|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

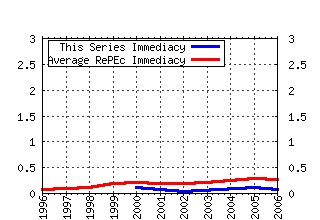

School of Business, Reading University / ICMA Centre Discussion Papers in Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:rdg:icmadp:icma-dp2000-05 The ACD Model: Predictability of the Time Between Concecutive Trades (2000). (2) RePEc:rdg:icmadp:icma-dp2001-09 The Statistical Properties of Hedge Fund Index Returns (2001). (3) RePEc:rdg:icmadp:icma-dp2003-07 Multivariate GARCH Models: Software Choice and Estimation Issues (2003). (4) RePEc:rdg:icmadp:icma-dp2000-06 Orthogonal Methods for Generating Large Positive Semi-Definite Covariance Matrices (2000). (5) RePEc:rdg:icmadp:icma-dp2000-01 Value at Risk and Market Crashes (2000). (6) RePEc:rdg:icmadp:icma-dp2005-02 The Long-Term P/E Radio (2005). (7) RePEc:rdg:icmadp:icma-dp2006-03 Hedging Options with Scale-Invariant Models (2006). (8) RePEc:rdg:icmadp:icma-dp2002-15 Generalization of the Sharpe Ratio and the Arbitrage-Free Pricing of Higher Moments (2002). (9) RePEc:rdg:icmadp:icma-dp2004-06 MTS Time Series: Market and Data Description for the European Bond and Repo Database (2004). (10) RePEc:rdg:icmadp:icma-dp2006-07 Speculative Bubbles in the S&P 500: Was the Tech Bubble Confined to the Tech Sector? (2006). (11) RePEc:rdg:icmadp:icma-dp2003-03 Statistical Properties of Forward Libor Rates (2003). (12) RePEc:rdg:icmadp:icma-dp2005-05 The Spider in the Hedge (2005). (13) RePEc:rdg:icmadp:icma-dp2002-19 Smart Fund Managers? Stupid Money? (2003). (14) RePEc:rdg:icmadp:icma-dp2002-01 Best-advice and the true mortgate term. Actuaries endowment advice principles revisited (2002). (15) RePEc:rdg:icmadp:icma-dp2003-10 Long-term Information, Short-lived Securities (2003). (16) RePEc:rdg:icmadp:icma-dp2001-07 Credit Risk Diversification (2001). (17) RePEc:rdg:icmadp:icma-dp2007-02 Model-Based Stress Tests: Linking Stress Tests to VaR for Market Risk (2007). (18) RePEc:rdg:icmadp:icma-dp2003-06 Short and Long Term Smile Effects: The Binomial Normal Mixture Diffusion Model (2003). (19) RePEc:rdg:icmadp:icma-dp2003-02 Equity Indexing: Conitegration and Stock Price Dispersion: A Regime Switiching Approach to market Efficiency (2003). (20) RePEc:rdg:icmadp:icma-dp2005-03 Decomposing the P/E Ratio (2005). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:pra:mprapa:973 Path dependent volatility (2006). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2005 (1) RePEc:rdg:icmadp:icma-dp2005-03 Decomposing the P/E Ratio (2005). School of Business, Reading University / ICMA Centre Discussion Papers in Finance (2) RePEc:rdg:icmadp:icma-dp2005-04 The Extremes of the P/E Effect (2005). School of Business, Reading University / ICMA Centre Discussion Papers in Finance Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||