|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

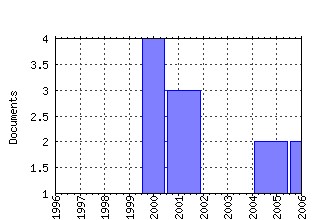

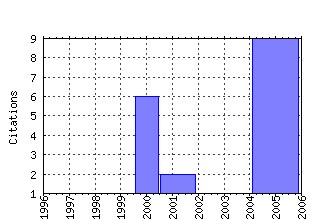

Universita di Modena e Reggio Emilia, Dipartimento di Economia Politica / Heterogeneity and monetary policy Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:mod:modena:0504 Forward-looking estimation of default probabilities with Italian data (2005). (2) RePEc:mod:modena:0004 Banks inefficiency and economic growth: a micro-macro approach (2000). (3) RePEc:mod:modena:0503 A less effective monetary transmission in the wake of EMU?

Evidence from lending rates pass-through (2005). (4) RePEc:mod:modena:0103 Is trade credit more expensive than bank loans? Evidence from

Italian firm-level data. (2001). (5) RePEc:mod:modena:0703 Stress testing of the stability of the Italian banking system: a VAR approach (2007). (6) RePEc:mod:modena:0303 When do trade credit discounts matter? Evidence from Italian

firm-level data (2003). (7) RePEc:mod:modena:0702 The Effect of Population Ageing on Household Portfolio Choices in Italy (2007). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:mod:depeco:518 Economic Growth Rates and Recession Probabilities:the predictive power of the term spread in Italy (2005). Universita di Modena e Reggio Emilia, Dipartimento di Economia Politica / Dipartimento di Economia Politica (Economics Department) Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||