|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

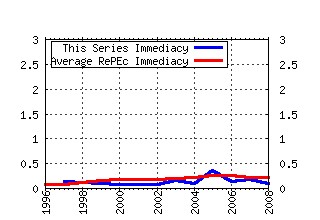

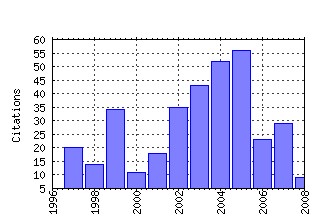

International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ays:ispwps:paper9803 Implementation Rules For Fiscal Decentralization (1999). (2) RePEc:ays:ispwps:paper0406 Societal Institutions and Tax Effort in Developing Countries (2004). (3) RePEc:ays:ispwps:paper9901 Implementation Rules For Fiscal Decentralization (1999). (4) RePEc:ays:ispwps:paper0312 The System of Equalization Transfers in China (2003). (5) RePEc:ays:ispwps:paper0720 Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia (2007). (6) RePEc:ays:ispwps:paper0306 Multiple Modes of Tax Evasion: Theory and Evidence from the TCMP (2003). (7) RePEc:ays:ispwps:paper0507 Redistribution via Taxation: The Limited Role of the Personal Income Tax in Developing Countries (2005). (8) RePEc:ays:ispwps:paper0516 Effects of Tax Morale on Tax Compliance: Experimental and Survey Evidence (2005). (9) RePEc:ays:ispwps:paper9707 Fiscal Decentralization, Economic Growth, and Democratic Governance (1997). (10) RePEc:ays:ispwps:paper0112 Mexico: An Evaluation of the Main Features of the Tax System (2001). (11) RePEc:ays:ispwps:paper9802 Intergovernmental Fiscal Relations in Vietnam (1998). (12) RePEc:ays:ispwps:paper0313 Fiscal Federalism and Economic Reform in China (2003). (13) RePEc:ays:ispwps:paper0310 No Pain, No Gain: Market Reform, Unemployment, and Politics in Bulgaria (2003). (14) RePEc:ays:ispwps:paper0216 Growth and Equity Tradeoff in Decentralization Policy: Chinas Experience (2002). (15) RePEc:ays:ispwps:paper9701 Tax Systems in Transition Economics (1997). (16) RePEc:ays:ispwps:paper0521 The Evolution of Tax Morale in Modern Spain (2005). (17) RePEc:ays:ispwps:paper0304 Asymmetric Federalism in Russia: Cure or Poison? (2002). (18) RePEc:ays:ispwps:paper9903 Fiscal Decentralization in the Russian Federation During the Transition (1999). (19) RePEc:ays:ispwps:paper0505 Value-Added Taxes in Developing and Transitional Countries: Lessons and Questions (2005). (20) repec:ays:ispwps:paper0101 (). (21) RePEc:ays:ispwps:paper0407 Is the Proposed East African Monetary Union an Optimal Currency Area? A Structural Vector Autoregression Analysis (2004). (22) RePEc:ays:ispwps:paper0502 Choosing between Centralized and Decentralized Models of Tax Administration (2005). (23) RePEc:ays:ispwps:paper0621 Who Bears the Burden of Taxes on Labor Income in Russia? (2006). (24) RePEc:ays:ispwps:paper0009 Making Decentralization Work: The Case of Russia, Ukraine, and Kazakhstan (2000). (25) RePEc:ays:ispwps:paper0302 Fiscal Flows, Fiscal Balance, and Fiscal Sustainability (2003). (26) RePEc:ays:ispwps:paper0501 Fiscal Decentralization and The Functional Composition of Public Expenditures (2005). (27) RePEc:ays:ispwps:paper0403 Effects of culture on tax compliance: A cross check of experimental and survey evidence (2004). (28) RePEc:ays:ispwps:paper0214 How Should Revenues From Natural Resources Be Shared? (2002). (29) RePEc:ays:ispwps:paper0002 Intergovernmental Fiscal Relations: Universal Principles, Local Applications (2000). (30) RePEc:ays:ispwps:paper0724 A Meta-Analysis of Tax Compliance Experiments (2007). (31) RePEc:ays:ispwps:paper0427 Property Transfer Tax and Stamp Duty (2004). (32) RePEc:ays:ispwps:paper0807 Pakistan: Provincial Government Taxation (2008). (33) RePEc:ays:ispwps:paper0434 Tax Burden in Jamaica (2004). (34) RePEc:ays:ispwps:paper9902 Intergovernmental Fiscal Relations in Leningrad Region (1999). (35) RePEc:ays:ispwps:paper0202 Closing the Gap: Fiscal Imbalaces and Intergovernmental Transfers in

Developed Federations (2002). (36) RePEc:ays:ispwps:paper0727 Tax Compliance, Tax Morale, and Governance Quality (2007). (37) RePEc:ays:ispwps:paper0721 Global Reform of Personal Income Taxation, 1981-2005: Evidence from 189 Countries (2007). (38) RePEc:ays:ispwps:paper0201 An Overview of Intergovernmental Fiscal Relations and Subnational Public Finance

in Nigeria (2002). (39) RePEc:ays:ispwps:paper0215 On the Use of Budgetary Norms as a Tool for Fiscal Management (2002). (40) RePEc:ays:ispwps:paper0609 Environmental Taxes in Spain: A Missed Opportunity (2006). (41) RePEc:ays:ispwps:paper9804 Multi-Year Budgeting: A Review of International Practices and Lessons for Developing

and Transitional Economies (1998). (42) RePEc:ays:ispwps:paper0110 The Impact of Budgets on the Poor: Tax and Benefit (2001). (43) RePEc:ays:ispwps:paper0515 Earmarking in Theory and Korean Practice (2005). (44) RePEc:ays:ispwps:paper0520 Chinas Fiscal System: A Work in Progress (2005). (45) RePEc:ays:ispwps:paper0301 IMF Lending, Maturity of International Debt and Moral Hazard (2002). (46) RePEc:ays:ispwps:paper0415 Fiscal Capacity Equalization and Economic Efficiency (2004). (47) RePEc:ays:ispwps:paper0506 Fiscal Decentralization,Macrostability, and Growth (2005). (48) RePEc:ays:ispwps:paper0611 Financing Local Governments: The Spanish Experience (2006). (49) RePEc:ays:ispwps:paper0311 The incidence of local government allocations in Tanzania (2003). (50) RePEc:ays:ispwps:paper0428 Corporate Income Tax and Tax Incentives (2004). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:ays:ispwps:paper0804 The BBLR Approach to tax Reform in Emerging Countries (2008). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ays:ispwps:paper0810 Assessing Enterprise Taxation and the Investment Climate in Pakistan (2008). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:ays:ispwps:paper0811 Pakistanâs Tax Gap: Estimates By Tax Calculation and Methodology (2008). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (4) RePEc:ays:ispwps:paper0813 Incidence of Taxes in Pakistan: Primer and Estimates (2008). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P Recent citations received in: 2007 (1) RePEc:ays:ispwps:paper0721 Global Reform of Personal Income Taxation, 1981-2005: Evidence from 189 Countries (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ays:ispwps:paper0729 Tax Evasion, Tax Amnesties and the Psychological Tax Contract (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:ces:ceswps:_1921 Tax Morale after the Reunification of Germany: Results from a Quasi-Natural Experiment (2007). CESifo GmbH / CESifo Working Paper Series (4) RePEc:lic:licosd:19307 Infrastructure endowment and corporate income taxes as determinants of Foreign Direct Investment in Central- and Eastern European Countries (2007). LICOS - Centre for Institutions and Economic Performance, K.U.Leuven / LICOS Discussion Papers (5) RePEc:qut:dpaper:209 Tax Morale after the Reunification of Germany: Results from a Quasi-Natural Experiment (2007). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series (6) RePEc:zbw:uoccpe:7221 Effects of flat tax reforms in Western Europe on equity and efficiency (2007). University of Cologne, CPE - Cologne Center for Public Economics / FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Recent citations received in: 2006 (1) RePEc:ays:ispwps:paper0623 The Practice of Fiscal Federalism in Spain (2006). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ays:ispwps:paper0631 Cost Benefit Analysis of Presumptive Taxation (2006). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:fem:femwpa:2006.40 Taxing Tourism in Spain: Results and Recommendations (2006). Fondazione Eni Enrico Mattei / Working Papers (4) RePEc:nbr:nberwo:12802 Which Countries Become Tax Havens? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:ubi:deawps:16 Taxing Tourism in Spain: Results and Recommendations (2006). Universitat de les Illes Balears, Departament d'EconomÃa Aplicada / DEA Working Papers Recent citations received in: 2005 (1) RePEc:ays:ispwps:paper05141 India: Fiscal Condition of the States, International Experience,and Options for Reform: Volume 1 (2005). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ays:ispwps:paper05142 India: Fiscal Condition of the States, International Experience,and Options for Reform: Volume 2 (2005). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:ays:ispwps:paper0520 Chinas Fiscal System: A Work in Progress (2005). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (4) RePEc:ess:wpaper:id:243 Trends and Issues in Tax Policy and Reform in India (2005). esocialsciences.com / Working Papers (5) RePEc:npf:wpaper:tru1 Trends and issues in tax policy and reform in India. (2005). National Institute of Public Finance and Policy / Working Papers (6) RePEc:pra:mprapa:18214 Tax systems and tax reforms in south and East Asia: Overview of the tax systems and main policy tax issues (2005). University Library of Munich, Germany / MPRA Paper (7) RePEc:pra:mprapa:1869 Tax Systems and Tax Reforms in South and East Asia: Overview of Tax Systems and main policy issues (2005). University Library of Munich, Germany / MPRA Paper (8) RePEc:ttp:itpwps:0515 China?s Fiscal System: A Work in Progress (2005). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||