19:y:1998:i:4:p:347-374 Does it pay to work in the public sector? (1998). (4) RePEc:ifs:fistud:v:14:y:1993:i:2:p:15-36 The welfare economics of tax co-ordination in the European Community : a survey (1993). (5) RePEc:ifs:fistud:v:17:y:1996:i:2:p:1-36 The gender earnings gap: evidence from the UK (1996). (6) RePEc:ifs:fistud:v:17:y:1996:i:1:p:37-58 Fighting international tax avoidance (1996). (7) RePEc:ifs:fistud:v:20:y:1999:i:1:p:1-23 Human capital investment: the returns from education and training to the individual, the firm and the economy (1999). (8) RePEc:ifs:fistud:v:15:y:1994:i:3:p:109-28 Monetary policy in the UK (1994). (9) RePEc:ifs:fistud:v:15:y:1994:i:2:p:19-43 Carbon taxes, consumer demand and carbon dioxide emissions: a simulation analysis for the UK (1994). (10) RePEc:ifs:fistud:v:12:y:1991:i:3:p:1-15 A general neutral profits tax (1991). (11) RePEc:ifs:fistud:v:25:y:2004:i:2:p:159-200 Ageing and the tax implied in public pension schemes: simulations for selected OECD countries (2004). (12) RePEc:ifs:fistud:v:13:y:1992:i:3:p:15-40 Labour supply and taxation: a survey (1992). (13) RePEc:ifs:fistud:v:19:y:1998:i:1:p:1-37 The balance between specific and ad valorem taxation (1998). (14) RePEc:ifs:fistud:v:20:y:1999:i:3:p:305-320 Combining input-output analysis and micro-simulation to assess the effects of carbon taxation on Spanish households (1999). (15) RePEc:ifs:fistud:v:21:y:2000:i:2:p:207-229 Public investment, the Stability Pact and the âgolden ruleâ (2000). (16) RePEc:ifs:fistud:v:15:y:1994:i:1:p:24-43 Retirement behaviour in Britain (1994). (17) RePEc:ifs:fistud:v:16:y:1995:i:4:p:23-68 Corporation tax: a survey (1995). (18) RePEc:ifs:fistud:v:21:y:2000:i:3:p:329-347 Expenditure incidence in Africa: microeconomic evidence (2000). (19) RePEc:ifs:fistud:v:17:y:1996:i:1:p:1-18 Profit-sharing regulation: an economic appraisal (1996). (20) RePEc:ifs:fistud:v:19:y:1998:i:4:p:375-402 Equity and ecotax reform in the EU: achieving a 10 per cent reduction in CO2 emissions using excise duties (1998). (21) RePEc:ifs:fistud:v:24:y:2003:i:3:p:237-274 Fiscal Decentralisation and Economic Growth in High-Income OECD Countries (2003). (22) RePEc:ifs:fistud:v:15:y:1994:i:2:p:1-18 Financial constraints and company investment (1994). (23) RePEc:ifs:fistud:v:23:y:2002:i:3:p:401-418 The Croatian profit tax: an ACE in practice (2002). (24) RePEc:ifs:fistud:v:18:y:1997:i:3:p:225-247 Wage structures in the private and public sectors in West Germany (1997). (25) RePEc:ifs:fistud:v:21:y:2000:i:3:p:375-399 Evidence on the relationship between income and poor health: is the government doing enough? (2000). (26) RePEc:ifs:fistud:v:1:y:1980:i:3:p:1-28 The economic implications of North Sea Oil Revenues (1980). (27) RePEc:ifs:fistud:v:13:y:1992:i:4:p:21-57 Taxation and the environment: a survey (1992). (28) RePEc:ifs:fistud:v:17:y:1996:i:3:p:1-19 The impact of compulsory competitive tendering on refuse collection services (1996). (29) RePEc:ifs:fistud:v:25:y:2004:i:4:p:367-388 Why has the UK corporation tax raised so much revenue? (2004). (30) RePEc:ifs:fistud:v:16:y:1995:i:3:p:40-54 Income, expenditure and the living standards of UK households (1995). (31) RePEc:ifs:fistud:v:19:y:1998:i:2:p:175-196 The dynamics of male retirement behaviour (1998). (32) RePEc:ifs:fistud:v:22:y:2001:i:1:p:41-77 Comparing in-work benefits and the reward to work for families with children in the US and the UK (2001). (33) RePEc:ifs:fistud:v:23:y:2002:i:1:p:1-49 Unemployment and workers compensation programmes: rationale, design, labour supply and income support . (2002). (34) RePEc:ifs:fistud:v:13:y:1992:i:1:p:1-21 Lone mothers, family credit and paid work (1992). (35) RePEc:ifs:fistud:v:7:y:1986:i:4:p:69-87 Competitive tendering and efficiency: the case of refuse collection (1986). (36) RePEc:ifs:fistud:v:17:y:1996:i:3:p:21-38 Carbon taxation, prices and inequality in Australia (1996). (37) RePEc:ifs:fistud:v:17:y:1996:i:4:p:31-48 Minimum wages: possible effects on the distribution of income (1996). (38) RePEc:ifs:fistud:v:19:y:1998:i:3:p:221-247 Global and regional public goods: a prognosis for collective action (1998). (39) RePEc:ifs:fistud:v:25:y:2004:i:3:p:279-303 The Take-Up of Multiple Means-Tested Benefits by British Pensioners: Evidence from the Family Resources Survey (2004). (40) RePEc:ifs:fistud:v:16:y:1995:i:2:p:94-114 Bringing it all back home: alcohol taxation and cross-border shopping (1995). (41) RePEc:ifs:fistud:v:14:y:1993:i:1:p:15-41 Optimal taxation as a guide to tax policy: a survey (1993). (42) RePEc:ifs:fistud:v:16:y:1995:i:2:p:21-44 Tax incentives for R&D (1995). (43) RePEc:ifs:fistud:v:18:y:1997:i:4:p:401-425 The possibility of a British earned income tax credit (1997). (44) RePEc:ifs:fistud:v:15:y:1994:i:4:p:119-35 Paying for public spending: is there a role for earmarked taxes? (1994). (45) RePEc:ifs:fistud:v:16:y:1995:i:2:p:71-93 Subsidising consumer services: effects on employment, welfare and the informal economy (1995). (46) RePEc:ifs:fistud:v:26:y:2005:i:4:p:423-470 Immigrants in the British labour market (2005). (47) RePEc:ifs:fistud:v:17:y:1996:i:4:p:67-97 Company Taxes in the European Union: Criteria and Options for Reform (1996). (48) RePEc:ifs:fistud:v:18:y:1997:i:3:p:303-318 A comment on the viability of the allowance for corporate equity (1997). (49) RePEc:ifs:fistud:v:18:y:1997:i:1:p:73-85 A cost-benefit approach to the evaluation of regional selective assistance (1997). (50) RePEc:ifs:fistud:v:20:y:1999:i:1:p:25-40 Human capital formation and general equilibrium treatment effects: a study of tax and tuition policy (1999). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:cep:sticas:/106 Modelling poverty by not modelling poverty: An application of a simultaneous hazards approach to the UK (2006). Centre for Analysis of Social Exclusion, LSE / CASE Papers (2) RePEc:pra:mprapa:1867 A family of big brother that do not talk esch other (2006). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2005 (1) RePEc:ces:ceswps:_1615 New Evidence on Fiscal Decentralization and the Size of Government (2005). CESifo GmbH / CESifo Working Paper Series Recent citations received in: 2004 (1) RePEc:ces:ceswps:_1214 Public Pensions in the National Accounts and Public Finance Targets (2004). CESifo GmbH / CESifo Working Paper Series (2) RePEc:zbw:zewdip:2349 A Simulation Method to Measure the Tax Burden on Highly Skilled Manpower (2004). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Recent citations received in: 2003 (1) RePEc:shr:wpaper:03-06 Poverty Measurement Under Risk Aversion Using Panel Data (2003). Departement d'Economique de la Faculte d'administration à l'Universite de Sherbrooke / Cahiers de recherche Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||