|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

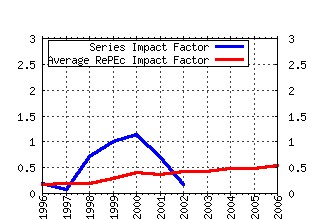

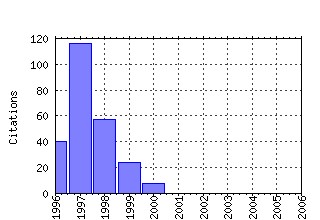

University of California at Berkeley / Research Program in Finance Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ucb:calbrf:rpf-232 Implied Binomial Trees. (1994). (2) RePEc:ucb:calbrf:rpf-271 International Portfolio Investment Flows. (1997). (3) RePEc:ucb:calbrf:rpf-233 Corporate Debt Value, Bond Covenants, and Optimal Capital Structure. (1994). (4) RePEc:ucb:calbrf:85 A Continuous-Time Approach to the Pricing of Bonds. (1979). (5) RePEc:ucb:calbrf:rpf-278 Agency Costs, Risk Management, and Capital Structure. (1998). (6) RePEc:ucb:calbrf:rpf-265 Recovering Risk Aversion from Option Prices and Realized Returns. (1996). (7) RePEc:ucb:calbrf:rpf-288 Order Flow and Exchange Rate Dynamics. (1999). (8) RePEc:ucb:calbrf:rpf-282 The Credit Crunch and the Availability of Credit to Small Business (1998). (9) RePEc:ucb:calbrf:rpf-259 Optimal Capital Structure, Endogenous Bankruptcy, and the Term Structure of

Credit Spreads. (1995). (10) RePEc:ucb:calbrf:rpf-243 Foreign Exchange Volume: Sound and Fury Signifying Nothing? (1995). (11) RePEc:ucb:calbrf:rpf-191 Consumption and Portfolio Policies with Incomplete Markets and Short-Sale

Constraints: The Infinite Dimensional Case. (1989). (12) RePEc:ucb:calbrf:rpf-189 Consumption and Portfolio Policies with Incomplete Markets and Short-Sale

Constraints: The Finite Dimensional Case. (1989). (13) RePEc:ucb:calbrf:41 Informational Asymmetries, Financial Structure, and Financial Intermediation. (1976). (14) RePEc:ucb:calbrf:rpf-230 Tests of Microstructural Hypotheses in the Foreign Exchange Market. (1993). (15) RePEc:ucb:calbrf:162 Empirical Assessment of Present Value Relations. (1986). (16) RePEc:ucb:calbrf:rpf-273 Profits and Position Control: A Week of FX Dealing. (1997). (17) RePEc:ucb:calbrf:181 The Attributes, Behavior and Performance of U.S. Mutual Funds. (1988). (18) RePEc:ucb:calbrf:rpf-256-rev How Do Firms Choose Their Lenders? An Empirical Investigation. (2000). (19) RePEc:ucb:calbrf:rpf-285 Search Costs: The Neglected Spread Component. (1998). (20) RePEc:ucb:calbrf:124 To Pay or Not to Pay Dividends. (1982). (21) RePEc:ucb:calbrf:43 The Limited Information Efficiency of Market Processes. (1976). (22) RePEc:ucb:calbrf:rpf-199 Convergence from Discrete to Continuous Time Contingent Claims Prices. (1990). (23) RePEc:ucb:calbrf:rpf-270 Is There Private Information in the FX Market? The Tokyo Experiment. (1997). (24) RePEc:ucb:calbrf:rpf-185 LBOs and Taxes: No One to Blame But Ourselves? (1989). (25) RePEc:ucb:calbrf:rpf-234 Trading and Liquidity on the Tokyo Stock Exchange: A Birds Eye View. (1994). (26) RePEc:ucb:calbrf:142 Pricing Deposit Insurance: The Effects of Mismeasurement. (1983). (27) RePEc:ucb:calbrf:rpf-211 Low Margins, Derivative Securities, and Volatility. (1991). (28) RePEc:ucb:calbrf:61 The Limits of Price Information in Market Processes. (1977). (29) RePEc:ucb:calbrf:rpf-231 Optimal Transparency in a Dealership Market with an Application to Foreign

Exchange. (1993). (30) RePEc:ucb:calbrf:rpf-193 Moment Approximation and Estimation of Diffusion Models of Asset Prices. (1990). (31) RePEc:ucb:calbrf:rpf-264 Generalized Binomial Trees. (1996). (32) RePEc:ucb:calbrf:rpf-262 Implied Binomial Trees: Generalizations and Empirical Tests. (1996). (33) RePEc:ucb:calbrf:174 Risk and Return in an Equilibrium APT. (1987). (34) RePEc:ucb:calbrf:163 Dividend Behavior for the Aggregate Stock Market. (1986). (35) RePEc:ucb:calbrf:156 Aspects of Optimal Multiperiod Life Insurance. (1985). (36) RePEc:ucb:calbrf:94 The Option Value of Reserves of Natural Resources. (1979). (37) RePEc:ucb:calbrf:rpf-192 Market Liquidity, Hedging and Crashes. (1989). (38) RePEc:ucb:calbrf:rpf-240 Bond Prices, Yield Spreads, and Optimal Capital Structure with Default Risk. (1994). (39) RePEc:ucb:calbrf:rpf-263-rev Beyond Mean-Variance: Performance Measurement of Portfolios Using Options or Dynamic Strategies. (1996). (40) RePEc:ucb:calbrf:125 Comments on the Valuation of Derivative Assets. (1982). (41) RePEc:ucb:calbrf:rpf-205 Continuously Rebalanced Investment Strategies. (1991). (42) RePEc:ucb:calbrf:50 A General Theory of Asset Valuation under Diffusion State Processes. (1976). (43) RePEc:ucb:calbrf:rpf-266 Volume, Volatility, Price and Profit When All Trader Are Above Average. (1996). (44) RePEc:ucb:calbrf:rpf-291 Corporate Diversification and Agency. (2000). (45) RePEc:ucb:calbrf:55 Information, Managerial Choice, and Stockholder Unanimity. (1976). (46) RePEc:ucb:calbrf:rpf-201 Industry vs. Other Factors in Risk Prediction. (1991). (47) RePEc:ucb:calbrf:rpf-269 Are Investors Reluctant to Realize Their Losses? (1996). (48) RePEc:ucb:calbrf:rpf-184 Market Liquidity, Hedging and Crashes. (1989). (49) RePEc:ucb:calbrf:37 The Valuation of Uncertain Income Streams and the Pricing of Options. (1975). (50) RePEc:ucb:calbrf:rpf-236 Dynamic Aggregation and Computation of Equilibria in Finite-Dimensional

Economies with Incomplete Financial Markets. (1994). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||