|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

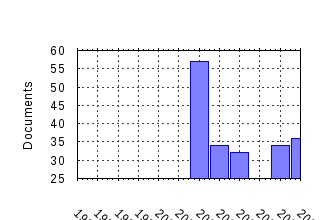

Journal of Accounting Research Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:joares:v:42:y:2004:i:2:p:207-252 What Determines Corporate Transparency? (2004). (2) RePEc:bla:joares:v:40:y:2002:i:1:p:105-134 Errors in Estimating Accruals: Implications for Empirical Research (2002). (3) RePEc:bla:joares:v:44:y:2006:i:3:p:485-531 International Differences in the Cost of Equity Capital: Do Legal Institutions and Securities Regulation Matter? (2006). (4) RePEc:bla:joares:v:41:y:2003:i:5:p:797-836 Does Greater Firm-Specific Return Variation Mean More or Less Informed Stock Pricing? (2003). (5) RePEc:bla:joares:v:41:y:2003:i:3:p:445-472 IAS Versus U.S. GAAP: Information Asymmetry-Based Evidence from Germanys New Market (2003). (6) RePEc:bla:joares:v:40:y:2002:i:1:p:21-40 A Re-examination of Disclosure Level and the Expected Cost of Equity Capital (2002). (7) RePEc:bla:joares:v:40:y:2002:i:3:p:613-630 Estimating the Value of Employee Stock Option Portfolios and Their Sensitivities to Price and Volatility (2002). (8) RePEc:bla:joares:v:41:y:2003:i:2:p:317-345 ADRs, Analysts, and Accuracy: Does Cross Listing in the United States Improve a Firms Information Environment and Increase Market Value? (2003). (9) RePEc:bla:joares:v:40:y:2002:i:3:p:797-808 Has the Information Content of Quarterly Earnings Announcements Declined in the Past Three Decades? (2002). (10) RePEc:bla:joares:v:41:y:2003:i:2:p:363-386 How Representative Are Firms That Are Cross-Listed in the United States? An Analysis of Accounting Quality (2003). (11) RePEc:bla:joares:v:40:y:2002:i:1:p:135-172 Equity Valuation Using Multiples (2002). (12) RePEc:bla:joares:v:43:y:2005:i:4:p:557-592 Earnings Management? The Shapes of the Frequency Distributions of Earnings Metrics Are Not Evidence Ipso Facto (2005). (13) RePEc:bla:joares:v:45:y:2007:i:2:p:333-371 IPO Failure Risk (2007). (14) RePEc:bla:joares:v:42:y:2004:i:1:p:1-29 Why Do Managers Explain Their Earnings Forecasts? (2004). (15) RePEc:bla:joares:v:43:y:2005:i:4:p:623-650 Analyst Impartiality and Investment Banking Relationships (2005). (16) RePEc:bla:joares:v:40:y:2002:i:3:p:657-676 Using Forecasts of Earnings to Simultaneously Estimate Growth and the Rate of Return on Equity Investment (2002). (17) RePEc:bla:joares:v:40:y:2002:i:4:p:1091-1123 Large-Sample Evidence on the Debt Covenant Hypothesis (2002). (18) RePEc:bla:joares:v:41:y:2003:i:2:p:347-362 Discussion of ADRs, Analysts, and Accuracy: Does Cross-Listing in the United States Improve a Firms Information Environment and Increase Market Value? (2003). (19) RePEc:bla:joares:v:43:y:2005:i:2:p:153-193 Does the Market Value Financial Expertise on Audit Committees of Boards of Directors? (2005). (20) RePEc:bla:joares:v:40:y:2002:i:1:p:41-66 GAAP versus The Street: An Empirical Assessment of Two Alternative Definitions of Earnings (2002). (21) RePEc:bla:joares:v:45:y:2007:i:2:p:385-420 Accounting Information, Disclosure, and the Cost of Capital (2007). (22) RePEc:bla:joares:v:44:y:2006:i:2:p:207-242 The Role of Accruals in Asymmetrically Timely Gain and Loss Recognition (2006). (23) RePEc:bla:joares:v:40:y:2002:i:1:p:173-204 Earnings Performance and Discretionary Disclosure (2002). (24) RePEc:bla:joares:v:44:y:2006:i:1:p:113-143 Is There a Link between Executive Equity Incentives and Accounting Fraud? (2006). (25) RePEc:bla:joares:v:44:y:2006:i:3:p:585-618 Subjective Performance Indicators and Discretionary Bonus Pools (2006). (26) RePEc:bla:joares:v:41:y:2003:i:5:p:837-866 Leading Indicator Variables, Performance Measurement, and Long-Term Versus Short-Term Contracts (2003). (27) RePEc:bla:joares:v:40:y:2002:i:4:p:1247-1274 Do Non-Audit Service Fees Impair Auditor Independence? Evidence from Going Concern Audit Opinions (2002). (28) RePEc:bla:joares:v:40:y:2002:i:4:p:1071-1090 Accounting Policies in Agencies with Moral Hazard and Renegotiation (2002). (29) RePEc:bla:joares:v:42:y:2004:i:2:p:269-312 Investor Protection and Corporate Governance: Evidence from Worldwide CEO Turnover (2004). (30) RePEc:bla:joares:v:40:y:2002:i:4:p:1221-1245 Shredded Reputation: The Cost of Audit Failure (2002). (31) RePEc:bla:joares:v:42:y:2004:i:2:p:123-150 Firms Voluntary Recognition of Stock-Based Compensation Expense (2004). (32) RePEc:bla:joares:v:41:y:2003:i:4:p:721-744 Evidence on the Joint Determination of Audit and Non-Audit Fees (2003). (33) RePEc:bla:joares:v:46:y:2008:i:2:p:435-460 Marking-to-Market: Panacea or Pandoras Box? (2008). (34) RePEc:bla:joares:v:41:y:2003:i:4:p:611-651 Capital Gains Taxes and Equity Trading: Empirical Evidence (2003). (35) RePEc:bla:joares:v:42:y:2004:i:2:p:423-462 Ultimate Ownership, Income Management, and Legal and Extra-Legal Institutions (2004). (36) RePEc:bla:joares:v:40:y:2002:i:2:p:359-393 Real Investment Implications of Employee Stock Option Exercises (2002). (37) RePEc:bla:joares:v:41:y:2003:i:2:p:235-272 Disclosure Practices, Enforcement of Accounting Standards, and Analysts Forecast Accuracy: An International Study (2003). (38) RePEc:bla:joares:v:40:y:2002:i:3:p:585-612 Do Stock Prices Fully Reflect the Implications of Special Items for Future Earnings? (2002). (39) RePEc:bla:joares:v:40:y:2002:i:3:p:711-726 The Association Between Activity-Based Costing and Manufacturing Performance (2002). (40) RePEc:bla:joares:v:43:y:2005:i:4:p:521-556 Inflation Illusion and Post-Earnings-Announcement Drift (2005). (41) RePEc:bla:joares:v:42:y:2004:i:1:p:31-49 Efficient Manipulation in a Repeated Setting (2004). (42) RePEc:bla:joares:v:42:y:2004:i:4:p:755-793 Does Auditor Quality and Tenure Matter to Investors? Evidence from the Bond Market (2004). (43) RePEc:bla:joares:v:41:y:2003:i:4:p:581-609 Market Effects of Recognition and Disclosure (2003). (44) RePEc:bla:joares:v:44:y:2006:i:3:p:619-656 Founding Family Ownership and Earnings Quality (2006). (45) RePEc:bla:joares:v:41:y:2003:i:5:p:867-890 The Role of Supplementary Statements with Management Earnings Forecasts (2003). (46) RePEc:bla:joares:v:44:y:2006:i:1:p:1-28 External and Internal Pricing in Multidivisional Firms (2006). (47) RePEc:bla:joares:v:46:y:2008:i:5:p:1085-1142 Mandatory IFRS Reporting around the World: Early Evidence on the Economic Consequences (2008). (48) RePEc:bla:joares:v:42:y:2004:i:3:p:589-623 Concentrated Control, Analyst Following, and Valuation: Do Analysts Matter Most When Investors Are Protected Least? (2004). (49) RePEc:bla:joares:v:41:y:2003:i:1:p:135-162 The Value Relevance of Network Advantages: The Case of E-Commerce Firms (2003). (50) RePEc:bla:joares:v:44:y:2006:i:5:p:1001-1033 The Press as a Watchdog for Accounting Fraud (2006). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:pra:mprapa:5197 Accruals and Aggregate Stock Market Returns (2007). University Library of Munich, Germany / MPRA Paper (2) RePEc:rug:rugwps:07/455 AN ASSESSMENT OF GOVERNMENT FUNDING OF BUSINESS ANGEL NETWORKS: A REGIONAL STUDY (2007). Ghent University, Faculty of Economics and Business Administration / Working Papers of Faculty of Economics and Business Administration, Ghent Univers (3) RePEc:xrs:sfbmaa:07-75 How Does Fair Value Measurement under IAS 39 Affect Disclosure Choices of European Banks? (2007). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Recent citations received in: 2006 (1) RePEc:ecl:stabus:1956 Conservatism, Growth, and Return on Investment (2006). Stanford University, Graduate School of Business / Research Papers (2) RePEc:iza:izadps:dp2423 Relative Rewards within Team-Based Compensation (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (3) RePEc:nbr:nberwo:12222 Do Foreigners Invest Less in Poorly Governed Firms? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (4) RePEc:nbr:nberwo:12525 The Corporate Governance Role of the Media: Evidence from Russia (2006). National Bureau of Economic Research, Inc / NBER Working Papers Recent citations received in: 2005 (1) RePEc:lan:wpaper:003059 Are analysts loss functions asymmetric? (2005). Lancaster University Management School, Economics Department / Working Papers Recent citations received in: 2004 (1) RePEc:hcx:wpaper:0413 The Earnings Quality Consequences of Announcements to Voluntarily Adopt the Fair Value Method of Accounting for Stock-Based Compensation (2004). College of the Holy Cross, Department of Economics / Working Papers (2) RePEc:iza:izadps:dp1356 Performance Measure Properties and Incentives (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||