|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

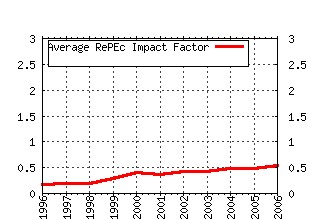

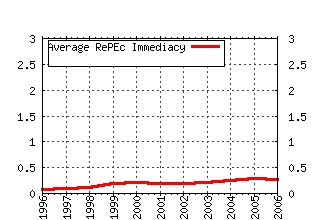

Institute for Monetary and Economic Studies, Bank of Japan / IMES Discussion Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ime:imedps:07-e-17 CAPITAL MARKET INTEGRATION IN JAPAN (2007). (2) RePEc:ime:imedps:07-e-19 The Broad Yen Carry Trade (2007). (3) RePEc:ime:imedps:08-e-21 Growth Expectation (2008). (4) RePEc:ime:imedps:07-e-12 Financial Integration in East Asia (2007). (5) RePEc:ime:imedps:08-e-05 Accounting for Persistence and Volatility of Good-level Real

Exchange Rates: The Role of Sticky Information (2008). (6) RePEc:ime:imedps:07-e-10 Monetary Policy in East Asia: the Case of Singapore (2007). (7) RePEc:ime:imedps:08-e-08 Optimal Monetary Policy under Staggered Loan Contracts (2008). (8) RePEc:ime:imedps:08-e-01 Monetary Policy and Learning from the Central Banks Forecast (2008). (9) RePEc:ime:imedps:07-e-18 Monetary Policy in East Asia: Common Concerns (2007). (10) RePEc:ime:imedps:08-e-22 The Global Impact of Chinese Growth (2008). (11) RePEc:ime:imedps:08-e-16 Can News Be a Major Source of Aggregate Fluctuations? A Bayesian

DSGE Approach (2008). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||